Intro

Discover 5 ways to understand invoices, including invoice templates, billing cycles, and payment terms, to streamline accounting and invoicing processes with ease.

Understanding invoices is a crucial aspect of managing finances, whether you're a business owner, freelancer, or individual receiving bills for services. Invoices serve as a formal request for payment, detailing the goods or services provided, their costs, and the terms of payment. Effective invoice management can help prevent late payments, reduce financial stress, and improve relationships between buyers and sellers. This article delves into the importance of invoices, their components, and provides insights on how to efficiently manage them.

In today's fast-paced business environment, invoices play a pivotal role in the cash flow of companies. They are not just pieces of paper or digital documents but represent the lifeline of any business, ensuring that services rendered or products sold are compensated for. A well-structured invoice communicates clearly and professionally, leaving no room for misunderstandings about what is being charged and by when the payment is due. Moreover, with the advancement in technology, invoicing has become more streamlined, allowing for quicker payments and better tracking of financial transactions.

For individuals and businesses alike, understanding the intricacies of invoices is essential for maintaining a healthy financial profile. It involves not just sending out invoices but also ensuring they are accurate, sent on time, and follow up on them when necessary. On the receiving end, it's about reviewing invoices carefully, ensuring all charges are legitimate, and making timely payments to avoid penalties or damage to credit scores. The process might seem straightforward, but it requires attention to detail and a systematic approach to manage invoices effectively.

Understanding Invoice Basics

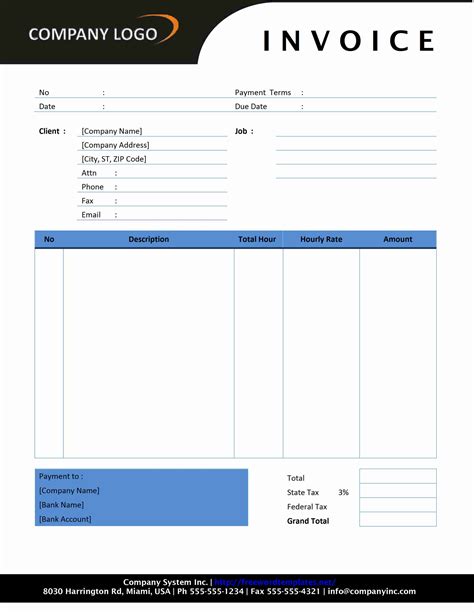

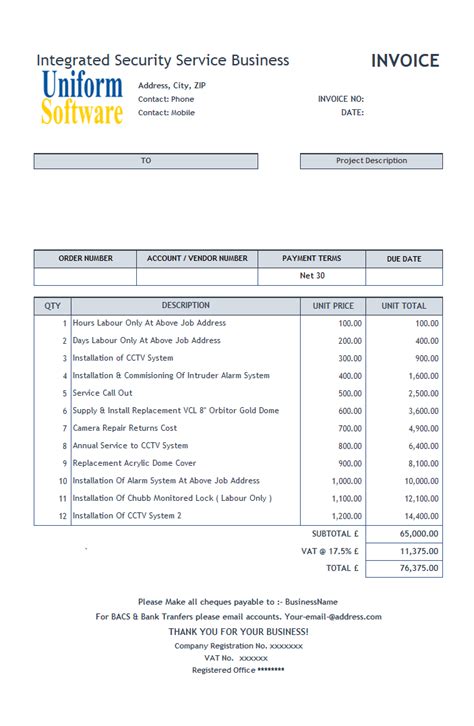

To grasp the concept of invoices fully, it's essential to start with the basics. An invoice typically includes several key elements such as the invoice number, date, billing information, a detailed list of goods or services provided, the cost of each item, any applicable taxes, the total amount due, payment terms, and methods of payment. Each component serves a specific purpose, ensuring clarity and transparency in financial transactions.

Components of an Invoice

The components of an invoice are what make it a legally binding document. They include: - **Invoice Number**: A unique identifier for the invoice, useful for tracking and record-keeping. - **Date**: The date the invoice was issued, which is crucial for determining payment deadlines. - **Billing Information**: The name and address of the business or individual issuing the invoice, as well as the recipient's details. - **Itemized List**: A detailed breakdown of the goods or services provided, including quantities and rates. - **Subtotal, Taxes, and Total**: The subtotal of the goods or services before taxes, the amount of taxes applied, and the total amount due. - **Payment Terms and Methods**: Specifies how and by when the payment should be made.Benefits of Understanding Invoices

Understanding invoices comes with numerous benefits, both for the sender and the recipient. For businesses, it ensures a steady cash flow, reduces the likelihood of late payments, and helps in maintaining a good relationship with clients. On the other hand, for individuals or businesses receiving invoices, understanding them helps in budgeting, avoiding unnecessary penalties, and ensuring that they are not overcharged.

Importance for Businesses

For businesses, the importance of understanding invoices cannot be overstated. It: - **Improves Cash Flow**: Timely and accurate invoices ensure that payments are received on time, which is crucial for a business's cash flow. - **Enhances Professionalism**: A well-structured invoice reflects positively on the business, enhancing its professional image. - **Reduces Disputes**: Clear and detailed invoices reduce the chance of disputes over charges, ensuring smoother client relationships.Managing Invoices Effectively

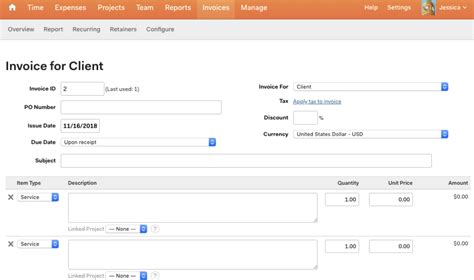

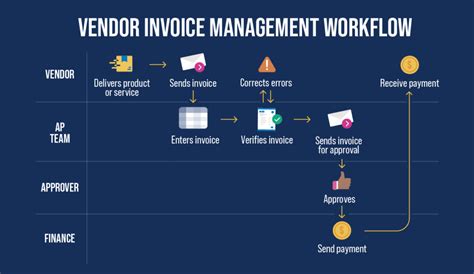

Effective invoice management involves several steps, from creating and sending invoices to following up on payments. With the advent of digital invoicing tools, this process has become more efficient, allowing for automation of tasks such as generating invoices, sending reminders, and tracking payments.

Tools for Invoice Management

Various tools and software are available to help with invoice management. These tools can: - **Automate Invoicing**: Generate invoices automatically based on the services provided or products sold. - **Track Payments**: Keep a record of payments made and pending, sending reminders for overdue invoices. - **Analyze Cash Flow**: Provide insights into the business's cash flow, helping in making informed financial decisions.Best Practices for Creating Invoices

Creating an effective invoice involves several best practices. It should be clear, concise, and professional, including all necessary details to avoid confusion. The payment terms should be straightforward, and the methods of payment should be convenient for the client.

Tips for Clear Invoicing

Some tips for clear invoicing include: - **Use Simple Language**: Avoid using jargon or technical terms that the client might not understand. - **Include Contact Information**: Provide a point of contact for any queries or disputes. - **Specify Payment Terms**: Clearly state the payment deadline and the consequences of late payment.Common Mistakes in Invoicing

Despite the importance of invoices, many businesses and individuals make mistakes that can lead to delayed payments or disputes. These mistakes can range from incorrect billing information to unclear payment terms.

How to Avoid Mistakes

To avoid common invoicing mistakes: - **Double-Check Details**: Ensure all information, including names, addresses, and amounts, is accurate. - **Test Invoicing Systems**: Regularly test invoicing systems to catch and fix any glitches. - **Follow Up**: Promptly follow up on overdue invoices to minimize the risk of non-payment.Future of Invoicing

The future of invoicing is digital, with technologies like blockchain, artificial intelligence, and cloud computing set to revolutionize the way invoices are created, sent, and paid. These technologies promise to make invoicing more secure, efficient, and automated.

Trends in Digital Invoicing

Some trends in digital invoicing include: - **Increased Automation**: More tasks related to invoicing will be automated, reducing manual errors and increasing speed. - **Enhanced Security**: Digital invoicing will become more secure, protecting against fraud and ensuring the integrity of transactions. - **Real-Time Payments**: The ability to make real-time payments will become more prevalent, improving cash flow for businesses.Invoice Management Image Gallery

What is the purpose of an invoice?

+An invoice is a document that serves as a request for payment for goods or services provided. It outlines the details of the transaction, including the amount due, payment terms, and methods of payment.

How do I create an effective invoice?

+To create an effective invoice, ensure it is clear, concise, and professional. Include all necessary details such as invoice number, date, billing information, a detailed list of goods or services, and payment terms.

What are the benefits of digital invoicing?

+Digital invoicing offers several benefits, including increased efficiency, reduced errors, improved security, and faster payment processing. It also allows for real-time tracking and automation of invoicing tasks.

In conclusion, understanding invoices is crucial for effective financial management, whether you're a business owner, freelancer, or individual. By grasping the basics of invoices, managing them efficiently, and staying abreast of the latest trends in digital invoicing, you can improve your financial health and ensure smooth transactions. We invite you to share your thoughts on the importance of invoices and how you manage them in your daily operations. Your insights can help others navigate the complex world of invoicing and financial management. Additionally, if you found this article informative, please consider sharing it with others who might benefit from understanding the intricacies of invoices and their role in maintaining a healthy financial profile.