Intro

Establishing a solid credit foundation is crucial for individuals and businesses alike, as it can significantly impact their ability to secure loans, credit cards, and other financial services. A good credit setup can provide numerous benefits, including lower interest rates, higher credit limits, and better loan terms. In this article, we will delve into the importance of credit setup and provide five valuable tips to help you establish a strong credit foundation.

Having a good credit setup is essential for achieving financial stability and security. It can open up more opportunities for you, whether you're looking to purchase a house, start a business, or simply want to have a better financial safety net. A well-established credit history can also give you more negotiating power when dealing with lenders, allowing you to secure better interest rates and terms. Moreover, a good credit setup can help you build a positive credit score, which is a crucial factor in determining your creditworthiness.

In today's financial landscape, having a good credit setup is no longer a luxury, but a necessity. With the increasing demand for credit and the rising costs of living, it's essential to have a solid credit foundation to fall back on. Whether you're a student, a working professional, or an entrepreneur, establishing a good credit setup can help you achieve your financial goals and secure a brighter financial future. By following the tips outlined in this article, you can take the first step towards building a strong credit foundation and unlocking a world of financial opportunities.

Understanding Credit Setup

To understand credit setup, it's crucial to familiarize yourself with the different types of credit and how they impact your credit score. There are two primary types of credit: installment credit and revolving credit. Installment credit includes loans with fixed payments, such as mortgages and car loans, while revolving credit includes credit cards and lines of credit. By understanding how these types of credit work and how they impact your credit score, you can make informed decisions when building your credit setup.

Benefits of Credit Setup

The benefits of credit setup are numerous, and they can have a significant impact on your financial well-being. Some of the most notable benefits include: * Lower interest rates: A good credit setup can help you qualify for lower interest rates on loans and credit cards, saving you money in the long run. * Higher credit limits: By establishing a strong credit history, you can increase your credit limits and have more flexibility when making purchases. * Better loan terms: A well-established credit setup can help you negotiate better loan terms, including longer repayment periods and lower fees. * Improved credit score: A good credit setup is essential for building a positive credit score, which can open up more financial opportunities and provide better loan terms.Tips for Credit Setup

Additional Tips for Credit Setup

In addition to the five tips outlined above, there are several other strategies you can use to establish a strong credit setup. Some of these include: * **Diversify your credit**: By having a mix of different credit types, such as credit cards, loans, and mortgages, you can demonstrate your ability to manage various credit accounts. * **Avoid negative marks**: Negative marks, such as late payments, collections, and bankruptcies, can significantly impact your credit score. By avoiding these negative marks, you can maintain a healthy credit score and establish a strong credit setup. * **Consider a secured credit card**: If you're struggling to get approved for a regular credit card, consider applying for a secured credit card. Secured credit cards require a security deposit, which becomes your credit limit, and can help you establish a positive credit history.Common Credit Setup Mistakes

Avoiding Credit Setup Mistakes

To avoid common credit setup mistakes, it's essential to be mindful of your credit actions and their potential impact on your credit score. Some strategies for avoiding credit setup mistakes include: * **Carefully reviewing credit offers**: Before applying for credit, carefully review the terms and conditions to ensure you understand the interest rate, fees, and repayment terms. * **Monitoring your credit report**: Regularly monitoring your credit report can help you identify errors, disputes, or negative marks that may be impacting your credit score. * **Seeking professional advice**: If you're unsure about how to build your credit setup or need guidance on managing your credit, consider seeking advice from a financial advisor or credit counselor.Conclusion and Next Steps

As you continue on your journey to establishing a strong credit setup, remember to stay informed and adapt to changes in the credit landscape. By staying up-to-date with the latest credit trends and best practices, you can ensure you're always making the most of your credit opportunities.

Credit Setup Image Gallery

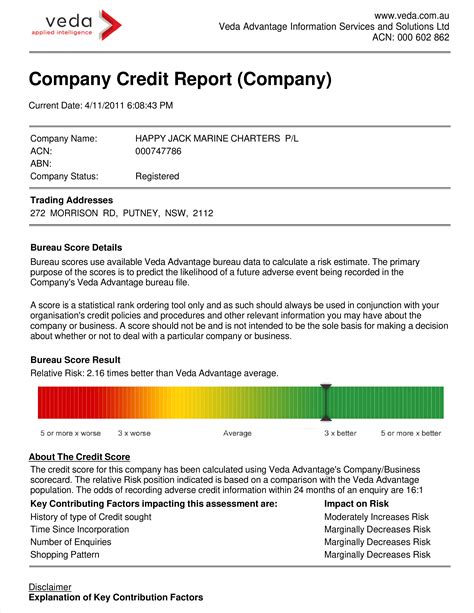

What is a good credit score?

+A good credit score is typically considered to be 700 or higher. However, the exact definition of a good credit score can vary depending on the credit scoring model used.

How do I check my credit report?

+You can check your credit report by requesting a free copy from the three major credit bureaus (Experian, TransUnion, and Equifax) once a year. You can also check your credit report through online credit monitoring services.

What is credit utilization ratio?

+Credit utilization ratio refers to the amount of credit you're using compared to your available credit limit. It's calculated by dividing your total credit usage by your total available credit.

How can I improve my credit score?

+You can improve your credit score by making timely payments, keeping credit utilization low, avoiding new credit inquiries, and building a long credit history.

What are the benefits of a good credit setup?

+The benefits of a good credit setup include lower interest rates, higher credit limits, better loan terms, and improved credit score.

We hope this article has provided you with valuable insights and tips on establishing a strong credit setup. By following the advice outlined in this article and avoiding common credit setup mistakes, you can build a positive credit history and unlock a world of financial opportunities. If you have any further questions or would like to share your experiences with credit setup, please don't hesitate to comment below. Share this article with your friends and family to help them establish a strong credit foundation and achieve financial stability.