Intro

Discover what a ledger is, a fundamental accounting tool, and learn about ledger accounts, ledger books, and digital ledger systems, including blockchain ledger technology.

The concept of a ledger has been around for centuries, playing a crucial role in the financial management of businesses, organizations, and even individuals. At its core, a ledger is a book or digital file that contains a record of all financial transactions, including income, expenses, assets, and liabilities. This comprehensive record-keeping system allows users to track their financial activities, make informed decisions, and ensure the accuracy and integrity of their financial data.

In the past, ledgers were typically maintained manually, with entries being written by hand in a physical book. However, with the advent of technology, digital ledger systems have become increasingly popular, offering greater efficiency, accuracy, and convenience. These digital ledgers can be accessed and updated in real-time, allowing users to stay on top of their financial transactions and make adjustments as needed.

The importance of a ledger cannot be overstated, as it provides a clear and transparent picture of an individual's or organization's financial situation. By regularly updating and reviewing their ledger, users can identify areas for improvement, detect potential errors or discrepancies, and make strategic decisions about their financial resources. Whether you're a business owner, accountant, or simply an individual looking to manage your personal finances, understanding the concept of a ledger and how to use it effectively is essential.

Types of Ledgers

There are several types of ledgers, each designed to serve a specific purpose or cater to a particular industry or profession. Some of the most common types of ledgers include:

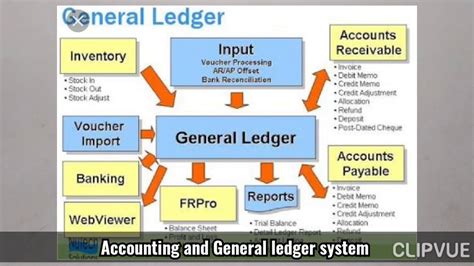

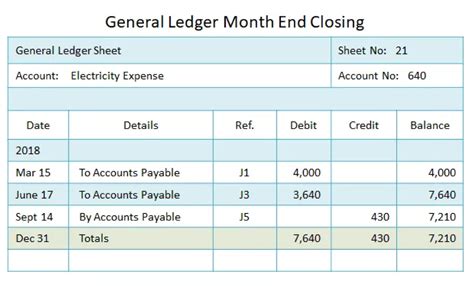

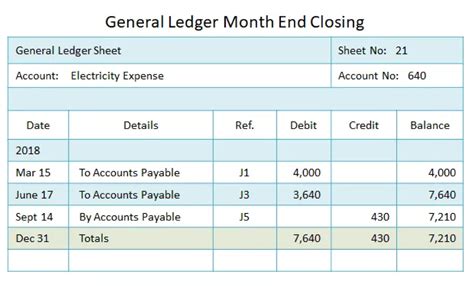

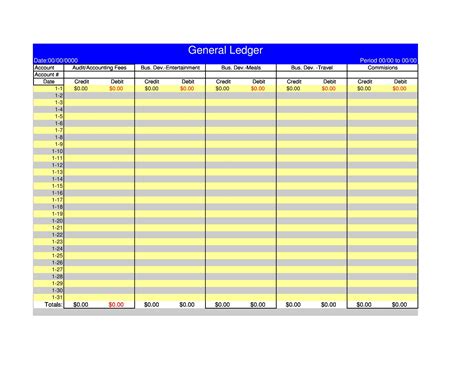

- General ledger: This is the most comprehensive type of ledger, containing a record of all financial transactions, including income, expenses, assets, and liabilities.

- Sales ledger: This type of ledger is used to track sales transactions, including customer invoices, payments, and credit notes.

- Purchase ledger: This ledger is used to record purchase transactions, including invoices, payments, and credit notes from suppliers.

- Cash ledger: This type of ledger is used to track cash transactions, including receipts, payments, and bank deposits.

- Petty cash ledger: This ledger is used to record small cash transactions, such as office expenses or employee reimbursements.

Benefits of Using a Ledger

The benefits of using a ledger are numerous, and can have a significant impact on an individual's or organization's financial management and decision-making. Some of the key benefits of using a ledger include:- Improved financial accuracy and transparency

- Enhanced financial control and management

- Increased efficiency and productivity

- Better decision-making and strategic planning

- Reduced errors and discrepancies

- Improved compliance with financial regulations and standards

How to Use a Ledger

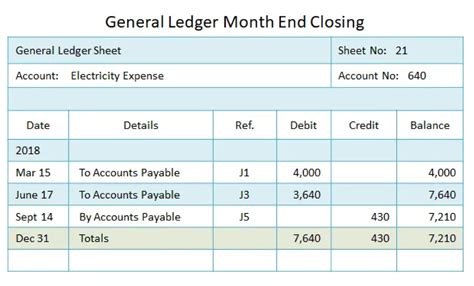

Using a ledger effectively requires a basic understanding of accounting principles and practices. Here are some steps to follow when using a ledger:

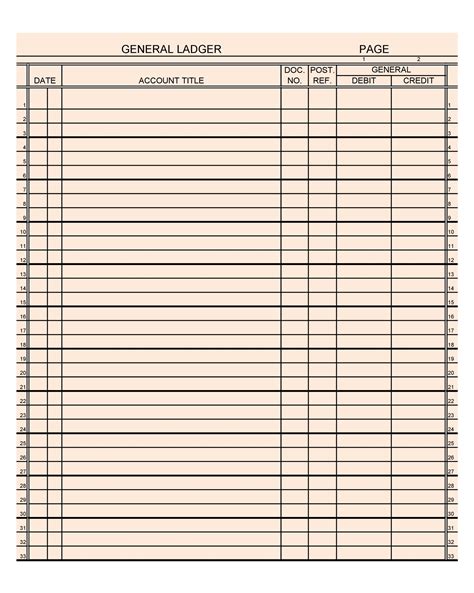

- Set up your ledger: Determine the type of ledger you need, and set it up accordingly. This may involve creating accounts, setting up a chart of accounts, and establishing a system for recording transactions.

- Record transactions: Record all financial transactions in your ledger, including income, expenses, assets, and liabilities. This may involve writing entries by hand or using a digital ledger system.

- Post transactions: Post each transaction to the relevant account in your ledger, using a system of debits and credits to ensure that the transaction is recorded accurately.

- Balance your ledger: Regularly balance your ledger to ensure that the debits and credits are equal, and that the ledger is accurate and up-to-date.

- Review and analyze: Regularly review and analyze your ledger to identify trends, patterns, and areas for improvement.

Common Ledger Accounts

A ledger typically consists of several accounts, each designed to track a specific type of financial transaction. Some common ledger accounts include:- Asset accounts: These accounts are used to track the value of assets, such as cash, inventory, and equipment.

- Liability accounts: These accounts are used to track the value of liabilities, such as loans, credit card debt, and accounts payable.

- Equity accounts: These accounts are used to track the value of equity, such as owner's capital, retained earnings, and dividends.

- Revenue accounts: These accounts are used to track income, such as sales, services, and interest income.

- Expense accounts: These accounts are used to track expenses, such as salaries, rent, and utilities.

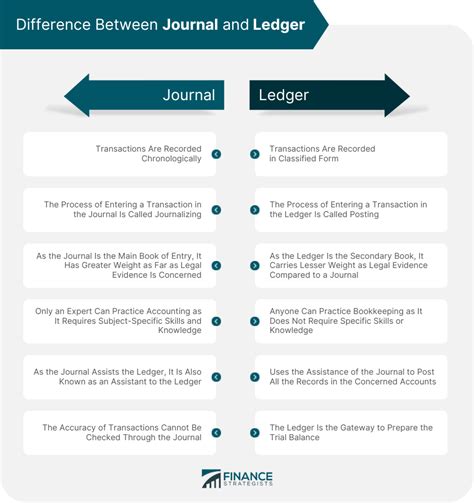

ledger vs Journal

A ledger and a journal are two types of accounting books that are often used together to record and track financial transactions. While they share some similarities, they also have some key differences.

A journal is a book of original entry, where financial transactions are first recorded. It is used to record transactions in chronological order, and is often used to record transactions that are not routine or recurring.

A ledger, on the other hand, is a book of final entry, where financial transactions are posted and summarized. It is used to track the balance of each account, and is often used to prepare financial statements and reports.

In summary, a journal is used to record transactions, while a ledger is used to post and summarize those transactions.

Importance of Ledger in Accounting

The importance of a ledger in accounting cannot be overstated. A ledger provides a comprehensive and accurate record of all financial transactions, allowing accountants and business owners to:- Prepare financial statements and reports

- Make informed decisions about financial resources

- Identify areas for improvement and optimize financial performance

- Detect and prevent errors and discrepancies

- Comply with financial regulations and standards

Modern Ledger Systems

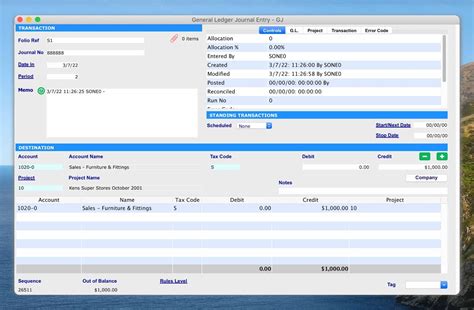

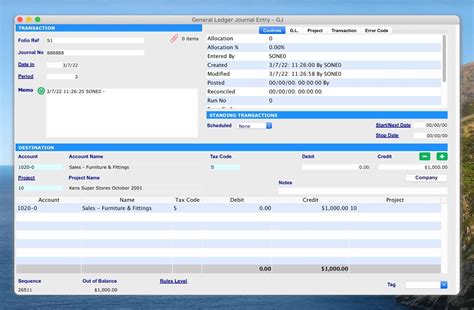

In recent years, there has been a significant shift towards digital ledger systems, which offer greater efficiency, accuracy, and convenience. Some of the key features of modern ledger systems include:

- Cloud-based storage and access

- Automated transaction recording and posting

- Real-time updates and reporting

- Advanced security and encryption

- Integration with other accounting and financial systems

These modern ledger systems have revolutionized the way businesses and individuals manage their finances, and have opened up new opportunities for financial analysis, planning, and decision-making.

Future of Ledger

The future of ledger is likely to be shaped by advances in technology, changes in financial regulations, and shifts in business and economic trends. Some potential developments that may impact the future of ledger include:- Increased use of artificial intelligence and machine learning

- Greater emphasis on cloud-based and mobile ledger systems

- Growing demand for real-time reporting and analysis

- Increased focus on security and data protection

- Greater integration with other financial and accounting systems

As the financial landscape continues to evolve, it is likely that the concept of a ledger will continue to adapt and change, incorporating new technologies and innovations to meet the needs of businesses and individuals.

Gallery of Ledger Images

Ledger Image Gallery

What is a ledger?

+A ledger is a book or digital file that contains a record of all financial transactions, including income, expenses, assets, and liabilities.

What are the benefits of using a ledger?

+The benefits of using a ledger include improved financial accuracy and transparency, enhanced financial control and management, increased efficiency and productivity, and better decision-making and strategic planning.

How do I set up a ledger?

+To set up a ledger, determine the type of ledger you need, and set it up accordingly. This may involve creating accounts, setting up a chart of accounts, and establishing a system for recording transactions.

What is the difference between a ledger and a journal?

+A journal is a book of original entry, where financial transactions are first recorded. A ledger, on the other hand, is a book of final entry, where financial transactions are posted and summarized.

Why is a ledger important in accounting?

+A ledger is important in accounting because it provides a comprehensive and accurate record of all financial transactions, allowing accountants and business owners to prepare financial statements and reports, make informed decisions about financial resources, and identify areas for improvement and optimize financial performance.

In conclusion, a ledger is a powerful tool for managing finances, providing a comprehensive and accurate record of all financial transactions. By understanding the concept of a ledger, and how to use it effectively, individuals and businesses can make informed decisions about their financial resources, optimize their financial performance, and achieve their goals. Whether you're a business owner, accountant, or simply an individual looking to manage your personal finances, a ledger is an essential tool that can help you achieve financial success. We encourage you to share your thoughts and experiences with using a ledger in the comments below, and to explore the many resources available for learning more about this important financial tool.