Intro

Discover what is an invoice, its types, and purpose, including billing, payment terms, and invoicing processes, to streamline financial transactions and accounting procedures effectively.

In today's fast-paced business world, efficient financial management is crucial for the success of any organization. One essential tool that facilitates smooth financial transactions is the invoice. An invoice is a document that outlines the details of a transaction between a buyer and a seller, serving as a request for payment for goods or services provided. In this article, we will delve into the world of invoices, exploring their importance, types, and best practices for creation and management.

The significance of invoices cannot be overstated. They provide a clear and transparent record of transactions, helping businesses to keep track of their income and expenses. Invoices also play a vital role in maintaining healthy relationships between buyers and sellers, as they ensure that payments are made on time and in the correct amount. Furthermore, invoices are often required for tax purposes, making them an essential component of a company's financial records.

Invoices have been a cornerstone of commerce for centuries, with their evolution reflecting changes in technology and business practices. From handwritten documents to digital invoices, the format and content of invoices have adapted to meet the needs of modern businesses. Today, invoices can be created and sent electronically, making it easier than ever to manage financial transactions.

Understanding the Basics of Invoicing

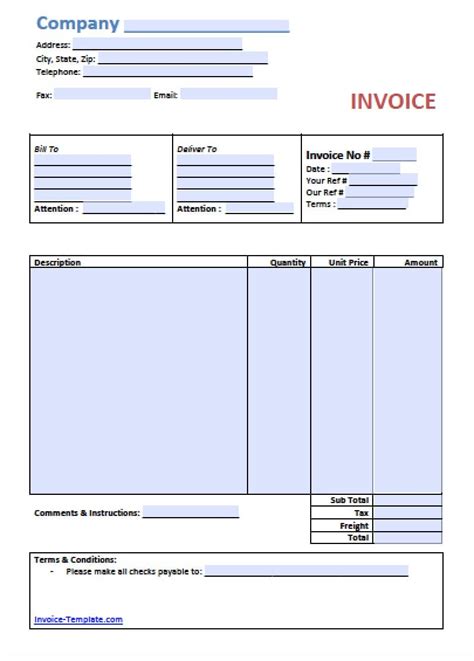

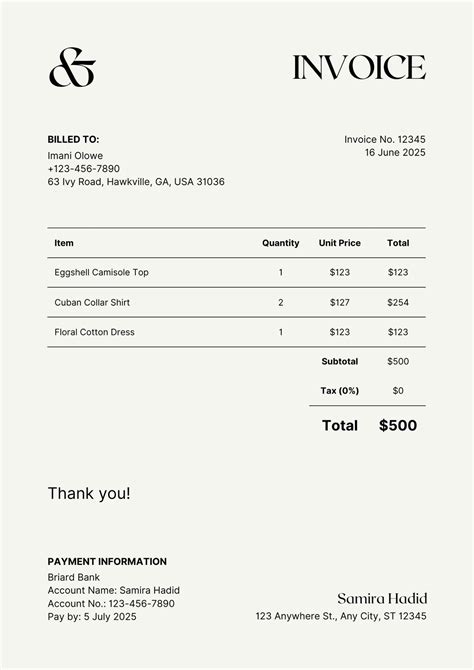

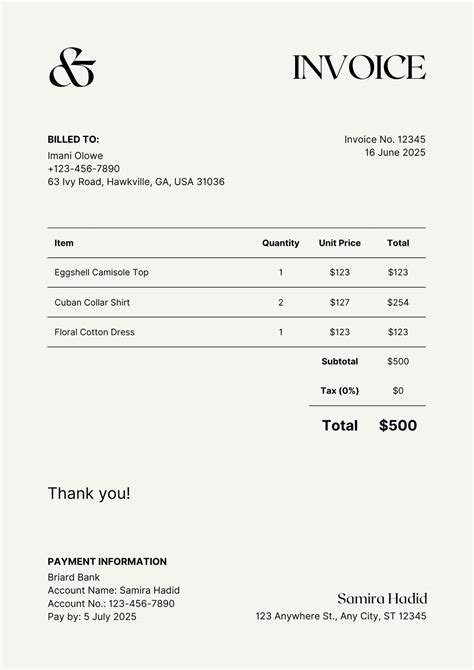

To create an effective invoice, it is essential to understand the basic components that make up this document. A typical invoice includes the following elements: the seller's contact information, the buyer's contact information, a unique invoice number, the date of the invoice, a description of the goods or services provided, the quantity and unit price of each item, the total amount due, and payment terms. These elements provide a clear and concise summary of the transaction, making it easier for buyers to understand what they are being charged for and how to make payment.

Key Components of an Invoice

- Seller's contact information

- Buyer's contact information

- Unique invoice number

- Date of the invoice

- Description of goods or services

- Quantity and unit price of each item

- Total amount due

- Payment terms

In addition to these basic components, invoices may also include other information, such as tax rates, discounts, and payment instructions. The specific content of an invoice will depend on the type of business, the nature of the transaction, and the requirements of the buyer and seller.

Types of Invoices

Invoices come in various forms, each designed to meet the specific needs of different businesses and transactions. Some common types of invoices include:

- Sales invoices: These are the most common type of invoice and are used to request payment for goods or services provided.

- Pro forma invoices: These invoices are used to provide a quote or estimate for goods or services and are often used in international trade.

- Commercial invoices: These invoices are used for international trade and provide detailed information about the goods being shipped, including their value, weight, and country of origin.

- Recurring invoices: These invoices are used for ongoing services, such as subscription-based products or monthly maintenance fees.

- Credit invoices: These invoices are used to refund or credit a customer for goods or services that were not provided or were defective.

Each type of invoice has its own unique characteristics and requirements, and businesses must choose the type that best fits their needs and the nature of the transaction.

Best Practices for Creating Invoices

- Use a clear and concise format

- Include all necessary information, such as contact details and payment terms

- Use a unique invoice number and date

- Provide a detailed description of goods or services

- Include tax rates and discounts, if applicable

- Make payment instructions clear and easy to follow

By following these best practices, businesses can create effective invoices that facilitate smooth financial transactions and help to build trust with their customers.

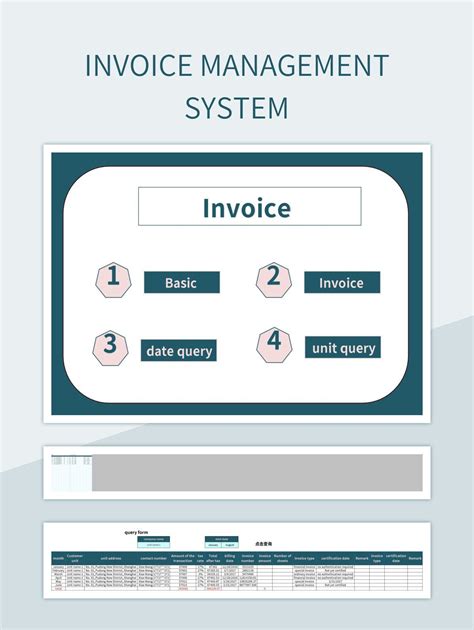

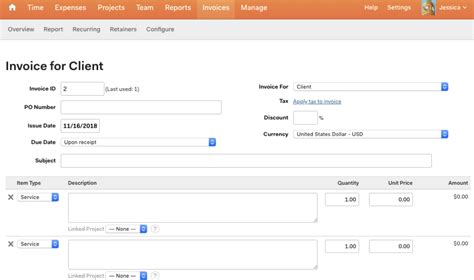

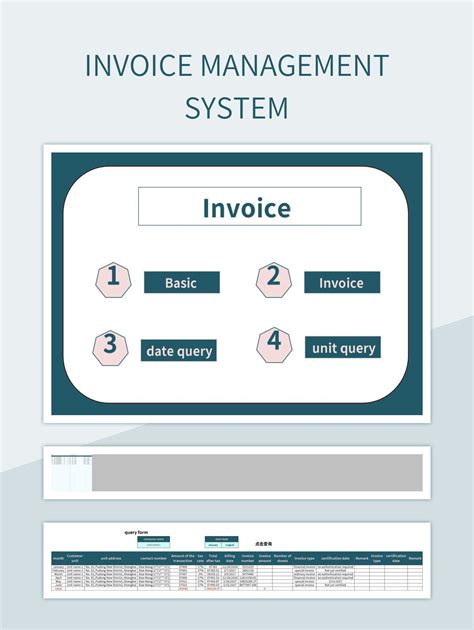

Managing Invoices Effectively

Effective invoice management is crucial for maintaining healthy cash flow and avoiding financial disputes. Businesses must have a system in place for creating, sending, and tracking invoices, as well as for following up on overdue payments. This can be achieved through the use of accounting software, spreadsheets, or other tools designed specifically for invoice management.

In addition to using the right tools, businesses must also establish clear policies and procedures for invoicing, including payment terms, late fees, and dispute resolution. This will help to ensure that invoices are paid on time and that any issues are resolved quickly and efficiently.

Benefits of Effective Invoice Management

- Improved cash flow

- Reduced financial disputes

- Increased customer satisfaction

- Better financial record-keeping

- Enhanced business credibility

By implementing effective invoice management practices, businesses can reap these benefits and improve their overall financial health.

The Future of Invoicing

As technology continues to evolve, the way we create, send, and manage invoices is likely to change. Electronic invoicing, also known as e-invoicing, is becoming increasingly popular, offering businesses a faster, more efficient, and more secure way to manage their financial transactions. E-invoicing also provides a range of benefits, including reduced paper waste, improved accuracy, and enhanced security.

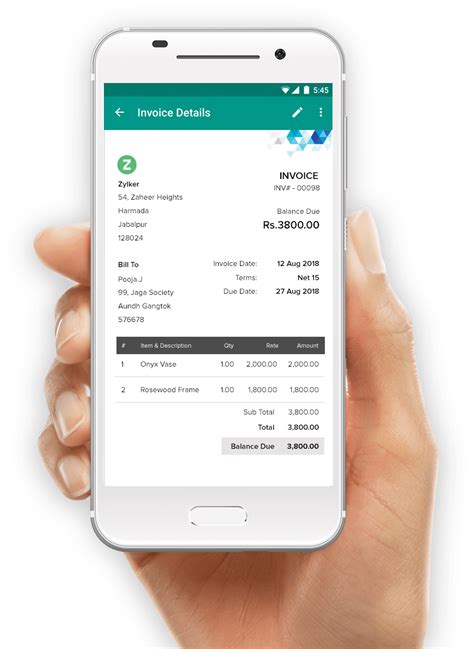

In addition to e-invoicing, other trends are emerging in the world of invoicing, such as automated invoicing, mobile invoicing, and blockchain-based invoicing. These innovations have the potential to revolutionize the way businesses manage their financial transactions, making it easier, faster, and more secure than ever before.

Trends in Invoicing

- Electronic invoicing

- Automated invoicing

- Mobile invoicing

- Blockchain-based invoicing

- Artificial intelligence-powered invoicing

As these trends continue to emerge and evolve, businesses must be prepared to adapt and take advantage of the benefits they offer.

Invoice Image Gallery

What is an invoice?

+An invoice is a document that outlines the details of a transaction between a buyer and a seller, serving as a request for payment for goods or services provided.

What are the different types of invoices?

+There are several types of invoices, including sales invoices, pro forma invoices, commercial invoices, recurring invoices, and credit invoices.

How do I create an effective invoice?

+To create an effective invoice, use a clear and concise format, include all necessary information, and make payment instructions clear and easy to follow.

What are the benefits of effective invoice management?

+The benefits of effective invoice management include improved cash flow, reduced financial disputes, increased customer satisfaction, better financial record-keeping, and enhanced business credibility.

What is the future of invoicing?

+The future of invoicing is likely to involve electronic invoicing, automated invoicing, mobile invoicing, and blockchain-based invoicing, making it easier, faster, and more secure than ever before.

In conclusion, invoices play a vital role in facilitating smooth financial transactions and maintaining healthy relationships between buyers and sellers. By understanding the basics of invoicing, creating effective invoices, and managing them efficiently, businesses can reap the benefits of improved cash flow, reduced financial disputes, and enhanced business credibility. As technology continues to evolve, the way we create, send, and manage invoices is likely to change, offering businesses new opportunities to streamline their financial transactions and improve their overall financial health. We encourage you to share your thoughts and experiences with invoicing in the comments below, and to explore our other resources on financial management and business operations.