Intro

Discover what POS debit means, exploring point of sale transactions, debit card processing, and online payment systems, to understand how POS debit works in retail and e-commerce environments.

The term "POS" stands for Point of Sale, and when combined with "debit," it refers to a type of payment transaction where a customer uses their debit card to make a purchase. In essence, POS debit means that the customer is using their debit card to pay for goods or services at the point of sale, which is typically a retail store, restaurant, or other business location. This type of transaction is also known as an offline debit transaction, as it is processed through the same networks as credit card transactions, but the funds are deducted directly from the customer's checking account.

The POS debit system has become increasingly popular in recent years, as it offers a convenient and secure way for customers to make purchases without the need for cash. With the rise of contactless payments and mobile wallets, POS debit transactions have become even more streamlined, allowing customers to simply tap their card or device to make a payment. In this article, we will delve into the world of POS debit, exploring its benefits, working mechanisms, and the impact it has on businesses and consumers alike.

How POS Debit Works

The POS debit process is relatively straightforward. When a customer makes a purchase using their debit card, the merchant's point-of-sale terminal sends a request to the customer's bank to verify the availability of funds in their account. If the funds are available, the bank sends a response back to the merchant, approving the transaction. The merchant then completes the sale, and the customer receives their goods or services. The funds are typically deducted from the customer's account within a few days, depending on the bank's processing time.

Benefits of POS Debit

There are several benefits to using POS debit, including:

- Convenience: POS debit allows customers to make purchases without the need for cash, making it a convenient option for everyday transactions.

- Security: POS debit transactions are secure, as they require the customer's PIN or signature to authorize the payment.

- Budgeting: POS debit helps customers stick to their budget, as the funds are deducted directly from their account, preventing overspending.

- Record-keeping: POS debit transactions are recorded on the customer's bank statement, making it easy to track expenses and stay organized.

Types of POS Debit Transactions

There are several types of POS debit transactions, including:

- Online debit transactions: These transactions are processed through the internet, using a virtual terminal or online payment gateway.

- Offline debit transactions: These transactions are processed through a physical point-of-sale terminal, using a debit card and PIN or signature.

- Contactless debit transactions: These transactions use near-field communication (NFC) technology, allowing customers to tap their card or device to make a payment.

- Mobile debit transactions: These transactions use a mobile device, such as a smartphone or tablet, to make a payment.

Impact of POS Debit on Businesses

The impact of POS debit on businesses is significant, as it offers a convenient and secure way for customers to make purchases. By accepting POS debit, businesses can:

- Increase sales: By offering a convenient payment option, businesses can attract more customers and increase sales.

- Reduce cash handling: POS debit reduces the need for cash handling, making it easier for businesses to manage their finances.

- Improve customer satisfaction: POS debit provides customers with a convenient and secure way to make purchases, improving their overall shopping experience.

Security Measures for POS Debit

To ensure the security of POS debit transactions, businesses and financial institutions use several security measures, including:

- Encryption: POS debit transactions are encrypted, making it difficult for hackers to intercept and steal sensitive information.

- Tokenization: POS debit transactions use tokenization, replacing sensitive information with a unique token, making it difficult for hackers to access the original information.

- Secure sockets layer (SSL): POS debit transactions use SSL, a secure protocol that ensures the integrity and confidentiality of data transmitted over the internet.

Future of POS Debit

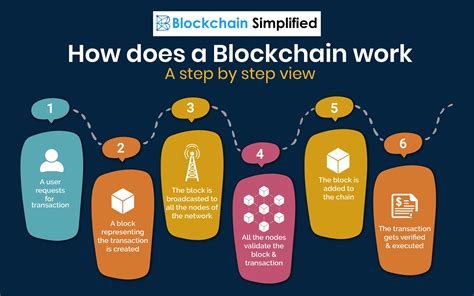

The future of POS debit is exciting, with emerging technologies such as blockchain and artificial intelligence (AI) expected to play a significant role in shaping the industry. As the use of contactless payments and mobile wallets continues to grow, POS debit is likely to become even more prevalent, offering customers a convenient and secure way to make purchases.

Gallery of POS Debit Images

POS Debit Image Gallery

What is POS debit?

+POS debit refers to a type of payment transaction where a customer uses their debit card to make a purchase at the point of sale.

How does POS debit work?

+POS debit works by sending a request to the customer's bank to verify the availability of funds in their account, and if the funds are available, the bank sends a response back to the merchant, approving the transaction.

What are the benefits of POS debit?

+The benefits of POS debit include convenience, security, budgeting, and record-keeping, making it a popular payment option for customers.

In conclusion, POS debit is a convenient and secure way for customers to make purchases, offering businesses a range of benefits, including increased sales and reduced cash handling. As the use of contactless payments and mobile wallets continues to grow, POS debit is likely to become even more prevalent, shaping the future of the payment industry. We invite you to share your thoughts on POS debit, and how it has impacted your shopping experience. Whether you are a business owner or a consumer, we would love to hear your feedback and insights on this topic.