Intro

Unlock insights into Aging Report Analysis, exploring demographic trends, population aging, and longevity factors to understand societal impacts and economic effects.

Aging report analysis is a crucial tool for businesses to manage their finances effectively. It provides a comprehensive overview of a company's accounts receivable and payable, helping to identify areas where cash flow can be improved. By analyzing an aging report, businesses can make informed decisions about their financial strategies, such as determining which customers to prioritize for payment collection and which vendors to negotiate with for better payment terms. In today's fast-paced business environment, having a clear understanding of a company's financial position is essential for success, and aging report analysis plays a vital role in achieving this goal.

Effective aging report analysis enables businesses to streamline their financial operations, reducing the risk of bad debt and improving cash flow. By closely monitoring accounts receivable and payable, companies can identify potential issues before they become major problems. For instance, if a business notices that a particular customer is consistently late with payments, they can take proactive steps to address the issue, such as sending reminders or offering alternative payment options. Similarly, by analyzing accounts payable, businesses can identify opportunities to negotiate better payment terms with vendors, freeing up more cash for investment in growth initiatives.

The importance of aging report analysis cannot be overstated, as it has a direct impact on a company's bottom line. By optimizing cash flow, businesses can invest in new opportunities, expand their operations, and improve their overall financial health. Moreover, aging report analysis helps companies to build stronger relationships with their customers and vendors, as it enables them to communicate more effectively about payment terms and expectations. In the following sections, we will delve deeper into the world of aging report analysis, exploring its benefits, working mechanisms, and best practices for implementation.

Aging Report Basics

Benefits of Aging Report Analysis

The benefits of aging report analysis are numerous, and they can have a significant impact on a company's financial performance. Some of the most notable advantages include: * Improved cash flow: By identifying areas where cash flow can be improved, businesses can reduce the risk of bad debt and free up more cash for investment in growth initiatives. * Enhanced customer relationships: Aging report analysis helps companies to communicate more effectively with their customers about payment terms and expectations, building stronger relationships and reducing the risk of disputes. * Better vendor management: By analyzing accounts payable, businesses can identify opportunities to negotiate better payment terms with vendors, freeing up more cash for investment in growth initiatives. * Reduced bad debt: By closely monitoring accounts receivable, companies can identify potential issues before they become major problems, reducing the risk of bad debt and improving their overall financial health.Aging Report Analysis Techniques

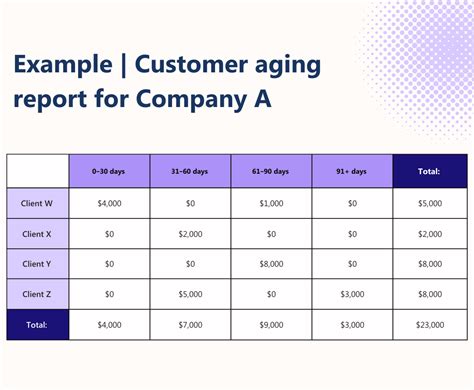

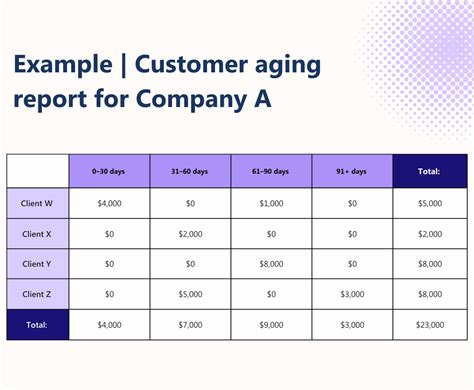

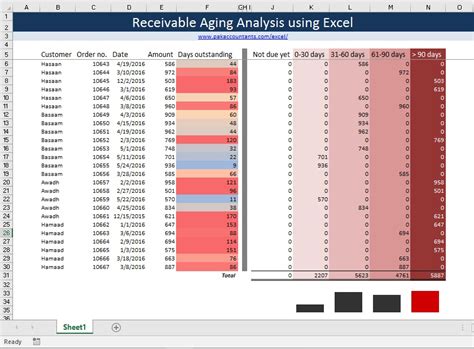

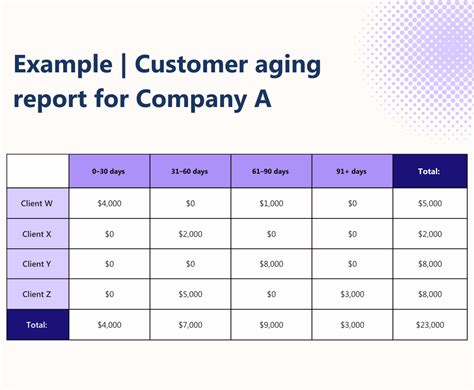

Steps for Implementing Aging Report Analysis

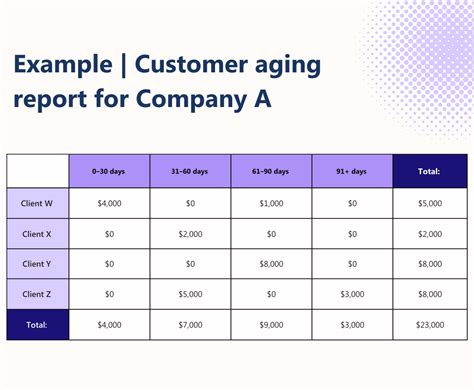

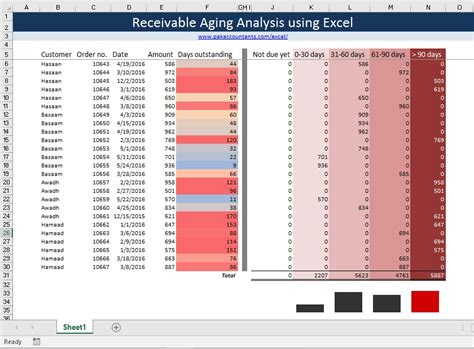

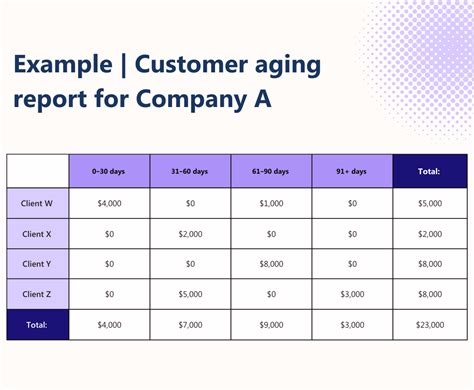

Implementing aging report analysis is a straightforward process that involves the following steps: 1. Gather data: The first step is to gather the necessary data, including accounts receivable and payable information. 2. Categorize data: The next step is to categorize the data based on the aging period, using columns such as 0-30 days, 31-60 days, and 90+ days. 3. Analyze data: The third step is to analyze the data, using techniques such as trend analysis, ratio analysis, and benchmarking. 4. Identify areas for improvement: The final step is to identify areas for improvement, such as customers who are consistently late with payments or vendors who offer favorable payment terms.Best Practices for Aging Report Analysis

Common Challenges in Aging Report Analysis

There are several common challenges that businesses may face when implementing aging report analysis, including: * Data quality issues: Poor data quality can make it difficult to accurately analyze the aging report, reducing its effectiveness. * Limited resources: Small businesses may not have the resources or expertise to implement aging report analysis, making it difficult to get started. * Complexity: Aging report analysis can be complex, especially for businesses with large numbers of customers and vendors.Real-World Examples of Aging Report Analysis

Future of Aging Report Analysis

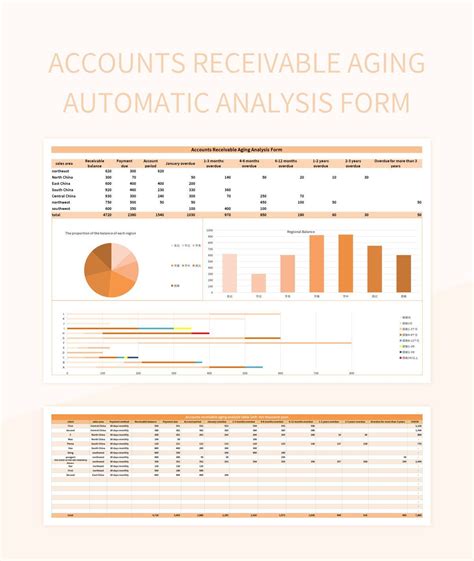

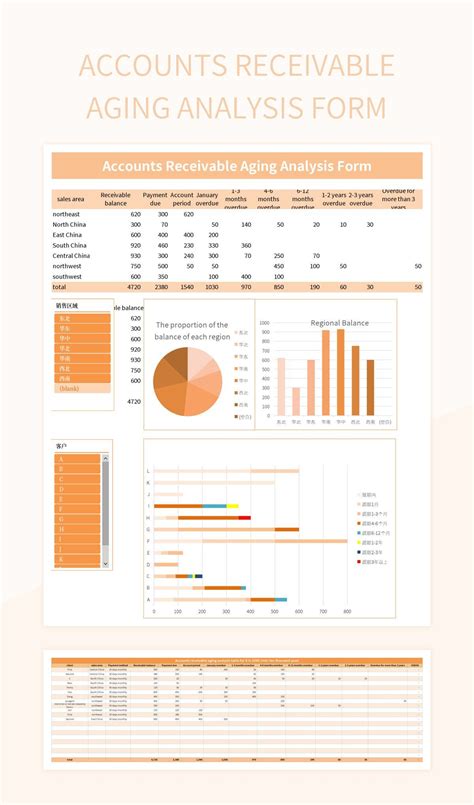

The future of aging report analysis is likely to be shaped by advances in technology, such as automated accounting software and artificial intelligence. These technologies will make it easier for businesses to gather and analyze data, reducing the risk of errors and improving efficiency. Additionally, the increasing use of cloud-based accounting software will make it easier for businesses to access and share financial data, facilitating collaboration and improving decision-making.Gallery of Aging Report Analysis

Aging Report Analysis Image Gallery

What is aging report analysis?

+Aging report analysis is a financial analysis technique used to evaluate a company's accounts receivable and payable.

What are the benefits of aging report analysis?

+The benefits of aging report analysis include improved cash flow, enhanced customer relationships, better vendor management, and reduced bad debt.

How is aging report analysis used in real-world applications?

+Aging report analysis is used in a variety of real-world applications, including identifying customers who are consistently late with payments and negotiating better payment terms with vendors.

What are some common challenges in aging report analysis?

+Common challenges in aging report analysis include data quality issues, limited resources, and complexity.

What is the future of aging report analysis?

+The future of aging report analysis is likely to be shaped by advances in technology, such as automated accounting software and artificial intelligence.

In conclusion, aging report analysis is a powerful tool for businesses to manage their finances effectively. By analyzing an aging report, companies can identify areas where cash flow can be improved, build stronger relationships with customers and vendors, and reduce the risk of bad debt. As technology continues to evolve, the future of aging report analysis is likely to be shaped by advances in automated accounting software and artificial intelligence. We encourage readers to share their experiences and insights on aging report analysis, and to explore the many resources available for learning more about this important topic. Whether you are a seasoned financial professional or just starting to learn about aging report analysis, we hope that this article has provided valuable information and inspiration for improving your financial management skills.