Intro

Discover the 5 FIFO requirements for efficient inventory management, including first-in, first-out methods, stock control, and warehouse optimization techniques.

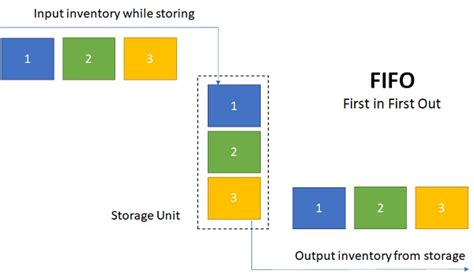

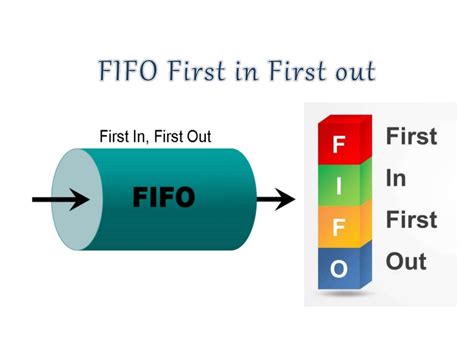

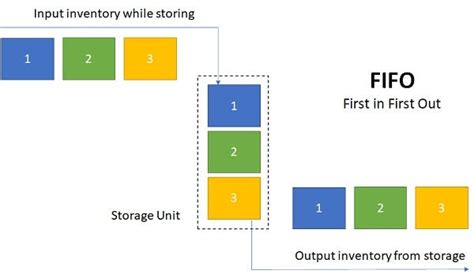

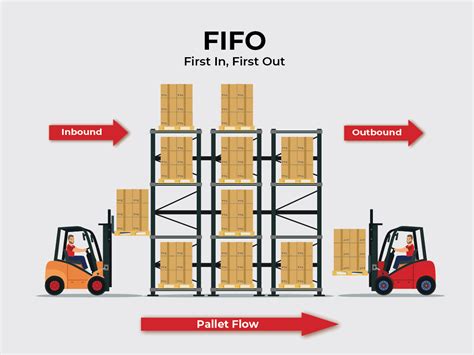

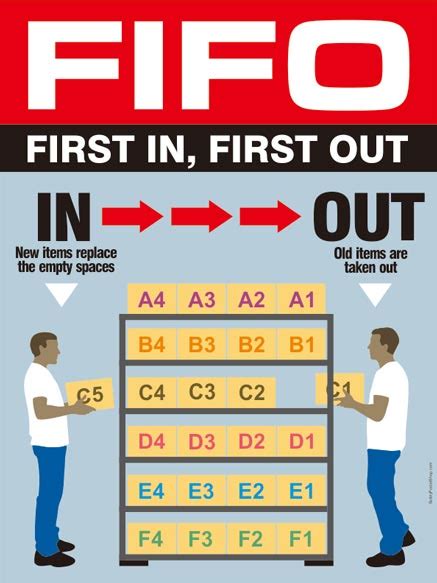

The First-In-First-Out (FIFO) method is a fundamental concept in inventory management and accounting. It assumes that the oldest items in inventory are sold or used first, which can have significant implications for businesses. Understanding the FIFO requirements is crucial for companies to ensure compliance with accounting standards and to make informed decisions about their inventory management practices.

The FIFO method is widely used in various industries, including retail, manufacturing, and distribution. It is essential to recognize the importance of FIFO requirements, as they can impact a company's financial statements, tax liabilities, and overall profitability. In this article, we will delve into the world of FIFO requirements, exploring their significance, benefits, and implementation.

FIFO requirements are designed to provide a clear and consistent approach to inventory valuation and costing. By following these requirements, businesses can ensure that their financial statements accurately reflect the value of their inventory and the costs associated with it. The FIFO method is particularly useful in industries where inventory items have a limited shelf life or are subject to rapid obsolescence.

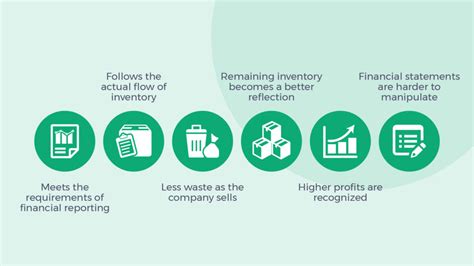

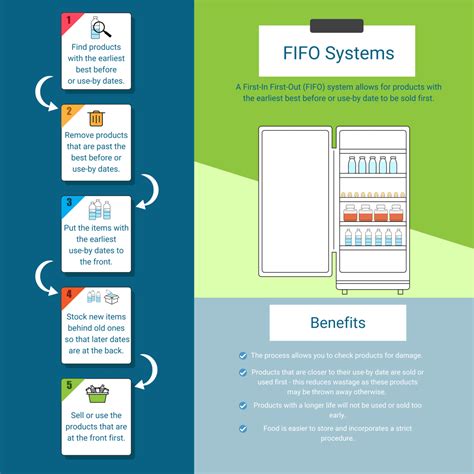

The benefits of using the FIFO method are numerous. It helps companies to reduce the risk of inventory obsolescence, as older items are sold or used before newer ones. This approach also enables businesses to match the cost of goods sold with the revenue generated from their sale, providing a more accurate picture of profitability. Furthermore, the FIFO method simplifies the inventory valuation process, as it eliminates the need to track individual inventory items and their respective costs.

Introduction to Fifo Requirements

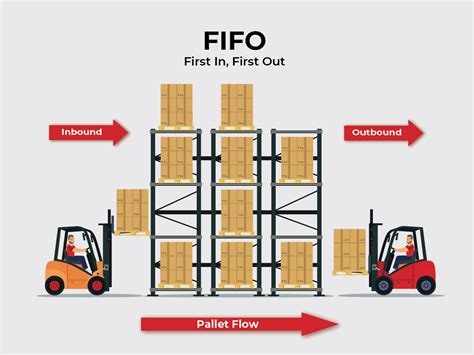

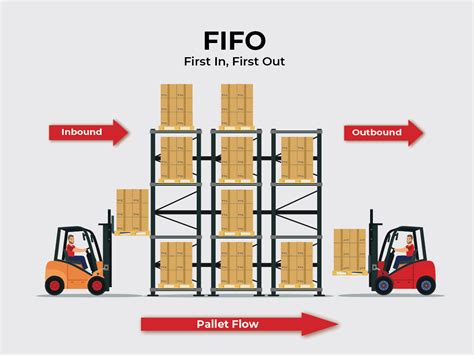

To implement the FIFO method effectively, businesses must establish a robust inventory management system. This system should be capable of tracking inventory items from receipt to sale or use, ensuring that the oldest items are prioritized. Companies can use various tools and techniques, such as inventory management software, barcoding, and RFID technology, to streamline their inventory management processes.

The FIFO requirements also involve regular inventory audits and reconciliations to ensure that the inventory records are accurate and up-to-date. These audits help to identify any discrepancies or errors in the inventory records, which can then be corrected to prevent financial statement errors.

Benefits of Fifo Requirements

In addition to the benefits mentioned earlier, the FIFO method can also help businesses to improve their cash flow management. By selling or using older inventory items first, companies can reduce the risk of inventory becoming obsolete or unsellable, which can result in significant write-offs and financial losses.

The FIFO requirements can also facilitate better decision-making within an organization. By providing a clear and accurate picture of inventory costs and values, businesses can make informed decisions about pricing, production, and inventory management. This can lead to improved profitability, reduced waste, and enhanced competitiveness in the market.

Implementation of Fifo Requirements

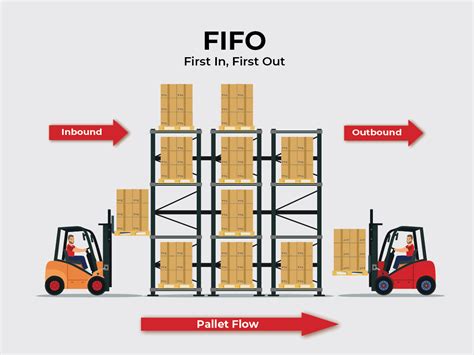

To implement the FIFO requirements effectively, businesses should follow these steps:

- Establish a robust inventory management system that can track inventory items from receipt to sale or use.

- Conduct regular inventory audits and reconciliations to ensure that the inventory records are accurate and up-to-date.

- Use inventory management software, barcoding, and RFID technology to streamline inventory management processes.

- Prioritize the sale or use of older inventory items to reduce the risk of obsolescence and write-offs.

- Monitor and analyze inventory costs and values to make informed decisions about pricing, production, and inventory management.

Challenges and Limitations of Fifo Requirements

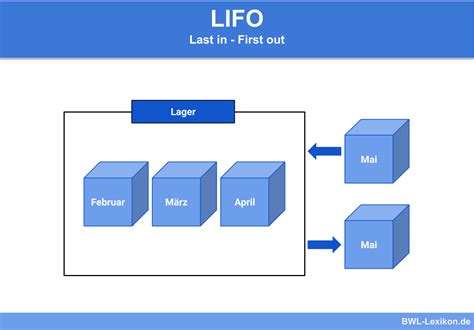

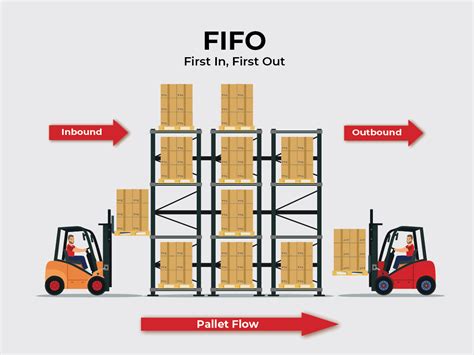

While the FIFO method offers numerous benefits, it also has some challenges and limitations. One of the main challenges is the need for accurate and up-to-date inventory records, which can be time-consuming and resource-intensive to maintain. Additionally, the FIFO method may not be suitable for businesses with complex inventory management systems or those that use multiple inventory locations.

Another limitation of the FIFO method is that it can be affected by changes in market conditions, such as fluctuations in demand or supply chain disruptions. In such cases, the FIFO method may not provide an accurate picture of inventory costs and values, which can lead to financial statement errors and poor decision-making.

Best Practices for Fifo Requirements

To overcome the challenges and limitations of the FIFO method, businesses should follow best practices such as:

- Implementing a robust inventory management system that can track inventory items from receipt to sale or use.

- Conducting regular inventory audits and reconciliations to ensure that the inventory records are accurate and up-to-date.

- Using inventory management software, barcoding, and RFID technology to streamline inventory management processes.

- Prioritizing the sale or use of older inventory items to reduce the risk of obsolescence and write-offs.

- Monitoring and analyzing inventory costs and values to make informed decisions about pricing, production, and inventory management.

Conclusion and Future Directions

In conclusion, the FIFO requirements are essential for businesses to ensure compliance with accounting standards and to make informed decisions about their inventory management practices. By understanding the benefits, challenges, and limitations of the FIFO method, companies can implement effective inventory management systems that prioritize the sale or use of older inventory items.

As businesses continue to evolve and adapt to changing market conditions, the importance of FIFO requirements will only continue to grow. By following best practices and staying up-to-date with the latest inventory management technologies and techniques, companies can optimize their inventory management processes, reduce costs, and improve profitability.

Fifo Requirements Image Gallery

What is the FIFO method?

+The FIFO method is a inventory valuation method that assumes that the oldest items in inventory are sold or used first.

What are the benefits of using the FIFO method?

+The benefits of using the FIFO method include reducing the risk of inventory obsolescence, matching the cost of goods sold with the revenue generated from their sale, and simplifying the inventory valuation process.

How can businesses implement the FIFO method effectively?

+Businesses can implement the FIFO method effectively by establishing a robust inventory management system, conducting regular inventory audits and reconciliations, and using inventory management software, barcoding, and RFID technology to streamline inventory management processes.

We hope this article has provided you with a comprehensive understanding of the FIFO requirements and their importance in inventory management. If you have any further questions or would like to share your experiences with implementing the FIFO method, please don't hesitate to comment below. Additionally, if you found this article informative and helpful, please share it with your colleagues and friends who may benefit from this knowledge.