Intro

Streamline payments with easy credit card acceptance solutions, featuring secure processing, online payment gateways, and merchant services for businesses.

Accepting credit cards is a crucial aspect of running a successful business in today's digital age. With the rise of online shopping and contactless payments, consumers expect to have the option to pay with their credit cards, whether they're making a purchase online or in-person. As a business owner, it's essential to understand the importance of accepting credit cards and how it can benefit your business. In this article, we'll delve into the world of credit card processing, exploring the benefits, working mechanisms, and steps to accept credit cards with ease.

Accepting credit cards can significantly increase sales and revenue for your business. When customers have the option to pay with their credit cards, they're more likely to make impulse purchases and spend more money. Additionally, credit cards provide a convenient and secure way for customers to make payments, which can lead to increased customer satisfaction and loyalty. With the ability to accept credit cards, you can also expand your customer base to include online shoppers and international customers.

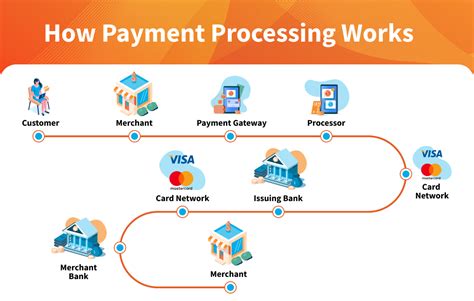

The process of accepting credit cards involves several key players, including the merchant, the customer, the payment processor, and the credit card network. When a customer makes a purchase using their credit card, the merchant submits the transaction to the payment processor, who then forwards it to the credit card network for authorization. If the transaction is approved, the credit card network sends the funds to the payment processor, who then deposits the funds into the merchant's account.

Benefits of Accepting Credit Cards

Some of the key benefits of accepting credit cards include:

- Increased sales and revenue

- Improved cash flow

- Enhanced customer satisfaction

- Reduced risk of late payments and bad debt

- Secure and reliable transaction processing

- Ability to expand customer base to include online shoppers and international customers

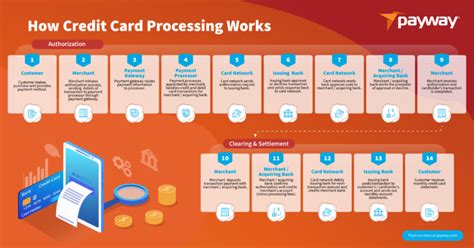

How Credit Card Processing Works

The credit card processing cycle includes the following steps:

- Authorization: The merchant submits the transaction to the payment processor, who then forwards it to the credit card network for authorization.

- Capture: If the transaction is approved, the payment processor captures the funds from the customer's credit card account.

- Settlement: The payment processor settles the transaction by depositing the funds into the merchant's account.

- Funding: The merchant receives the funds from the payment processor, minus any applicable fees.

Steps to Accept Credit Cards

Types of Credit Card Processing

Some of the most common types of credit card processing include:

- In-person payments: Swiping or inserting a credit card at a physical payment terminal.

- Online payments: Entering credit card information on a website or mobile app.

- Mobile payments: Using a mobile device to make payments, either in-person or online.

- Recurring payments: Automatically charging a customer's credit card on a recurring basis.

Security and Compliance

Some of the key security and compliance measures include:

- Implementing encryption to protect sensitive data

- Installing firewalls to prevent unauthorized access

- Implementing access controls to restrict access to sensitive data

- Regularly updating software and systems to ensure compliance with the latest security standards

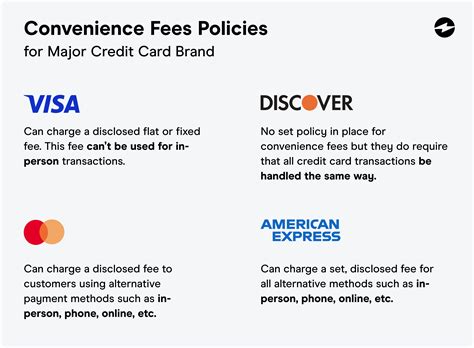

Common Credit Card Processing Fees

Choosing the Right Payment Processor

When choosing a payment processor, consider the following factors:

- Fees: Compare fees among different payment processors to find the best rate.

- Customer support: Look for payment processors with 24/7 customer support.

- Security features: Ensure the payment processor has robust security features to protect sensitive data.

- Integration: Consider payment processors that integrate with your point-of-sale system and online platform.

Credit Card Processing Image Gallery

What is credit card processing?

+Credit card processing is the process of handling credit card transactions, from authorization to settlement.

How do I accept credit cards?

+To accept credit cards, you need to choose a payment processor, set up a payment terminal, and obtain a merchant account.

What are the benefits of accepting credit cards?

+Accepting credit cards can increase sales, improve cash flow, and enhance customer satisfaction.

How do I choose the right payment processor?

+When choosing a payment processor, consider factors such as fees, customer support, and security features.

What are the common credit card processing fees?

+Common credit card processing fees include transaction fees, interchange fees, assessment fees, and monthly fees.

In conclusion, accepting credit cards is a crucial aspect of running a successful business in today's digital age. By understanding the benefits, working mechanisms, and steps to accept credit cards, businesses can increase sales, improve cash flow, and enhance customer satisfaction. Whether you're a small business or a large enterprise, accepting credit cards can help you stay competitive and grow your customer base. We hope this article has provided you with valuable insights and information to help you navigate the world of credit card processing. If you have any questions or comments, please don't hesitate to reach out. Share this article with your friends and colleagues to help them understand the importance of accepting credit cards.