Intro

Boost security with 5 ways PCI compliance, ensuring data protection, payment security, and risk management through vulnerability scans, penetration testing, and secure protocols.

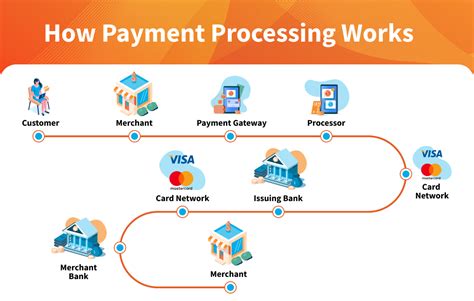

The importance of PCI compliance cannot be overstated in today's digital landscape, where data breaches and cyber attacks are becoming increasingly common. For businesses that handle credit card information, achieving and maintaining Payment Card Industry (PCI) compliance is crucial to protect sensitive customer data and prevent financial losses. In this article, we will delve into the world of PCI compliance, exploring its significance, benefits, and the steps businesses can take to ensure they meet the required standards.

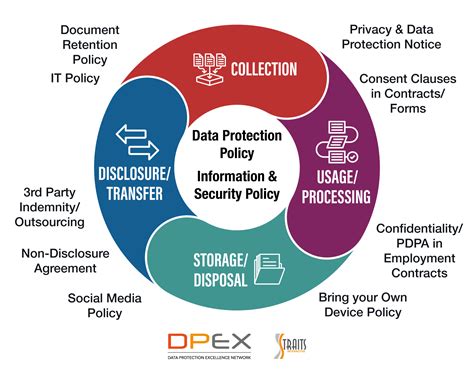

PCI compliance is a set of security standards designed to ensure that companies that handle credit card information maintain a secure environment for the protection of cardholder data. The Payment Card Industry Data Security Standard (PCI DSS) is a multifaceted security standard that includes requirements for security management, policies, procedures, network architecture, software design, and other critical protective measures. By adhering to these standards, businesses can significantly reduce the risk of data breaches and cyber attacks, thereby protecting their customers' sensitive information.

The consequences of non-compliance can be severe, including hefty fines, legal action, and damage to a company's reputation. Furthermore, businesses that suffer data breaches may also face financial losses due to the costs associated with notifying and compensating affected customers, as well as the potential loss of customer trust and loyalty. Therefore, it is essential for companies to prioritize PCI compliance and take proactive steps to ensure they meet the required standards.

Understanding PCI Compliance

To understand PCI compliance, it is essential to familiarize oneself with the PCI DSS, which is a comprehensive security standard that includes 12 requirements. These requirements are designed to ensure that companies implement robust security measures to protect cardholder data, including installing and maintaining a firewall, encrypting sensitive data, and implementing secure authentication and access controls. By understanding these requirements, businesses can take the necessary steps to achieve and maintain PCI compliance.

Benefits of PCI Compliance

The benefits of PCI compliance extend far beyond the avoidance of fines and penalties. By achieving and maintaining PCI compliance, businesses can demonstrate their commitment to protecting sensitive customer data, thereby enhancing their reputation and building trust with their customers. Additionally, PCI compliance can help businesses to identify and address vulnerabilities in their systems and processes, reducing the risk of data breaches and cyber attacks.5 Ways to Achieve PCI Compliance

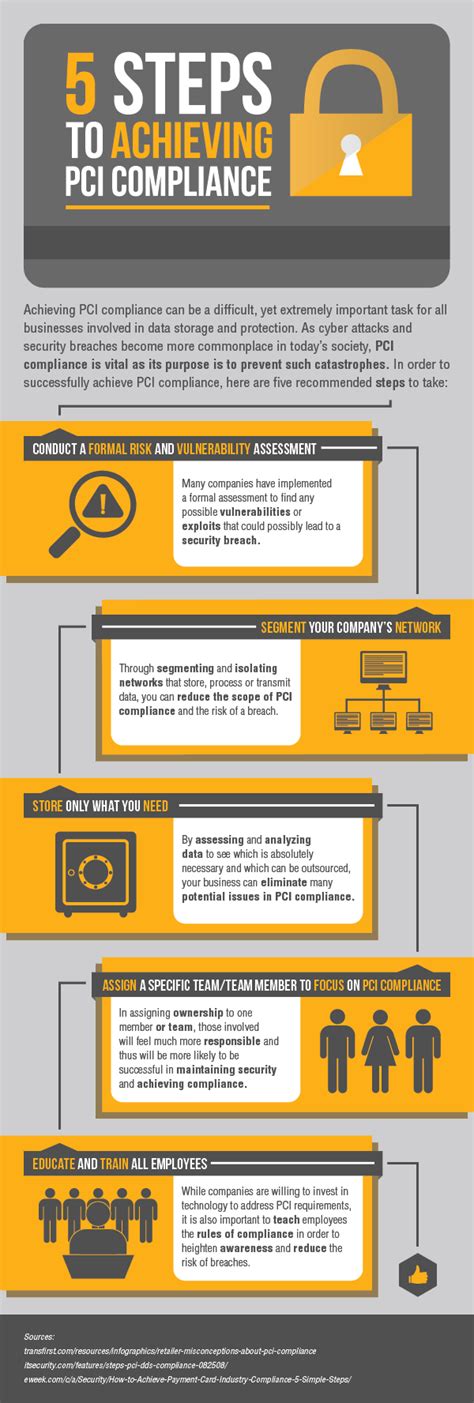

Achieving PCI compliance requires a multifaceted approach that includes the following five ways:

- Implementing robust security measures, such as firewalls and encryption, to protect cardholder data

- Conducting regular security audits and risk assessments to identify vulnerabilities in systems and processes

- Developing and implementing comprehensive security policies and procedures

- Providing ongoing training and education to employees on PCI compliance and security best practices

- Continuously monitoring and maintaining systems and processes to ensure they remain compliant with PCI DSS requirements

Step 1: Implementing Robust Security Measures

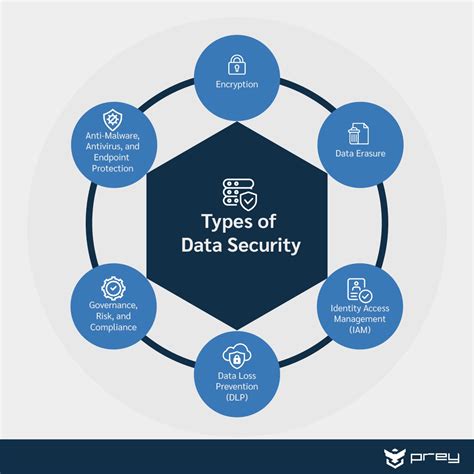

Implementing robust security measures is a critical step in achieving PCI compliance. This includes installing and maintaining a firewall, encrypting sensitive data, and implementing secure authentication and access controls. By implementing these measures, businesses can significantly reduce the risk of data breaches and cyber attacks, thereby protecting sensitive customer data.PCI Compliance Requirements

The PCI DSS includes 12 requirements that businesses must comply with to achieve PCI compliance. These requirements are designed to ensure that companies implement robust security measures to protect cardholder data, including:

- Installing and maintaining a firewall to protect cardholder data

- Encrypting sensitive data, both in transit and at rest

- Implementing secure authentication and access controls to prevent unauthorized access to cardholder data

- Conducting regular security audits and risk assessments to identify vulnerabilities in systems and processes

- Developing and implementing comprehensive security policies and procedures

Step 2: Conducting Regular Security Audits and Risk Assessments

Conducting regular security audits and risk assessments is a critical step in achieving PCI compliance. This includes identifying vulnerabilities in systems and processes, assessing the likelihood and potential impact of a data breach, and implementing remediation measures to address identified vulnerabilities. By conducting regular security audits and risk assessments, businesses can identify and address vulnerabilities before they can be exploited by hackers.Best Practices for PCI Compliance

To achieve and maintain PCI compliance, businesses should follow best practices, including:

- Implementing robust security measures, such as firewalls and encryption

- Conducting regular security audits and risk assessments

- Developing and implementing comprehensive security policies and procedures

- Providing ongoing training and education to employees on PCI compliance and security best practices

- Continuously monitoring and maintaining systems and processes to ensure they remain compliant with PCI DSS requirements

Step 3: Developing and Implementing Comprehensive Security Policies and Procedures

Developing and implementing comprehensive security policies and procedures is a critical step in achieving PCI compliance. This includes establishing clear policies and procedures for handling cardholder data, implementing secure authentication and access controls, and providing ongoing training and education to employees on PCI compliance and security best practices. By developing and implementing comprehensive security policies and procedures, businesses can ensure that they are taking a proactive approach to protecting sensitive customer data.Maintaining PCI Compliance

Maintaining PCI compliance requires ongoing effort and commitment. This includes continuously monitoring and maintaining systems and processes to ensure they remain compliant with PCI DSS requirements, conducting regular security audits and risk assessments, and providing ongoing training and education to employees on PCI compliance and security best practices. By maintaining PCI compliance, businesses can demonstrate their commitment to protecting sensitive customer data, thereby enhancing their reputation and building trust with their customers.

Step 4: Providing Ongoing Training and Education to Employees

Providing ongoing training and education to employees on PCI compliance and security best practices is a critical step in maintaining PCI compliance. This includes educating employees on the importance of PCI compliance, the risks associated with non-compliance, and the steps they can take to protect sensitive customer data. By providing ongoing training and education to employees, businesses can ensure that they are taking a proactive approach to protecting sensitive customer data.Common Challenges in Achieving PCI Compliance

Achieving PCI compliance can be challenging, particularly for small and medium-sized businesses. Common challenges include:

- Limited resources and budget

- Lack of expertise and knowledge

- Complexity of PCI DSS requirements

- Difficulty in maintaining compliance over time

Step 5: Continuously Monitoring and Maintaining Systems and Processes

Continuously monitoring and maintaining systems and processes is a critical step in maintaining PCI compliance. This includes regularly reviewing and updating security policies and procedures, conducting regular security audits and risk assessments, and implementing remediation measures to address identified vulnerabilities. By continuously monitoring and maintaining systems and processes, businesses can ensure that they are taking a proactive approach to protecting sensitive customer data.Conclusion and Final Thoughts

In conclusion, achieving and maintaining PCI compliance is crucial for businesses that handle credit card information. By following the five steps outlined in this article, businesses can ensure that they are taking a proactive approach to protecting sensitive customer data. Additionally, by understanding the benefits and requirements of PCI compliance, businesses can demonstrate their commitment to protecting sensitive customer data, thereby enhancing their reputation and building trust with their customers.

PCI Compliance Image Gallery

What is PCI compliance?

+PCI compliance refers to the adherence to the Payment Card Industry Data Security Standard (PCI DSS), which is a set of security standards designed to ensure that companies that handle credit card information maintain a secure environment for the protection of cardholder data.

Why is PCI compliance important?

+PCI compliance is important because it helps to protect sensitive customer data, reduces the risk of data breaches and cyber attacks, and enhances a company's reputation and builds trust with its customers.

What are the consequences of non-compliance?

+The consequences of non-compliance can be severe, including hefty fines, legal action, and damage to a company's reputation. Additionally, businesses that suffer data breaches may also face financial losses due to the costs associated with notifying and compensating affected customers, as well as the potential loss of customer trust and loyalty.

How can businesses achieve PCI compliance?

+Businesses can achieve PCI compliance by implementing robust security measures, conducting regular security audits and risk assessments, developing and implementing comprehensive security policies and procedures, providing ongoing training and education to employees, and continuously monitoring and maintaining systems and processes to ensure they remain compliant with PCI DSS requirements.

What are the benefits of PCI compliance?

+The benefits of PCI compliance include protecting sensitive customer data, reducing the risk of data breaches and cyber attacks, enhancing a company's reputation and building trust with its customers, and avoiding hefty fines and penalties associated with non-compliance.

We hope this article has provided you with a comprehensive understanding of PCI compliance and the steps businesses can take to achieve and maintain it. If you have any further questions or would like to learn more about PCI compliance, please do not hesitate to comment below. Additionally, if you found this article informative and helpful, please share it with others who may benefit from the information. By working together, we can help to protect sensitive customer data and prevent data breaches and cyber attacks.