Intro

Boost finances with the 5 Ways Savings Challenge, a money-saving strategy incorporating budgeting, frugal living, and expense tracking to achieve financial freedom.

The concept of a savings challenge has been around for a while, and it's a great way to encourage people to save money. With the rise of social media, savings challenges have become even more popular, with many people sharing their progress and tips with others. Saving money is an essential aspect of personal finance, and it's crucial to have a solid savings plan in place. In this article, we'll explore five ways savings challenges can help you achieve your financial goals.

Saving money can be challenging, especially with the temptation to spend on non-essential items. However, with a savings challenge, you can stay motivated and focused on your goals. A savings challenge is a fun and interactive way to save money, and it can be tailored to suit your individual needs and financial goals. Whether you're looking to save for a specific purpose, such as a down payment on a house or a vacation, or you simply want to build up your emergency fund, a savings challenge can help.

The benefits of a savings challenge are numerous. For one, it helps you develop a savings habit, which is essential for achieving long-term financial stability. By committing to a savings challenge, you'll be more likely to stick to your savings plan and make saving a priority. Additionally, a savings challenge can help you stay motivated and engaged in the savings process, which can be a significant challenge for many people. With a savings challenge, you'll have a clear goal in mind, and you'll be able to track your progress, which can be a great motivator.

Understanding Savings Challenges

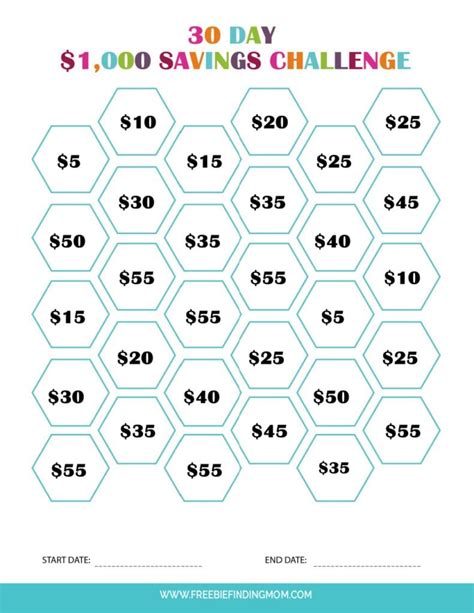

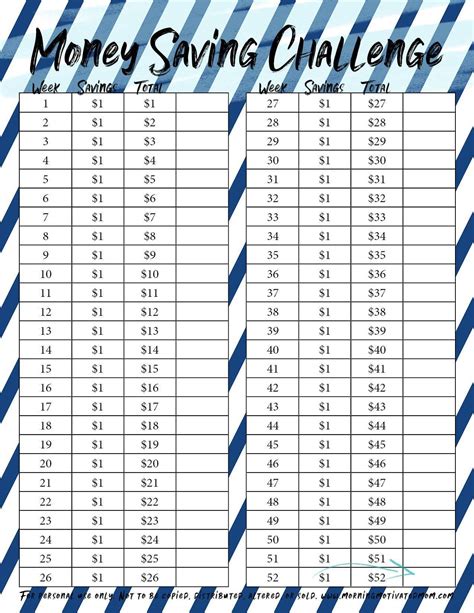

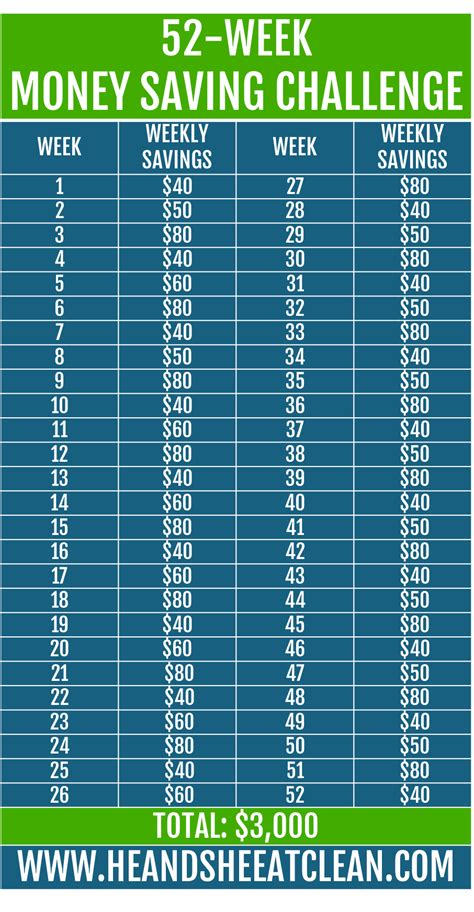

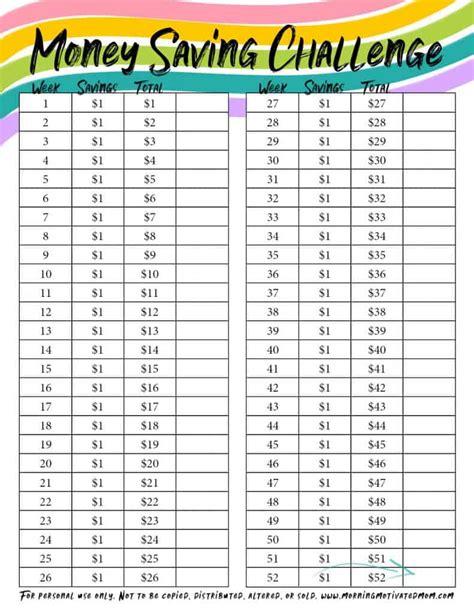

There are many different types of savings challenges, and you can choose the one that works best for you. Some popular savings challenges include the 52-week savings challenge, where you save an amount equal to the number of the week (e.g., Week 1: Save $1, Week 2: Save $2, and so on), and the no-spend challenge, where you avoid spending money on non-essential items for a certain period. You can also create your own savings challenge based on your individual needs and financial goals.

Benefits of Savings Challenges

With a savings challenge, you'll have a clear goal in mind, and you'll be able to track your progress, which can be a great motivator. You'll also be able to see the results of your efforts, which can be a powerful incentive to continue saving. Furthermore, a savings challenge can help you build up your emergency fund, which is essential for covering unexpected expenses and avoiding debt.

Types of Savings Challenges

- The 52-week savings challenge: This challenge involves saving an amount equal to the number of the week (e.g., Week 1: Save $1, Week 2: Save $2, and so on).

- The no-spend challenge: This challenge involves avoiding spending money on non-essential items for a certain period.

- The savings jar challenge: This challenge involves putting a certain amount of money into a jar each day or week, and then using the money to pay for non-essential items.

- The envelope challenge: This challenge involves dividing your expenses into categories (e.g., housing, food, entertainment) and putting the corresponding budgeted amount into an envelope for each category.

Creating Your Own Savings Challenge

You can also create your own savings challenge based on your individual needs and financial goals. To do this, you'll need to determine how much you want to save and how long you want to save for. You'll also need to identify areas where you can cut back on expenses and put the saved amount into a savings account.Some tips for creating your own savings challenge include:

- Start small: Don't try to save too much too quickly. Start with a small amount and gradually increase it over time.

- Make it automatic: Set up automatic transfers from your checking account to your savings account to make saving easier and less prone to being neglected.

- Track your progress: Keep track of your progress and adjust your challenge as needed.

- Make it fun: Make saving a game or a challenge to make it more enjoyable and engaging.

Implementing a Savings Challenge

Some tips for implementing a savings challenge include:

- Create a budget: Start by tracking your income and expenses to see where your money is going. Make a budget that accounts for all of your necessary expenses, and then identify areas where you can cut back.

- Cut back on expenses: Look for ways to reduce your expenses, such as by canceling subscription services, cooking at home instead of eating out, and avoiding impulse purchases.

- Use the 50/30/20 rule: Allocate 50% of your income towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment.

- Make it a habit: Make saving a habit by setting up automatic transfers from your checking account to your savings account.

Overcoming Obstacles

- Lack of motivation: It can be hard to stay motivated to save, especially if you're not seeing immediate results.

- Emergency expenses: Unexpected expenses can derail your savings plan and make it difficult to get back on track.

- Limited income: If you have a limited income, it can be challenging to save money.

To overcome these obstacles, you can try the following:

- Find a savings buddy: Having someone to hold you accountable and provide support can make a big difference.

- Set small goals: Break your larger savings goal into smaller, more manageable goals to help you stay motivated.

- Use visual reminders: Place reminders around your home or on your phone to help you stay focused on your savings goal.

- Celebrate milestones: Celebrate your progress and milestones to help stay motivated and engaged.

Staying Motivated

Staying motivated is a crucial aspect of a savings challenge. To stay motivated, you can try the following:- Track your progress: Keep track of your progress and adjust your challenge as needed.

- Reward yourself: Reward yourself for reaching certain milestones or completing a certain number of weeks of the challenge.

- Make it a game: Make saving a game or a challenge to make it more enjoyable and engaging.

- Get support: Share your savings goal with a friend or family member and ask them to hold you accountable.

Savings Challenge Image Gallery

What is a savings challenge?

+A savings challenge is a fun and interactive way to save money, where you set a specific savings goal and challenge yourself to reach it within a certain timeframe.

How do I create a savings challenge?

+To create a savings challenge, you'll need to determine how much you want to save and how long you want to save for. You can then choose a type of savings challenge, such as the 52-week savings challenge or the no-spend challenge, and set up automatic transfers from your checking account to your savings account.

What are the benefits of a savings challenge?

+The benefits of a savings challenge include developing a savings habit, staying motivated and engaged in the savings process, and building up your emergency fund. A savings challenge can also help you achieve your long-term financial goals and improve your overall financial stability.

How can I stay motivated during a savings challenge?

+To stay motivated during a savings challenge, you can try tracking your progress, rewarding yourself for reaching certain milestones, and making saving a game or a challenge. You can also share your savings goal with a friend or family member and ask them to hold you accountable.

What are some common obstacles to a savings challenge?

+Some common obstacles to a savings challenge include lack of motivation, emergency expenses, and limited income. To overcome these obstacles, you can try finding a savings buddy, setting small goals, and using visual reminders to stay focused on your savings goal.

In summary, a savings challenge is a fun and interactive way to save money and achieve your financial goals. By understanding the benefits and types of savings challenges, creating your own challenge, and staying motivated, you can overcome obstacles and reach your savings goal. Remember to track your progress, reward yourself for reaching certain milestones, and make saving a game or a challenge to stay motivated and engaged in the savings process. With a savings challenge, you can develop a savings habit, build up your emergency fund, and improve your overall financial stability. So why not give it a try and start your savings challenge today? Share your experience with others, and don't hesitate to ask for help or advice along the way. Good luck!