The world of finance is constantly evolving, and one of the most significant advancements in recent years is the introduction of Automated Clearing House (ACH) credit. ACH credit has revolutionized the way businesses and individuals make payments, providing a faster, more secure, and more efficient alternative to traditional payment methods. In this article, we will delve into the world of ACH credit, exploring its benefits, working mechanisms, and the various ways it can be used.

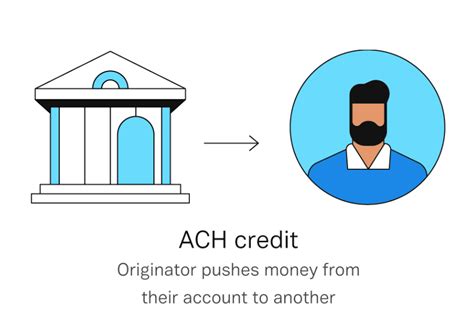

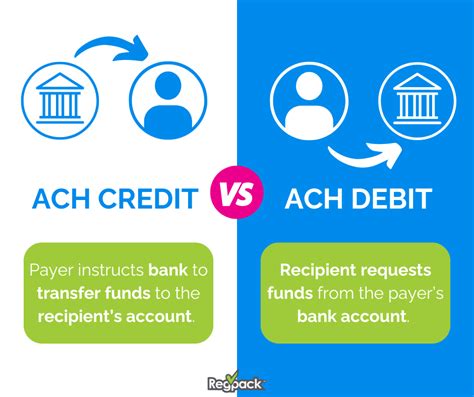

ACH credit is an electronic payment method that allows businesses and individuals to send and receive payments directly from their bank accounts. This payment method is facilitated by the Automated Clearing House network, which is a secure and reliable system that processes transactions between banks. ACH credit is widely used for various transactions, including payroll, bill payments, and online purchases. One of the primary advantages of ACH credit is its speed, with transactions typically being processed within 24-48 hours.

Introduction to ACH Credit

The introduction of ACH credit has transformed the way businesses and individuals manage their finances. With ACH credit, payments can be made quickly and securely, reducing the need for paper checks and other traditional payment methods. This has resulted in increased efficiency, reduced costs, and improved cash flow management. Moreover, ACH credit provides a high level of security, with transactions being encrypted and protected by robust security protocols.

Benefits of ACH Credit

The benefits of ACH credit are numerous, and they can be summarized as follows:

* Faster payment processing: ACH credit transactions are typically processed within 24-48 hours, which is significantly faster than traditional payment methods.

* Increased security: ACH credit transactions are encrypted and protected by robust security protocols, reducing the risk of fraud and unauthorized transactions.

* Improved cash flow management: ACH credit allows businesses and individuals to manage their cash flow more effectively, with payments being made and received quickly and efficiently.

* Reduced costs: ACH credit reduces the need for paper checks and other traditional payment methods, resulting in cost savings for businesses and individuals.

* Convenience: ACH credit provides a convenient payment method, with transactions being able to be made online or through mobile devices.

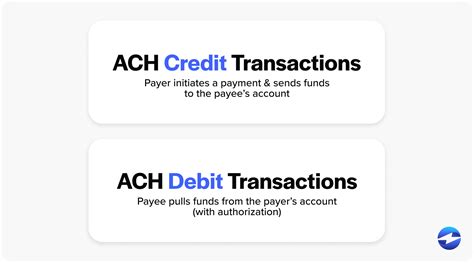

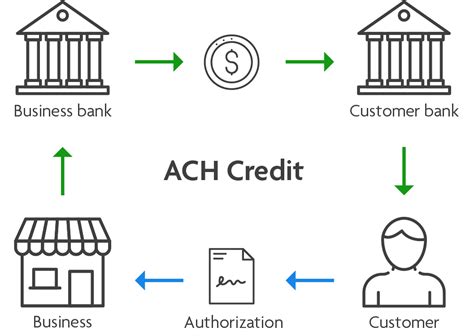

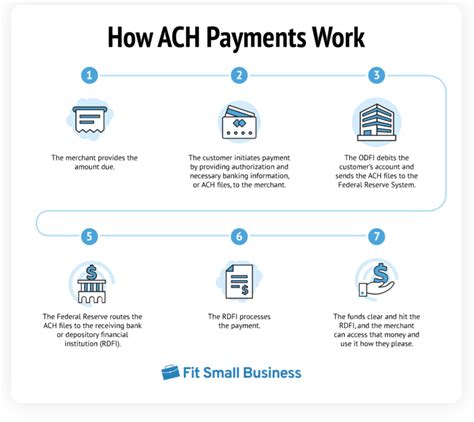

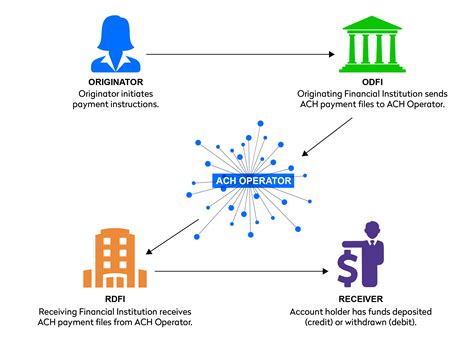

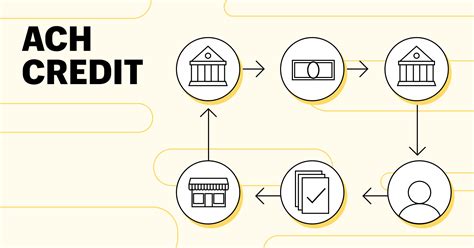

Working Mechanism of ACH Credit

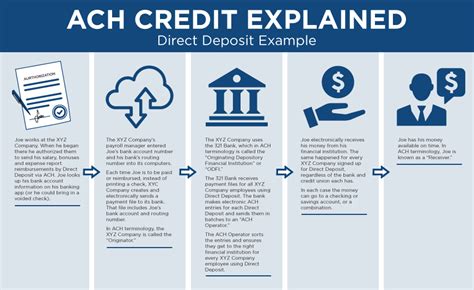

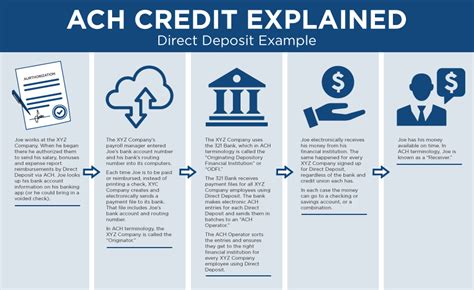

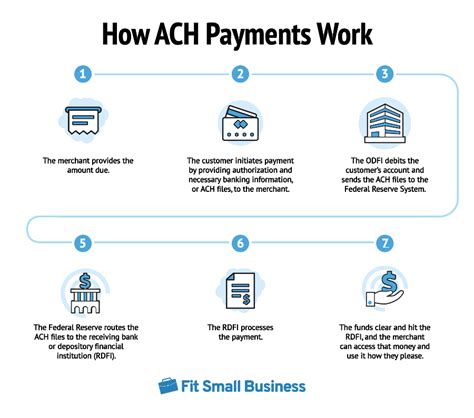

The working mechanism of ACH credit is relatively straightforward. Here's a step-by-step overview of how it works:

1. The payer initiates a payment: The payer initiates a payment by providing the payee's bank account information and the payment amount.

2. The payment is processed: The payment is processed through the Automated Clearing House network, which verifies the payer's account information and ensures that sufficient funds are available.

3. The payment is sent: The payment is sent to the payee's bank, where it is deposited into their account.

4. The payment is confirmed: The payment is confirmed, and the payee is notified that the payment has been received.

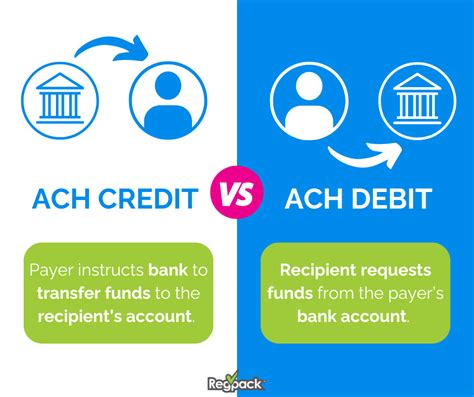

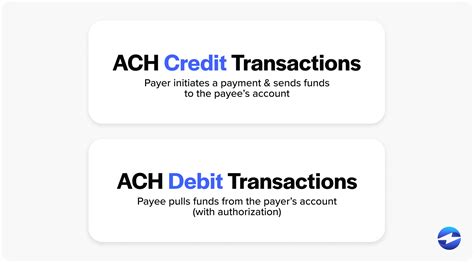

Types of ACH Credit Transactions

There are several types of ACH credit transactions, including:

* Direct deposit: This type of transaction involves depositing funds directly into an individual's bank account.

* Bill payment: This type of transaction involves paying bills, such as utility bills or credit card bills, using ACH credit.

* Online purchases: This type of transaction involves making online purchases using ACH credit.

* Business-to-business payments: This type of transaction involves making payments between businesses using ACH credit.

Security Measures for ACH Credit

ACH credit provides a high level of security, with several measures in place to protect transactions. These measures include:

* Encryption: ACH credit transactions are encrypted, making it difficult for unauthorized parties to access sensitive information.

* Secure authentication: ACH credit transactions require secure authentication, ensuring that only authorized parties can initiate transactions.

* Transaction monitoring: ACH credit transactions are monitored in real-time, allowing for the detection and prevention of suspicious activity.

* Compliance with regulations: ACH credit transactions must comply with relevant regulations, such as the Gramm-Leach-Bliley Act and the Payment Card Industry Data Security Standard.

Gallery of ACH Credit

What is ACH credit?

+

ACH credit is an electronic payment method that allows businesses and individuals to send and receive payments directly from their bank accounts.

How does ACH credit work?

+

ACH credit works by processing transactions through the Automated Clearing House network, which verifies the payer's account information and ensures that sufficient funds are available.

What are the benefits of ACH credit?

+

The benefits of ACH credit include faster payment processing, increased security, improved cash flow management, reduced costs, and convenience.

In conclusion, ACH credit is a revolutionary payment method that has transformed the way businesses and individuals manage their finances. With its fast payment processing, increased security, and improved cash flow management, ACH credit has become a popular choice for various transactions. As the world of finance continues to evolve, it is likely that ACH credit will play an increasingly important role in the way we make payments. We invite you to share your thoughts and experiences with ACH credit in the comments below, and to explore the various resources available on our website to learn more about this exciting payment method.