Intro

Discover 5 ways to understand invoices, including invoice templates, billing cycles, and payment terms, to streamline accounting and invoicing processes with ease.

Understanding invoices is crucial for businesses and individuals alike, as they serve as a vital tool for tracking payments, managing finances, and maintaining transparent transactions. Invoices are documents that outline the details of a sale or service provided, including the amount due, payment terms, and other relevant information. In this article, we will delve into the world of invoices, exploring their importance, types, and key components.

In today's fast-paced business environment, invoices play a pivotal role in ensuring that transactions are conducted efficiently and effectively. They provide a clear and concise record of the goods or services provided, allowing both parties to keep track of their financial obligations. Moreover, invoices help businesses to manage their cash flow, identify areas for improvement, and make informed decisions about their financial strategies.

The importance of invoices cannot be overstated, as they have a direct impact on the financial health and reputation of a business. A well-structured invoice can help to build trust with customers, reduce the risk of payment disputes, and improve the overall efficiency of the payment process. On the other hand, a poorly crafted invoice can lead to confusion, delays, and even legal issues.

Understanding the Basics of Invoices

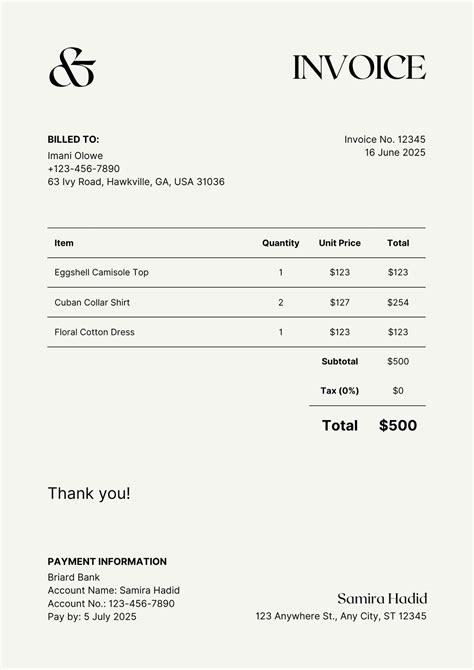

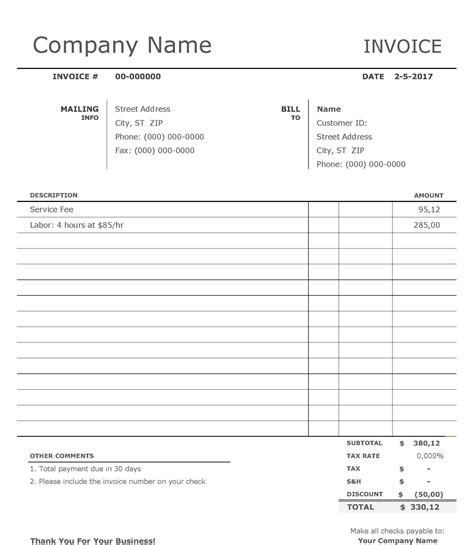

To understand invoices, it is essential to familiarize yourself with their basic components. These include the invoice number, date, billing information, payment terms, and a detailed breakdown of the goods or services provided. Each of these components plays a critical role in ensuring that the invoice is accurate, complete, and easy to understand.

Types of Invoices

There are several types of invoices, each designed to serve a specific purpose. These include pro forma invoices, commercial invoices, and credit memos. Pro forma invoices are used to provide a quote or estimate for goods or services, while commercial invoices are used for international transactions. Credit memos, on the other hand, are used to refund or credit customers for goods or services that were not provided.

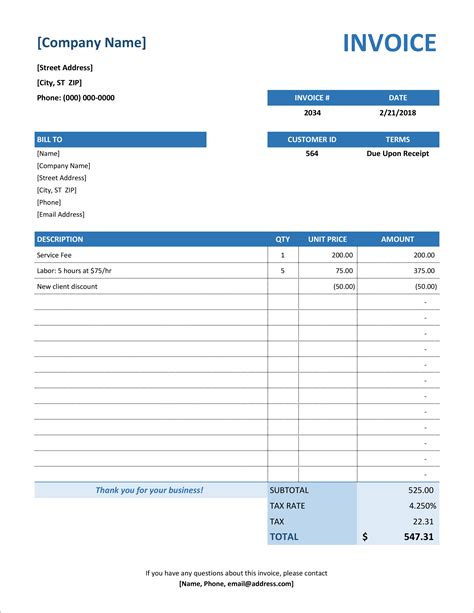

Key Components of an Invoice

A well-structured invoice should include several key components, including the invoice number, date, billing information, payment terms, and a detailed breakdown of the goods or services provided. The invoice number serves as a unique identifier, allowing businesses to track and manage their invoices efficiently. The date, on the other hand, indicates when the invoice was issued and when payment is due.

Benefits of Using Invoices

Using invoices can bring numerous benefits to businesses, including improved cash flow, reduced payment disputes, and enhanced financial management. Invoices provide a clear and concise record of transactions, allowing businesses to track their financial obligations and make informed decisions about their financial strategies. Moreover, invoices can help to build trust with customers, reduce the risk of payment disputes, and improve the overall efficiency of the payment process.

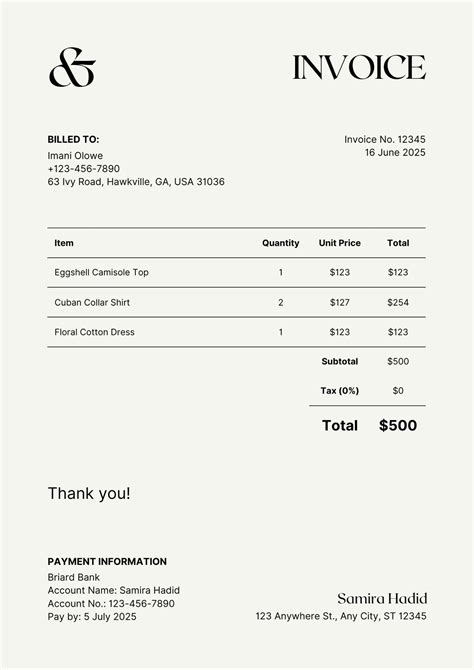

Best Practices for Creating Invoices

Creating an effective invoice requires careful attention to detail and a clear understanding of the key components involved. Businesses should ensure that their invoices are accurate, complete, and easy to understand, with a clear breakdown of the goods or services provided. Moreover, invoices should be sent promptly, with a clear indication of when payment is due and what payment methods are accepted.

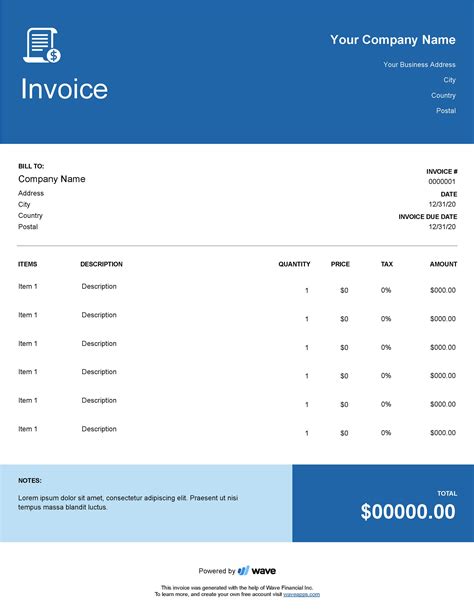

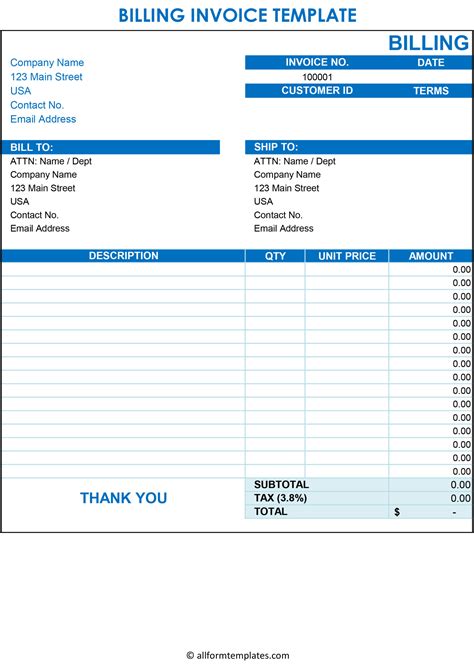

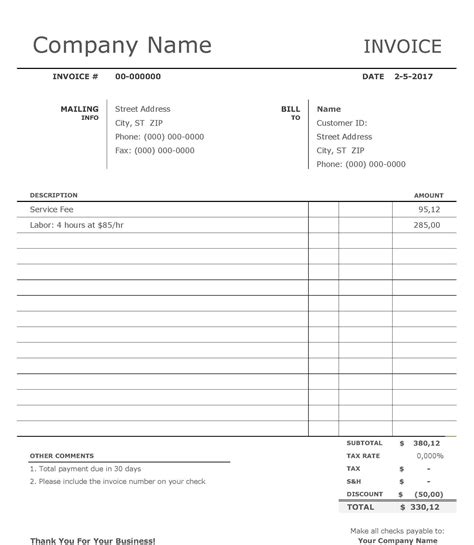

In addition to these best practices, businesses should also consider using invoice templates or software to streamline their invoicing process. These tools can help to reduce errors, improve efficiency, and enhance the overall professionalism of the invoice.

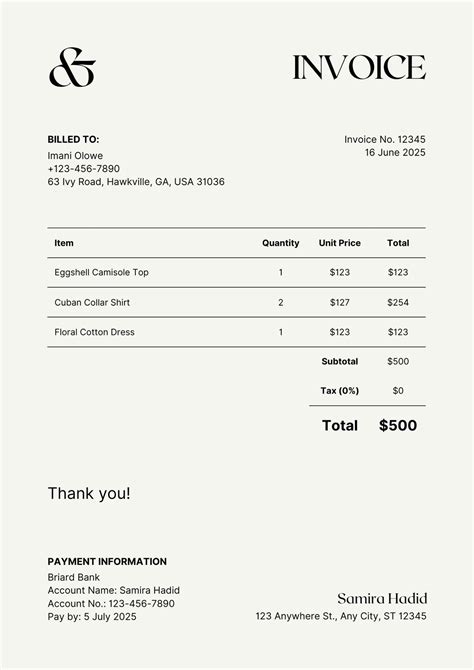

Gallery of Invoice Templates

Invoice Templates Image Gallery

What is an invoice and why is it important?

+An invoice is a document that outlines the details of a sale or service provided, including the amount due, payment terms, and other relevant information. It is essential for businesses and individuals to use invoices, as they provide a clear and concise record of transactions, helping to manage finances, track payments, and maintain transparent transactions.

What are the key components of an invoice?

+The key components of an invoice include the invoice number, date, billing information, payment terms, and a detailed breakdown of the goods or services provided. These components are essential for ensuring that the invoice is accurate, complete, and easy to understand.

How can I create an effective invoice?

+To create an effective invoice, you should ensure that it is accurate, complete, and easy to understand. Use a clear and concise format, with a detailed breakdown of the goods or services provided. Include the invoice number, date, billing information, payment terms, and any other relevant details. You can also consider using invoice templates or software to streamline your invoicing process.

In conclusion, understanding invoices is crucial for businesses and individuals alike, as they serve as a vital tool for tracking payments, managing finances, and maintaining transparent transactions. By familiarizing yourself with the key components of an invoice, using best practices for creating invoices, and leveraging invoice templates or software, you can streamline your invoicing process, reduce errors, and improve the overall efficiency of your financial management. We invite you to share your thoughts and experiences with invoices in the comments below, and to explore our other articles for more insights and tips on managing your finances effectively.