Intro

Discover the 5 Visa Interchange Rates, including assessment fees, and learn about payment processing, merchant services, and credit card transactions to optimize your business finances.

The world of payment processing can be complex, with various players and stakeholders involved. One key aspect of this ecosystem is the interchange rate, which is a fee paid by merchants to banks for processing credit and debit card transactions. In this article, we will delve into the world of Visa interchange rates, exploring their importance, how they work, and the benefits they provide to merchants and consumers alike.

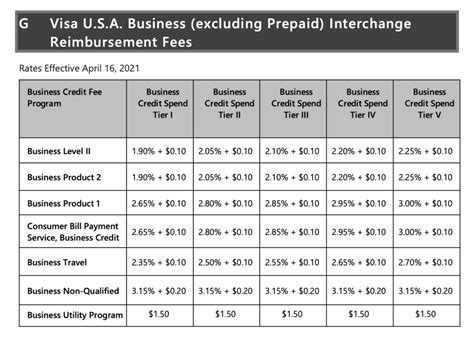

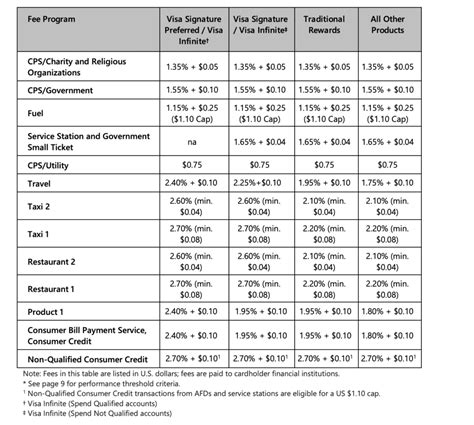

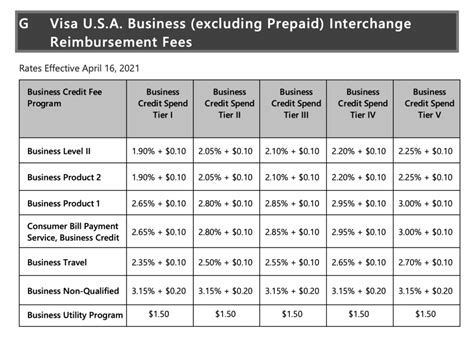

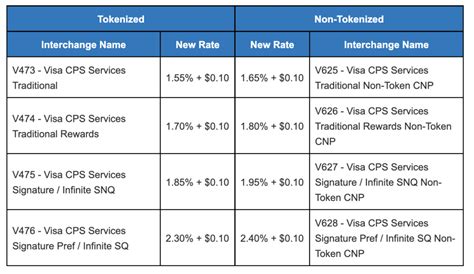

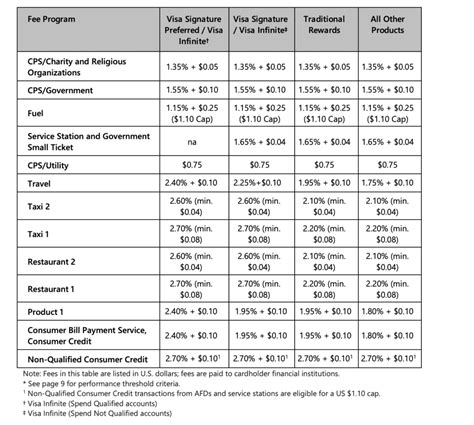

Visa interchange rates are a crucial component of the payment processing landscape, as they enable merchants to accept Visa cards and provide consumers with a convenient and secure way to make purchases. The rates are set by Visa and are typically a percentage of the transaction amount, plus a fixed fee. These rates vary depending on the type of transaction, the merchant category, and the card type.

The importance of understanding Visa interchange rates cannot be overstated. Merchants who accept Visa cards need to be aware of the rates they are being charged, as these fees can eat into their profit margins. Consumers, on the other hand, benefit from the convenience and security that Visa cards provide, and may not even be aware of the interchange rates that are being charged behind the scenes. By understanding how Visa interchange rates work, merchants and consumers can make informed decisions about their payment processing options.

How Visa Interchange Rates Work

The interchange rate is typically composed of several components, including a percentage of the transaction amount, a fixed fee, and an assessment fee. The assessment fee is a small fee that is charged by Visa for each transaction, and is typically a percentage of the transaction amount. The fixed fee is a flat fee that is charged for each transaction, and is typically a few cents per transaction.

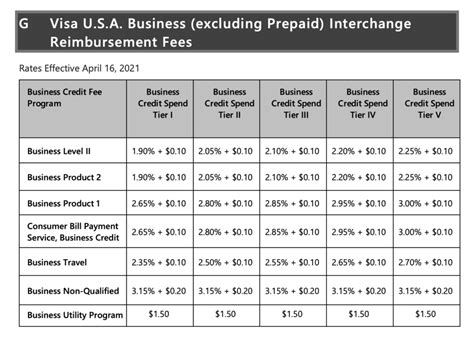

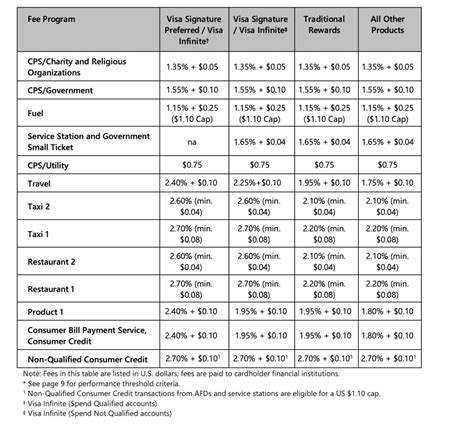

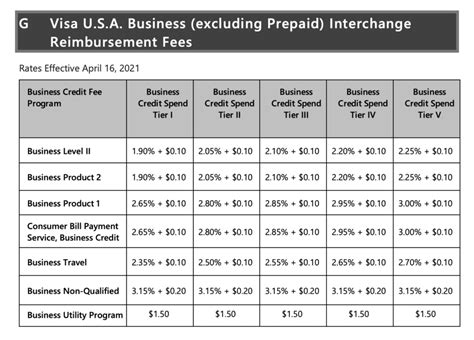

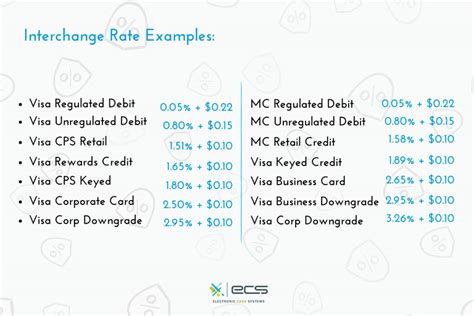

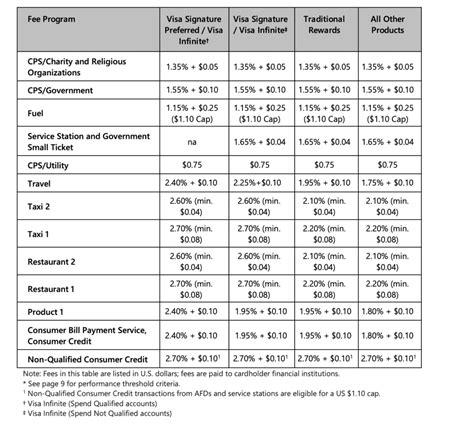

Types of Visa Interchange Rates

There are several types of Visa interchange rates, including: * Credit interchange rates: These rates apply to credit card transactions and are typically higher than debit interchange rates. * Debit interchange rates: These rates apply to debit card transactions and are typically lower than credit interchange rates. * Commercial interchange rates: These rates apply to commercial card transactions and are typically higher than credit and debit interchange rates. * International interchange rates: These rates apply to international transactions and are typically higher than domestic interchange rates.Benefits of Visa Interchange Rates

For consumers, Visa interchange rates provide a convenient and secure way to make purchases. The rates also help to support the development of new payment technologies and services, such as contactless payments and mobile payments. Additionally, the rates help to ensure that merchants are able to accept Visa cards, which provides consumers with a wide range of payment options.

How Merchants Can Minimize Interchange Rates

Merchants can minimize interchange rates by taking several steps, including: * Qualifying for lower interchange rates: Merchants can qualify for lower interchange rates by meeting certain requirements, such as having a high volume of transactions or using certain types of payment technology. * Using debit cards: Merchants can reduce their interchange rates by encouraging customers to use debit cards instead of credit cards. * Using alternative payment methods: Merchants can reduce their interchange rates by offering alternative payment methods, such as cash or check. * Negotiating with processors: Merchants can negotiate with their payment processors to reduce their interchange rates.Visa Interchange Rate Structure

The interchange rate structure is typically composed of several components, including:

- A percentage of the transaction amount: This is the main component of the interchange rate and is typically a percentage of the transaction amount.

- A fixed fee: This is a flat fee that is charged for each transaction, and is typically a few cents per transaction.

- An assessment fee: This is a small fee that is charged by Visa for each transaction, and is typically a percentage of the transaction amount.

Visa Interchange Rate Categories

Visa interchange rates are categorized into several different categories, including: * Credit: This category includes credit card transactions and is typically the highest interchange rate category. * Debit: This category includes debit card transactions and is typically the lowest interchange rate category. * Commercial: This category includes commercial card transactions and is typically higher than the credit and debit categories. * International: This category includes international transactions and is typically higher than the domestic categories.Impact of Visa Interchange Rates on Merchants

The impact of Visa interchange rates on merchants can be significant, as they can:

- Reduce profit margins: Interchange rates can eat into a merchant's profit margins, reducing their ability to invest in their business.

- Increase costs: Interchange rates can increase a merchant's costs, making it more difficult for them to compete with other businesses.

- Limit payment options: Interchange rates can limit a merchant's payment options, making it more difficult for them to offer customers a range of payment choices.

How Merchants Can Manage Interchange Rates

Merchants can manage interchange rates by taking several steps, including: * Understanding the interchange rate structure: Merchants need to understand the interchange rate structure and how it applies to their business. * Qualifying for lower interchange rates: Merchants can qualify for lower interchange rates by meeting certain requirements, such as having a high volume of transactions or using certain types of payment technology. * Negotiating with processors: Merchants can negotiate with their payment processors to reduce their interchange rates. * Using alternative payment methods: Merchants can reduce their interchange rates by offering alternative payment methods, such as cash or check.Visa Interchange Rate Image Gallery

What are Visa interchange rates?

+Visa interchange rates are fees paid by merchants to banks for processing credit and debit card transactions.

How do Visa interchange rates work?

+Visa interchange rates are set by Visa and are typically a percentage of the transaction amount, plus a fixed fee. The rates vary depending on the type of transaction, the merchant category, and the card type.

What are the benefits of Visa interchange rates?

+Visa interchange rates provide several benefits to merchants and consumers alike, including enabling merchants to accept Visa cards and providing consumers with a convenient and secure way to make purchases.

How can merchants minimize interchange rates?

+Merchants can minimize interchange rates by qualifying for lower interchange rates, using debit cards, using alternative payment methods, and negotiating with processors.

What is the impact of Visa interchange rates on merchants?

+Visa interchange rates can have a significant impact on merchants, as they can eat into their profit margins and increase their costs.

In conclusion, Visa interchange rates are an important aspect of the payment processing landscape, providing several benefits to merchants and consumers alike. By understanding how Visa interchange rates work and how they can be minimized, merchants can make informed decisions about their payment processing options and reduce their costs. We hope this article has provided you with a comprehensive understanding of Visa interchange rates and their impact on the payment processing industry. If you have any further questions or would like to learn more about payment processing, please don't hesitate to comment below or share this article with your network.