Intro

Discover the surcharge meaning and its impact on transactions, including extra fees, additional charges, and payment processing costs, to understand how surcharges affect consumers and businesses in various industries.

The concept of surcharge has become increasingly prevalent in various aspects of our daily lives, from credit card transactions to utility bills. But have you ever stopped to think about what surcharge actually means? In this article, we will delve into the world of surcharges, exploring their definition, types, and implications on our financial lives.

A surcharge is essentially an additional fee or charge levied on top of the original cost of a product or service. This extra amount is usually imposed by the provider or seller to cover various expenses, such as processing fees, taxes, or other operational costs. Surcharges can be found in various industries, including finance, retail, and hospitality. For instance, when you use a credit card to make a purchase, you may be charged a surcharge by the merchant to cover the processing fee.

The importance of understanding surcharges cannot be overstated. With the rise of digital payments and online transactions, surcharges have become a common phenomenon. However, many consumers are unaware of the surcharges they are being charged, which can lead to unexpected expenses and financial strain. By grasping the concept of surcharge, individuals can make informed decisions about their financial transactions and avoid unnecessary costs.

In recent years, surcharges have become a topic of debate among consumers, businesses, and regulatory bodies. Some argue that surcharges are a necessary evil, allowing businesses to cover their operational costs and maintain profitability. Others claim that surcharges are unfair and exploitative, taking advantage of unsuspecting consumers. As we navigate the complex world of surcharges, it is essential to consider the perspectives of all stakeholders involved.

Types of Surcharges

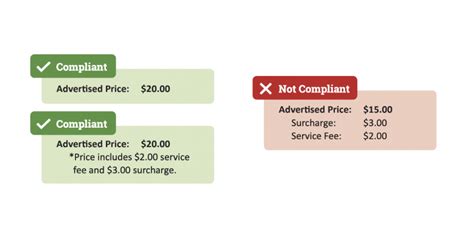

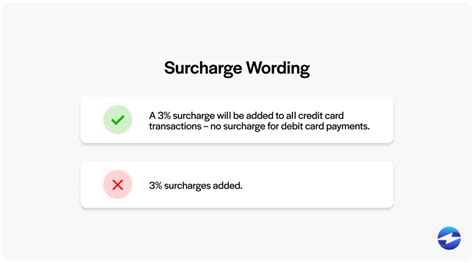

Each type of surcharge has its own set of rules and regulations, which can vary depending on the industry and location. For instance, credit card surcharges are subject to regulations that dictate how much a merchant can charge and how the fee must be disclosed to the consumer.

How Surcharges Work

The process of implementing surcharges typically involves several steps, including:

- Calculation: The surcharge amount is calculated based on the original cost or other factors.

- Disclosure: The surcharge is disclosed to the consumer, either through a receipt, invoice, or other notification.

- Payment: The consumer pays the surcharge, either separately or as part of the original cost.

It is essential to note that surcharges can be mandatory or optional, depending on the context. For instance, a credit card surcharge might be mandatory for certain types of transactions, while a service surcharge might be optional, depending on the consumer's preferences.

Benefits and Drawbacks of Surcharges

However, surcharges also have several drawbacks, including:

- Increased costs: Surcharges can increase the cost of a product or service, making it more expensive for consumers.

- Complexity: Surcharges can add complexity to pricing, making it difficult for consumers to understand the full cost of a product or service.

- Inequity: Surcharges can be inequitable, disproportionately affecting certain groups of consumers, such as low-income households.

Regulations and Laws Surrounding Surcharges

It is essential to note that regulations and laws surrounding surcharges are constantly evolving, with new legislation and guidelines being introduced regularly. Businesses and consumers must stay up-to-date with these changes to ensure compliance and avoid potential penalties.

Best Practices for Implementing Surcharges

By following these best practices, businesses can implement surcharges in a way that is fair, transparent, and compliant with regulations.

Conclusion and Future Directions

As we look to the future, it is likely that surcharges will continue to play a significant role in our financial lives. With the rise of digital payments and online transactions, surcharges will become increasingly prevalent. However, by promoting transparency, fairness, and compliance with regulations, we can ensure that surcharges are implemented in a way that benefits all stakeholders involved.

Surcharge Image Gallery

What is a surcharge?

+A surcharge is an additional fee or charge levied on top of the original cost of a product or service.

What are the different types of surcharges?

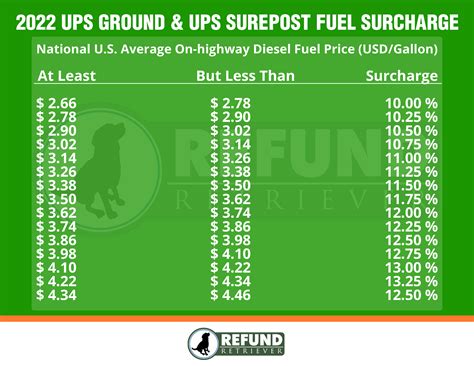

+There are various types of surcharges, including credit card surcharges, fuel surcharges, utility surcharges, and service surcharges.

How are surcharges calculated?

+Surcharges can be calculated as a percentage of the original cost or as a flat fee, depending on the type of surcharge and the industry.

What are the benefits and drawbacks of surcharges?

+Surcharges have both benefits and drawbacks, including revenue generation, transparency, and flexibility, as well as increased costs, complexity, and inequity.

What are the regulations and laws surrounding surcharges?

+Surcharges are subject to various regulations and laws, including the Dodd-Frank Act, FTC guidelines, and state and local laws, which can vary depending on the industry and location.

We hope this article has provided you with a comprehensive understanding of surcharges and their implications on our financial lives. Whether you are a consumer or a business, it is essential to stay informed about surcharges and their effects on your financial transactions. By sharing this article with others and engaging in discussions about surcharges, we can promote transparency, fairness, and compliance with regulations. What are your thoughts on surcharges? Share your comments and experiences below!