Intro

Discover 5 ways a general ledger boosts accounting efficiency, simplifying financial tracking, and enhancing ledger management with automated ledger posting, accounts reconciliation, and financial reporting.

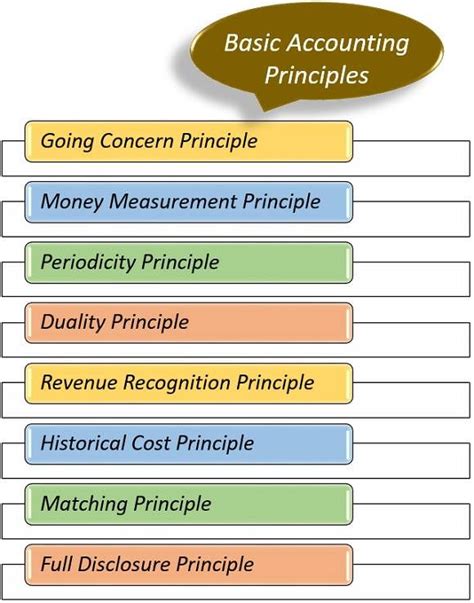

General ledger accounting is a fundamental aspect of financial management, serving as the backbone of a company's financial records. It provides a comprehensive and detailed account of all financial transactions, making it an indispensable tool for businesses of all sizes. The importance of general ledger accounting cannot be overstated, as it enables companies to track their financial performance, make informed decisions, and ensure compliance with regulatory requirements. In this article, we will delve into the world of general ledger accounting, exploring its benefits, working mechanisms, and best practices.

Effective financial management is crucial for the success of any business, and general ledger accounting plays a vital role in achieving this goal. By maintaining accurate and up-to-date financial records, companies can gain valuable insights into their financial performance, identify areas for improvement, and make data-driven decisions. Moreover, general ledger accounting helps businesses to ensure compliance with financial regulations, reducing the risk of non-compliance and associated penalties. With the increasing complexity of financial transactions and regulatory requirements, the importance of general ledger accounting has never been more pronounced.

As businesses navigate the complexities of financial management, they must stay informed about the latest trends, best practices, and technologies in general ledger accounting. This includes understanding the benefits of automation, cloud-based accounting, and data analytics, as well as the importance of maintaining accurate and detailed financial records. By leveraging these tools and techniques, companies can streamline their financial processes, improve efficiency, and gain a competitive edge in the market. In the following sections, we will explore the key aspects of general ledger accounting, providing readers with a comprehensive understanding of this critical business function.

What is General Ledger Accounting?

Key Components of General Ledger Accounting

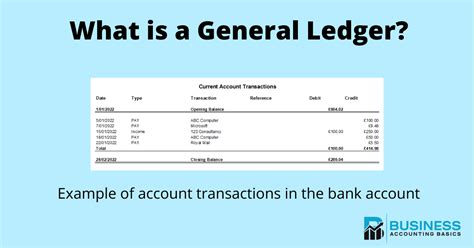

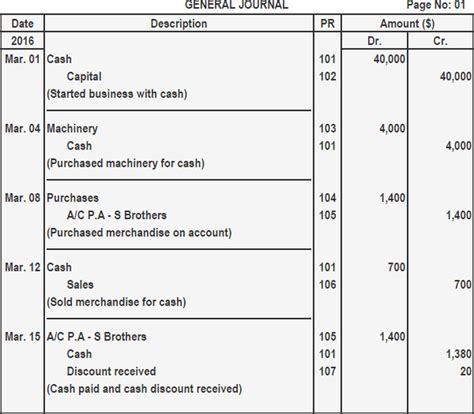

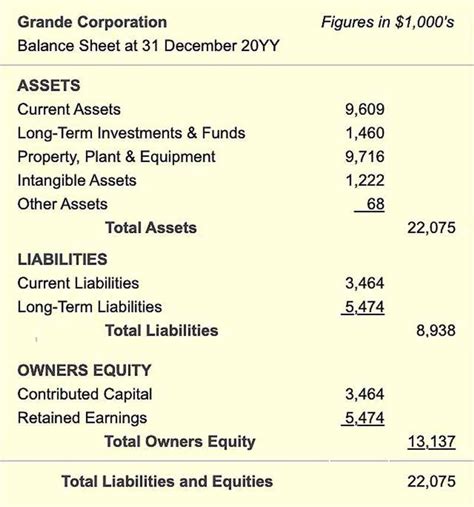

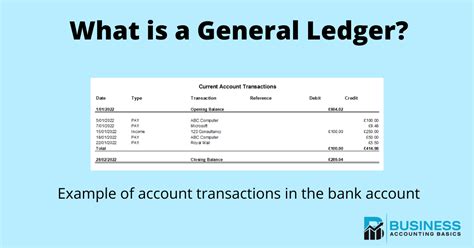

The general ledger accounting system consists of several key components, including: * Chart of accounts: A list of all financial accounts used by the company, including assets, liabilities, equity, revenues, and expenses. * Journal entries: Records of individual financial transactions, including date, account, debit, and credit. * Ledger accounts: Detailed records of each financial account, including opening balance, transactions, and closing balance. * Financial statements: Periodic reports that provide a summary of a company's financial performance, including balance sheet, income statement, and cash flow statement.Benefits of General Ledger Accounting

Best Practices for General Ledger Accounting

To get the most out of general ledger accounting, businesses should follow best practices, including: * Maintaining accurate and up-to-date financial records * Regularly reviewing and reconciling financial statements * Implementing automated accounting systems * Providing training and support to accounting staff * Conducting regular audits and reviews to ensure compliance and accuracyGeneral Ledger Accounting Software

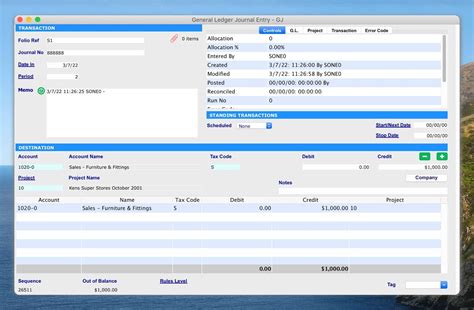

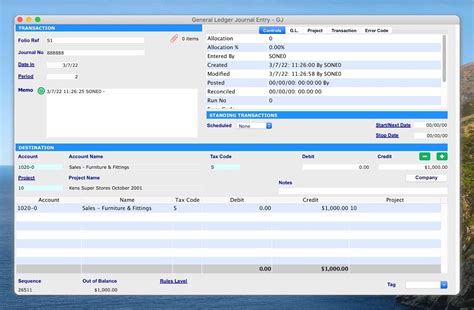

Key Features of General Ledger Accounting Software

When selecting general ledger accounting software, businesses should look for key features, including: * Automated journal entries and ledger accounts * Real-time financial reporting and analysis * Multi-user access and collaboration * Integration with other accounting systems and tools * Scalability and flexibility to meet growing business needsCommon Challenges in General Ledger Accounting

Overcoming Challenges in General Ledger Accounting

To overcome challenges in general ledger accounting, businesses should: * Invest in automated accounting systems and tools * Provide training and support to accounting staff * Regularly review and reconcile financial statements * Seek professional advice and guidance from accounting experts * Stay informed about the latest trends, best practices, and technologies in general ledger accountingFuture of General Ledger Accounting

Impact of Emerging Technologies on General Ledger Accounting

Emerging technologies are having a significant impact on general ledger accounting, including: * Artificial intelligence: Automating tasks, improving accuracy, and enhancing decision-making * Blockchain: Enhancing security, transparency, and accountability * Cloud-based accounting: Improving accessibility, scalability, and collaboration * Big data analytics: Providing insights and intelligence to drive business growth and decision-makingGeneral Ledger Accounting Image Gallery

What is the purpose of general ledger accounting?

+The purpose of general ledger accounting is to provide a comprehensive and detailed account of a company's financial activities, enabling businesses to track their financial performance, make informed decisions, and ensure compliance with regulatory requirements.

What are the key components of general ledger accounting?

+The key components of general ledger accounting include the chart of accounts, journal entries, ledger accounts, and financial statements.

What are the benefits of general ledger accounting?

+The benefits of general ledger accounting include improved financial management, enhanced accuracy, increased efficiency, and better decision-making.

What is the future of general ledger accounting?

+The future of general ledger accounting is exciting and rapidly evolving, with emerging trends and technologies, such as artificial intelligence, blockchain, and cloud-based accounting, transforming the way businesses manage their financial records.

How can businesses overcome challenges in general ledger accounting?

+Businesses can overcome challenges in general ledger accounting by investing in automated accounting systems and tools, providing training and support to accounting staff, regularly reviewing and reconciling financial statements, seeking professional advice and guidance from accounting experts, and staying informed about the latest trends, best practices, and technologies in general ledger accounting.

In conclusion, general ledger accounting is a critical business function that provides a comprehensive and detailed account of a company's financial activities. By understanding the benefits, working mechanisms, and best practices of general ledger accounting, businesses can improve their financial management, enhance accuracy, increase efficiency, and drive growth. As the future of general ledger accounting continues to evolve, businesses must stay informed and adapt to changing regulatory requirements, technological advancements, and industry best practices. We invite readers to share their thoughts and experiences on general ledger accounting, and to explore the resources and tools available to support their financial management needs.