Intro

Discover 5 ways to invoice, including digital invoicing, online billing, and payment tracking, to streamline billing processes and improve cash flow management with effective invoicing techniques and tools.

Invoicing is a crucial aspect of any business, as it allows companies to request payment from clients for their products or services. Effective invoicing can help businesses maintain a healthy cash flow, build trust with clients, and reduce the risk of late or non-payment. In this article, we will explore five different ways to invoice, each with its own advantages and disadvantages.

The importance of invoicing cannot be overstated. It is a critical step in the payment process, as it provides clients with a clear breakdown of the costs and services provided. A well-crafted invoice can help to establish trust and credibility with clients, while a poorly designed invoice can lead to confusion and delays in payment. With the rise of digital technologies, invoicing has become more efficient and convenient than ever before. Businesses can now create and send invoices electronically, reducing the need for paper and postage.

In addition to its practical benefits, invoicing also plays a key role in maintaining accurate financial records. By keeping track of invoices and payments, businesses can monitor their cash flow, identify areas for improvement, and make informed decisions about their financial management. Whether you are a small business owner, a freelancer, or a large corporation, invoicing is an essential part of your financial operations. In this article, we will delve into the world of invoicing, exploring the different methods and techniques that businesses use to request payment from clients.

Introduction to Invoicing

Benefits of Invoicing

The benefits of invoicing are numerous. It helps businesses to maintain a healthy cash flow, build trust with clients, and reduce the risk of late or non-payment. Invoicing also provides a clear record of transactions, which can be useful for accounting and tax purposes. Furthermore, invoicing can help businesses to identify areas for improvement, such as slow-paying clients or inefficient payment processes.1. Manual Invoicing

Advantages and Disadvantages of Manual Invoicing

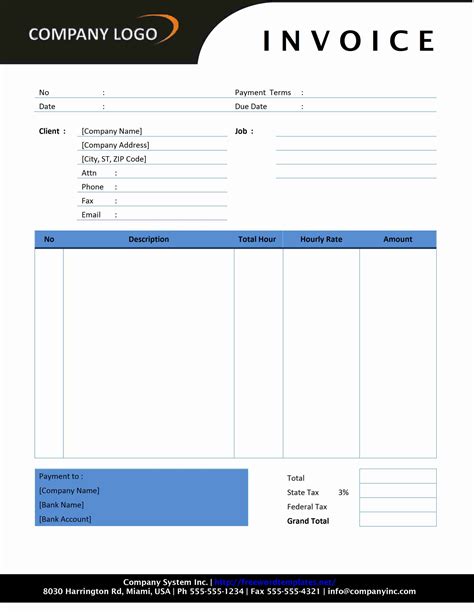

The advantages of manual invoicing include its low cost and flexibility. Businesses can create invoices using a word processing software or by hand, without the need for specialized invoicing software. However, manual invoicing also has several disadvantages, including its time-consuming nature and susceptibility to errors. Manual invoicing can also be difficult to track and manage, especially for businesses with a large number of invoices.2. Invoicing Software

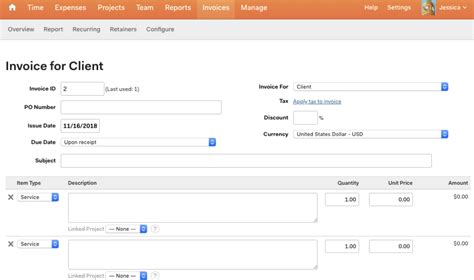

Features of Invoicing Software

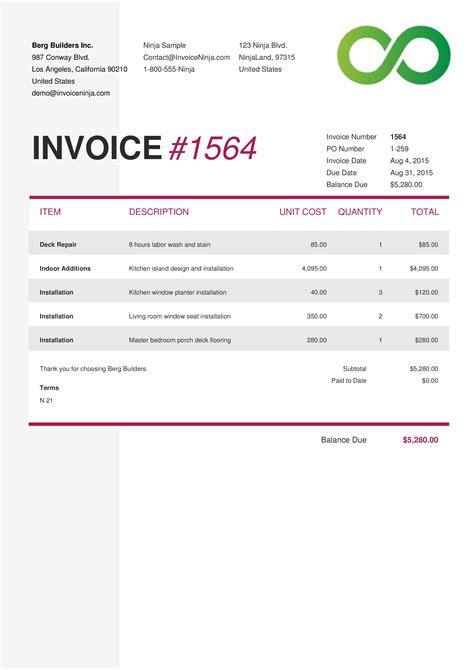

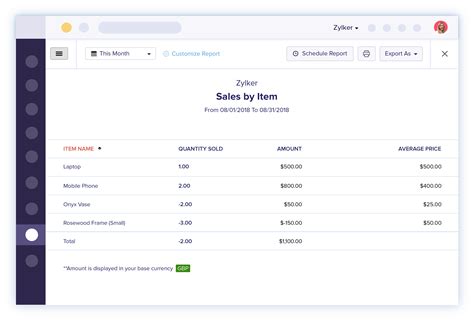

Invoicing software typically includes a range of features, such as invoice templates, automated billing, and payment tracking. It can also integrate with other business systems, such as accounting and customer relationship management software. Invoicing software can help businesses to streamline their invoicing processes, reduce errors, and improve their cash flow.3. Online Invoicing

Benefits of Online Invoicing

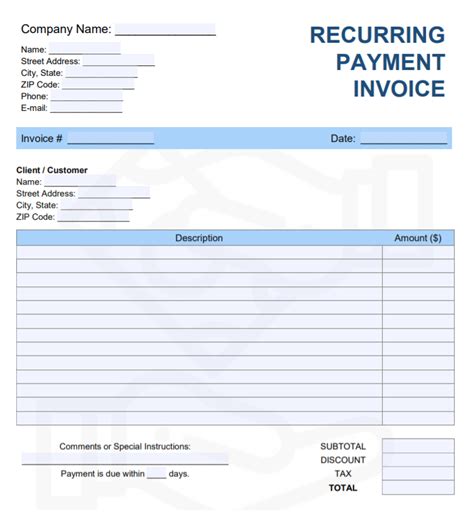

The benefits of online invoicing include its convenience, speed, and cost-effectiveness. Businesses can create and send invoices quickly and easily, without the need for paper or postage. Online invoicing can also help businesses to reduce their environmental impact and improve their cash flow.4. Recurring Invoicing

Advantages of Recurring Invoicing

The advantages of recurring invoicing include its convenience and predictability. Businesses can set up recurring invoices to be sent automatically, without the need for manual intervention. Recurring invoicing can also help businesses to improve their cash flow, by ensuring that clients are billed regularly and consistently.5. Mobile Invoicing

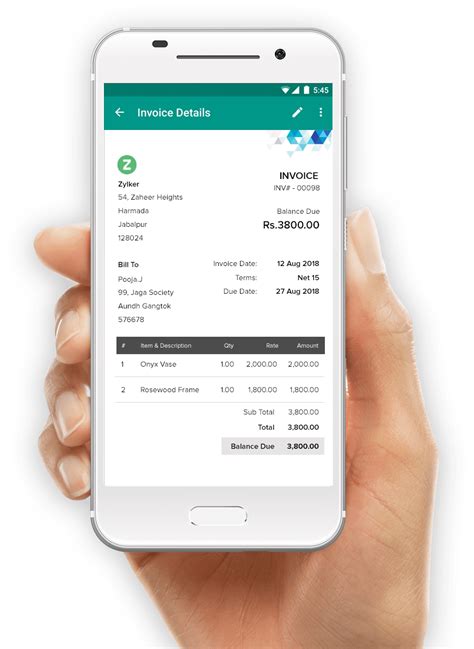

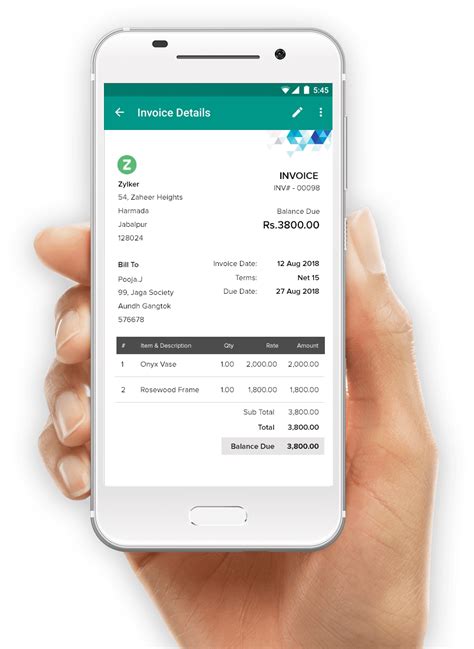

Benefits of Mobile Invoicing

The benefits of mobile invoicing include its convenience, speed, and flexibility. Businesses can create and send invoices quickly and easily, without the need for a computer or internet connection. Mobile invoicing can also help businesses to improve their cash flow, by enabling them to invoice clients in real-time.Invoicing Image Gallery

What is invoicing and why is it important?

+Invoicing is the process of creating and sending a bill to a client for products or services provided. It is important because it helps businesses to maintain a healthy cash flow, build trust with clients, and reduce the risk of late or non-payment.

What are the different types of invoicing methods?

+There are several types of invoicing methods, including manual invoicing, invoicing software, online invoicing, recurring invoicing, and mobile invoicing. Each method has its own advantages and disadvantages, and businesses should choose the method that best suits their needs.

How can I create an effective invoice?

+To create an effective invoice, you should include essential information such as the date, invoice number, client's name and address, description of products or services, quantity and rate, subtotal, tax, and total amount due. You should also use a clear and concise format, and make sure that the invoice is easy to read and understand.

What are the benefits of using invoicing software?

+The benefits of using invoicing software include its ability to automate many of the tasks involved in invoicing, such as generating invoice numbers and calculating taxes. It can also help businesses to streamline their invoicing processes, reduce errors, and improve their cash flow.

How can I ensure that my invoices are paid on time?

+To ensure that your invoices are paid on time, you should send them to clients in a timely manner, and follow up with them regularly to check on the status of payment. You should also use a clear and concise format, and make sure that the invoice is easy to read and understand.

In conclusion, invoicing is a crucial aspect of any business, and there are several different methods that businesses can use to create and send invoices. By choosing the right invoicing method and creating effective invoices, businesses can maintain a healthy cash flow, build trust with clients, and reduce the risk of late or non-payment. Whether you are a small business owner, a freelancer, or a large corporation, invoicing is an essential part of your financial operations. We hope that this article has provided you with a comprehensive understanding of the different invoicing methods and techniques, and has given you the knowledge and skills you need to create effective invoices and manage your cash flow. If you have any further questions or comments, please do not hesitate to contact us. We would be happy to hear from you and help you with any invoicing needs you may have.