Intro

Discover what GL means, exploring General Ledger definitions, accounting concepts, and financial management systems, to understand its role in bookkeeping and ledger accounting processes.

The importance of understanding GL (General Ledger) accounting cannot be overstated, as it serves as the backbone of a company's financial management system. A well-organized and accurate GL system enables businesses to make informed decisions, ensure compliance with regulatory requirements, and maintain transparency in their financial dealings. In this article, we will delve into the world of GL accounting, exploring its benefits, working mechanisms, and best practices for implementation.

As we navigate the complexities of financial management, it becomes clear that a robust GL system is essential for tracking and recording financial transactions. This, in turn, allows businesses to generate accurate financial statements, such as balance sheets and income statements, which are crucial for stakeholders, investors, and regulatory bodies. Furthermore, a well-implemented GL system helps to identify areas of inefficiency, enabling companies to streamline their operations and optimize resource allocation.

The significance of GL accounting extends beyond mere financial record-keeping, as it also plays a critical role in facilitating internal controls, audit trails, and compliance with accounting standards. By maintaining a transparent and accurate GL system, businesses can demonstrate their commitment to good governance and financial integrity, thereby enhancing their reputation and credibility in the market. As we explore the intricacies of GL accounting, it becomes evident that its importance cannot be overstated, and its implementation is essential for any business seeking to establish a strong financial foundation.

Introduction to General Ledger Accounting

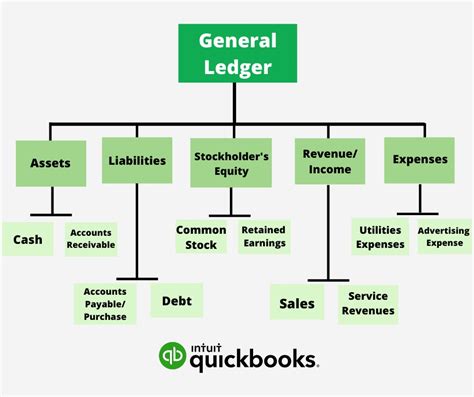

General Ledger accounting is a systematic approach to recording, classifying, and reporting financial transactions. It involves the use of a centralized ledger, which contains all the financial accounts of a business, including assets, liabilities, equity, revenues, and expenses. The GL system is designed to provide a comprehensive and accurate picture of a company's financial position, enabling management to make informed decisions and drive business growth.

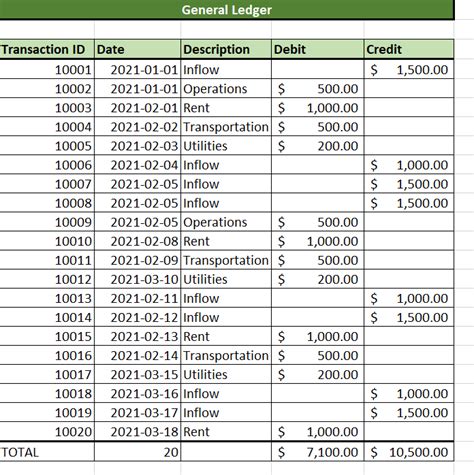

At its core, GL accounting involves the following key components:

- Chart of accounts: A master list of all financial accounts used by the business

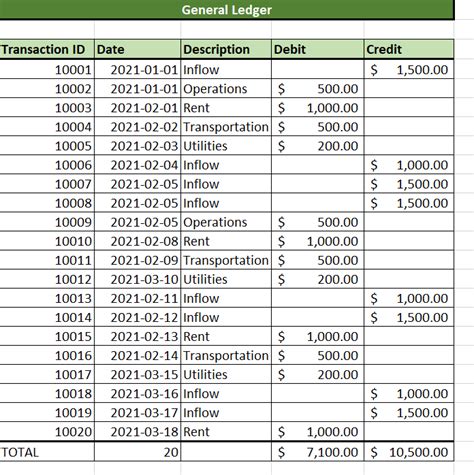

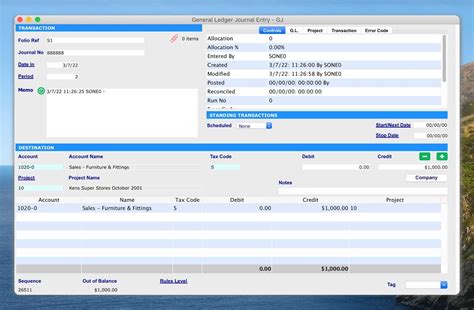

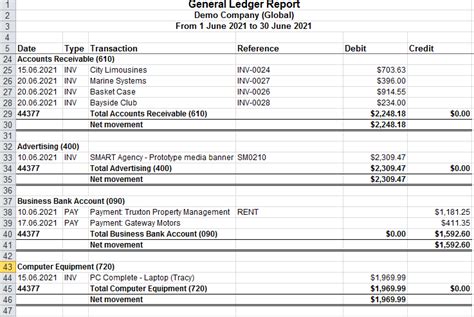

- Journal entries: The process of recording financial transactions in the GL system

- Ledger accounts: The individual accounts that make up the GL system

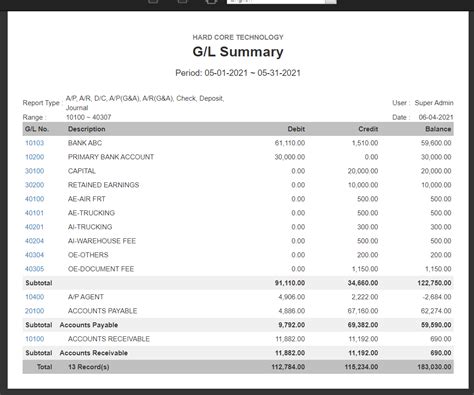

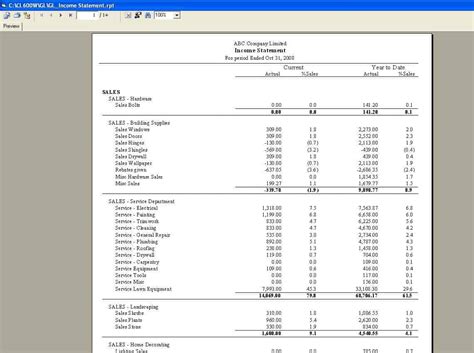

- Financial statements: The output of the GL system, including balance sheets, income statements, and cash flow statements

Benefits of General Ledger Accounting

The benefits of implementing a robust GL system are numerous and far-reaching. Some of the most significant advantages include:- Improved financial accuracy and transparency

- Enhanced decision-making capabilities

- Increased efficiency and productivity

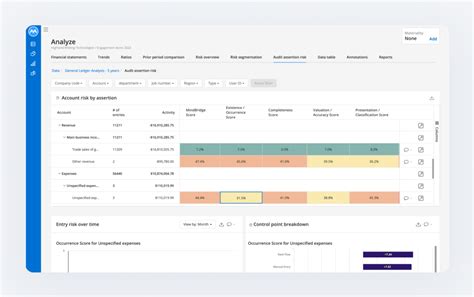

- Better internal controls and audit trails

- Compliance with regulatory requirements and accounting standards

By leveraging these benefits, businesses can establish a strong financial foundation, drive growth, and achieve long-term success.

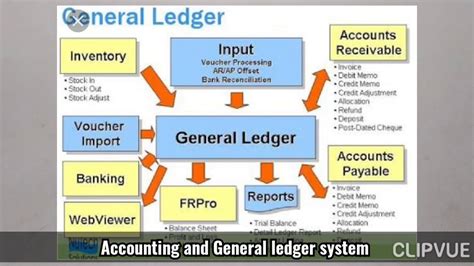

Working Mechanisms of General Ledger Accounting

The working mechanisms of GL accounting involve a series of steps, including:

- Transaction recording: Financial transactions are recorded in the GL system using journal entries.

- Account classification: Transactions are classified into different accounts, such as assets, liabilities, and equity.

- Ledger posting: Journal entries are posted to the respective ledger accounts.

- Financial statement preparation: The GL system is used to generate financial statements, including balance sheets and income statements.

By understanding these working mechanisms, businesses can ensure that their GL system is operating effectively and efficiently.

Steps to Implement General Ledger Accounting

Implementing a GL system involves several key steps, including:- Defining the chart of accounts

- Setting up the GL system

- Recording financial transactions

- Preparing financial statements

- Reviewing and reconciling the GL system

By following these steps, businesses can establish a robust GL system that meets their financial management needs.

Best Practices for General Ledger Accounting

To ensure the effectiveness and efficiency of the GL system, businesses should adhere to best practices, including:

- Maintaining a comprehensive and up-to-date chart of accounts

- Implementing robust internal controls and audit trails

- Ensuring compliance with regulatory requirements and accounting standards

- Providing regular training and support to GL system users

- Reviewing and reconciling the GL system on a regular basis

By following these best practices, businesses can optimize their GL system and achieve long-term financial success.

Common Challenges in General Ledger Accounting

Despite its importance, GL accounting can be challenging, particularly for small and medium-sized businesses. Some common challenges include:- Limited resources and expertise

- Inadequate internal controls and audit trails

- Non-compliance with regulatory requirements and accounting standards

- Inefficient GL systems and processes

By understanding these challenges, businesses can take proactive steps to address them and ensure the effectiveness and efficiency of their GL system.

Gallery of General Ledger Accounting

General Ledger Accounting Image Gallery

Frequently Asked Questions

What is General Ledger accounting?

+General Ledger accounting is a systematic approach to recording, classifying, and reporting financial transactions.

What are the benefits of General Ledger accounting?

+The benefits of General Ledger accounting include improved financial accuracy and transparency, enhanced decision-making capabilities, and increased efficiency and productivity.

How do I implement General Ledger accounting in my business?

+To implement General Ledger accounting in your business, you should define your chart of accounts, set up your GL system, record financial transactions, prepare financial statements, and review and reconcile your GL system on a regular basis.

What are some common challenges in General Ledger accounting?

+Some common challenges in General Ledger accounting include limited resources and expertise, inadequate internal controls and audit trails, non-compliance with regulatory requirements and accounting standards, and inefficient GL systems and processes.

How can I ensure the effectiveness and efficiency of my General Ledger system?

+To ensure the effectiveness and efficiency of your General Ledger system, you should maintain a comprehensive and up-to-date chart of accounts, implement robust internal controls and audit trails, ensure compliance with regulatory requirements and accounting standards, provide regular training and support to GL system users, and review and reconcile your GL system on a regular basis.

In conclusion, General Ledger accounting is a critical component of a company's financial management system. By understanding the benefits, working mechanisms, and best practices of GL accounting, businesses can establish a strong financial foundation, drive growth, and achieve long-term success. We encourage readers to share their thoughts and experiences with General Ledger accounting in the comments section below. Additionally, we invite readers to explore our other articles and resources on financial management and accounting topics. By working together, we can promote financial literacy and support businesses in achieving their goals.