Intro

Unlock the Cost Total Formula explained with related concepts like total cost calculation, cost accounting, and expenditure analysis to optimize financial management and budgeting strategies.

The cost total formula is a crucial concept in project management and accounting, as it helps organizations determine the total cost of a project or a product. Understanding this formula is essential for businesses to make informed decisions about resource allocation, pricing, and profitability. In this article, we will delve into the cost total formula, its components, and its significance in various industries.

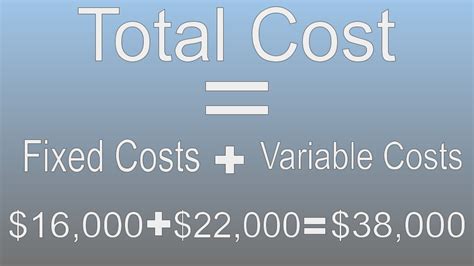

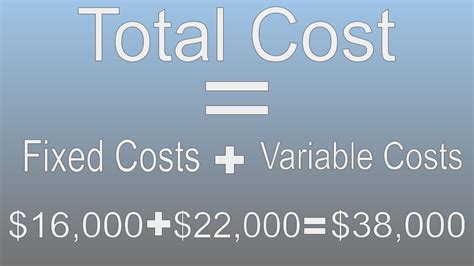

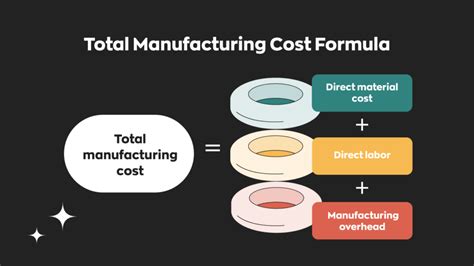

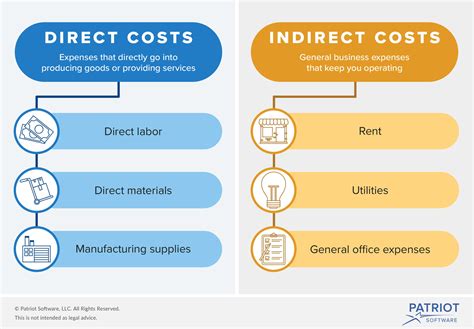

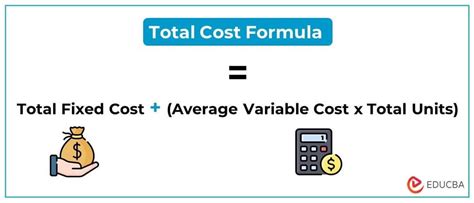

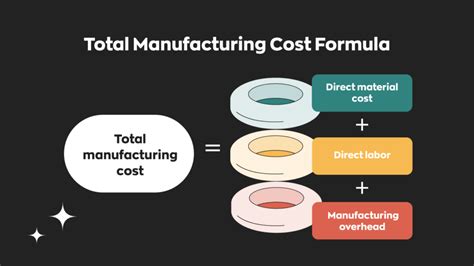

The cost total formula is a straightforward calculation that involves adding up all the costs associated with a project or a product. These costs can be direct or indirect, and they may include labor, materials, overhead, and other expenses. The formula is: Cost Total = Direct Costs + Indirect Costs. Direct costs are expenses that can be directly attributed to the project or product, such as labor, materials, and equipment. Indirect costs, on the other hand, are expenses that are not directly related to the project or product but are still necessary for its completion, such as overhead, utilities, and administrative costs.

The cost total formula is widely used in various industries, including construction, manufacturing, and software development. It helps organizations to estimate the total cost of a project, identify areas where costs can be reduced, and make informed decisions about pricing and profitability. For instance, a construction company can use the cost total formula to estimate the total cost of building a house, including labor, materials, and overhead costs. This information can be used to determine the selling price of the house and ensure that the company makes a profit.

Understanding Direct Costs

In project management, direct costs are often referred to as "project-specific" costs. They are costs that are incurred specifically for the project and are not shared with other projects or departments. For instance, the cost of hiring a consultant to work on a specific project is a direct cost, as it is directly related to the project and is not shared with other projects.

Types of Direct Costs

There are several types of direct costs, including: * Labor costs: These are the costs associated with hiring employees or contractors to work on a project. * Material costs: These are the costs associated with purchasing materials and supplies needed for a project. * Equipment costs: These are the costs associated with purchasing or renting equipment needed for a project. * Travel costs: These are the costs associated with traveling to and from a project site.Understanding Indirect Costs

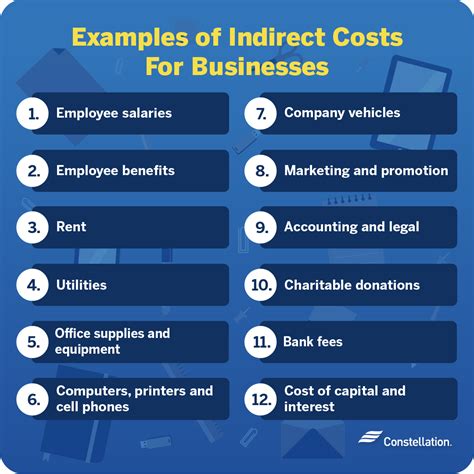

In project management, indirect costs are often referred to as "overhead" costs. They are costs that are incurred to support the overall operations of the organization, rather than being directly related to a specific project. For instance, the cost of renting office space is an indirect cost, as it is not directly related to a specific project but is necessary for the overall operations of the organization.

Types of Indirect Costs

There are several types of indirect costs, including: * Overhead costs: These are the costs associated with running the organization, such as rent, utilities, and insurance. * Administrative costs: These are the costs associated with managing the organization, such as salaries, benefits, and training. * Marketing costs: These are the costs associated with promoting the organization and its products, such as advertising and public relations. * Utilities: These are the costs associated with providing essential services, such as electricity, water, and internet.Calculating the Cost Total Formula

For instance, a company that manufactures widgets may have the following direct costs:

- Labor: $10 per hour

- Materials: $5 per unit

- Equipment: $1,000 per month The company may also have the following indirect costs:

- Overhead: $5,000 per month

- Administrative costs: $2,000 per month

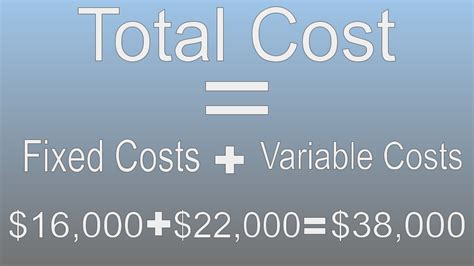

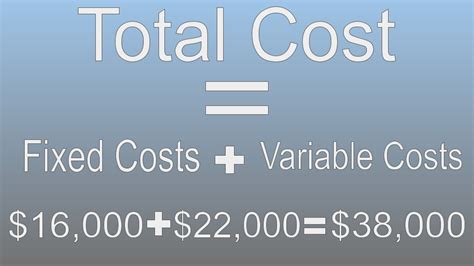

- Marketing costs: $1,000 per month To calculate the cost total, the company would add up all the direct and indirect costs: Cost Total = ($10 per hour x number of hours) + ($5 per unit x number of units) + $1,000 per month + $5,000 per month + $2,000 per month + $1,000 per month.

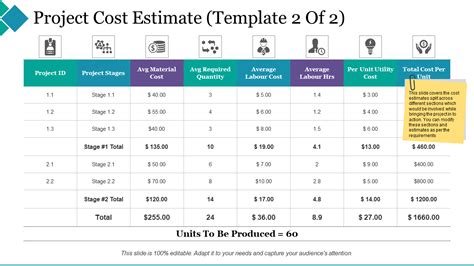

Example of Cost Total Formula

Let's say a company is manufacturing 1,000 units of a product, and the direct costs are: * Labor: $10 per hour x 100 hours = $1,000 * Materials: $5 per unit x 1,000 units = $5,000 * Equipment: $1,000 per month The indirect costs are: * Overhead: $5,000 per month * Administrative costs: $2,000 per month * Marketing costs: $1,000 per month The cost total would be: Cost Total = $1,000 + $5,000 + $1,000 + $5,000 + $2,000 + $1,000 = $15,000.Importance of the Cost Total Formula

The cost total formula is also useful for organizations to compare the costs of different projects or products and make informed decisions about which ones to pursue. For instance, a company may have two projects with different cost totals, and the company can use this information to decide which project to prioritize based on its cost and potential return on investment.

Benefits of Using the Cost Total Formula

There are several benefits of using the cost total formula, including: * Improved cost estimation: The cost total formula helps organizations to estimate the total cost of a project or a product more accurately. * Better decision-making: The cost total formula provides organizations with the information they need to make informed decisions about pricing, profitability, and resource allocation. * Increased efficiency: The cost total formula helps organizations to identify areas where costs can be reduced and optimize their operations to improve efficiency and profitability. * Enhanced competitiveness: The cost total formula helps organizations to compare the costs of different projects or products and make informed decisions about which ones to pursue, which can enhance their competitiveness in the market.Common Challenges in Calculating the Cost Total Formula

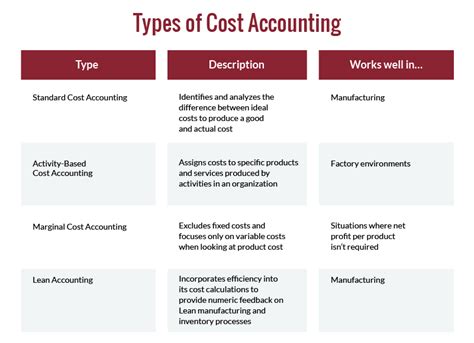

To overcome these challenges, organizations can use various techniques, such as:

- Activity-based costing: This involves assigning costs to specific activities or tasks within a project or a product.

- Cost accounting: This involves using financial and accounting data to estimate the costs of a project or a product.

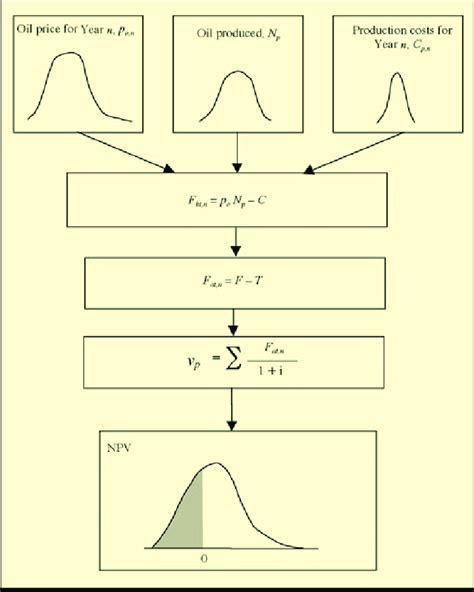

- Monte Carlo simulation: This involves using statistical models to estimate the costs of a project or a product and account for uncertainty and variability.

Best Practices for Calculating the Cost Total Formula

There are several best practices for calculating the cost total formula, including: * Using a standardized costing methodology to ensure consistency and accuracy. * Identifying and quantifying all the direct and indirect costs associated with a project or a product. * Allocating indirect costs to specific projects or products using a fair and transparent methodology. * Estimating the costs of future projects or products using historical data and statistical models. * Reviewing and updating the cost total formula regularly to ensure that it remains accurate and relevant.Cost Total Formula Image Gallery

What is the cost total formula?

+The cost total formula is a calculation that involves adding up all the direct and indirect costs associated with a project or a product.

What are direct costs?

+Direct costs are expenses that can be directly attributed to a project or a product, such as labor, materials, and equipment.

What are indirect costs?

+Indirect costs are expenses that are not directly related to a project or a product but are still necessary for its completion, such as overhead, utilities, and administrative costs.

Why is the cost total formula important?

+The cost total formula is essential for organizations to determine the total cost of a project or a product and make informed decisions about pricing, profitability, and resource allocation.

How can organizations overcome common challenges in calculating the cost total formula?

+Organizations can overcome common challenges in calculating the cost total formula by using standardized costing methodologies, identifying and quantifying all direct and indirect costs, allocating indirect costs fairly and transparently, and estimating future costs using historical data and statistical models.

In

Final Thoughts