Intro

Discover 5 ways WhatsApp Ledger simplifies accounting, invoicing, and expense tracking, utilizing digital ledgers, online invoicing, and automated expense management for efficient financial record-keeping and analysis.

The importance of understanding and utilizing ledgers in various aspects of life, including personal finance, business, and accounting, cannot be overstated. A ledger is a book or digital file that records and stores financial transactions, providing a clear picture of an individual's or organization's financial situation. In this article, we will delve into the world of ledgers, exploring their significance, types, and benefits, as well as providing guidance on how to create and maintain a ledger.

Ledgers have been used for centuries, with early examples dating back to ancient civilizations. The concept of a ledger has evolved over time, from handwritten records to digital spreadsheets and software. Today, ledgers are an essential tool for anyone looking to manage their finances effectively. Whether you are an individual, a small business owner, or a large corporation, a ledger can help you track your income and expenses, make informed financial decisions, and achieve your financial goals.

The use of ledgers is not limited to financial transactions. They can also be used to record and track other types of data, such as inventory, customer information, and project progress. In fact, ledgers are used in a variety of industries, including healthcare, education, and government. The versatility and flexibility of ledgers make them an invaluable resource for anyone looking to organize and analyze data.

What is a Ledger?

Types of Ledgers

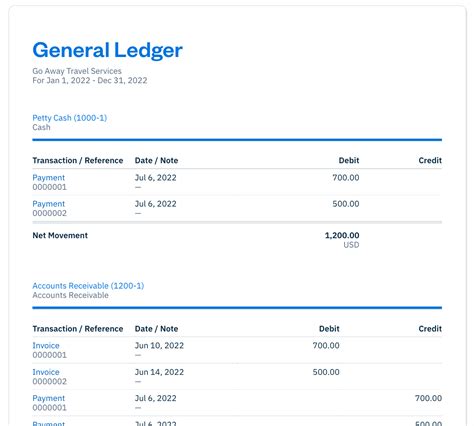

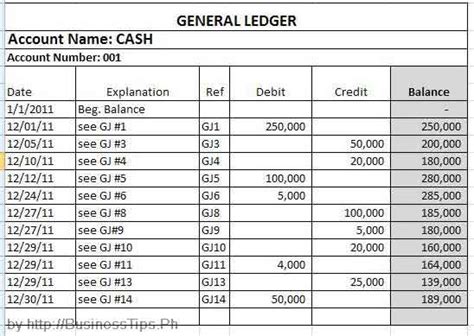

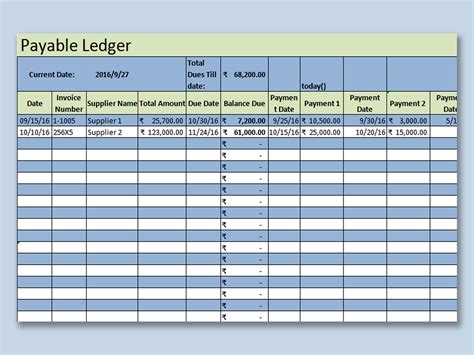

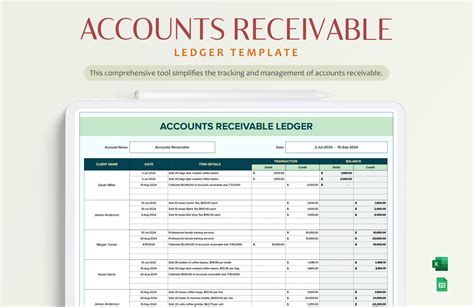

There are several types of ledgers, each designed to serve a specific purpose. The most common types of ledgers include: * General ledger: A general ledger is a comprehensive ledger that contains all financial transactions, including income, expenses, assets, and liabilities. * Cash ledger: A cash ledger is a ledger that records all cash transactions, including receipts and payments. * Accounts payable ledger: An accounts payable ledger is a ledger that records all outstanding debts and liabilities. * Accounts receivable ledger: An accounts receivable ledger is a ledger that records all outstanding invoices and payments due.Benefits of Using a Ledger

How to Create a Ledger

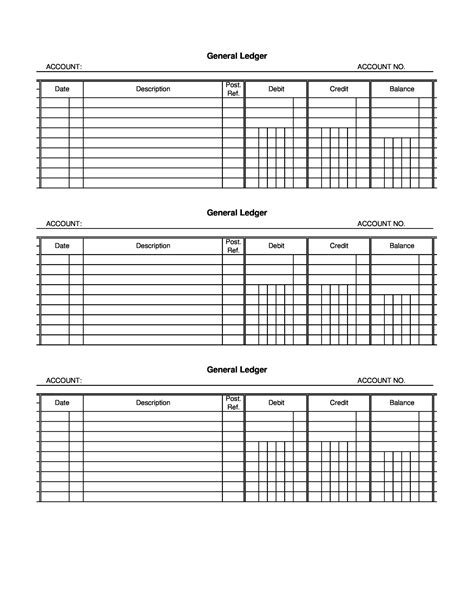

Creating a ledger is a relatively simple process. The following steps can help: * Determine the type of ledger: Decide what type of ledger you need, based on your specific requirements and goals. * Choose a format: Decide whether you want to use a physical ledger or a digital spreadsheet. * Set up the ledger: Create a template or format for your ledger, including columns for date, description, debit, and credit. * Record transactions: Start recording your financial transactions, including income, expenses, assets, and liabilities.5 Ways to Use a Ledger

Common Ledger Mistakes

While ledgers are a powerful tool for financial management, there are common mistakes that can reduce their effectiveness. Some of the most common mistakes include: * Inaccurate or incomplete data: Failing to record transactions accurately or completely can lead to errors and inaccuracies. * Lack of organization: Failing to organize your ledger effectively can make it difficult to find and analyze data. * Insufficient security: Failing to secure your ledger can put your financial data at risk.Best Practices for Using a Ledger

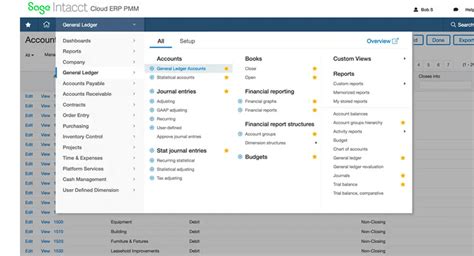

Ledger Software and Tools

There are many software and tools available to help you create and manage your ledger. Some of the most popular options include: * Spreadsheets: Spreadsheets, such as Microsoft Excel or Google Sheets, provide a flexible and customizable way to create and manage your ledger. * Accounting software: Accounting software, such as QuickBooks or Xero, provides a comprehensive and integrated way to manage your finances. * Ledger apps: Ledger apps, such as Ledger or Budget, provide a mobile and accessible way to manage your finances.Conclusion and Next Steps

Ledger Image Gallery

What is a ledger?

+A ledger is a book or digital file that contains a record of all financial transactions, including income, expenses, assets, and liabilities.

What are the benefits of using a ledger?

+The benefits of using a ledger include improved financial management, increased accuracy, enhanced decision-making, and better budgeting.

How do I create a ledger?

+To create a ledger, determine the type of ledger you need, choose a format, set up the ledger, and start recording your financial transactions.

What are some common ledger mistakes?

+Common ledger mistakes include inaccurate or incomplete data, lack of organization, and insufficient security.

What are some best practices for using a ledger?

+Best practices for using a ledger include regularly updating your ledger, using a consistent format, and securing your ledger.

We hope this article has provided you with a comprehensive understanding of ledgers and their importance in financial management. Whether you are an individual or an organization, a ledger can help you achieve your financial goals and make informed financial decisions. If you have any further questions or would like to share your experiences with using ledgers, please comment below. Additionally, if you found this article helpful, please share it with others who may benefit from this information.