Intro

Embark on 5 money saving challenges to boost finances, reduce spending, and achieve budgeting goals with effective frugal living tips and expense tracking strategies.

Saving money is an essential aspect of personal finance, and it can be challenging to get started. However, with the right mindset and strategies, anyone can develop healthy financial habits. One effective way to save money is by participating in money saving challenges. These challenges can help individuals stay motivated, track their progress, and achieve their financial goals. In this article, we will explore five money saving challenges that can help you save money and improve your financial well-being.

The importance of saving money cannot be overstated. Having a safety net of savings can provide peace of mind, reduce financial stress, and allow individuals to achieve their long-term goals. Whether it's saving for a down payment on a house, a vacation, or retirement, having a solid savings plan in place is crucial. Money saving challenges can be a fun and engaging way to stay on track with your savings goals, and they can be tailored to fit individual needs and financial situations.

For those who are new to saving money, it can be overwhelming to know where to start. Money saving challenges can provide a sense of structure and accountability, helping individuals stay focused on their financial goals. By participating in a money saving challenge, individuals can develop healthy financial habits, such as budgeting, saving, and investing. These habits can have a lasting impact on one's financial well-being, and they can help individuals achieve financial stability and security.

Understanding Money Saving Challenges

Money saving challenges are designed to help individuals save money by providing a structured plan and a sense of accountability. These challenges can be tailored to fit individual needs and financial situations, and they can be adjusted to suit different savings goals. Some money saving challenges may involve saving a certain amount of money each month, while others may involve reducing expenses or increasing income. The key to success is to find a challenge that works for you and to stick with it over time.

One of the benefits of money saving challenges is that they can help individuals develop healthy financial habits. By participating in a challenge, individuals can learn how to budget, save, and invest their money effectively. These habits can have a lasting impact on one's financial well-being, and they can help individuals achieve financial stability and security. Additionally, money saving challenges can provide a sense of community and support, as individuals can share their progress and connect with others who are working towards similar financial goals.

5 Money Saving Challenges to Try

There are many different money saving challenges to try, and the right one for you will depend on your individual needs and financial goals. Here are five money saving challenges to consider:

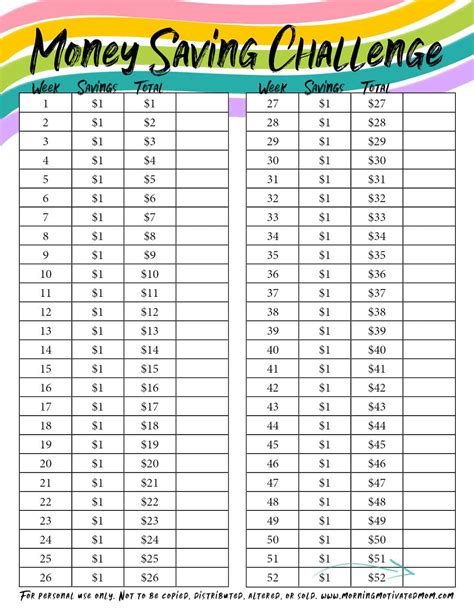

- The 52-Week Savings Challenge: This challenge involves saving an amount of money each week that corresponds to the number of the week. For example, in week one, you would save $1, in week two, you would save $2, and so on. This challenge can be a fun and engaging way to save money, and it can help individuals develop a consistent savings habit.

- The Envelope System: This challenge involves dividing your expenses into categories, such as housing, transportation, and food, and placing the corresponding budgeted amount into an envelope for each category. This challenge can help individuals stick to their budget and reduce their expenses.

- The No-Spend Challenge: This challenge involves avoiding non-essential purchases for a certain period of time, such as a month or a year. This challenge can help individuals reduce their expenses and save money.

- The Savings Jar Challenge: This challenge involves placing a certain amount of money into a jar each day or week, and watching your savings grow over time. This challenge can be a fun and visual way to save money, and it can help individuals develop a consistent savings habit.

- The Budgeting Challenge: This challenge involves creating a budget and tracking your expenses to see where your money is going. This challenge can help individuals identify areas where they can cut back and save money.

Benefits of Money Saving Challenges

Money saving challenges can have a number of benefits, including:

- Improved financial discipline: Money saving challenges can help individuals develop healthy financial habits, such as budgeting, saving, and investing.

- Increased savings: Money saving challenges can help individuals save money and achieve their financial goals.

- Reduced financial stress: Money saving challenges can help individuals reduce their financial stress and anxiety, and achieve a sense of financial stability and security.

- Improved financial awareness: Money saving challenges can help individuals understand where their money is going, and identify areas where they can cut back and save money.

How to Get Started with a Money Saving Challenge

Getting started with a money saving challenge is easy. Here are some steps to follow:

- Choose a challenge: Select a money saving challenge that fits your individual needs and financial goals.

- Set a goal: Determine what you want to achieve with your challenge, such as saving a certain amount of money or reducing your expenses.

- Create a budget: Make a budget to track your income and expenses, and identify areas where you can cut back and save money.

- Start small: Begin with a small, achievable goal, and gradually increase your savings over time.

- Stay consistent: Stick to your challenge and make saving a regular habit.

Tips for Success

Here are some tips for success with a money saving challenge:

- Make it automatic: Set up automatic transfers from your checking account to your savings account to make saving easier and less prone to being neglected.

- Track your progress: Keep track of your savings progress to stay motivated and see how far you've come.

- Avoid temptation: Avoid temptation to spend money on non-essential items, and stay focused on your financial goals.

- Get support: Share your challenge with a friend or family member, and ask for their support and encouragement.

Common Mistakes to Avoid

Here are some common mistakes to avoid when participating in a money saving challenge:

- Not setting a goal: Failing to set a clear goal for your challenge can make it difficult to stay motivated and focused.

- Not tracking progress: Failing to track your progress can make it difficult to see how far you've come, and can lead to discouragement.

- Not being consistent: Failing to stick to your challenge can lead to a lack of progress, and can make it difficult to achieve your financial goals.

- Not seeking support: Failing to seek support from friends, family, or a financial advisor can make it difficult to stay motivated and accountable.

Money Saving Image Gallery

What is a money saving challenge?

+A money saving challenge is a structured plan to help individuals save money and achieve their financial goals.

How do I get started with a money saving challenge?

+To get started with a money saving challenge, choose a challenge that fits your individual needs and financial goals, set a goal, create a budget, start small, and stay consistent.

What are the benefits of a money saving challenge?

+The benefits of a money saving challenge include improved financial discipline, increased savings, reduced financial stress, and improved financial awareness.

How can I stay motivated during a money saving challenge?

+To stay motivated during a money saving challenge, make it automatic, track your progress, avoid temptation, and get support from friends, family, or a financial advisor.

What are some common mistakes to avoid during a money saving challenge?

+Some common mistakes to avoid during a money saving challenge include not setting a goal, not tracking progress, not being consistent, and not seeking support.

In

Conclusion and Final Thoughts

participating in a money saving challenge can be a fun and engaging way to save money and achieve your financial goals. By choosing a challenge that fits your individual needs and financial goals, setting a goal, creating a budget, starting small, and staying consistent, you can develop healthy financial habits and achieve financial stability and security. Remember to stay motivated by making it automatic, tracking your progress, avoiding temptation, and getting support from friends, family, or a financial advisor. Avoid common mistakes such as not setting a goal, not tracking progress, not being consistent, and not seeking support. With the right mindset and strategies, you can overcome any financial challenge and achieve your goals.

We hope this article has provided you with valuable information and insights on money saving challenges. If you have any questions or comments, please don't hesitate to reach out. Share this article with your friends and family, and let's work together to achieve financial stability and security. Remember, saving money is a journey, and it's okay to take it one step at a time. Start your money saving challenge today, and see the positive impact it can have on your financial well-being.