Intro

Discover the 5 ways invoice works, streamlining billing and payment processes with invoice management, online invoicing, and payment tracking, for efficient cash flow and financial management.

In today's fast-paced business environment, efficient financial management is crucial for the success of any organization. One key aspect of financial management is invoicing, which plays a vital role in ensuring timely payments and maintaining healthy cash flows. Understanding how invoices work is essential for businesses to optimize their financial operations and build strong relationships with clients. In this article, we will delve into the world of invoicing, exploring its importance, benefits, and the various ways it can be utilized to enhance business operations.

Effective invoicing is the backbone of any business, as it directly impacts the company's revenue and profitability. A well-structured invoice not only facilitates smooth transactions but also helps in building trust and credibility with customers. Moreover, with the advent of digital invoicing, businesses can now streamline their invoicing processes, reducing errors and increasing efficiency. Whether you are a small business owner or a financial manager in a large corporation, grasping the concept of invoicing and its applications is vital for making informed decisions and driving business growth.

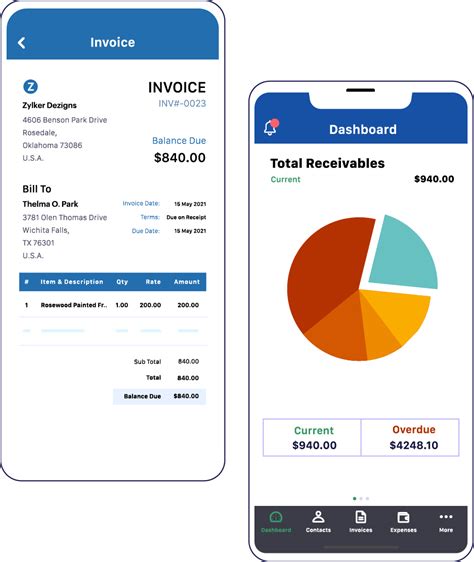

The invoicing process has undergone significant transformations over the years, from traditional paper-based invoices to modern digital invoices. This shift has not only reduced paperwork and increased productivity but also enabled businesses to access a wide range of invoicing tools and software. These tools offer advanced features such as automated invoicing, payment reminders, and real-time tracking, making it easier for businesses to manage their invoices and stay on top of their finances. As we navigate through the complexities of invoicing, it becomes clear that understanding its mechanisms and applications is essential for businesses to stay competitive and achieve their financial goals.

Introduction to Invoicing

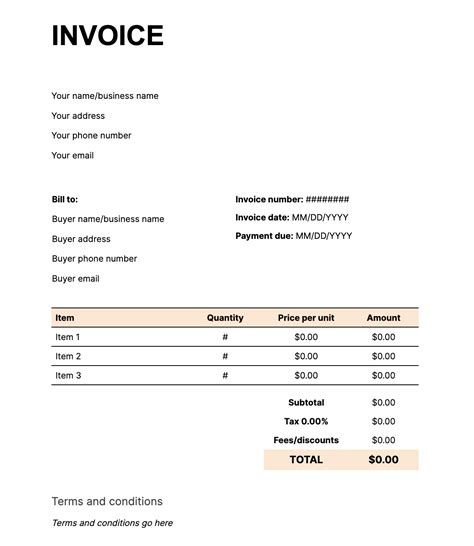

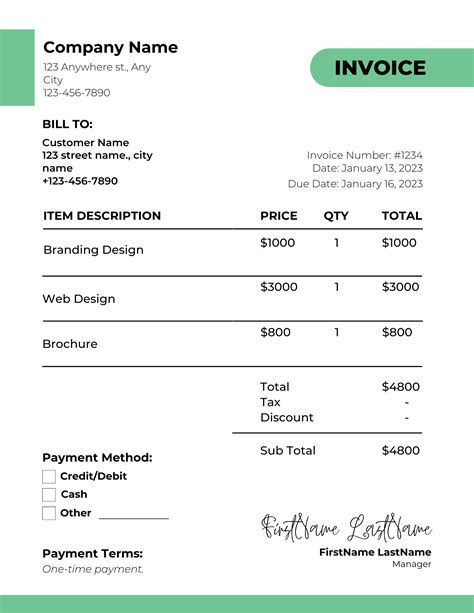

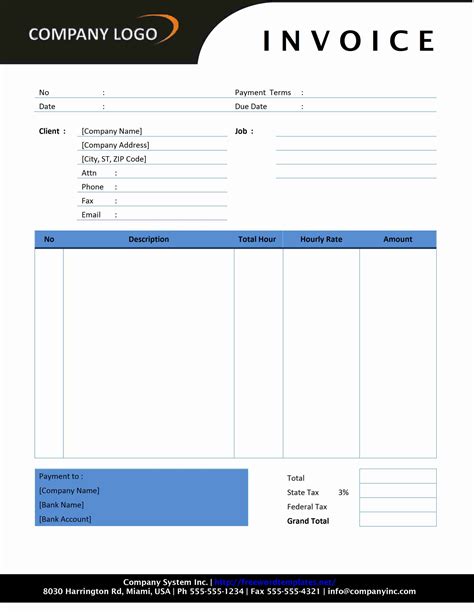

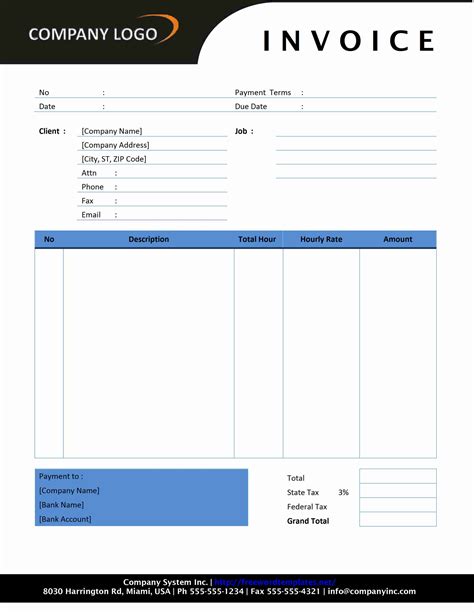

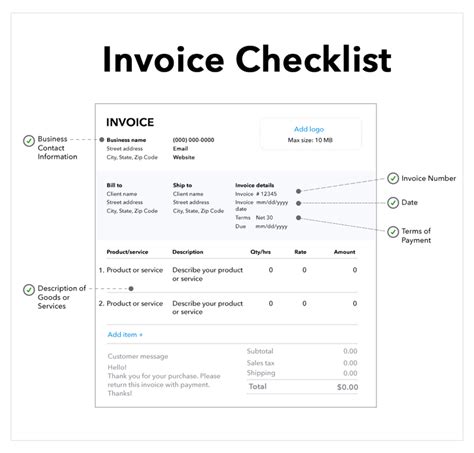

Invoicing is a critical component of financial management that involves creating and sending invoices to clients or customers for goods or services provided. An invoice serves as a formal request for payment, outlining the details of the transaction, including the amount due, payment terms, and due date. Invoices can be issued in various formats, including paper, email, or through online invoicing platforms. The primary purpose of an invoice is to facilitate payment and ensure that businesses receive timely compensation for their products or services.

Benefits of Invoicing

The benefits of invoicing are numerous, ranging from improved cash flows to enhanced customer relationships. Some of the key advantages of invoicing include:

- Timely payments: Invoices help businesses receive payments on time, reducing the risk of late payments and associated penalties.

- Accurate record-keeping: Invoices provide a clear record of transactions, making it easier to track payments, revenues, and expenses.

- Professionalism: Invoices convey a sense of professionalism, helping businesses build trust and credibility with their clients.

- Efficiency: Digital invoicing streamlines the invoicing process, reducing paperwork and increasing productivity.

- Customization: Invoices can be tailored to meet the specific needs of a business, including branding, payment terms, and contact information.

Types of Invoices

There are several types of invoices, each serving a specific purpose or industry. Some common types of invoices include:

- Standard invoices: These are the most common type of invoice, used for routine transactions and payments.

- Pro forma invoices: These invoices are used to provide a quote or estimate for goods or services, often used in international trade.

- Commercial invoices: These invoices are used for international trade, providing detailed information about the goods being shipped.

- Recurring invoices: These invoices are used for repeat transactions, such as subscription-based services or monthly payments.

- Credit invoices: These invoices are used to issue refunds or credits to customers, often used to correct errors or resolve disputes.

How Invoices Work

The invoicing process typically involves several steps, from creating and sending the invoice to receiving payment. Here's an overview of how invoices work:

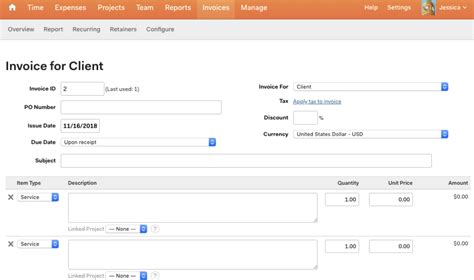

- Creating the invoice: The business creates an invoice, either manually or using invoicing software, outlining the details of the transaction, including the amount due, payment terms, and due date.

- Sending the invoice: The invoice is sent to the client or customer, either by email, mail, or through an online invoicing platform.

- Receiving payment: The client or customer receives the invoice and makes payment, either by check, bank transfer, or online payment methods.

- Recording payment: The business records the payment, updating their financial records and accounts receivable.

- Following up: If payment is not received on time, the business may follow up with the client or customer, sending reminders or notifications to prompt payment.

Best Practices for Invoicing

To ensure effective invoicing, businesses should follow best practices, including:

- Clear and concise invoicing: Invoices should be easy to understand, with clear details about the transaction, payment terms, and due date.

- Timely invoicing: Invoices should be sent promptly, as soon as the goods or services are delivered.

- Professional invoicing: Invoices should be professional, including the business's logo, contact information, and branding.

- Follow-up: Businesses should follow up with clients or customers if payment is not received on time, sending reminders or notifications to prompt payment.

- Record-keeping: Businesses should maintain accurate records of invoices, payments, and transactions, using invoicing software or accounting systems.

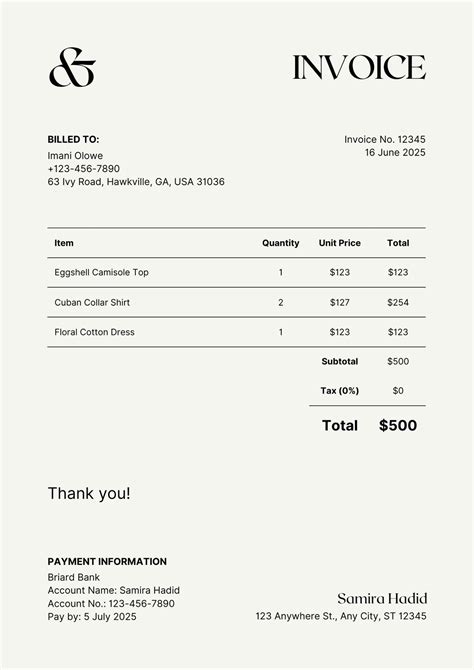

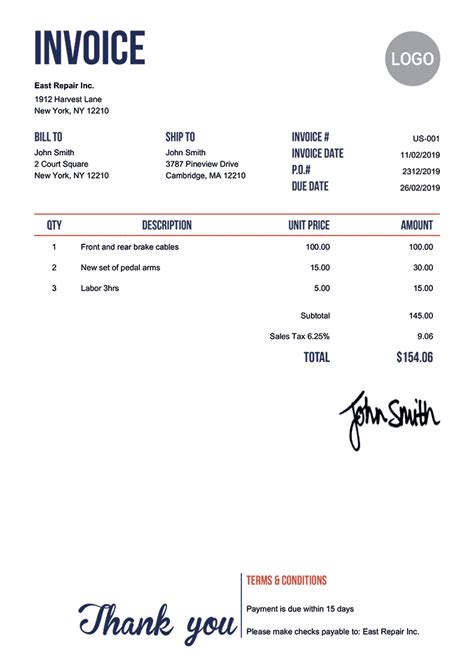

Gallery of Invoicing Examples

Invoicing Image Gallery

What is an invoice?

+An invoice is a formal request for payment, outlining the details of a transaction, including the amount due, payment terms, and due date.

Why is invoicing important?

+Invoicing is important because it facilitates timely payments, provides a clear record of transactions, and helps businesses build trust and credibility with their clients.

What are the different types of invoices?

+There are several types of invoices, including standard invoices, pro forma invoices, commercial invoices, recurring invoices, and credit invoices.

How do I create an invoice?

+You can create an invoice using invoicing software, a spreadsheet, or a word processing program, including the details of the transaction, payment terms, and due date.

What are some best practices for invoicing?

+Best practices for invoicing include clear and concise invoicing, timely invoicing, professional invoicing, follow-up, and accurate record-keeping.

In conclusion, invoicing is a vital aspect of financial management that plays a crucial role in ensuring timely payments and maintaining healthy cash flows. By understanding the importance, benefits, and applications of invoicing, businesses can optimize their financial operations, build strong relationships with clients, and drive growth. Whether you are a small business owner or a financial manager in a large corporation, grasping the concept of invoicing and its applications is essential for making informed decisions and achieving your financial goals. We invite you to share your thoughts, experiences, and questions about invoicing, and we look forward to continuing the conversation.