Intro

Discover what is ACH transaction, a secure payment processing method using Automated Clearing House network, enabling direct deposit, online bill pay, and e-checks with low transaction fees and high security.

The world of financial transactions is vast and complex, with numerous methods and systems in place to facilitate the exchange of money between individuals, businesses, and institutions. One such system that plays a crucial role in the financial landscape is the Automated Clearing House (ACH) network. In this article, we will delve into the world of ACH transactions, exploring what they are, how they work, and their benefits and drawbacks.

The ACH network is a batch processing system that enables the electronic transfer of funds between financial institutions. It is a cost-effective and efficient way to move money, making it an attractive option for businesses and individuals alike. ACH transactions are commonly used for direct deposit, bill payments, and online transactions. They are also used by businesses to pay employees, vendors, and suppliers.

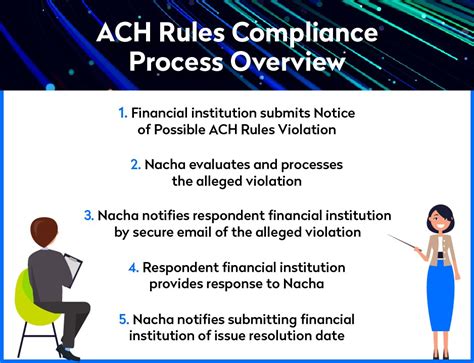

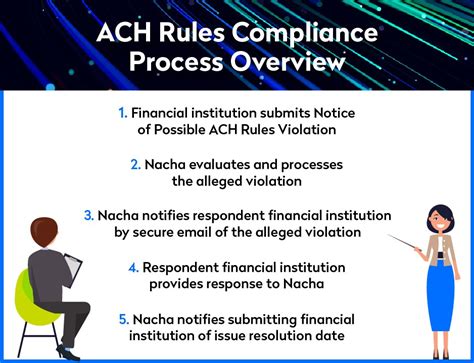

The ACH network is governed by the National Automated Clearing House Association (NACHA), which sets rules and guidelines for the processing of ACH transactions. These rules ensure that transactions are secure, reliable, and compliant with regulatory requirements. The ACH network is also subject to regulations imposed by the Federal Reserve and other government agencies, which helps to maintain the integrity and stability of the financial system.

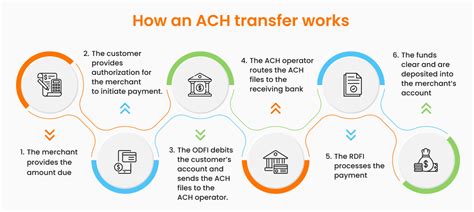

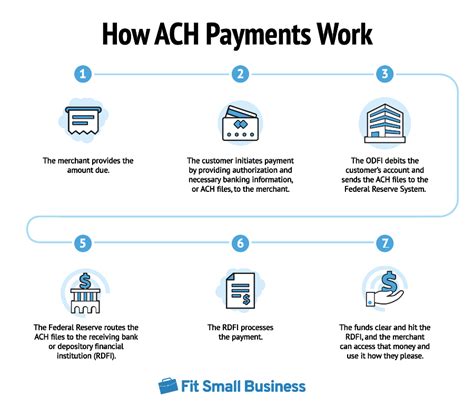

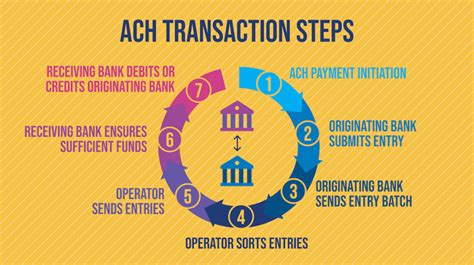

How ACH Transactions Work

The ACH transaction process involves several steps, from initiation to settlement. Here's an overview of how it works:

- Initiation: The transaction is initiated by the originator, who is typically a business or individual. The originator provides the necessary information, including the amount, recipient's account number, and routing number.

- Batching: The originator's bank batches the transaction with other ACH transactions, which are then sent to the ACH operator.

- Sorting and Routing: The ACH operator sorts and routes the transactions to the recipient's bank.

- Settlement: The recipient's bank receives the transaction and updates the recipient's account.

- Notification: The recipient is notified of the transaction, which can be done through online banking, mobile banking, or paper statements.

Benefits of ACH Transactions

ACH transactions offer several benefits, including:

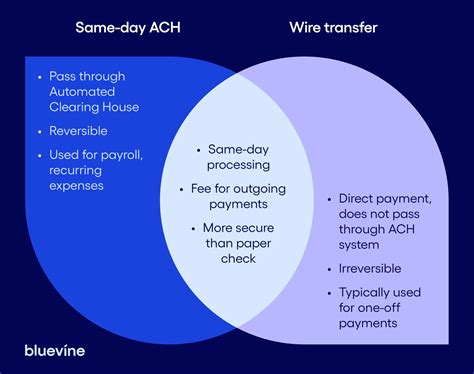

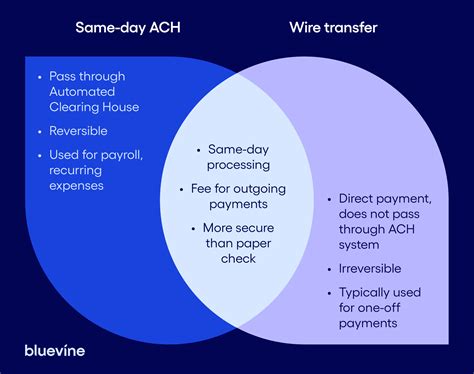

- Cost-effectiveness: ACH transactions are generally less expensive than other payment methods, such as wire transfers or credit card transactions.

- Convenience: ACH transactions can be initiated online or through mobile devices, making it easy to manage finances on the go.

- Security: ACH transactions are secure and reliable, with multiple layers of protection to prevent unauthorized transactions.

- Efficiency: ACH transactions are processed in batches, which reduces the risk of errors and delays.

Types of ACH Transactions

There are several types of ACH transactions, including:

- Direct Deposit: This type of transaction involves the deposit of funds into a recipient's account, such as payroll or government benefits.

- Direct Payment: This type of transaction involves the payment of bills or invoices, such as utility bills or mortgage payments.

- Person-to-Person (P2P) Transactions: This type of transaction involves the transfer of funds between individuals, such as sending money to friends or family members.

ACH Transaction Fees

ACH transaction fees vary depending on the type of transaction, the originator's bank, and the recipient's bank. Some common fees associated with ACH transactions include:

- Origination fees: These fees are charged by the originator's bank for initiating the transaction.

- Receipt fees: These fees are charged by the recipient's bank for receiving the transaction.

- Interchange fees: These fees are charged by the ACH operator for processing the transaction.

Security and Compliance

ACH transactions are subject to various security and compliance requirements, including:

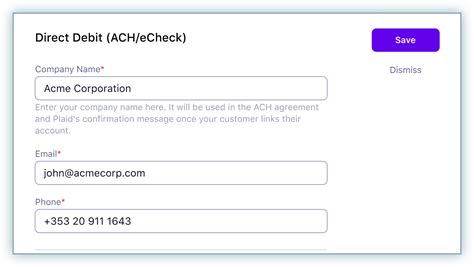

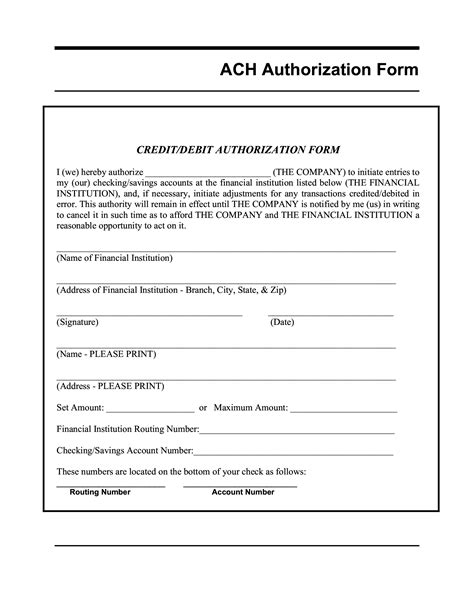

- Authentication: The originator and recipient must authenticate the transaction to ensure its legitimacy.

- Authorization: The recipient must authorize the transaction to ensure that it is valid.

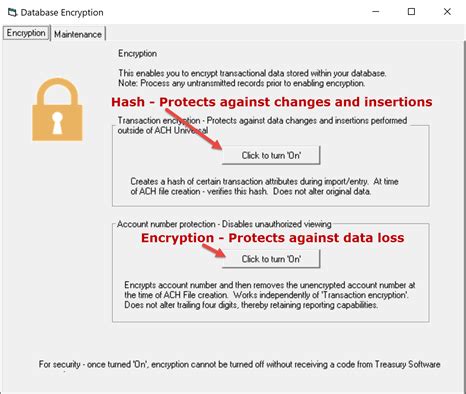

- Encryption: ACH transactions must be encrypted to protect sensitive information.

Gallery of ACH Transactions

ACH Transaction Image Gallery

Frequently Asked Questions

What is an ACH transaction?

+An ACH transaction is an electronic transfer of funds between financial institutions through the Automated Clearing House network.

How do ACH transactions work?

+ACH transactions involve the initiation of a transaction by the originator, batching and sorting by the originator's bank, and settlement by the recipient's bank.

What are the benefits of ACH transactions?

+ACH transactions offer several benefits, including cost-effectiveness, convenience, security, and efficiency.

What are the different types of ACH transactions?

+There are several types of ACH transactions, including direct deposit, direct payment, and person-to-person transactions.

How secure are ACH transactions?

+ACH transactions are secure and reliable, with multiple layers of protection to prevent unauthorized transactions.

In conclusion, ACH transactions play a vital role in the financial landscape, offering a cost-effective, convenient, and secure way to transfer funds between financial institutions. By understanding how ACH transactions work, their benefits and drawbacks, and the different types of transactions, individuals and businesses can make informed decisions about their financial transactions. We invite you to share your thoughts and experiences with ACH transactions in the comments section below.