Intro

Discover what a ledger is, a fundamental accounting tool, and learn about ledger accounts, ledger books, and digital ledger systems, including blockchain ledger technology.

The concept of a ledger has been around for centuries, playing a crucial role in the financial management and record-keeping of individuals, businesses, and organizations. In its simplest form, a ledger is a book or digital file that contains a collection of financial transactions, accounts, and balances. It serves as a central repository for all financial data, providing a clear and comprehensive picture of an entity's financial situation.

The importance of a ledger cannot be overstated, as it enables individuals and businesses to track their income and expenses, manage their cash flow, and make informed decisions about their financial resources. With the advent of digital technology, ledgers have evolved to become more sophisticated and efficient, offering a range of features and benefits that make financial management easier and more effective.

In today's fast-paced business environment, a ledger is an essential tool for anyone looking to manage their finances effectively. Whether you're a small business owner, a freelancer, or an individual looking to track your personal finances, a ledger can help you stay organized, reduce errors, and make the most of your financial resources. In this article, we'll delve into the world of ledgers, exploring their history, types, benefits, and features, as well as providing practical tips and examples to help you get the most out of your ledger.

Introduction to Ledgers

A ledger is a fundamental component of accounting and financial management, providing a systematic and organized way to record and track financial transactions. It's a critical tool for businesses, individuals, and organizations, enabling them to manage their finances effectively, make informed decisions, and achieve their financial goals. In this section, we'll explore the basics of ledgers, including their history, types, and benefits.

History of Ledgers

The concept of a ledger dates back to ancient civilizations, where merchants and traders used clay tablets and papyrus to record their financial transactions. The modern ledger, however, emerged during the Middle Ages, where it was used by merchants and traders to record their transactions, manage their inventory, and track their profits. Over time, the ledger has evolved to become more sophisticated, with the advent of digital technology and accounting software.Types of Ledgers

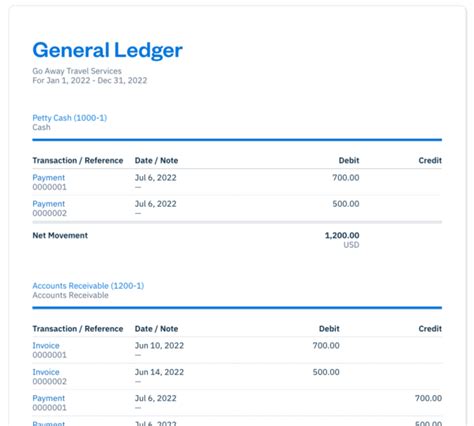

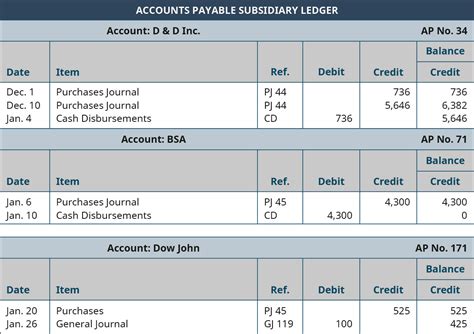

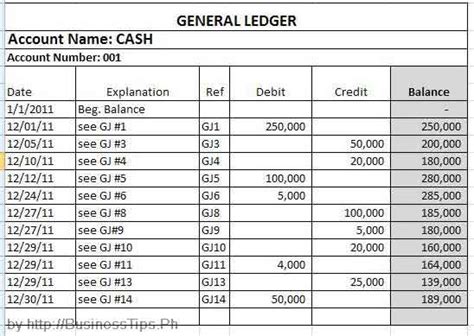

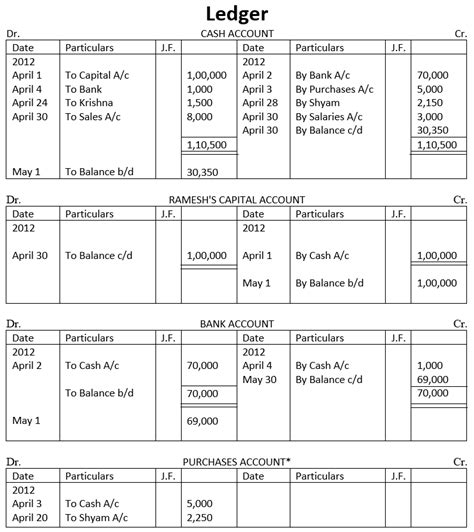

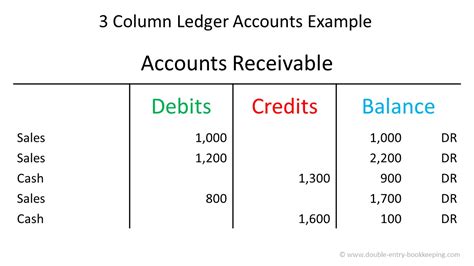

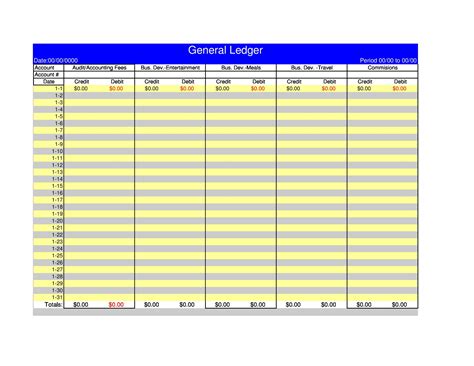

There are several types of ledgers, each designed to meet the specific needs of individuals, businesses, and organizations. Some of the most common types of ledgers include: * General ledger: A general ledger is a comprehensive ledger that contains all the financial transactions of a business or organization. * Subsidiary ledger: A subsidiary ledger is a specialized ledger that contains detailed information about specific accounts, such as accounts payable or accounts receivable. * Cash ledger: A cash ledger is a ledger that tracks all cash transactions, including receipts and payments. * Journal ledger: A journal ledger is a ledger that records all financial transactions in chronological order.Benefits of Ledgers

Ledgers offer a range of benefits, including:

- Improved financial management: A ledger provides a clear and comprehensive picture of an entity's financial situation, enabling them to make informed decisions about their financial resources.

- Enhanced accuracy: A ledger helps to reduce errors and inaccuracies, providing a systematic and organized way to record and track financial transactions.

- Increased efficiency: A ledger automates many financial tasks, such as data entry and calculations, freeing up time and resources for more strategic activities.

- Better decision-making: A ledger provides valuable insights and information, enabling individuals and businesses to make informed decisions about their financial resources.

Features of Ledgers

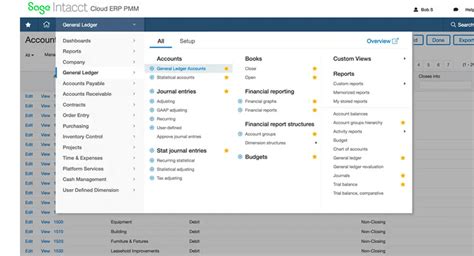

Modern ledgers offer a range of features, including: * Automated data entry: Many ledgers offer automated data entry, enabling users to import financial data from various sources, such as bank statements and invoices. * Real-time reporting: Ledgers provide real-time reporting, enabling users to access up-to-date financial information and make informed decisions. * Budgeting and forecasting: Many ledgers offer budgeting and forecasting tools, enabling users to plan and manage their finances more effectively. * Security and backup: Ledgers provide robust security and backup features, protecting financial data from loss or corruption.Types of Ledger Accounts

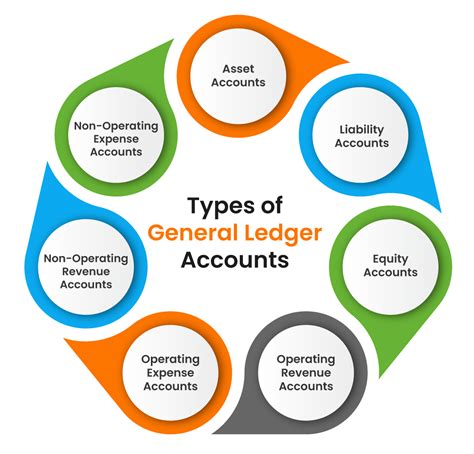

Ledger accounts are the building blocks of a ledger, providing a systematic and organized way to record and track financial transactions. There are several types of ledger accounts, including:

- Asset accounts: Asset accounts represent the resources owned or controlled by a business or organization, such as cash, inventory, and equipment.

- Liability accounts: Liability accounts represent the debts or obligations of a business or organization, such as accounts payable and loans.

- Equity accounts: Equity accounts represent the ownership interest in a business or organization, such as common stock and retained earnings.

- Revenue accounts: Revenue accounts represent the income earned by a business or organization, such as sales and services.

- Expense accounts: Expense accounts represent the costs incurred by a business or organization, such as salaries and rent.

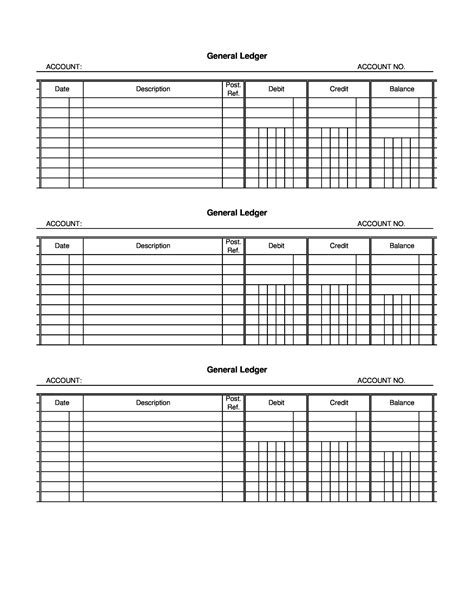

How to Set Up a Ledger

Setting up a ledger is a straightforward process that involves several steps, including: * Defining the ledger structure: The first step is to define the ledger structure, including the types of accounts and the financial reporting requirements. * Creating ledger accounts: The next step is to create ledger accounts, including asset, liability, equity, revenue, and expense accounts. * Setting up ledger templates: Many ledgers offer pre-built templates, enabling users to set up their ledger quickly and easily. * Importing financial data: The final step is to import financial data, including transactions, accounts, and balances.Best Practices for Using a Ledger

Using a ledger effectively requires several best practices, including:

- Regularly updating the ledger: It's essential to regularly update the ledger, including recording all financial transactions and reconciling accounts.

- Reconciling accounts: Reconciling accounts is critical to ensuring the accuracy and integrity of the ledger.

- Using ledger templates: Using ledger templates can help to streamline the setup and maintenance of the ledger.

- Monitoring financial performance: A ledger provides valuable insights into financial performance, enabling users to monitor and manage their finances more effectively.

Common Ledger Mistakes

There are several common ledger mistakes, including: * Inaccurate data entry: Inaccurate data entry can lead to errors and inaccuracies in the ledger. * Failure to reconcile accounts: Failing to reconcile accounts can lead to discrepancies and inaccuracies in the ledger. * Insufficient security: Insufficient security can lead to data loss or corruption, compromising the integrity of the ledger.Future of Ledgers

The future of ledgers is exciting, with several trends and technologies emerging, including:

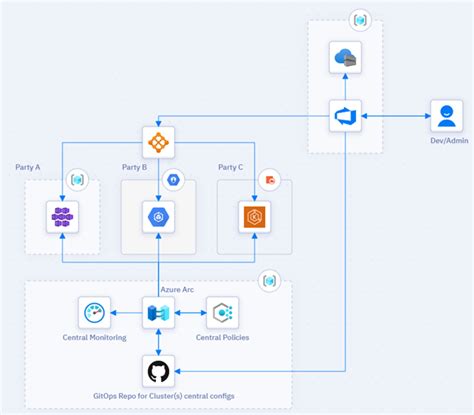

- Cloud-based ledgers: Cloud-based ledgers offer greater flexibility, scalability, and security, enabling users to access their financial data from anywhere.

- Artificial intelligence: Artificial intelligence is being used to automate many ledger tasks, such as data entry and reconciliation.

- Blockchain: Blockchain technology is being used to create secure and transparent ledgers, enabling users to track and verify financial transactions.

Conclusion and Next Steps

In conclusion, a ledger is a powerful tool for managing finances, providing a systematic and organized way to record and track financial transactions. By following best practices, avoiding common mistakes, and embracing new technologies, individuals and businesses can get the most out of their ledger and achieve their financial goals. The next step is to explore the various types of ledgers, including general ledgers, subsidiary ledgers, and cash ledgers, and to learn more about the features and benefits of each.Ledger Image Gallery

What is a ledger?

+A ledger is a book or digital file that contains a collection of financial transactions, accounts, and balances.

What are the benefits of using a ledger?

+The benefits of using a ledger include improved financial management, enhanced accuracy, increased efficiency, and better decision-making.

What are the different types of ledgers?

+The different types of ledgers include general ledgers, subsidiary ledgers, cash ledgers, and journal ledgers.

How do I set up a ledger?

+To set up a ledger, define the ledger structure, create ledger accounts, set up ledger templates, and import financial data.

What are the best practices for using a ledger?

+The best practices for using a ledger include regularly updating the ledger, reconciling accounts, using ledger templates, and monitoring financial performance.

We hope this article has provided you with a comprehensive understanding of ledgers and their importance in financial management. Whether you're an individual or a business, a ledger can help you manage your finances effectively, make informed decisions, and achieve your financial goals. If you have any questions or comments, please don't hesitate to reach out. Share this article with others who may benefit from it, and let's work together to improve our financial literacy and management skills.