Automated Clearing House (ACH) payments have revolutionized the way individuals and businesses transfer funds. With the rise of digital payments, ACH has become an essential aspect of modern finance. In this article, we will delve into the world of ACH payments, exploring their benefits, working mechanisms, and key information related to this topic.

ACH payments offer a convenient and cost-effective way to transfer funds between bank accounts. This payment method has gained popularity due to its ability to process transactions quickly and securely. Whether you are an individual or a business owner, understanding ACH payments can help you streamline your financial transactions and save time. The importance of ACH payments cannot be overstated, as they have become an integral part of the financial landscape.

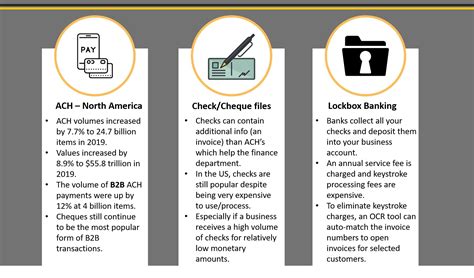

The growth of ACH payments can be attributed to their numerous benefits, including reduced transaction costs and increased efficiency. Unlike traditional payment methods, such as wire transfers or paper checks, ACH payments are processed electronically, eliminating the need for physical documents and reducing the risk of errors. This has led to widespread adoption of ACH payments among individuals and businesses, who appreciate the convenience and speed of this payment method. As the financial landscape continues to evolve, it is essential to understand the role of ACH payments and how they can benefit your financial transactions.

Introduction to ACH Payments

ACH payments are a type of electronic payment that allows individuals and businesses to transfer funds between bank accounts. This payment method is facilitated by the Automated Clearing House network, which connects banks and financial institutions across the United States. ACH payments are commonly used for direct deposit, bill payments, and online transactions. The ACH network processes transactions in batches, ensuring that funds are transferred securely and efficiently.

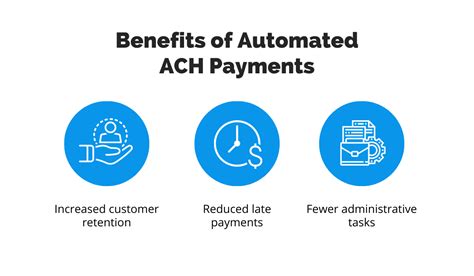

Benefits of ACH Payments

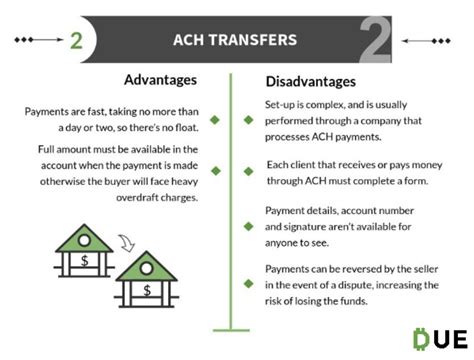

The benefits of ACH payments are numerous, making them an attractive option for individuals and businesses. Some of the key advantages of ACH payments include:

* Reduced transaction costs: ACH payments are generally less expensive than traditional payment methods, such as wire transfers or paper checks.

* Increased efficiency: ACH payments are processed electronically, eliminating the need for physical documents and reducing the risk of errors.

* Improved security: ACH payments are facilitated by the Automated Clearing House network, which ensures that transactions are secure and protected against fraud.

* Convenience: ACH payments can be initiated online or through mobile devices, making it easy to transfer funds at any time.

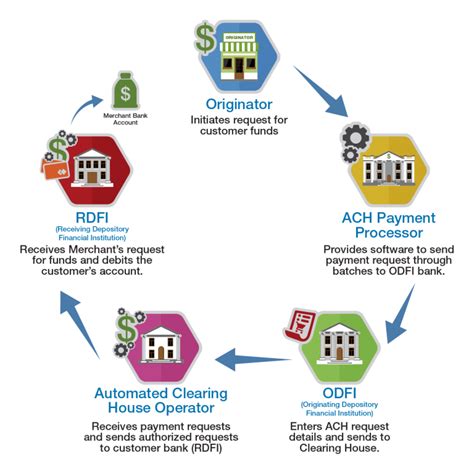

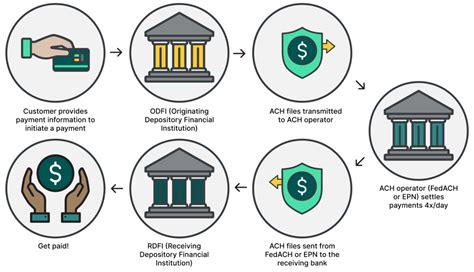

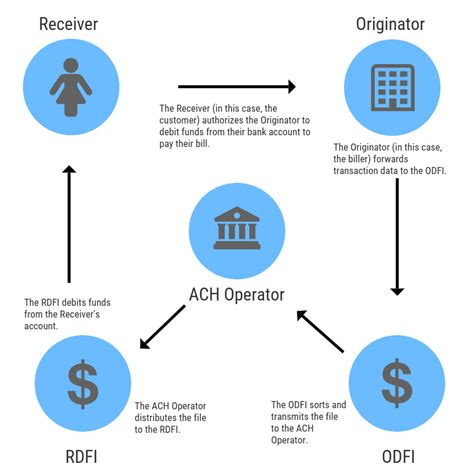

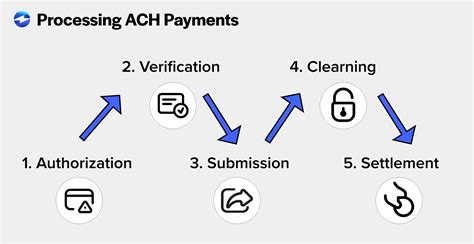

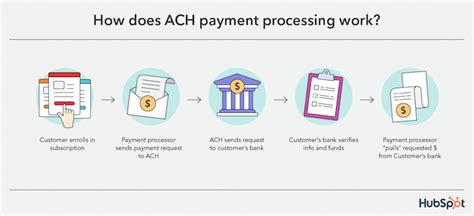

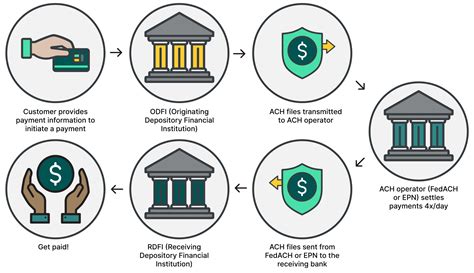

How ACH Payments Work

The ACH payment process involves several steps, including:

1. Initialization: The payment process begins when an individual or business initiates an ACH payment. This can be done online or through a mobile device.

2. Verification: The payment information is verified to ensure that the transaction is legitimate and that the funds are available.

3. Batch processing: The ACH network processes transactions in batches, ensuring that funds are transferred securely and efficiently.

4. Settlement: The transaction is settled, and the funds are transferred between bank accounts.

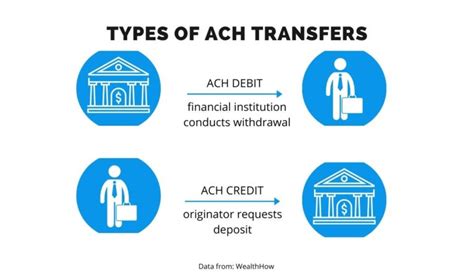

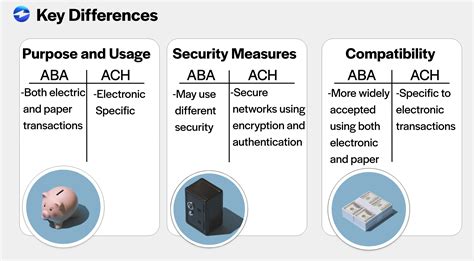

Types of ACH Payments

There are two main types of ACH payments: direct deposit and direct payment. Direct deposit is used to transfer funds into an account, while direct payment is used to transfer funds out of an account. ACH payments can also be classified as either credit or debit transactions. Credit transactions involve transferring funds into an account, while debit transactions involve transferring funds out of an account.

Security Measures for ACH Payments

The ACH network has implemented several security measures to protect transactions from fraud and unauthorized access. Some of these measures include:

* Encryption: ACH transactions are encrypted to prevent unauthorized access to sensitive information.

* Verification: Payment information is verified to ensure that transactions are legitimate and that funds are available.

* Authentication: Users are required to authenticate their identity before initiating an ACH payment.

* Monitoring: ACH transactions are monitored in real-time to detect and prevent suspicious activity.

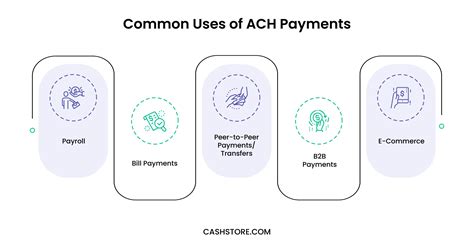

Common Uses of ACH Payments

ACH payments are commonly used for a variety of transactions, including:

* Direct deposit: ACH payments are often used to deposit paychecks, pensions, and other benefits directly into bank accounts.

* Bill payments: ACH payments can be used to pay bills, such as utility bills, credit card bills, and loan payments.

* Online transactions: ACH payments can be used to make online purchases, pay invoices, and transfer funds between bank accounts.

Future of ACH Payments

The future of ACH payments looks promising, with advancements in technology and the increasing demand for digital payments. Some of the trends that are expected to shape the future of ACH payments include:

* Real-time payments: The ACH network is expected to implement real-time payments, allowing for faster and more efficient transactions.

* Mobile payments: The use of mobile devices to initiate ACH payments is expected to increase, making it easier for individuals and businesses to transfer funds on the go.

* Blockchain technology: The use of blockchain technology is expected to improve the security and efficiency of ACH payments, reducing the risk of fraud and unauthorized access.

ACH Payments Image Gallery

What is an ACH payment?

+

An ACH payment is a type of electronic payment that allows individuals and businesses to transfer funds between bank accounts.

How do ACH payments work?

+

ACH payments are processed through the Automated Clearing House network, which connects banks and financial institutions across the United States.

What are the benefits of ACH payments?

+

The benefits of ACH payments include reduced transaction costs, increased efficiency, and improved security.

Are ACH payments secure?

+

Yes, ACH payments are secure. The ACH network has implemented several security measures to protect transactions from fraud and unauthorized access.

What are the common uses of ACH payments?

+

ACH payments are commonly used for direct deposit, bill payments, and online transactions.

In summary, ACH payments have become an essential aspect of modern finance, offering a convenient and cost-effective way to transfer funds between bank accounts. With their numerous benefits, including reduced transaction costs and increased efficiency, ACH payments have gained popularity among individuals and businesses. As the financial landscape continues to evolve, it is essential to understand the role of ACH payments and how they can benefit your financial transactions. We invite you to share your thoughts and experiences with ACH payments in the comments section below. Additionally, if you found this article informative, please consider sharing it with your network to help others understand the importance of ACH payments.