Intro

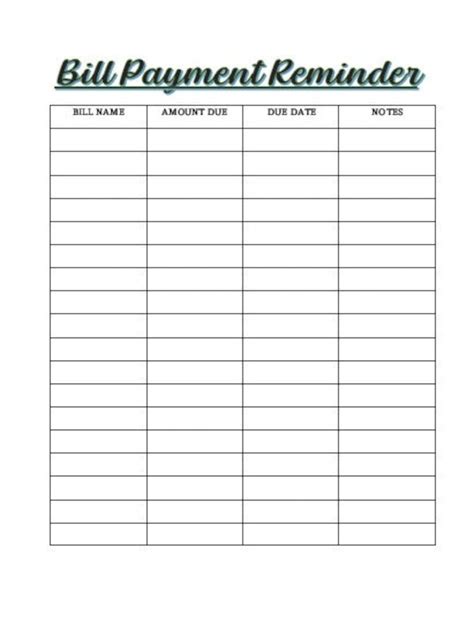

Organizing finances is a crucial aspect of managing a household or a business. One of the key tools that can help in keeping track of expenses and ensuring timely payments is a bill list printable. This simple yet effective tool allows individuals to list down all their bills, due dates, and payment amounts in one place, making it easier to stay on top of financial obligations.

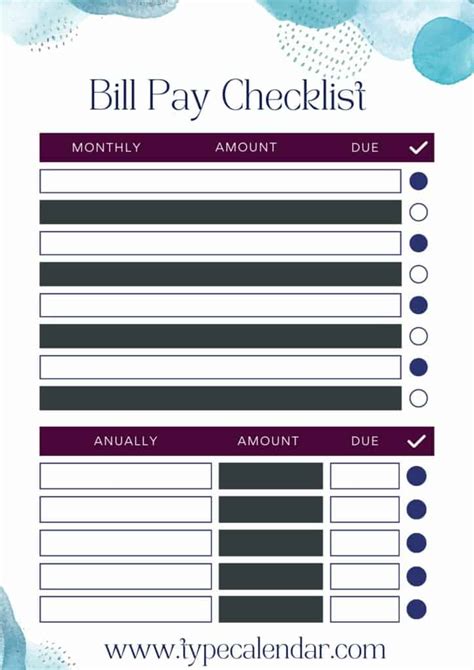

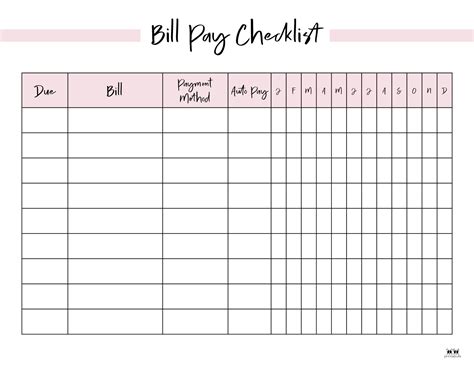

Having a clear overview of all the bills that need to be paid can significantly reduce stress and help avoid late payment fees. A bill list printable can be customized to fit individual needs, including space for noting down payment methods, check numbers, or confirmation codes for online payments. This level of detail ensures that all financial transactions are well-documented and easily traceable.

In today's digital age, while many opt for digital reminders and online payment systems, there's still a significant advantage to using a physical bill list printable. It provides a tangible record that can be easily referenced without needing to log into an account or worry about digital storage space. Moreover, for those who prefer handwriting their notes or enjoy the satisfaction of physically checking off completed tasks, a bill list printable offers a satisfying and engaging way to manage finances.

Benefits of Using a Bill List Printable

Using a bill list printable comes with several benefits, including improved financial organization, reduced stress due to missed payments, and a clear overview of monthly expenses. It allows for better budgeting by providing a comprehensive view of all outgoing payments, helping individuals prioritize their spending and make informed financial decisions.

Enhanced Financial Organization

A key advantage of a bill list printable is its ability to centralize all financial obligations in one document. This makes it easier to keep track of which bills have been paid and which are still pending, reducing the likelihood of overlooking a payment.Reduced Stress

Missing a payment can lead to additional fees and negatively impact credit scores. A bill list printable helps mitigate this risk by providing a constant reminder of upcoming due dates, ensuring that payments are made on time.Better Budgeting

By having a detailed list of all bills and their respective due dates, individuals can plan their budget more effectively. This includes allocating funds appropriately, avoiding unnecessary expenses, and making smart financial decisions.Creating a Bill List Printable

Creating a bill list printable is a straightforward process that can be tailored to individual preferences and needs. Here are the basic steps to follow:

- List All Bills: Start by compiling a list of all regular bills, including utilities, credit card payments, loan repayments, and any other recurring expenses.

- Include Due Dates: Note down the due date for each bill. This is crucial for planning payments and avoiding late fees.

- Add Payment Amounts: Specify the amount that needs to be paid for each bill. This helps in calculating the total monthly expenditure.

- Customize as Needed: Depending on personal preference, additional columns can be added for payment method, check number, or confirmation code for online payments.

- Review and Update: Regularly review the bill list to ensure it remains accurate and up-to-date, reflecting any changes in billing cycles or amounts.

Tips for Effective Use

- **Place it in a Visible Spot**: Keep the bill list printable in a location where it can be easily seen and referenced, such as on a fridge or a bulletin board. - **Check Off Payments**: As payments are made, check them off on the list. This provides a visual confirmation of completed tasks and helps in keeping track of payments. - **Review Regularly**: Set aside time each month to review the bill list, update it as necessary, and plan for upcoming payments.Common Types of Bills to Include

When creating a bill list printable, it's essential to include all types of recurring expenses. These can vary from person to person but commonly include:

- Utilities: Electricity, water, gas, internet, and phone bills.

- Credit Card Payments: Minimum payments or full balances due on credit cards.

- Loan Repayments: Car loans, mortgages, student loans, and personal loans.

- Insurance Premiums: Health, life, auto, and home insurance payments.

- Subscription Services: Streaming services, software subscriptions, and membership fees.

Importance of Inclusion

Including all types of bills ensures that no payment is overlooked, helping to maintain a good credit score and avoid additional fees associated with late payments.Digital Alternatives and Complements

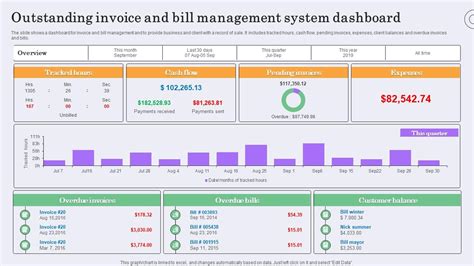

While a bill list printable offers a tangible and straightforward way to manage bills, digital tools and apps can provide additional functionality and convenience. These can include:

- Mobile Apps: Dedicated bill tracking apps that send reminders and allow for online payments.

- Spreadsheets: Digital spreadsheets that can be updated and accessed from anywhere, offering more flexibility than a physical document.

- Automated Payments: Setting up automatic payments for bills to ensure timely payments without manual intervention.

Combining Physical and Digital Methods

Many individuals find that combining a bill list printable with digital tools provides the best of both worlds. The physical list offers a quick glance at upcoming bills, while digital tools handle the intricacies of payment tracking and reminders.Conclusion and Next Steps

Effective bill management is key to maintaining financial stability and reducing stress. A bill list printable is a simple, effective tool that can be used alone or in conjunction with digital methods to keep track of all financial obligations. By understanding the benefits, creating a tailored list, and potentially integrating digital alternatives, individuals can better manage their finances and make progress towards their long-term financial goals.

Final Thoughts

The journey to financial stability and peace of mind begins with small, manageable steps. Implementing a bill list printable is one such step that can have a significant impact on financial organization and stress reduction. Whether used as a standalone tool or as part of a broader financial management strategy, its benefits are undeniable.Bill List Printable Image Gallery

What is a bill list printable?

+A bill list printable is a document or template used to track and manage recurring bills and payments.

Why use a bill list printable?

+Using a bill list printable helps in organizing finances, reducing stress due to missed payments, and providing a clear overview of monthly expenses.

How to create a bill list printable?

+To create a bill list printable, list all bills, include due dates, add payment amounts, customize as needed, and regularly review and update the list.

We invite you to share your thoughts and experiences with using bill list printables for managing your finances. How has it impacted your financial organization and stress levels? Do you use it in conjunction with digital tools, or do you prefer it as a standalone method? Your insights can help others in their journey to better financial management. Feel free to comment below and share this article with anyone who might benefit from learning more about the practical applications of a bill list printable.