Intro

Boost savings with the 12 Month Savings Challenge, a financial plan using monthly savings strategies, budgeting tips, and expense tracking to achieve long-term financial goals and money management success.

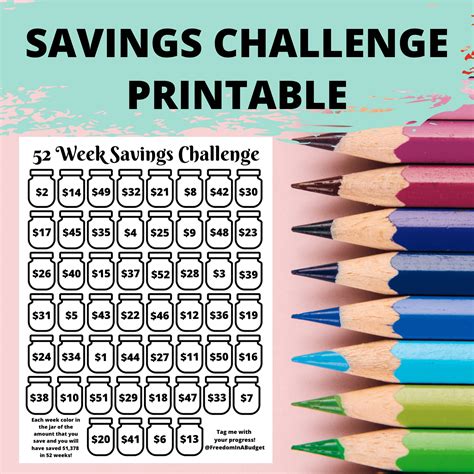

Saving money is a crucial aspect of personal finance, and it's essential to develop healthy financial habits to achieve long-term stability. One effective way to start saving is by taking on a savings challenge. A 12-month savings challenge is a great way to kick-start your savings journey, and it's easy to follow. The challenge involves saving a specific amount of money each month for 12 months, and the amount increases gradually. This approach helps you build the habit of saving and makes it easier to manage your finances.

The importance of saving money cannot be overstated. Having a safety net in place can help you navigate unexpected expenses, avoid debt, and achieve your financial goals. Moreover, saving money can reduce stress and anxiety related to financial uncertainty. By committing to a 12-month savings challenge, you'll be taking the first step towards securing your financial future. The challenge is straightforward, and with discipline and patience, you can develop a consistent savings habit that will benefit you for years to come.

The 12-month savings challenge is an excellent way to introduce yourself to the world of saving, and it's suitable for individuals with varying income levels. The challenge can be tailored to fit your financial situation, and you can adjust the amount you save each month accordingly. The key is to start small and increase the amount gradually. This approach will help you build confidence in your ability to save and make it easier to stick to the challenge. Whether you're a student, a working professional, or a stay-at-home parent, the 12-month savings challenge is an excellent way to take control of your finances and achieve your goals.

Understanding the 12 Month Savings Challenge

The 12-month savings challenge involves saving a specific amount of money each month for 12 months. The amount you save each month increases gradually, and this approach helps you build the habit of saving. The challenge can be tailored to fit your financial situation, and you can adjust the amount you save each month accordingly. For example, you can start by saving $10 in the first month, $20 in the second month, $30 in the third month, and so on. This approach will help you build confidence in your ability to save and make it easier to stick to the challenge.

Benefits of the 12 Month Savings Challenge

The 12-month savings challenge offers several benefits, including: * Developing a consistent savings habit * Building confidence in your ability to save * Reducing stress and anxiety related to financial uncertainty * Achieving your financial goals * Improving your overall financial stabilityHow to Start the 12 Month Savings Challenge

Starting the 12-month savings challenge is easy, and it requires minimal effort. Here are the steps to follow:

- Determine your financial goals: Identify what you want to achieve through the challenge. Do you want to save for a specific purpose, such as a down payment on a house, a car, or a vacation? Or do you want to build an emergency fund?

- Set a realistic target: Based on your financial goals, set a realistic target for the amount you want to save each month. Make sure the target is achievable and aligns with your financial situation.

- Create a budget: Track your income and expenses to understand where your money is going. Create a budget that accounts for your savings and ensures you have enough money for essential expenses.

- Automate your savings: Set up an automatic transfer from your checking account to your savings account. This will help you stick to the challenge and ensure that you save the designated amount each month.

- Monitor your progress: Regularly review your progress to ensure you're on track to meet your financial goals. Adjust your budget and savings amount as needed to stay on track.

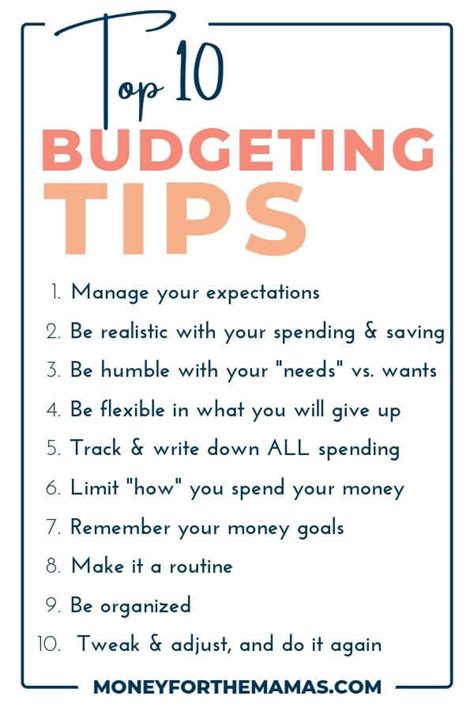

Tips for Success

To ensure success with the 12-month savings challenge, follow these tips: * Start small: Begin with a manageable amount and gradually increase it over time. * Be consistent: Make saving a priority and stick to the challenge. * Avoid temptations: Avoid impulse purchases and stay focused on your financial goals. * Review and adjust: Regularly review your progress and adjust your budget and savings amount as needed.Overcoming Obstacles

While the 12-month savings challenge is an excellent way to develop a consistent savings habit, you may encounter obstacles along the way. Here are some common challenges and tips for overcoming them:

- Limited income: If you have a limited income, start with a small amount and gradually increase it over time.

- Emergency expenses: Build an emergency fund to cover unexpected expenses, and avoid dipping into your savings for non-essential purchases.

- Lack of motivation: Share your goals with a friend or family member and ask them to hold you accountable. Celebrate your progress and reward yourself for reaching milestones.

Staying Motivated

Staying motivated is crucial to success with the 12-month savings challenge. Here are some tips to help you stay motivated: * Celebrate milestones: Reward yourself for reaching milestones, such as saving a certain amount or completing a specific number of months. * Share your goals: Share your goals with a friend or family member and ask them to hold you accountable. * Visualize your goals: Create a vision board or write down your goals to help you stay focused and motivated.Conclusion and Next Steps

In conclusion, the 12-month savings challenge is an excellent way to develop a consistent savings habit and achieve your financial goals. By following the steps outlined in this article and staying motivated, you can overcome obstacles and reach your goals. Remember to start small, be consistent, and avoid temptations. With discipline and patience, you can build a strong foundation for long-term financial stability.

Final Thoughts

The 12-month savings challenge is a powerful tool for building wealth and achieving financial freedom. By committing to the challenge and staying focused, you can develop a consistent savings habit and achieve your goals. Remember to stay motivated, celebrate your progress, and adjust your budget and savings amount as needed. With the right mindset and approach, you can overcome obstacles and achieve long-term financial success.12 Month Savings Challenge Image Gallery

What is the 12-month savings challenge?

+The 12-month savings challenge is a savings plan that involves saving a specific amount of money each month for 12 months. The amount you save each month increases gradually, helping you build a consistent savings habit.

How do I start the 12-month savings challenge?

+To start the 12-month savings challenge, determine your financial goals, set a realistic target, create a budget, automate your savings, and monitor your progress. You can adjust the amount you save each month based on your financial situation.

What are the benefits of the 12-month savings challenge?

+The 12-month savings challenge offers several benefits, including developing a consistent savings habit, building confidence in your ability to save, reducing stress and anxiety related to financial uncertainty, and achieving your financial goals.

How can I stay motivated during the 12-month savings challenge?

+To stay motivated during the 12-month savings challenge, celebrate your milestones, share your goals with a friend or family member, and visualize your goals. You can also reward yourself for reaching certain milestones to stay motivated.

What if I encounter obstacles during the 12-month savings challenge?

+If you encounter obstacles during the 12-month savings challenge, don't get discouraged. Instead, identify the obstacle and find a solution. You can adjust your budget, reduce your expenses, or increase your income to stay on track.

We hope this article has provided you with valuable insights and tips for starting the 12-month savings challenge. Remember to stay motivated, celebrate your progress, and adjust your budget and savings amount as needed. With discipline and patience, you can achieve long-term financial success and secure your financial future. Share your thoughts and experiences with the 12-month savings challenge in the comments below, and don't forget to share this article with your friends and family to help them achieve their financial goals.