Intro

Discover what PCI compliance entails, including security standards, data protection, and merchant requirements, to ensure your business meets Payment Card Industry regulations and maintains customer trust.

The importance of security in the digital age cannot be overstated, especially when it comes to sensitive information such as credit card numbers. One of the key standards for ensuring the secure handling of this information is PCI compliance. PCI, which stands for Payment Card Industry, compliance refers to the adherence to a set of security standards designed to ensure that companies that handle credit card information maintain a secure environment for the protection of cardholder data. This is crucial not just for the financial institutions and merchants who directly handle credit card transactions but also for any entity that stores, processes, or transmits cardholder data.

The need for PCI compliance arises from the ever-increasing threat of data breaches and cyberattacks. These incidents can lead to the theft of sensitive information, resulting in financial loss for both the affected individuals and the businesses involved. By implementing the security measures outlined in the PCI Data Security Standard (DSS), companies can significantly reduce the risk of such breaches, protecting both their customers and their own reputation. Moreover, being PCI compliant is not just a matter of security; it is also a requirement for any business that wants to accept credit card payments. Failure to comply can result in fines, penalties, and even the loss of the ability to process credit card transactions.

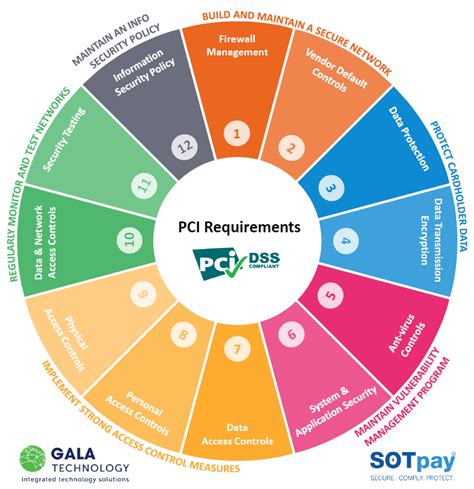

The PCI DSS is maintained by the Payment Card Industry Security Standards Council (PCI SSC), which was founded by the major payment card brands (Visa, Mastercard, American Express, Discover, and JCB). The standard is regularly updated to address new threats and technologies, ensuring that it remains effective in protecting cardholder data. The most recent version of the standard outlines 12 key requirements that businesses must follow to achieve PCI compliance. These requirements cover areas such as the installation and maintenance of firewall configurations, the encryption of cardholder data, the restriction of access to cardholder data on a need-to-know basis, and the regular testing of security systems and processes.

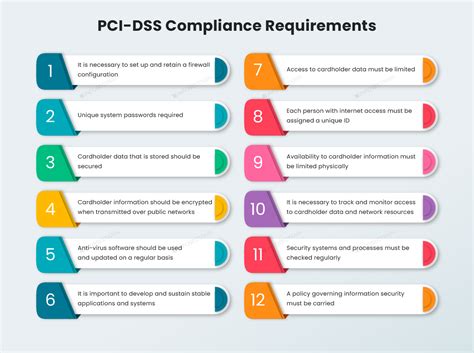

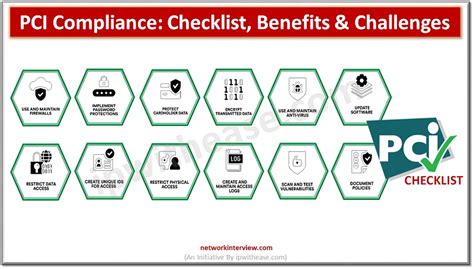

Understanding PCI Compliance Requirements

Understanding the requirements for PCI compliance is the first step towards achieving it. The 12 requirements of the PCI DSS are designed to be comprehensive, covering all aspects of security that are relevant to the protection of cardholder data. These requirements include:

- Install and maintain a firewall configuration to protect cardholder data. This involves ensuring that all connections to and from the internet are secure and that only necessary data is allowed through.

- Do not use vendor-supplied defaults for system passwords and other security parameters. Changing default passwords and settings is crucial to prevent unauthorized access.

- Protect stored cardholder data. This involves encrypting data when it is stored and ensuring that only authorized personnel have access to it.

- Encrypt transmission of cardholder data across open, public networks. Any data that is transmitted over the internet or other public networks must be encrypted to prevent interception.

- Use and regularly update antivirus software. Antivirus software is essential for protecting against malware and other viruses that could compromise security.

- Develop and maintain secure systems and applications. This involves ensuring that all software and systems are up-to-date and that any vulnerabilities are promptly addressed.

- Restrict access to cardholder data by business need to know. Access to sensitive data should be limited to those who need it to perform their job functions.

- Assign a unique ID to each person with computer access. This helps to track who has accessed cardholder data and when.

- Restrict physical access to cardholder data. This includes ensuring that devices and media that store cardholder data are secure and that access to them is restricted.

- Track and monitor all access to network resources and cardholder data. Logging all access and activities related to cardholder data helps in detecting and responding to security incidents.

- Regularly test security systems and processes. Vulnerability scans and penetration testing are essential for identifying and addressing security weaknesses.

- Maintain a policy that addresses information security. This policy should be communicated to all personnel and should outline the procedures for protecting cardholder data.

Benefits of Achieving PCI Compliance

Achieving PCI compliance offers numerous benefits to businesses. Not only does it ensure the security of cardholder data, thereby protecting customers, but it also enhances the reputation of the business. Customers are more likely to trust a company that prioritizes the security of their financial information. Furthermore, PCI compliance can help businesses avoid the significant financial penalties associated with data breaches and non-compliance. These penalties can include fines from payment card brands, legal fees, and the costs of notifying and compensating affected customers.

In addition to these direct benefits, achieving PCI compliance can also improve a company's overall security posture. By implementing the security controls and best practices outlined in the PCI DSS, businesses can protect themselves against a wide range of cyber threats, not just those related to credit card data. This can lead to cost savings in the long run by reducing the risk of security incidents and the associated costs of response and recovery.

Steps to Achieve PCI Compliance

Achieving PCI compliance involves several steps, including:

- Conducting a risk assessment to identify vulnerabilities and weaknesses in the current security environment.

- Implementing the required security controls as outlined in the PCI DSS.

- Performing regular security audits and scans to identify and address any new vulnerabilities.

- Maintaining documentation of all security policies, procedures, and testing.

- Training personnel on security best practices and the importance of PCI compliance.

By following these steps and maintaining a commitment to security, businesses can achieve and maintain PCI compliance, ensuring the protection of cardholder data and the integrity of their operations.

Common Challenges in Achieving PCI Compliance

Despite the importance of PCI compliance, many businesses face challenges in achieving and maintaining it. One of the most common challenges is the complexity of the PCI DSS requirements themselves. The standard is detailed and technical, requiring a significant understanding of security principles and technologies. Small and medium-sized businesses, in particular, may struggle with the resources and expertise needed to implement and maintain the required security controls.

Another challenge is the cost associated with achieving PCI compliance. Implementing new security technologies and hiring personnel with the necessary expertise can be expensive. Additionally, the ongoing costs of maintaining compliance, including regular security testing and audits, can be a burden for many businesses.

Furthermore, the ever-evolving nature of cyber threats means that PCI compliance is not a one-time achievement but an ongoing process. Businesses must continually monitor their security environment and update their controls to address new threats and vulnerabilities. This requires a significant commitment to security and an understanding that PCI compliance is an integral part of overall business operations.

Best Practices for Maintaining PCI Compliance

To maintain PCI compliance, businesses should adopt several best practices, including:

- Regularly reviewing and updating security policies to ensure they remain effective and compliant with the PCI DSS.

- Providing ongoing security training to personnel to ensure they understand the importance of security and their role in maintaining compliance.

- Continuously monitoring the security environment for new threats and vulnerabilities.

- Performing regular security audits and vulnerability scans to identify and address any weaknesses.

- Maintaining open communication with stakeholders, including customers and partners, about security practices and compliance status.

By following these best practices, businesses can ensure that they not only achieve PCI compliance but also maintain it over time, protecting cardholder data and enhancing their reputation and trust with their customers.

PCI Compliance and Technology

Technology plays a crucial role in achieving and maintaining PCI compliance. Various security technologies and tools are available to help businesses implement the required security controls and maintain a secure environment for cardholder data. These include firewalls, intrusion detection and prevention systems, encryption technologies, and security information and event management (SIEM) systems.

Cloud computing and managed security services are also becoming increasingly important in the context of PCI compliance. These services allow businesses to outsource certain security functions to specialized providers, who can provide the expertise and resources needed to maintain a secure environment. This can be particularly beneficial for small and medium-sized businesses that may not have the in-house resources to manage complex security technologies.

However, the use of technology in PCI compliance also presents challenges. The rapid evolution of technology means that security threats and vulnerabilities are constantly changing, requiring businesses to stay up-to-date with the latest security patches and updates. Additionally, the complexity of some security technologies can make them difficult to implement and manage, especially for businesses without significant security expertise.

Future of PCI Compliance

The future of PCI compliance is likely to be shaped by several factors, including advancements in technology, changes in consumer behavior, and the evolving nature of cyber threats. As technology continues to advance, we can expect to see new security threats emerge, requiring updates to the PCI DSS and new strategies for maintaining compliance.

One of the key trends that is expected to impact PCI compliance is the increasing use of mobile and contactless payments. These technologies introduce new security challenges, such as the potential for data breaches through mobile devices and the need for secure authentication methods. Businesses will need to adapt their security practices to address these challenges and ensure that they can maintain PCI compliance in a rapidly changing payments landscape.

Another trend is the growing importance of cloud security. As more businesses move their operations to the cloud, ensuring the security of cloud environments will become critical for maintaining PCI compliance. This will require businesses to work closely with their cloud service providers to ensure that adequate security controls are in place and that the shared responsibility model for security is clearly understood.

Gallery of PCI Compliance Images

PCI Compliance Image Gallery

What is PCI compliance?

+PCI compliance refers to the adherence to a set of security standards designed to ensure that companies that handle credit card information maintain a secure environment for the protection of cardholder data.

Why is PCI compliance important?

+PCI compliance is important because it helps protect cardholder data from being compromised, reducing the risk of data breaches and financial loss for both businesses and their customers.

How do I achieve PCI compliance?

+Achieving PCI compliance involves implementing the 12 requirements of the PCI DSS, including installing and maintaining a firewall, encrypting cardholder data, and regularly testing security systems and processes.

In conclusion, PCI compliance is a critical aspect of security for any business that handles credit card information. By understanding the requirements and benefits of PCI compliance, and by adopting best practices for maintaining compliance, businesses can protect cardholder data, enhance their reputation, and avoid the significant costs associated with data breaches and non-compliance. As technology continues to evolve and new security threats emerge, the importance of PCI compliance will only continue to grow, making it essential for businesses to stay informed and proactive in their security efforts. We invite you to share your thoughts and experiences with PCI compliance in the comments below and to explore more resources on this topic to further enhance your understanding of this critical security standard.