Intro

Discover how invoices work with 5 key methods, including billing, payment terms, and invoicing software, to streamline accounting and payment processing, reducing errors and late payments.

Invoices are a crucial part of any business, serving as a formal request for payment from a customer or client for goods or services provided. Understanding how invoices work is essential for effective financial management, maintaining healthy cash flow, and building strong relationships with customers. In this article, we will delve into the world of invoices, exploring their importance, types, and the processes involved in creating and managing them.

The importance of invoices cannot be overstated. They provide a clear and concise record of transactions, outlining the goods or services provided, the amount due, and the payment terms. This transparency helps prevent misunderstandings and disputes, ensuring that both parties are on the same page. Moreover, invoices play a vital role in accounting and bookkeeping, allowing businesses to track their income, expenses, and tax liabilities accurately.

Invoices have been around for centuries, with early examples dating back to ancient civilizations. Over time, the format and content of invoices have evolved, but their fundamental purpose remains the same. Today, invoices are used by businesses of all sizes and industries, from small startups to large corporations. With the advent of digital technology, invoicing has become more efficient and convenient, enabling businesses to create, send, and manage invoices electronically.

Understanding the Basics of Invoices

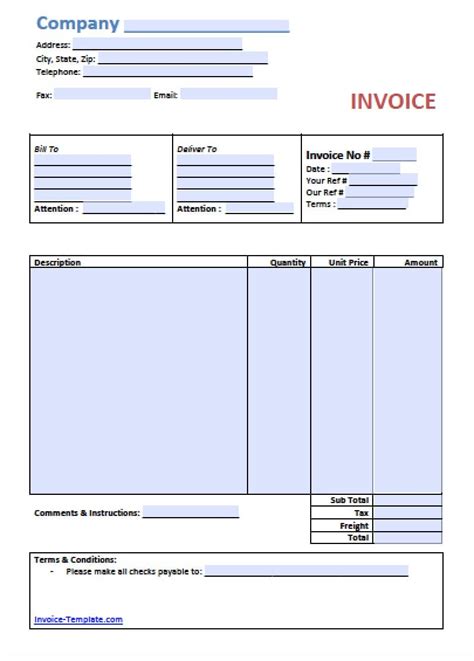

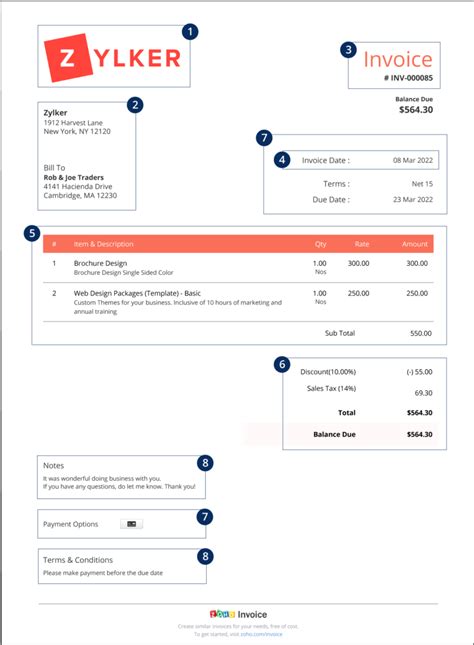

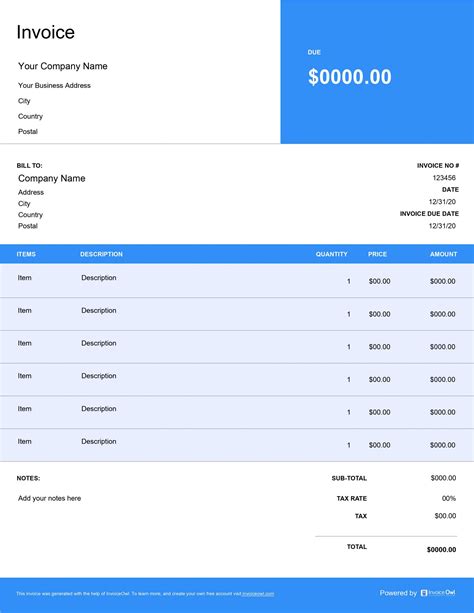

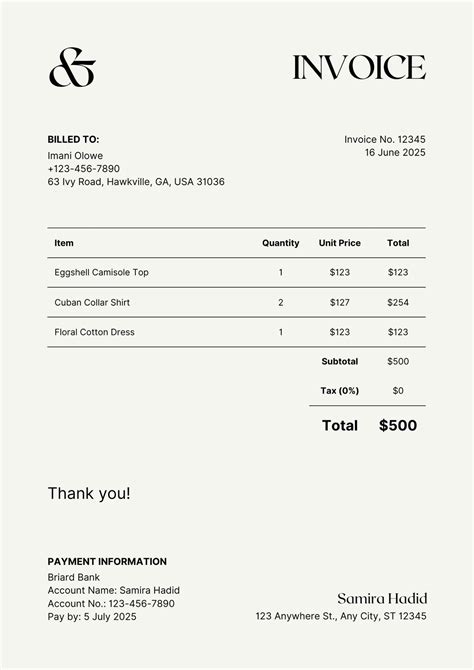

To appreciate the intricacies of invoicing, it's essential to understand the basic components of an invoice. These include the invoice number, date, billing information, payment terms, and a detailed description of the goods or services provided. The invoice number serves as a unique identifier, allowing businesses to track and reference specific invoices easily. The date indicates when the invoice was created, while the billing information outlines the customer's details and the payment address.

Key Components of an Invoice

- Invoice number: A unique identifier for the invoice

- Date: The date the invoice was created

- Billing information: The customer's details and payment address

- Payment terms: The conditions under which payment is expected

- Description of goods or services: A detailed outline of what is being invoiced

Types of Invoices

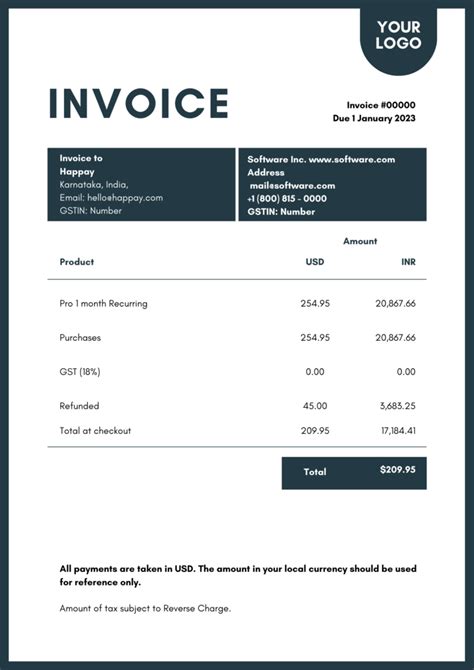

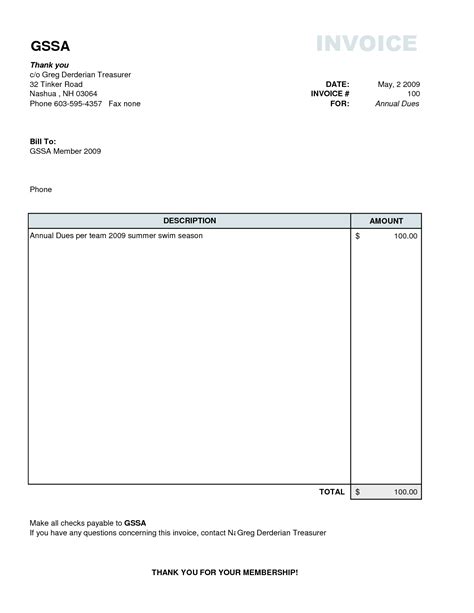

Invoices come in various forms, each serving a specific purpose. The most common types of invoices include standard invoices, recurring invoices, and pro forma invoices. Standard invoices are the most widely used, outlining the goods or services provided, the amount due, and the payment terms. Recurring invoices, on the other hand, are used for ongoing services or subscriptions, such as monthly membership fees or rental payments.

Common Types of Invoices

- Standard invoices: Used for one-time transactions

- Recurring invoices: Used for ongoing services or subscriptions

- Pro forma invoices: Used for quotes or estimates

- Credit invoices: Used to refund or credit customers

- Debit invoices: Used to charge customers for additional services or fees

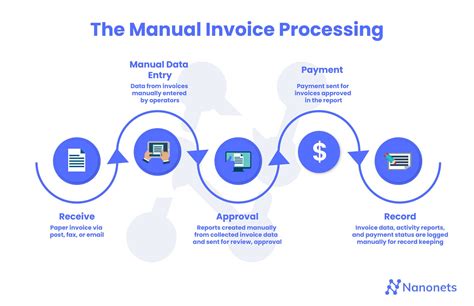

The Invoicing Process

The invoicing process typically begins with the creation of an invoice, which is then sent to the customer. The customer reviews the invoice, verifies the details, and makes payment according to the specified terms. Businesses can use various methods to send invoices, including email, postal mail, or online invoicing platforms. It's essential to ensure that invoices are accurate, complete, and delivered promptly to avoid delays in payment.

Best Practices for Invoicing

- Use a clear and concise format

- Include all necessary details, such as invoice number and payment terms

- Send invoices promptly, ideally within 24 hours of providing goods or services

- Use online invoicing platforms to streamline the process and reduce errors

- Follow up with customers to ensure timely payment

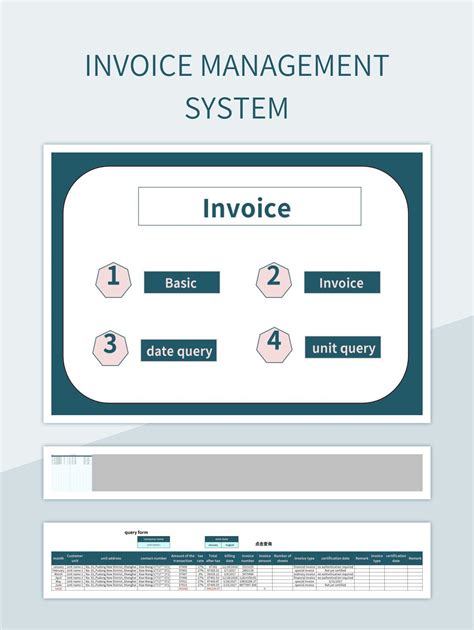

Managing Invoices Effectively

Effective invoice management is critical for maintaining healthy cash flow and preventing financial difficulties. Businesses should implement a robust invoicing system, which includes tracking invoices, sending reminders, and following up with customers. This can be achieved through manual processes or by using specialized invoicing software. Regularly reviewing and reconciling invoices can help identify errors, discrepancies, or unpaid invoices, enabling prompt action to be taken.

Benefits of Effective Invoice Management

- Improved cash flow: By ensuring timely payment, businesses can maintain a stable financial position

- Reduced errors: Accurate invoicing minimizes the risk of errors, disputes, or lost payments

- Enhanced customer relationships: Clear and transparent invoicing builds trust and strengthens customer relationships

- Increased efficiency: Streamlined invoicing processes save time and reduce administrative burdens

Common Invoicing Challenges

Despite the importance of invoicing, many businesses face challenges in managing their invoices effectively. Common issues include delayed payments, lost or misplaced invoices, and errors in invoicing. To overcome these challenges, businesses can implement robust invoicing systems, use online invoicing platforms, and establish clear communication channels with customers. Regularly reviewing and updating invoicing processes can help identify areas for improvement and optimize the invoicing cycle.

Overcoming Invoicing Challenges

- Implement a robust invoicing system

- Use online invoicing platforms to streamline the process

- Establish clear communication channels with customers

- Regularly review and update invoicing processes

- Consider outsourcing invoicing to a third-party provider

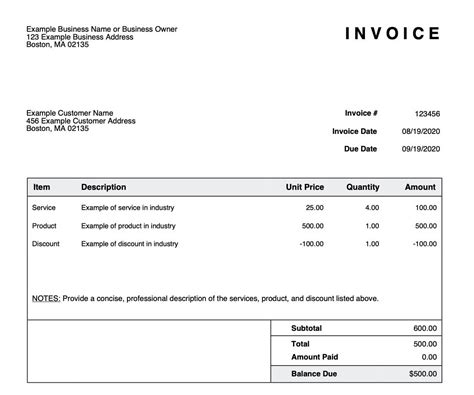

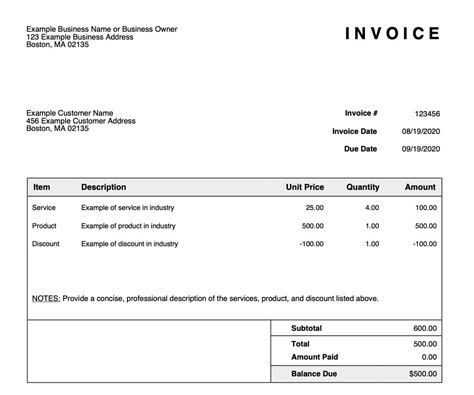

Best Practices for Creating Invoices

Creating effective invoices requires attention to detail and a clear understanding of the invoicing process. Businesses should use a standard format, include all necessary details, and ensure that invoices are accurate and complete. Using online invoicing platforms can help streamline the process, reduce errors, and improve efficiency. Regularly reviewing and updating invoicing templates can help ensure that invoices remain relevant and effective.

Key Considerations for Invoice Creation

- Use a standard format: Ensure consistency in invoicing to avoid confusion

- Include all necessary details: Provide clear and concise information to avoid disputes

- Ensure accuracy and completeness: Verify invoices for errors or omissions

- Use online invoicing platforms: Streamline the process and reduce administrative burdens

- Regularly review and update invoicing templates: Ensure invoices remain relevant and effective

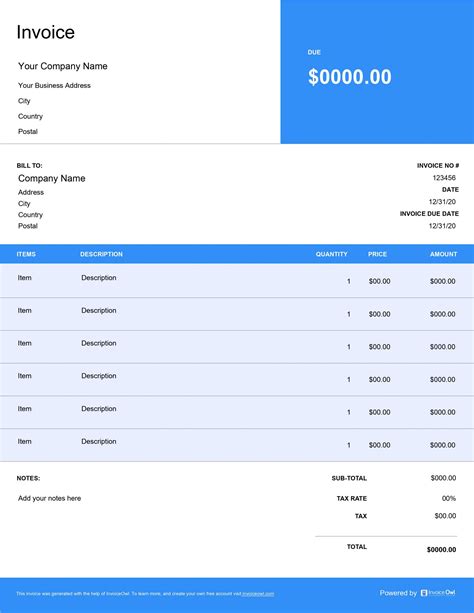

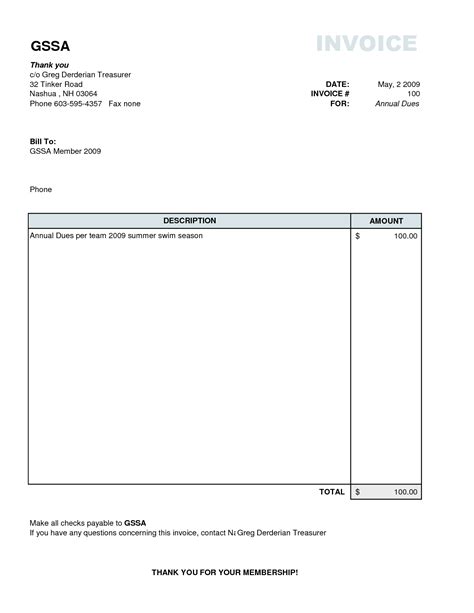

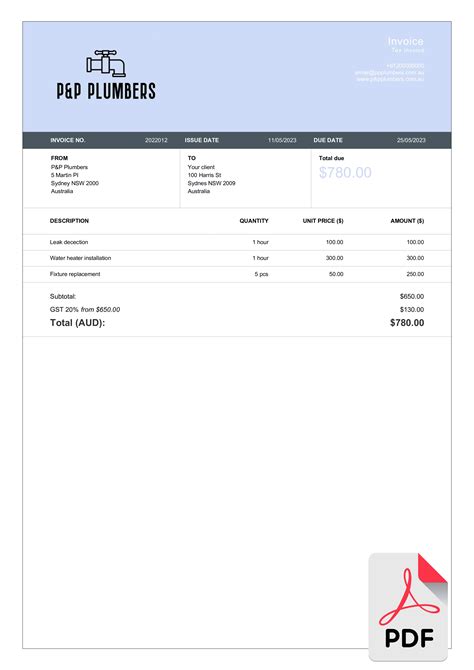

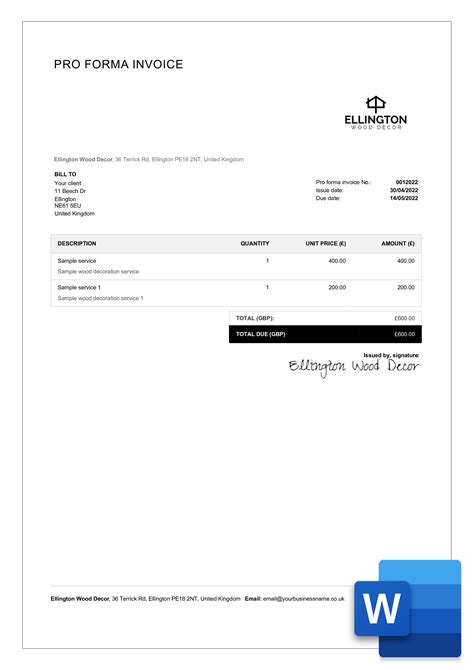

Gallery of Invoicing Examples

Invoicing Image Gallery

What is an invoice?

+An invoice is a formal request for payment from a customer or client for goods or services provided.

What are the different types of invoices?

+The most common types of invoices include standard invoices, recurring invoices, and pro forma invoices.

How do I create an effective invoice?

+To create an effective invoice, use a standard format, include all necessary details, and ensure that invoices are accurate and complete.

What are the benefits of effective invoice management?

+Effective invoice management can improve cash flow, reduce errors, and enhance customer relationships.

How can I overcome common invoicing challenges?

+To overcome common invoicing challenges, implement a robust invoicing system, use online invoicing platforms, and establish clear communication channels with customers.

In conclusion, invoices play a vital role in the financial management of businesses, serving as a formal request for payment from customers or clients. Understanding the basics of invoices, types of invoices, and the invoicing process is essential for effective financial management and maintaining healthy cash flow. By implementing best practices for invoicing, managing invoices effectively, and overcoming common invoicing challenges, businesses can optimize their invoicing cycle and improve their overall financial performance. We invite you to share your thoughts and experiences with invoicing in the comments section below, and don't forget to share this article with others who may benefit from this comprehensive guide to invoices.