Intro

Discover 5 ways credit chargeback protects consumers from fraudulent transactions, errors, and unauthorized payments, offering a refund and dispute resolution process with merchants and issuers, ensuring fair credit card practices and consumer rights.

The world of credit card transactions can be complex, with numerous rules and regulations governing how payments are processed and disputes are resolved. One important concept in this realm is the credit chargeback, a process that allows consumers to dispute and potentially reverse certain transactions. Understanding how credit chargebacks work and the scenarios under which they can be initiated is crucial for both consumers and merchants. This article delves into the intricacies of credit chargebacks, exploring what they are, how they function, and the common reasons they are initiated.

Credit chargebacks are essentially a consumer protection mechanism, designed to safeguard cardholders from fraudulent or unauthorized transactions, as well as from merchants who fail to deliver on their promises. When a consumer disputes a charge, the credit card issuer temporarily removes the charge from the consumer's account and initiates an investigation. This process can be a powerful tool for consumers, but it also presents challenges for merchants, who must navigate the complexities of chargeback rules and procedures to protect their interests.

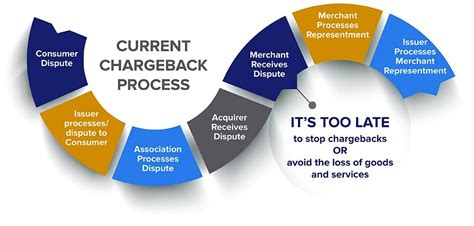

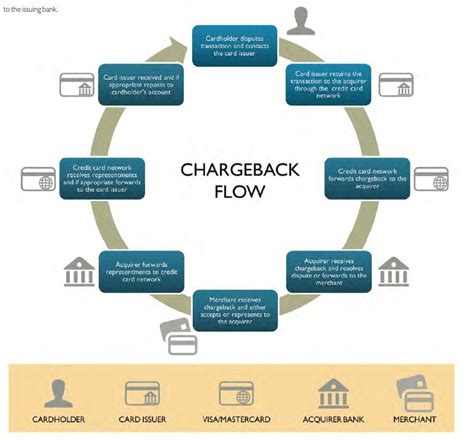

The process of initiating a credit chargeback typically begins when a consumer contacts their credit card issuer to report a disputed transaction. The issuer then requests documentation and information from the consumer to support the dispute. If the issuer determines that the dispute is valid, it will remove the charge from the consumer's account and debit the amount from the merchant's account. The merchant is then given an opportunity to respond and provide evidence to refute the dispute. If the merchant's response is deemed insufficient, the chargeback stands, and the merchant loses the transaction amount.

Understanding Credit Chargebacks

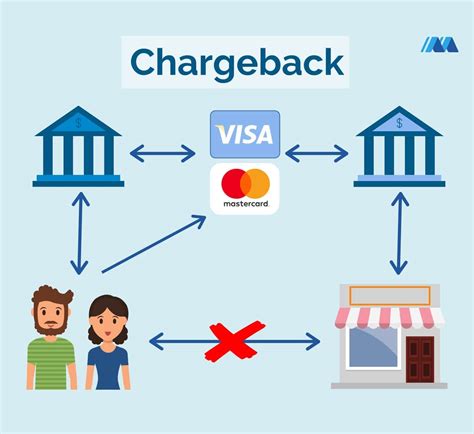

To truly grasp the concept of credit chargebacks, it's essential to understand the roles and responsibilities of the various parties involved. Consumers, merchants, and credit card issuers all play critical roles in the chargeback process. Consumers must be aware of their rights and the procedures for initiating a dispute, while merchants must understand how to prevent chargebacks and effectively respond to disputes when they arise. Credit card issuers, meanwhile, serve as intermediaries, facilitating the dispute resolution process and ensuring that transactions are conducted fairly and in accordance with the law.

The rules governing credit chargebacks are complex and can vary depending on the credit card network (e.g., Visa, Mastercard) and the specific circumstances of the dispute. Generally, consumers have a limited timeframe (typically 120 days from the transaction date) to initiate a chargeback. Merchants, on the other hand, must respond promptly to disputes, providing compelling evidence to support their position. Failure to do so can result in the chargeback being upheld, leading to financial losses for the merchant.

Reasons for Credit Chargebacks

There are several reasons why a consumer might initiate a credit chargeback. These include unauthorized transactions, where the consumer claims they did not make the purchase; merchandise or services not received, where the consumer pays for goods or services that are never delivered; and dissatisfaction with merchandise or services, where the consumer is unhappy with the quality of what they received. Additionally, chargebacks can be initiated due to processing errors, such as duplicate charges or incorrect amounts, and due to credit not processed, where a consumer is entitled to a refund that is not issued.

Merchants can take several steps to minimize the risk of chargebacks. Implementing robust security measures to prevent unauthorized transactions, ensuring clear communication with customers about what they are buying and when they can expect to receive it, and maintaining detailed records of transactions can all help. Additionally, merchants should have a clear and fair refund policy in place, as this can often resolve disputes before they escalate into chargebacks.

Preventing Credit Chargebacks

Preventing credit chargebacks requires a proactive approach from merchants. This includes verifying the identity of customers, especially for high-value transactions, and ensuring that customers understand and agree to the terms of the sale. Merchants should also keep detailed records of customer interactions, including emails, phone calls, and any agreements made. This documentation can be invaluable in the event of a dispute, providing evidence that the transaction was legitimate and that the customer was satisfied with the goods or services provided.

Furthermore, merchants should stay informed about the latest trends and best practices in chargeback prevention. This might involve attending industry workshops, participating in online forums, and consulting with experts in the field. By staying ahead of the curve, merchants can reduce their risk of chargebacks and maintain a positive relationship with their customers.

Responding to Credit Chargebacks

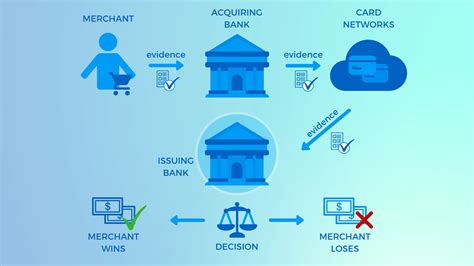

When a merchant receives notice of a credit chargeback, it's essential to respond quickly and effectively. The first step is to review the details of the dispute and gather any relevant evidence that supports the merchant's position. This might include receipts, communication records with the customer, and product or service descriptions. The merchant should then submit this evidence to the credit card issuer, along with a clear and concise explanation of why the chargeback is unjustified.

The key to a successful response is providing compelling evidence that contradicts the consumer's claim. For example, if a consumer claims that they did not receive a product, the merchant might provide tracking information showing that the product was indeed delivered. Similarly, if a consumer disputes the quality of a service, the merchant might offer evidence of the service agreement and any communications with the consumer regarding the service provided.

Resolving Credit Chargeback Disputes

Resolving credit chargeback disputes can be a complex and time-consuming process. Both consumers and merchants have rights and responsibilities in this process, and understanding these is key to achieving a fair outcome. Consumers must provide accurate and detailed information about the dispute, while merchants must respond promptly and provide compelling evidence to support their position.

In some cases, the dispute may be resolved through direct negotiation between the consumer and the merchant. This can often be the quickest and most satisfactory way to resolve the issue, as it allows both parties to come to a mutually agreeable solution. However, if the dispute cannot be resolved through negotiation, it may be necessary to involve the credit card issuer or, in some cases, seek legal advice.

Gallery of Credit Chargeback Images

Credit Chargeback Image Gallery

What is a credit chargeback?

+A credit chargeback is a process that allows consumers to dispute and potentially reverse certain transactions, providing a level of protection against unauthorized or unsatisfactory transactions.

How do I initiate a credit chargeback?

+To initiate a credit chargeback, contact your credit card issuer and report the disputed transaction. Provide detailed information and documentation to support your dispute, and follow the issuer's instructions for the next steps.

What are the common reasons for credit chargebacks?

+Common reasons for credit chargebacks include unauthorized transactions, merchandise or services not received, dissatisfaction with merchandise or services, processing errors, and credit not processed. Understanding these reasons can help both consumers and merchants navigate the chargeback process more effectively.

In conclusion, navigating the world of credit chargebacks requires a deep understanding of the process, the rights and responsibilities of all parties involved, and the strategies for preventing and responding to disputes. By staying informed and proactive, consumers can protect themselves from unfair transactions, and merchants can minimize their risk of chargebacks, fostering a healthier and more trustworthy transaction environment for everyone. We invite you to share your thoughts and experiences with credit chargebacks, and to explore the resources and support available for both consumers and merchants looking to navigate this complex but crucial aspect of credit card transactions.