Intro

Calculate your businesss viability with the Break Even Point Formula, analyzing costs, revenue, and profitability to determine financial stability and growth potential, using key metrics like fixed and variable expenses.

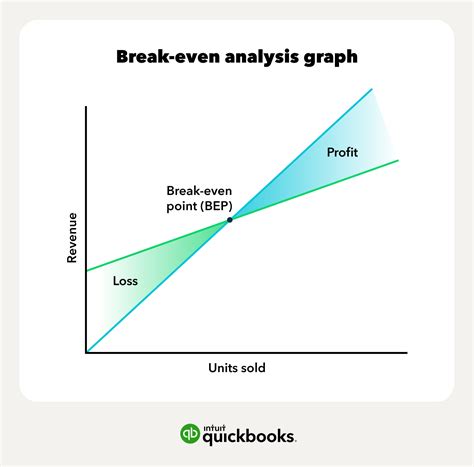

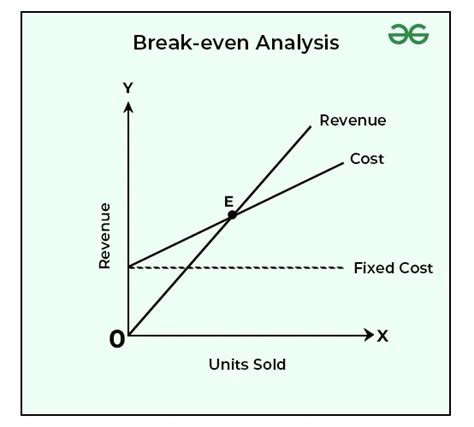

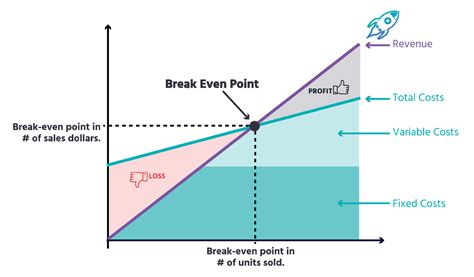

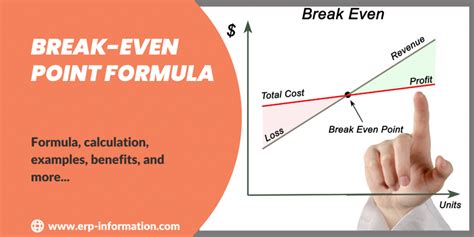

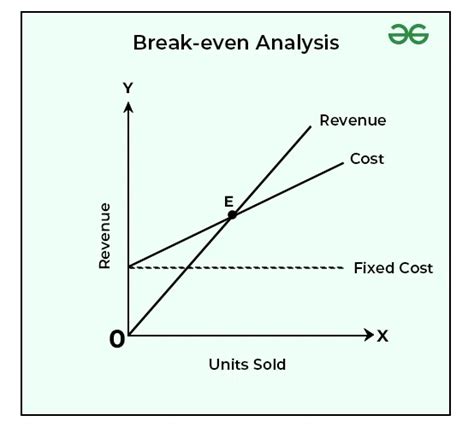

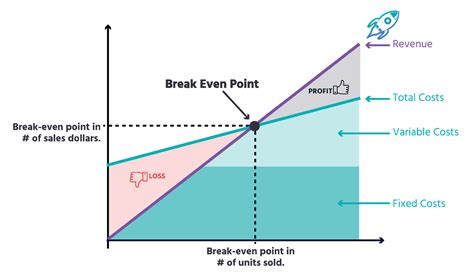

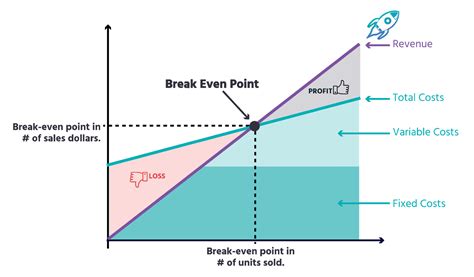

The break-even point is a crucial concept in business and finance that helps entrepreneurs and managers determine when their company will start generating profits. It is the point at which the total revenue equals the total fixed and variable costs, resulting in neither profit nor loss. Understanding the break-even point formula is essential for businesses to make informed decisions about pricing, production, and investment.

In today's competitive market, businesses face numerous challenges, including fluctuating demand, increasing competition, and rising costs. To stay ahead, companies must be able to analyze their financial performance and make adjustments as needed. The break-even point formula provides a valuable tool for businesses to evaluate their financial health and identify areas for improvement. By calculating the break-even point, companies can determine the minimum sales required to cover their costs and start generating profits.

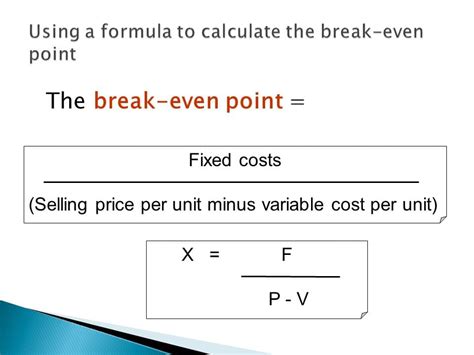

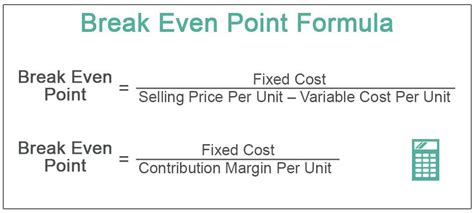

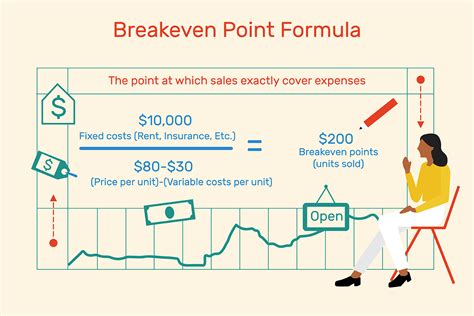

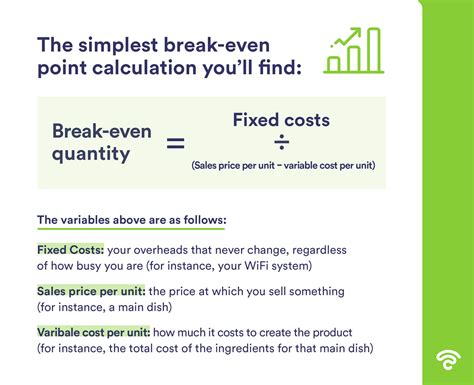

The break-even point formula is a simple yet powerful tool that can help businesses of all sizes and industries. It is calculated by dividing the total fixed costs by the contribution margin, which is the difference between the selling price and the variable costs. The break-even point formula is: Break-Even Point (BEP) = Fixed Costs / (Selling Price - Variable Costs). This formula provides a clear and concise way to determine the break-even point, allowing businesses to make informed decisions about their operations.

Understanding the Break-Even Point Formula

The break-even point formula is a fundamental concept in finance and accounting that helps businesses determine when they will start generating profits. To calculate the break-even point, businesses need to understand the different components of the formula, including fixed costs, variable costs, and selling price. Fixed costs are expenses that remain the same even if the company produces more or less, such as rent, salaries, and equipment. Variable costs, on the other hand, are expenses that vary with the level of production, such as materials, labor, and marketing.

Components of the Break-Even Point Formula

The break-even point formula consists of three main components: fixed costs, variable costs, and selling price. Fixed costs are expenses that remain the same even if the company produces more or less. Variable costs, on the other hand, are expenses that vary with the level of production. The selling price is the price at which the company sells its products or services. To calculate the break-even point, businesses need to determine the contribution margin, which is the difference between the selling price and the variable costs.

Calculating the Break-Even Point

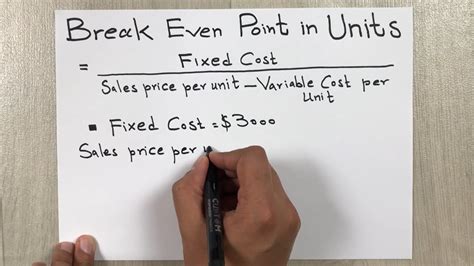

Calculating the break-even point is a straightforward process that involves dividing the total fixed costs by the contribution margin. The contribution margin is the difference between the selling price and the variable costs. To calculate the break-even point, businesses need to follow these steps: * Determine the fixed costs: Identify all the fixed costs, including rent, salaries, and equipment. * Determine the variable costs: Identify all the variable costs, including materials, labor, and marketing. * Determine the selling price: Determine the price at which the company sells its products or services. * Calculate the contribution margin: Calculate the difference between the selling price and the variable costs. * Calculate the break-even point: Divide the total fixed costs by the contribution margin.

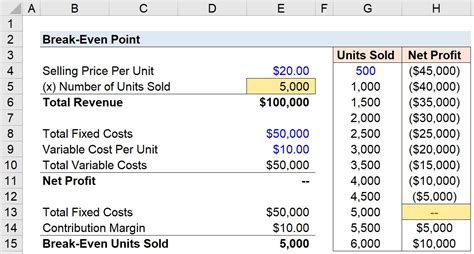

Example of Calculating the Break-Even Point

Let's consider an example of a company that produces and sells widgets. The company has fixed costs of $10,000 per month, variable costs of $5 per widget, and a selling price of $10 per widget. To calculate the break-even point, the company needs to follow these steps: * Determine the fixed costs: $10,000 per month * Determine the variable costs: $5 per widget * Determine the selling price: $10 per widget * Calculate the contribution margin: $10 - $5 = $5 per widget * Calculate the break-even point: $10,000 / $5 = 2,000 widgets per month

Importance of the Break-Even Point

The break-even point is a critical concept in business and finance that helps companies determine when they will start generating profits. Understanding the break-even point is essential for businesses to make informed decisions about pricing, production, and investment. The break-even point helps companies to: * Determine the minimum sales required to cover costs * Evaluate the financial health of the company * Identify areas for improvement * Make informed decisions about pricing and production * Determine the feasibility of new projects or investments

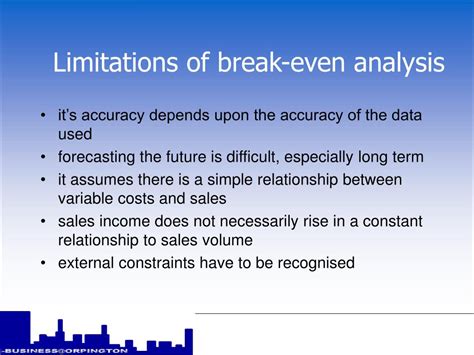

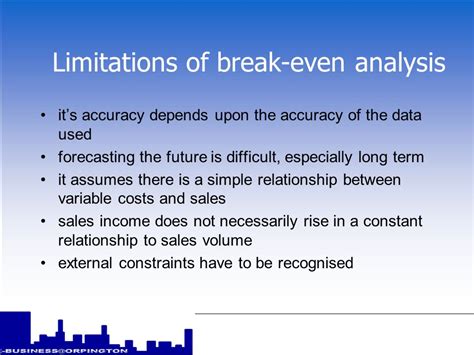

Limitations of the Break-Even Point

While the break-even point is a valuable tool for businesses, it has some limitations. The break-even point assumes that the selling price and variable costs remain constant, which may not always be the case. Additionally, the break-even point does not take into account other factors that may affect the company's financial performance, such as changes in demand or competition.

Gallery of Break Even Point

Break Even Point Image Gallery

Frequently Asked Questions

What is the break-even point?

+The break-even point is the point at which the total revenue equals the total fixed and variable costs, resulting in neither profit nor loss.

How is the break-even point calculated?

+The break-even point is calculated by dividing the total fixed costs by the contribution margin, which is the difference between the selling price and the variable costs.

What is the importance of the break-even point?

+The break-even point is a critical concept in business and finance that helps companies determine when they will start generating profits. It helps companies to evaluate the financial health of the company, identify areas for improvement, and make informed decisions about pricing and production.

What are the limitations of the break-even point?

+The break-even point assumes that the selling price and variable costs remain constant, which may not always be the case. Additionally, the break-even point does not take into account other factors that may affect the company's financial performance, such as changes in demand or competition.

How can the break-even point be used in decision-making?

+The break-even point can be used in decision-making to evaluate the feasibility of new projects or investments, determine the minimum sales required to cover costs, and identify areas for improvement.

In conclusion, the break-even point is a crucial concept in business and finance that helps companies determine when they will start generating profits. Understanding the break-even point formula and its components is essential for businesses to make informed decisions about pricing, production, and investment. By calculating the break-even point, companies can evaluate the financial health of the company, identify areas for improvement, and make informed decisions about pricing and production. We encourage readers to share their thoughts and experiences with the break-even point in the comments section below. Additionally, we invite readers to share this article with others who may benefit from understanding the break-even point formula and its importance in business and finance.