Intro

Discover the 5 ways invoice works, streamlining billing and payment processes with invoice management, online invoicing, and payment tracking, for efficient cash flow and financial management.

Invoicing is a crucial aspect of any business, as it enables companies to request payments from clients for goods or services provided. The invoice serves as a formal document that outlines the details of the transaction, including the items purchased, quantities, prices, and payment terms. Understanding how invoices work is essential for businesses to manage their finances effectively and maintain healthy relationships with customers. In this article, we will delve into the world of invoicing and explore the different ways invoices work.

The importance of invoicing cannot be overstated, as it plays a vital role in the financial management of a company. Invoices help businesses to track their sales, manage their accounts receivable, and ensure that they receive timely payments from clients. Moreover, invoices provide a paper trail that can be useful in case of disputes or audits. With the advancement of technology, invoicing has become more efficient and convenient, allowing businesses to create and send invoices electronically.

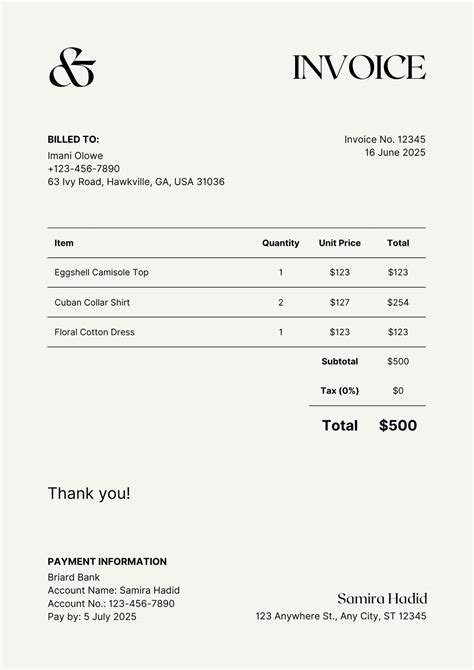

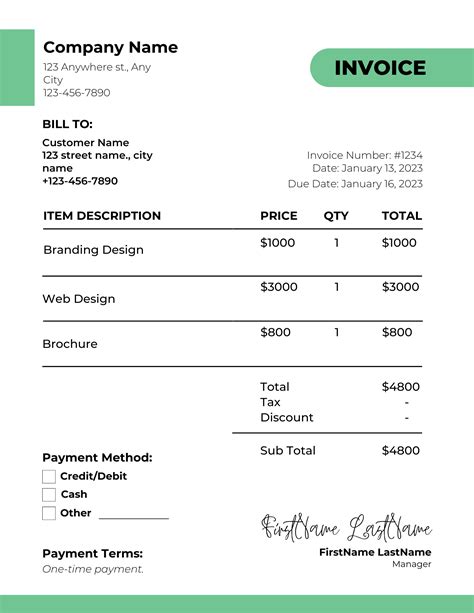

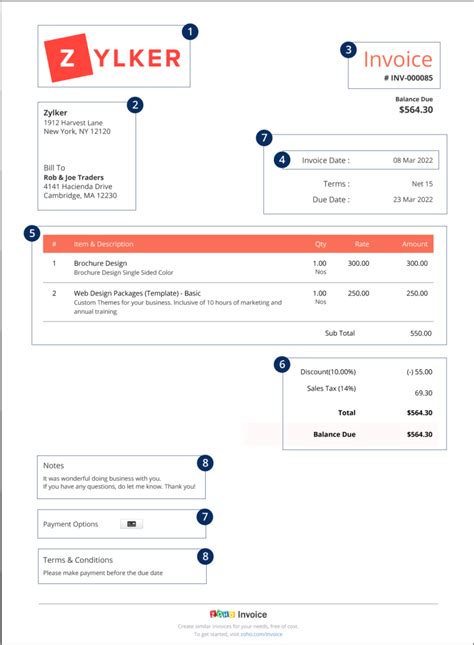

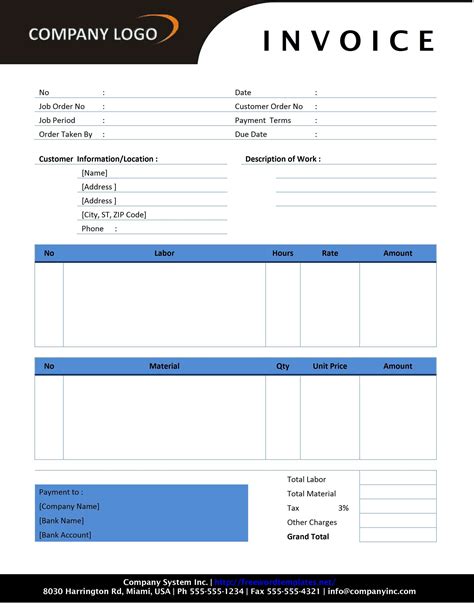

Invoicing is a critical process that involves several steps, from creating the invoice to receiving payment from the client. The invoice typically includes essential information such as the business's name and address, the client's name and address, a unique invoice number, date of issue, and a detailed breakdown of the items or services provided. The payment terms, including the due date and accepted payment methods, are also specified on the invoice. By understanding the invoicing process, businesses can streamline their financial operations and improve their overall efficiency.

Introduction to Invoicing

Invoicing is a fundamental aspect of business operations, and its importance extends beyond just requesting payments from clients. Invoices provide a formal record of transactions, which can be useful for accounting and tax purposes. Moreover, invoices help businesses to track their sales and revenue, enabling them to make informed decisions about their operations and growth strategies. With the rise of digital invoicing, businesses can now create and send invoices electronically, reducing the need for paper and increasing the speed of payment.

Benefits of Invoicing

The benefits of invoicing are numerous, and they can have a significant impact on a company's financial health and overall success. Some of the key benefits of invoicing include:

- Improved cash flow: Invoices enable businesses to request payments from clients in a timely manner, which can help to improve cash flow and reduce the risk of late payments.

- Enhanced financial management: Invoices provide a formal record of transactions, which can be useful for accounting and tax purposes.

- Increased efficiency: Digital invoicing can automate many of the tasks associated with invoicing, such as creating and sending invoices, and tracking payments.

- Better customer relationships: Invoices can help businesses to build trust with their clients by providing a clear and transparent record of transactions.

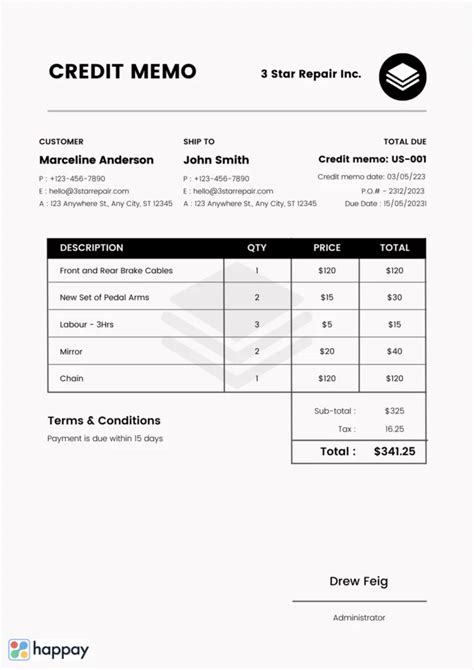

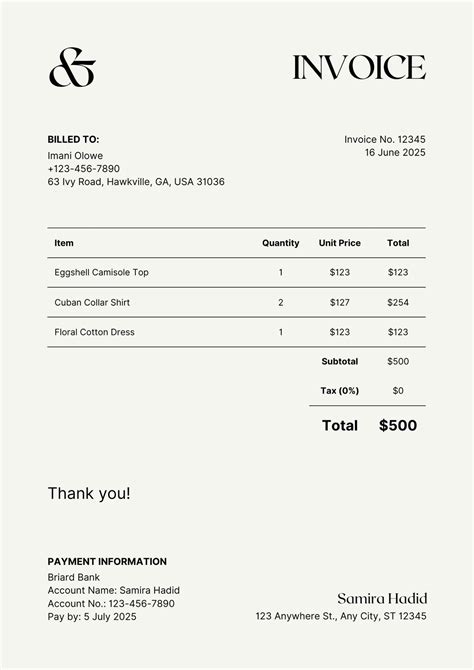

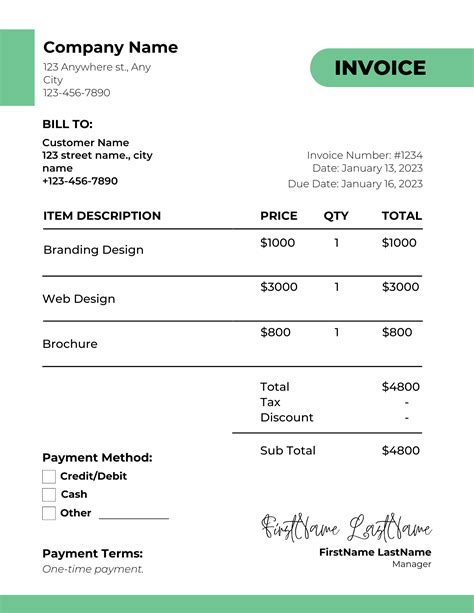

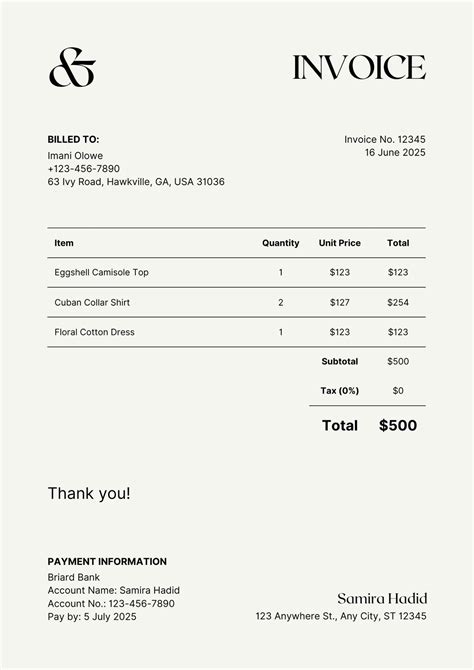

Types of Invoices

There are several types of invoices that businesses can use, depending on their specific needs and requirements. Some of the most common types of invoices include:

- Standard invoice: This is the most common type of invoice and is used for most business-to-business transactions.

- Pro forma invoice: This type of invoice is used to provide a quote or estimate for goods or services.

- Recurring invoice: This type of invoice is used for repeat business, such as subscription-based services.

- Credit invoice: This type of invoice is used to provide a refund or credit to a client.

- Debit invoice: This type of invoice is used to request payment from a client for goods or services provided.

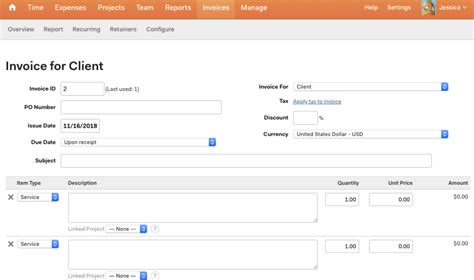

How to Create an Invoice

Creating an invoice is a straightforward process that involves several steps. Here are the basic steps to follow:

- Determine the invoice type: Choose the type of invoice that best suits your business needs.

- Gather necessary information: Collect all the necessary information, including the client's name and address, the date of issue, and the items or services provided.

- Choose an invoicing method: Decide whether to create a paper invoice or use digital invoicing software.

- Add essential details: Include all the essential details, such as the business's name and address, the client's name and address, and the payment terms.

- Review and send: Review the invoice for accuracy and completeness, and then send it to the client.

Best Practices for Invoicing

To get the most out of invoicing, businesses should follow best practices that can help to improve efficiency, reduce errors, and enhance customer relationships. Some of the best practices for invoicing include:

- Using clear and concise language: Avoid using jargon or technical terms that may confuse clients.

- Including all essential details: Make sure to include all the necessary information, such as the business's name and address, the client's name and address, and the payment terms.

- Using digital invoicing: Digital invoicing can automate many of the tasks associated with invoicing, such as creating and sending invoices, and tracking payments.

- Sending invoices promptly: Send invoices to clients in a timely manner to avoid delays in payment.

Gallery of Invoicing Examples

Invoicing Image Gallery

What is an invoice?

+An invoice is a formal document that outlines the details of a transaction, including the items purchased, quantities, prices, and payment terms.

Why is invoicing important?

+Invoicing is important because it enables businesses to request payments from clients in a timely manner, which can help to improve cash flow and reduce the risk of late payments.

What are the different types of invoices?

+There are several types of invoices, including standard invoices, pro forma invoices, recurring invoices, credit invoices, and debit invoices.

How do I create an invoice?

+To create an invoice, determine the type of invoice, gather necessary information, choose an invoicing method, add essential details, and review and send the invoice to the client.

What are the best practices for invoicing?

+Best practices for invoicing include using clear and concise language, including all essential details, using digital invoicing, and sending invoices promptly.

In conclusion, invoicing is a critical aspect of business operations that plays a vital role in financial management and customer relationships. By understanding the different types of invoices, creating invoices effectively, and following best practices, businesses can improve their cash flow, reduce errors, and enhance customer satisfaction. We hope this article has provided you with valuable insights into the world of invoicing and has encouraged you to take action to improve your invoicing processes. If you have any questions or comments, please do not hesitate to reach out to us. Share this article with your colleagues and friends who may benefit from learning more about invoicing, and stay tuned for more informative articles on business and finance.