Intro

Discover what is profit margin, a key metric for business success, calculating revenue, costs, and profitability, with related terms like gross margin, net margin, and operating margin, to boost financial performance.

Profit margin is a crucial metric for businesses, as it measures the amount of profit earned on each sale. In essence, it is the difference between the revenue generated from sales and the total cost of producing and selling the goods or services. Understanding profit margin is essential for companies to evaluate their pricing strategies, manage costs, and make informed decisions about investments and growth. A higher profit margin indicates that a company is able to maintain its pricing power, control its costs, and generate more earnings from its sales.

The importance of profit margin cannot be overstated. It serves as a key indicator of a company's financial health, allowing investors, analysts, and stakeholders to gauge its efficiency and competitiveness. By analyzing profit margins, businesses can identify areas for improvement, optimize their operations, and develop strategies to increase their profitability. Moreover, profit margin is a critical factor in determining a company's ability to invest in research and development, expand its product offerings, and enhance its market position.

In today's competitive business landscape, maintaining a healthy profit margin is more challenging than ever. Companies face intense pressure to reduce prices, improve quality, and innovate products, all while managing rising costs and maintaining profitability. As such, understanding the intricacies of profit margin and its impact on business performance is vital for companies to stay ahead of the curve. By grasping the concepts and strategies related to profit margin, businesses can unlock new opportunities for growth, improve their financial stability, and achieve long-term success.

Understanding Profit Margin

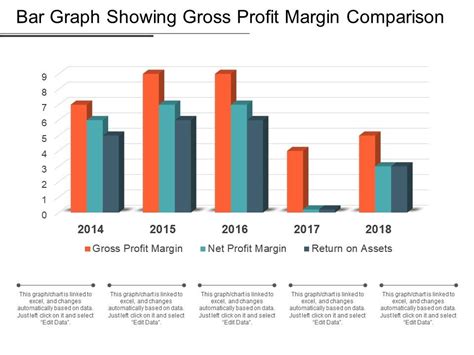

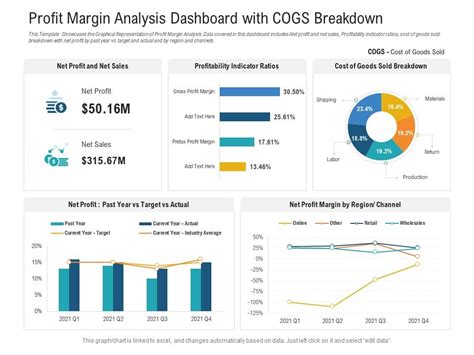

Profit margin is typically expressed as a percentage, calculated by dividing the profit by the revenue and multiplying by 100. There are three main types of profit margins: gross profit margin, operating profit margin, and net profit margin. Each of these metrics provides valuable insights into a company's financial performance and helps businesses make data-driven decisions. Gross profit margin, for instance, measures the profit earned from sales after deducting the cost of goods sold, while operating profit margin takes into account operating expenses, such as salaries, rent, and marketing costs. Net profit margin, on the other hand, represents the profit earned after accounting for all expenses, taxes, and interest.

Types of Profit Margins

The different types of profit margins are: * Gross profit margin: measures the profit earned from sales after deducting the cost of goods sold * Operating profit margin: takes into account operating expenses, such as salaries, rent, and marketing costs * Net profit margin: represents the profit earned after accounting for all expenses, taxes, and interestCalculating Profit Margin

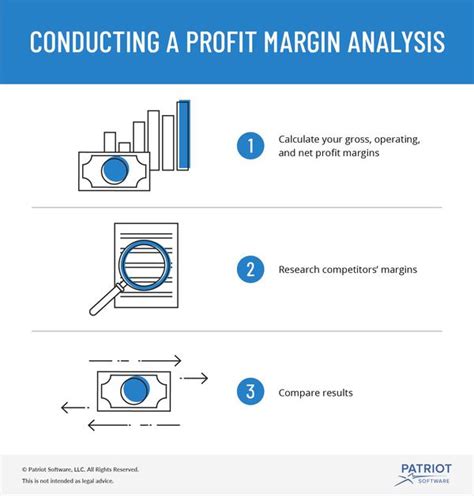

Calculating profit margin involves a simple yet crucial formula. To determine the profit margin, businesses need to subtract the total cost from the revenue and then divide the result by the revenue. This calculation provides the profit margin as a decimal, which can be converted to a percentage by multiplying by 100. For example, if a company generates $100,000 in revenue and incurs $70,000 in total costs, its profit margin would be 30%. This means that for every dollar sold, the company earns 30 cents in profit.

Profit Margin Formula

The profit margin formula is: Profit Margin = (Revenue - Total Cost) / Revenue This formula can be applied to different types of profit margins, including gross, operating, and net profit margins.Importance of Profit Margin

The importance of profit margin cannot be overstated. It serves as a key indicator of a company's financial health, allowing investors, analysts, and stakeholders to gauge its efficiency and competitiveness. By analyzing profit margins, businesses can identify areas for improvement, optimize their operations, and develop strategies to increase their profitability. Moreover, profit margin is a critical factor in determining a company's ability to invest in research and development, expand its product offerings, and enhance its market position.

Benefits of High Profit Margin

The benefits of a high profit margin include: * Increased financial stability * Improved ability to invest in research and development * Enhanced market position * Greater flexibility to respond to changes in the market * Increased attractiveness to investors and stakeholdersFactors Affecting Profit Margin

Several factors can affect a company's profit margin, including pricing strategies, production costs, competition, and market conditions. Businesses that operate in highly competitive industries may need to reduce their prices to remain competitive, which can negatively impact their profit margins. On the other hand, companies that have a strong brand reputation, unique products, or patented technologies may be able to maintain higher prices and enjoy higher profit margins.

Strategies to Improve Profit Margin

Strategies to improve profit margin include: * Optimizing pricing strategies * Reducing production costs * Improving operational efficiency * Enhancing product offerings * Investing in research and developmentIndustry Comparison

Profit margins can vary significantly across different industries. Companies that operate in industries with high barriers to entry, limited competition, and strong demand tend to enjoy higher profit margins. In contrast, businesses that operate in highly competitive industries with low barriers to entry and intense price competition may experience lower profit margins. By analyzing industry benchmarks and comparing their profit margins to those of their competitors, businesses can identify areas for improvement and develop strategies to increase their profitability.

Industry Benchmarking

Industry benchmarking involves: * Analyzing industry averages and trends * Comparing profit margins to those of competitors * Identifying areas for improvement * Developing strategies to increase profitabilityConclusion and Future Outlook

In conclusion, profit margin is a vital metric that plays a crucial role in determining a company's financial health, competitiveness, and long-term success. By understanding the different types of profit margins, calculating profit margin, and analyzing the factors that affect it, businesses can develop strategies to improve their profitability and stay ahead of the competition. As the business landscape continues to evolve, companies must remain agile, adapt to changing market conditions, and focus on optimizing their operations to maintain healthy profit margins.

Future Outlook

The future outlook for profit margin includes: * Increased focus on operational efficiency * Growing importance of digital transformation * Rising competition and pricing pressure * Need for continuous innovation and improvementProfit Margin Image Gallery

What is profit margin?

+Profit margin is the difference between the revenue generated from sales and the total cost of producing and selling the goods or services.

How is profit margin calculated?

+Profit margin is calculated by dividing the profit by the revenue and multiplying by 100.

What are the different types of profit margins?

+The different types of profit margins include gross profit margin, operating profit margin, and net profit margin.

Why is profit margin important?

+Profit margin is important because it serves as a key indicator of a company's financial health, allowing investors, analysts, and stakeholders to gauge its efficiency and competitiveness.

How can businesses improve their profit margin?

+Businesses can improve their profit margin by optimizing pricing strategies, reducing production costs, improving operational efficiency, enhancing product offerings, and investing in research and development.

We hope this article has provided you with a comprehensive understanding of profit margin and its importance in business. If you have any further questions or would like to share your thoughts on the topic, please don't hesitate to comment below. Additionally, if you found this article informative and helpful, please share it with your network to help others understand the significance of profit margin in achieving business success.