Intro

Discover debt financing options, including loans and bonds, to fund business growth, manage cash flow, and leverage capital, with expert insights on debt financing strategies and debt management techniques.

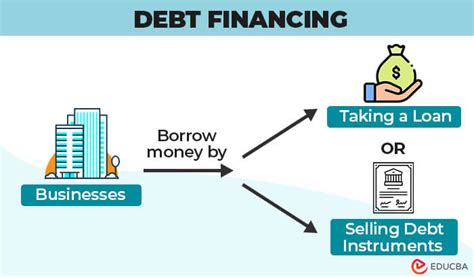

Debt financing is a crucial aspect of business operations, allowing companies to raise capital for various purposes such as expansion, modernization, and meeting financial obligations. It involves borrowing money from lenders, with the promise of repaying the principal amount along with interest. Debt financing can be obtained from various sources, including banks, financial institutions, and private lenders. In this article, we will delve into the world of debt financing, exploring its benefits, types, and implications for businesses.

Debt financing is essential for businesses, as it provides them with the necessary funds to achieve their goals and objectives. Without debt financing, many companies would struggle to survive, let alone thrive. It allows businesses to invest in new projects, hire more employees, and increase their production capacity. Moreover, debt financing can help companies to manage their cash flow, ensuring that they have sufficient funds to meet their financial obligations. However, it is crucial for businesses to understand the terms and conditions of debt financing, including the interest rates, repayment terms, and collateral requirements.

Debt financing can be categorized into different types, including short-term and long-term debt. Short-term debt is typically used to finance working capital requirements, such as paying salaries, rent, and utilities. It usually has a maturity period of less than one year and is often obtained from banks and other financial institutions. Long-term debt, on the other hand, is used to finance capital expenditures, such as purchasing equipment, land, and buildings. It has a maturity period of more than one year and can be obtained from various sources, including banks, bond markets, and private lenders.

Benefits of Debt Financing

The benefits of debt financing are numerous, and it can be a valuable tool for businesses looking to grow and expand. Some of the advantages of debt financing include:

- Increased financial flexibility: Debt financing allows businesses to access funds quickly, enabling them to respond to changing market conditions and capitalize on new opportunities.

- Lower cost of capital: Debt financing can be less expensive than equity financing, as interest payments are tax-deductible, reducing the overall cost of capital.

- Retention of ownership: Debt financing does not require businesses to give up ownership or control, allowing them to maintain their independence and decision-making authority.

- Improved credit rating: Repaying debt obligations on time can help businesses improve their credit rating, making it easier to access credit in the future.

Types of Debt Financing

Debt financing can be categorized into different types, including: * Secured debt: This type of debt requires collateral, such as assets or property, to secure the loan. * Unsecured debt: This type of debt does not require collateral and is often obtained from banks and other financial institutions. * Revolving debt: This type of debt allows businesses to borrow and repay funds as needed, often with a credit limit. * Term debt: This type of debt has a fixed repayment term, with regular payments made over a specified period.Working Mechanism of Debt Financing

The working mechanism of debt financing involves several steps, including:

- Application: Businesses apply for debt financing by submitting a loan application to a lender.

- Approval: The lender reviews the application and approves the loan, based on the business's creditworthiness and ability to repay.

- Disbursement: The lender disburses the loan amount to the business, either as a lump sum or in installments.

- Repayment: The business repays the loan, along with interest, according to the agreed-upon terms.

Steps to Obtain Debt Financing

To obtain debt financing, businesses should follow these steps: * Determine the amount of debt needed: Businesses should calculate the amount of debt required to achieve their goals and objectives. * Choose a lender: Businesses should research and select a lender that offers the best terms and conditions. * Prepare a loan application: Businesses should prepare a loan application, including financial statements, business plans, and other required documents. * Negotiate terms: Businesses should negotiate the terms of the loan, including the interest rate, repayment term, and collateral requirements.Implications of Debt Financing

The implications of debt financing can be significant, and businesses should carefully consider the potential risks and benefits. Some of the implications of debt financing include:

- Increased debt burden: Debt financing can increase a business's debt burden, making it challenging to repay loans and meet financial obligations.

- Reduced financial flexibility: Debt financing can reduce a business's financial flexibility, making it difficult to respond to changing market conditions.

- Credit rating impact: Debt financing can impact a business's credit rating, making it harder to access credit in the future.

Risks Associated with Debt Financing

The risks associated with debt financing include: * Default risk: Businesses may default on loan payments, resulting in penalties and damage to their credit rating. * Interest rate risk: Changes in interest rates can increase the cost of debt financing, making it challenging for businesses to repay loans. * Collateral risk: Businesses may lose collateral if they default on loan payments, resulting in significant financial losses.Practical Examples of Debt Financing

Debt financing is used by businesses in various industries, including:

- Real estate: Developers use debt financing to construct buildings, purchase land, and renovate properties.

- Manufacturing: Manufacturers use debt financing to purchase equipment, raw materials, and expand production capacity.

- Retail: Retailers use debt financing to purchase inventory, lease stores, and expand their operations.

Statistical Data on Debt Financing

According to statistical data, debt financing is a widely used source of funding for businesses. Some key statistics include: * 70% of small businesses use debt financing to fund their operations. * The average debt-to-equity ratio for small businesses is 1.5:1. * The total amount of debt financing issued to businesses in the United States is over $1 trillion.Conclusion and Future Outlook

In conclusion, debt financing is a vital source of funding for businesses, allowing them to achieve their goals and objectives. While it offers several benefits, including increased financial flexibility and lower cost of capital, it also poses significant risks, such as default risk and interest rate risk. As the business landscape continues to evolve, debt financing is likely to remain a crucial component of business operations. However, businesses must carefully consider the implications of debt financing and develop strategies to manage their debt burden effectively.

Final Thoughts

In final thoughts, debt financing is a complex and multifaceted topic that requires careful consideration and planning. Businesses should approach debt financing with caution, weighing the potential benefits against the potential risks. By doing so, they can make informed decisions that support their long-term growth and success.Debt Financing Image Gallery

What is debt financing?

+Debt financing is a type of financing where a business borrows money from a lender, with the promise of repaying the principal amount along with interest.

What are the benefits of debt financing?

+The benefits of debt financing include increased financial flexibility, lower cost of capital, and retention of ownership.

What are the risks associated with debt financing?

+The risks associated with debt financing include default risk, interest rate risk, and collateral risk.

How can businesses obtain debt financing?

+Businesses can obtain debt financing by applying for a loan from a lender, preparing a loan application, and negotiating the terms of the loan.

What is the importance of debt financing for businesses?

+Debt financing is essential for businesses, as it provides them with the necessary funds to achieve their goals and objectives, and helps them to manage their cash flow and meet financial obligations.

We hope this article has provided you with a comprehensive understanding of debt financing and its implications for businesses. If you have any further questions or would like to share your thoughts on the topic, please do not hesitate to comment below. Additionally, if you found this article informative and helpful, please consider sharing it with your network. By doing so, you can help others gain a better understanding of debt financing and its role in business operations.