Intro

Discover how payment processors work with 5 key methods, including transaction routing, security measures, and payment gateway integration, for seamless online payments and merchant services.

The world of payment processing is a complex and fascinating one, with various players and technologies working together to facilitate transactions between consumers and merchants. At the heart of this ecosystem are payment processors, which play a crucial role in enabling secure, efficient, and reliable payments. In this article, we'll delve into the inner workings of payment processors, exploring the different ways they operate and the benefits they offer to businesses and individuals alike.

Payment processing is an essential aspect of modern commerce, with the global payment processing market projected to reach $1.4 trillion by 2025. As the demand for digital payments continues to grow, payment processors must adapt and innovate to meet the evolving needs of consumers and merchants. From contactless payments to cryptocurrency transactions, the payment processing landscape is becoming increasingly diverse and sophisticated. Whether you're a business owner, a consumer, or simply someone interested in the world of finance, understanding how payment processors work is essential for navigating this complex and rapidly changing environment.

The importance of payment processors cannot be overstated, as they provide a vital link between merchants, banks, and consumers. By facilitating transactions and managing the flow of funds, payment processors enable businesses to accept payments from customers, while also ensuring that consumers can make purchases with confidence. With the rise of e-commerce and mobile payments, the role of payment processors has become even more critical, as they must balance security, speed, and convenience to meet the demands of a rapidly evolving market. In this article, we'll explore the different ways payment processors work, including their role in facilitating transactions, managing risk, and providing value-added services to merchants and consumers.

Introduction to Payment Processors

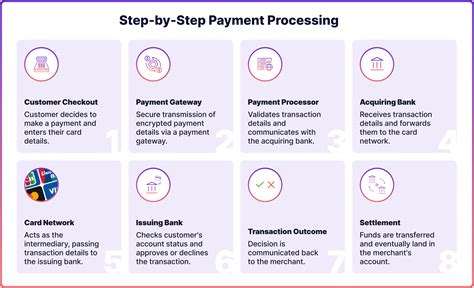

Payment processors are specialized companies that act as intermediaries between merchants and banks, enabling the transfer of funds from consumers to businesses. They provide a range of services, including transaction processing, payment gateway management, and risk assessment. By leveraging advanced technologies, such as artificial intelligence and machine learning, payment processors can detect and prevent fraudulent transactions, while also optimizing the payment experience for consumers. Whether you're making an online purchase, paying a bill, or transferring funds to a friend, payment processors play a vital role in facilitating these transactions and ensuring that your money reaches its intended destination.

Types of Payment Processors

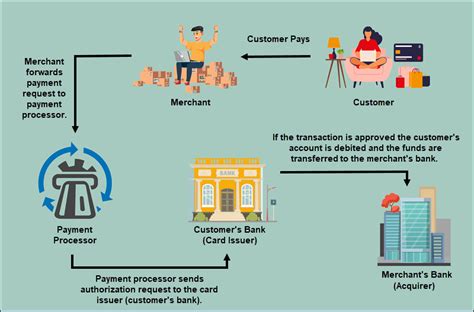

Payment processors can be broadly categorized into two main types: front-end and back-end processors. Front-end processors focus on the consumer-facing aspect of payment processing, providing payment gateways and interfaces for online transactions. Back-end processors, on the other hand, concentrate on the settlement and funding aspects of transactions, working with banks and other financial institutions to facilitate the transfer of funds. By understanding the different types of payment processors and their roles, businesses and individuals can better navigate the complex world of payment processing and make informed decisions about their payment needs.How Payment Processors Work

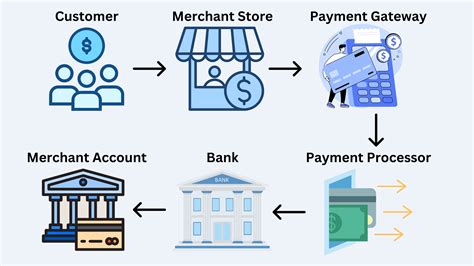

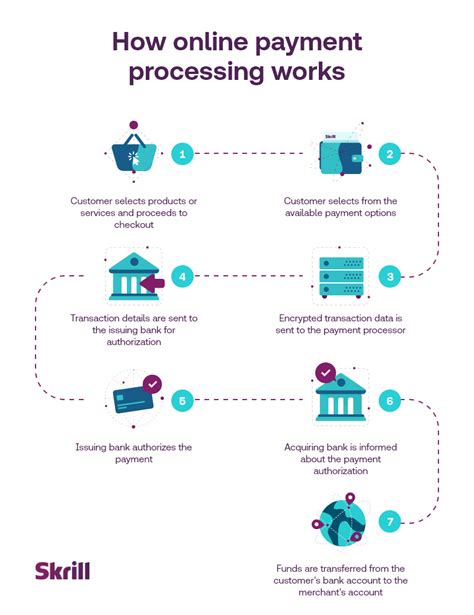

Payment processors work by facilitating transactions between merchants and consumers, using a combination of technology and financial expertise to manage the flow of funds. The process typically involves several steps, including authorization, capture, and settlement. During the authorization step, the payment processor verifies the consumer's payment information and checks for sufficient funds. If the transaction is approved, the payment processor captures the funds and initiates the settlement process, which involves transferring the funds to the merchant's bank account. By streamlining this process and reducing the risk of errors or fraud, payment processors can help businesses increase their revenue and improve their customer satisfaction.

Benefits of Payment Processors

The benefits of payment processors are numerous, ranging from increased security and convenience to improved cash flow and reduced risk. By outsourcing payment processing to a specialized company, businesses can focus on their core activities, while also gaining access to advanced technologies and expertise. Payment processors can also provide valuable insights and analytics, helping businesses to optimize their payment strategies and improve their overall performance. Whether you're a small business owner or a large enterprise, payment processors can play a vital role in helping you achieve your goals and succeed in a rapidly changing market.5 Ways Payment Processors Work

Payment processors work in a variety of ways, depending on the specific needs and requirements of merchants and consumers. Here are five ways payment processors work:

- Card Processing: Payment processors can facilitate card transactions, including credit and debit card payments. They work with card networks, such as Visa and Mastercard, to verify the consumer's payment information and authorize the transaction.

- Online Payment Gateways: Payment processors can provide online payment gateways, which enable merchants to accept payments through their websites or mobile apps. These gateways typically include features such as tokenization, encryption, and secure socket layer (SSL) technology to protect sensitive payment information.

- Mobile Payments: Payment processors can facilitate mobile payments, including transactions made through digital wallets, such as Apple Pay and Google Pay. They work with mobile operators and banks to enable secure and convenient payments.

- Contactless Payments: Payment processors can enable contactless payments, which allow consumers to make transactions without physically swiping or inserting their cards. These payments typically use near-field communication (NFC) technology to facilitate the transaction.

- Cryptocurrency Transactions: Payment processors can facilitate cryptocurrency transactions, including payments made with Bitcoin and other digital currencies. They work with cryptocurrency exchanges and wallets to enable secure and convenient transactions.

Security Measures

Payment processors must implement robust security measures to protect sensitive payment information and prevent fraudulent transactions. These measures typically include:- Encryption: Payment processors use encryption to protect payment information, both in transit and at rest.

- Tokenization: Payment processors use tokenization to replace sensitive payment information with unique tokens, which can be used to facilitate transactions without exposing the underlying payment data.

- Secure Socket Layer (SSL) Technology: Payment processors use SSL technology to create a secure connection between the consumer's browser and the payment gateway.

- Compliance with Industry Standards: Payment processors must comply with industry standards, such as the Payment Card Industry Data Security Standard (PCI DSS), to ensure the security and integrity of payment transactions.

Gallery of Payment Processing Images

Payment Processing Image Gallery

Frequently Asked Questions

What is a payment processor?

+A payment processor is a company that facilitates transactions between merchants and consumers, enabling the transfer of funds from one party to another.

How do payment processors work?

+Payment processors work by facilitating transactions between merchants and consumers, using a combination of technology and financial expertise to manage the flow of funds.

What are the benefits of using a payment processor?

+The benefits of using a payment processor include increased security, convenience, and efficiency, as well as improved cash flow and reduced risk.

How do payment processors ensure security?

+Payment processors ensure security by implementing robust measures, such as encryption, tokenization, and secure socket layer (SSL) technology, to protect sensitive payment information and prevent fraudulent transactions.

What types of payment methods do payment processors support?

+Payment processors support a range of payment methods, including credit and debit cards, online payment gateways, mobile payments, contactless payments, and cryptocurrency transactions.

In conclusion, payment processors play a vital role in facilitating transactions between merchants and consumers, providing a range of services and benefits that enhance the payment experience. By understanding how payment processors work and the different ways they operate, businesses and individuals can make informed decisions about their payment needs and optimize their payment strategies to achieve success in a rapidly changing market. We hope this article has provided you with a comprehensive overview of payment processors and their importance in modern commerce. If you have any further questions or would like to learn more about payment processing, please don't hesitate to comment or share this article with others.