Intro

Discover the meaning of Ach in finance, banking, and transactions, understanding its role in Automated Clearing House payments, direct deposits, and electronic funds transfers, simplifying online payments and money transfers.

The term "ACH" has multiple meanings depending on the context in which it is used. However, one of the most common interpretations of ACH is in the financial sector, where it stands for Automated Clearing House. This refers to a network used for electronic funds transfer between banks and other financial institutions. The ACH network is a key part of the U.S. payment system, facilitating direct deposit, direct payment, and other electronic transactions.

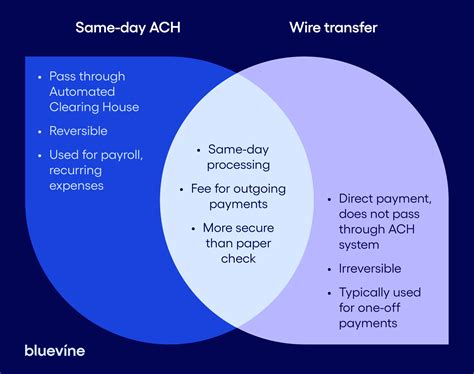

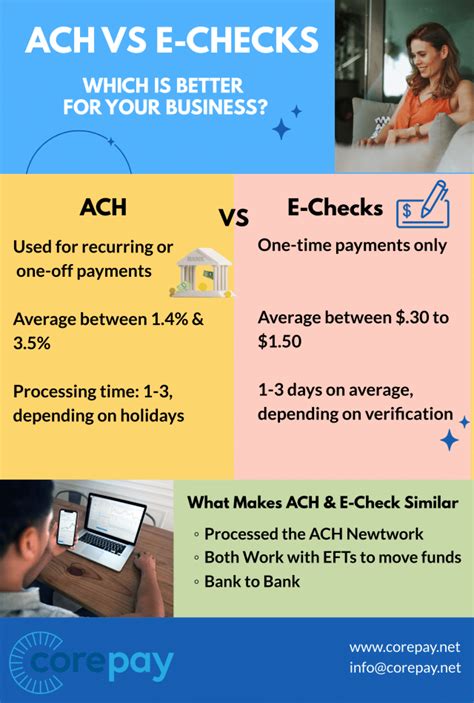

In the context of finance, ACH transactions are a crucial mechanism for moving money between accounts at different banks. These transactions can include payroll direct deposits, bill payments, and tax refunds, among others. The ACH system operates on a batch processing schedule, meaning that transactions are collected and processed in batches throughout the day, rather than in real-time. This distinguishes ACH transactions from other types of electronic payments, such as wire transfers, which are typically processed more quickly but may incur higher fees.

The efficiency and reliability of the ACH system have made it a preferred method for many types of transactions. For individuals, it means convenience and speed in receiving payments or paying bills. For businesses, it offers a cost-effective way to manage payroll and invoices. The ACH system is overseen by the National Automated Clearing House Association (NACHA), which sets rules and standards to ensure the security and integrity of the network.

Beyond its financial meaning, ACH can also refer to other concepts in different fields. For example, in chemistry, ACH might be an abbreviation for a chemical compound or an acronym for a process related to chemical reactions. In healthcare, it could stand for a medical condition, a treatment, or a healthcare-related term. The meaning of ACH can vary widely, and understanding its context is crucial to interpreting its significance accurately.

Understanding ACH Transactions

ACH transactions are fundamental to the modern financial system, enabling the smooth flow of funds between different parties. These transactions can be categorized into two main types: direct deposit and direct payment. Direct deposit involves pushing funds into an account, such as payroll deposits from an employer to an employee. Direct payment, on the other hand, involves pulling funds from an account, such as bill payments from a consumer to a utility company.

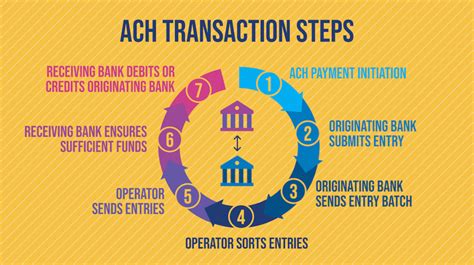

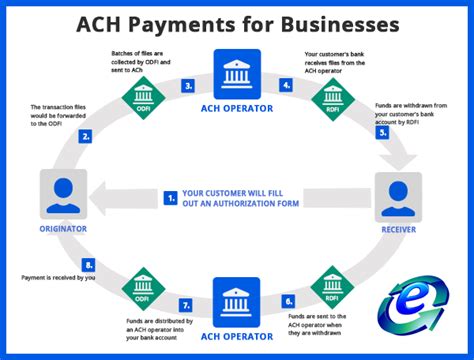

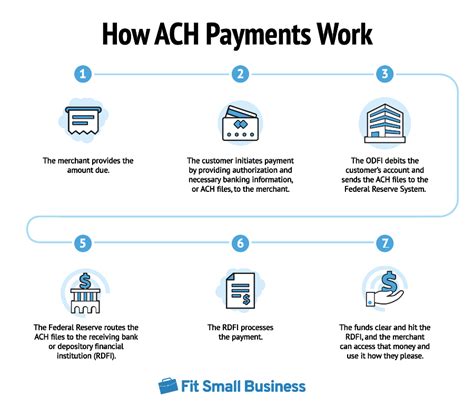

The process of an ACH transaction involves several steps:

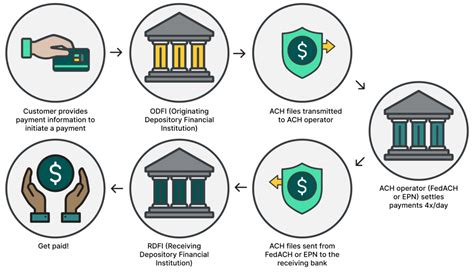

- Initiation: The transaction is initiated by the originator, who could be an individual, a business, or a government entity.

- Batching: The originator's bank (the ODFI, or Originating Depository Financial Institution) collects ACH transactions throughout the day and batches them for transmission to the ACH operator.

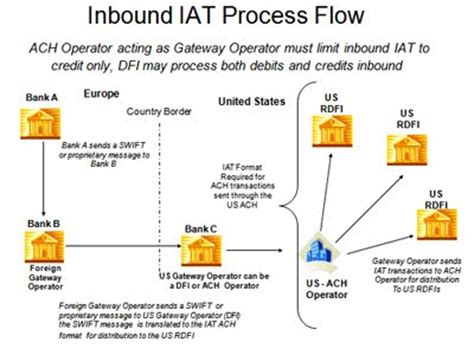

- Transmission: The batch of transactions is transmitted to the ACH operator, which sorts and distributes the transactions to the appropriate receiving banks (the RDFIs, or Receiving Depository Financial Institutions).

- Settlement: The settlement process involves the exchange of funds between the participating banks, typically through the Federal Reserve.

- Posting: Finally, the RDFI posts the transaction to the recipient's account, making the funds available.

Benefits of ACH Transactions

The use of ACH transactions offers several benefits to both individuals and businesses. Some of the key advantages include:

- Convenience: ACH transactions can be initiated online or through mobile banking apps, making it easy to manage finances remotely.

- Cost-Effectiveness: Compared to paper checks or wire transfers, ACH transactions are often less expensive, reducing the cost of doing business or managing personal finances.

- Speed: While not instantaneous, ACH transactions are generally faster than traditional check payments, with funds typically available within one to three business days.

- Security: The ACH network is subject to strict security standards, making it a safe way to move funds between accounts.

- Efficiency: ACH transactions reduce the need for physical checks and the labor associated with processing them, improving efficiency for businesses and financial institutions.

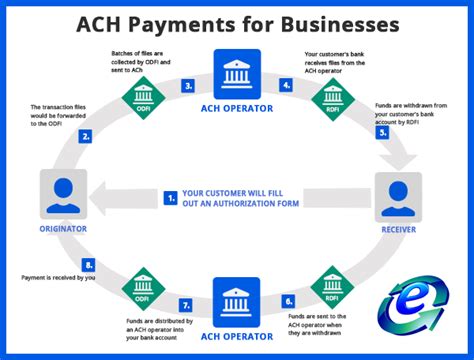

How ACH Works for Businesses

For businesses, integrating ACH transactions into their financial operations can streamline payroll, accounts payable, and accounts receivable processes. Here are some ways businesses can leverage ACH:

- Payroll: Businesses can use ACH for direct deposit of employee salaries, reducing the need for paper checks and the associated costs.

- Invoice Payments: ACH can be used to receive payments from customers, providing a convenient and cost-effective alternative to credit card payments or checks.

- Bill Payments: Businesses can also use ACH to pay their own bills, such as utility invoices or supplier payments, efficiently managing their cash flow.

Implementing ACH solutions requires businesses to work with their bank or a payment processor to set up the necessary infrastructure. This may involve obtaining approval, setting up accounts, and integrating ACH payment capabilities into their accounting or invoicing systems.

Security and Compliance in ACH Transactions

Given the sensitive nature of financial transactions, security and compliance are paramount in the ACH system. NACHA, the governing body over the ACH network, establishes and enforces rules to protect transactions and ensure the integrity of the system. Some of the key security measures include:

- Authentication: Verifying the identity of the parties involved in a transaction to prevent unauthorized access.

- Encryption: Protecting transaction data as it is transmitted through the network to prevent interception and reading by unauthorized parties.

- Compliance with Regulations: Adherence to federal and state laws, as well as industry standards, to safeguard consumer rights and prevent fraudulent activities.

Businesses and individuals must also take steps to secure their accounts and transactions, such as monitoring account activity regularly, using strong passwords, and being cautious of phishing scams aimed at obtaining sensitive financial information.

Future of ACH Transactions

The ACH system is evolving to meet the changing needs of consumers and businesses. One of the significant developments is the introduction of Same Day ACH, which enables faster processing of transactions. This enhancement allows for same-day settlement of eligible transactions, providing greater flexibility and speed in managing finances.

Additionally, advancements in technology, such as the integration of artificial intelligence and blockchain, are expected to further enhance the security, efficiency, and speed of ACH transactions. These innovations could lead to real-time payment capabilities, improved fraud detection, and more streamlined financial processes.

As the financial landscape continues to evolve, the role of ACH transactions is likely to expand, offering more convenient, secure, and efficient ways to move funds between accounts. Whether for personal use or business operations, understanding and leveraging ACH transactions can be a key strategy for managing finances effectively.

Gallery of ACH Related Images

ACH Image Gallery

What does ACH stand for?

+ACH stands for Automated Clearing House, which is a network used for electronic funds transfer between banks and other financial institutions.

How do ACH transactions work?

+ACH transactions involve the initiation of a transaction by the originator, batching and transmission of the transaction by the originating bank, sorting and distribution by the ACH operator, settlement between participating banks, and finally, posting of the transaction to the recipient's account.

What are the benefits of using ACH transactions?

+The benefits include convenience, cost-effectiveness, speed, security, and efficiency in managing finances and conducting business operations.

In conclusion, ACH transactions play a vital role in the financial system, offering a convenient, secure, and efficient way to move funds between accounts. As technology continues to evolve, the capabilities and benefits of ACH transactions are likely to expand, making it an even more essential tool for personal and business financial management. Whether you are an individual looking to streamline your finances or a business seeking to optimize your payment processes, understanding and leveraging ACH transactions can be a key strategy for achieving your goals. We invite you to share your thoughts on the role of ACH transactions in modern finance and how you see this technology evolving in the future. Your insights and experiences can help others better navigate the complex world of financial transactions.