Intro

Discover what surcharge means, including extra fees, additional charges, and service costs, to understand how it affects payments, pricing, and consumer expenses.

The concept of a surcharge has become increasingly common in various industries, including finance, retail, and hospitality. Understanding what a surcharge is and how it works is essential for consumers and businesses alike. In this article, we will delve into the world of surcharges, exploring their definition, types, and implications.

A surcharge is an additional fee or charge imposed on a transaction, service, or product. It is typically added to the original price or cost, resulting in a higher total amount paid by the consumer. Surcharges can be levied by businesses, governments, or other organizations, and they can serve various purposes, such as offsetting costs, generating revenue, or discouraging certain behaviors.

The importance of understanding surcharges cannot be overstated. With the rise of digital payments, online transactions, and global commerce, surcharges have become a ubiquitous aspect of modern trade. Consumers need to be aware of the surcharges they may incur when making purchases, using services, or engaging in financial transactions. Similarly, businesses must navigate the complex landscape of surcharges to ensure compliance with regulations, maintain competitiveness, and build trust with their customers.

As we explore the world of surcharges, it is essential to recognize the significance of this topic. Surcharges can have a substantial impact on individuals, businesses, and the economy as a whole. By examining the different types of surcharges, their applications, and their effects, we can gain a deeper understanding of the complex mechanisms that drive commerce and finance. Whether you are a consumer, business owner, or simply interested in the intricacies of trade, this article aims to provide a comprehensive and informative exploration of surcharges.

Types of Surcharges

There are various types of surcharges, each with its unique characteristics and purposes. Some common types of surcharges include:

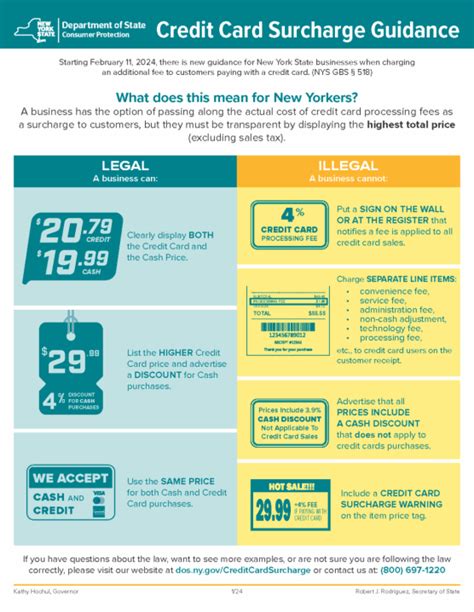

- Credit card surcharges: These are fees imposed on consumers when they use credit cards to make purchases. Credit card surcharges are typically a percentage of the transaction amount and are used to offset the costs associated with processing credit card transactions.

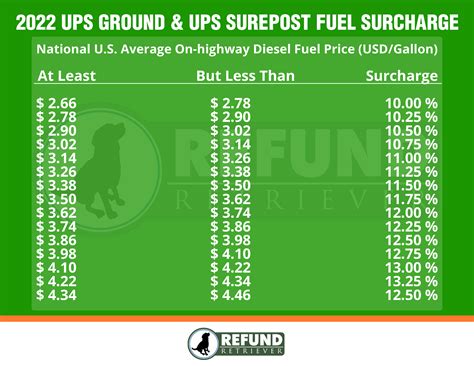

- Fuel surcharges: These are fees added to the cost of transportation, such as taxi fares or shipping costs, to account for fluctuations in fuel prices.

- Foreign transaction surcharges: These are fees imposed on consumers when they make transactions in foreign currencies. Foreign transaction surcharges are typically a percentage of the transaction amount and are used to offset the costs associated with converting currencies.

- Convenience fees: These are fees imposed on consumers for using certain payment methods, such as online bill pay or mobile payments.

How Surcharges Work

Surcharges can be levied in various ways, depending on the type of surcharge and the organization imposing it. In general, surcharges are calculated as a percentage of the transaction amount or as a flat fee. For example, a credit card surcharge might be 2% of the transaction amount, while a convenience fee might be a flat $2.50 per transaction.Surcharges can be disclosed upfront, or they may be added to the transaction amount without explicit disclosure. In some cases, surcharges may be optional, and consumers can choose to avoid them by using alternative payment methods or services.

Implications of Surcharges

Surcharges can have significant implications for consumers, businesses, and the economy as a whole. Some of the key implications of surcharges include:

- Increased costs: Surcharges can result in higher costs for consumers, which can be a burden for those on tight budgets.

- Reduced demand: Surcharges can discourage consumers from using certain services or products, which can lead to reduced demand and lower sales for businesses.

- Increased revenue: Surcharges can generate additional revenue for businesses and organizations, which can be used to offset costs or invest in new initiatives.

- Regulatory challenges: Surcharges can be subject to regulatory challenges, such as laws and regulations governing disclosure and fairness.

Benefits of Surcharges

While surcharges can be seen as a nuisance by some, they also offer several benefits. Some of the key benefits of surcharges include:- Offsetting costs: Surcharges can help businesses and organizations offset the costs associated with providing certain services or products.

- Generating revenue: Surcharges can generate additional revenue for businesses and organizations, which can be used to invest in new initiatives or improve existing services.

- Discouraging certain behaviors: Surcharges can be used to discourage certain behaviors, such as using credit cards or making foreign transactions.

Examples of Surcharges

Surcharges are used in various industries and contexts. Some examples of surcharges include:

- Credit card surcharges: Many businesses, such as restaurants and retail stores, impose credit card surcharges on consumers who use credit cards to make purchases.

- Fuel surcharges: Transportation companies, such as taxi services and shipping companies, often impose fuel surcharges on consumers to account for fluctuations in fuel prices.

- Foreign transaction surcharges: Banks and financial institutions often impose foreign transaction surcharges on consumers who make transactions in foreign currencies.

- Convenience fees: Many businesses, such as online bill pay services and mobile payment providers, impose convenience fees on consumers for using their services.

Best Practices for Implementing Surcharges

When implementing surcharges, businesses and organizations should follow best practices to ensure transparency, fairness, and compliance with regulations. Some best practices for implementing surcharges include:- Clear disclosure: Surcharges should be clearly disclosed to consumers upfront, including the amount of the surcharge and the reason for it.

- Fairness: Surcharges should be fair and reasonable, and should not be used to exploit or deceive consumers.

- Compliance with regulations: Surcharges should comply with relevant laws and regulations, such as those governing disclosure and fairness.

Regulations and Laws Governing Surcharges

Surcharges are subject to various regulations and laws, which can vary by country, state, or industry. Some of the key regulations and laws governing surcharges include:

- Truth in Lending Act: This law requires lenders to disclose the terms and conditions of credit, including surcharges, to consumers.

- Dodd-Frank Wall Street Reform and Consumer Protection Act: This law regulates the use of surcharges in the financial industry, including credit card surcharges and foreign transaction surcharges.

- State laws: Many states have laws governing surcharges, such as laws prohibiting certain types of surcharges or requiring clear disclosure.

Future of Surcharges

The future of surcharges is likely to be shaped by technological advancements, changing consumer behaviors, and evolving regulatory landscapes. Some potential trends and developments that may impact the use of surcharges include:- Increased transparency: Consumers are likely to demand greater transparency and disclosure around surcharges, which could lead to more explicit and upfront disclosure.

- Alternative payment methods: The rise of alternative payment methods, such as mobile payments and cryptocurrencies, could reduce the need for surcharges or create new opportunities for surcharging.

- Regulatory changes: Changes in regulations and laws governing surcharges could impact the use of surcharges in various industries and contexts.

Surcharge Image Gallery

What is a surcharge?

+A surcharge is an additional fee or charge imposed on a transaction, service, or product.

What are the different types of surcharges?

+There are various types of surcharges, including credit card surcharges, fuel surcharges, foreign transaction surcharges, and convenience fees.

How are surcharges calculated?

+Surcharges can be calculated as a percentage of the transaction amount or as a flat fee.

What are the implications of surcharges?

+Surcharges can result in higher costs for consumers, reduced demand, and increased revenue for businesses.

What are the best practices for implementing surcharges?

+Best practices for implementing surcharges include clear disclosure, fairness, and compliance with regulations.

In conclusion, surcharges are a common aspect of modern commerce, and understanding their definition, types, and implications is essential for consumers and businesses alike. By recognizing the benefits and drawbacks of surcharges, individuals and organizations can make informed decisions about their use and navigate the complex landscape of surcharging. As the world of commerce continues to evolve, it is likely that surcharges will remain a vital component of trade, and their impact will be shaped by technological advancements, changing consumer behaviors, and evolving regulatory landscapes. We invite you to share your thoughts on surcharges, ask questions, and explore the various aspects of this topic further. Your engagement and feedback are invaluable in helping us create informative and relevant content.