Intro

Learn about Credit Card Outage causes, prevention, and recovery, including network failures, system glitches, and transaction issues, to minimize financial disruptions and ensure seamless payments.

The world of finance has become increasingly digital, with credit cards being a staple in many people's wallets. However, like any other technology, credit card systems can be prone to outages, leaving users stranded and unsure of what to do. Credit card outages can be frustrating, especially when they occur at critical moments, such as during a purchase or when trying to access funds. In this article, we will delve into the world of credit card outages, exploring the causes, effects, and possible solutions to this issue.

Credit card outages can be caused by a variety of factors, including technical glitches, cyberattacks, and maintenance issues. Technical glitches can occur due to software or hardware failures, causing the credit card system to malfunction. Cyberattacks, on the other hand, can compromise the security of the credit card system, leading to outages and potential data breaches. Maintenance issues, such as system updates or upgrades, can also cause temporary outages, although these are usually planned and communicated in advance.

The effects of credit card outages can be far-reaching, impacting not only individuals but also businesses and the economy as a whole. For individuals, a credit card outage can mean being unable to make purchases or access funds, leading to inconvenience and potential financial losses. Businesses, on the other hand, can suffer from lost sales and revenue, as well as damage to their reputation. The economy can also be impacted, as credit card outages can disrupt the flow of money and commerce.

Understanding Credit Card Outages

To understand credit card outages, it's essential to know how credit card systems work. Credit card systems involve a complex network of banks, processors, and merchants, all working together to facilitate transactions. When a credit card is used, the transaction is sent to the processor, which then forwards it to the bank for approval. If the bank approves the transaction, the processor sends a response back to the merchant, and the transaction is completed. However, if any part of this process is disrupted, a credit card outage can occur.

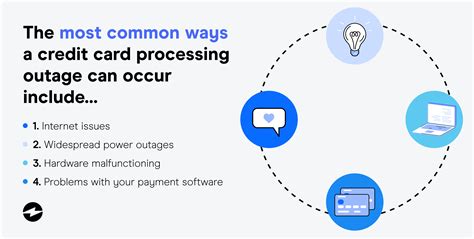

Causes of Credit Card Outages

Credit card outages can be caused by a variety of factors, including: * Technical glitches: Software or hardware failures can cause the credit card system to malfunction. * Cyberattacks: Cyberattacks can compromise the security of the credit card system, leading to outages and potential data breaches. * Maintenance issues: System updates or upgrades can cause temporary outages, although these are usually planned and communicated in advance. * Network issues: Problems with the network or internet connection can disrupt the credit card system. * Human error: Mistakes made by employees or users can also cause credit card outages.Effects of Credit Card Outages

The effects of credit card outages can be significant, impacting not only individuals but also businesses and the economy. Some of the effects of credit card outages include:

- Inconvenience: Credit card outages can cause inconvenience to individuals, who may be unable to make purchases or access funds.

- Financial losses: Businesses can suffer from lost sales and revenue, as well as damage to their reputation.

- Economic disruption: Credit card outages can disrupt the flow of money and commerce, having a ripple effect on the economy.

- Security risks: Credit card outages can also pose security risks, as sensitive information may be compromised during the outage.

Solutions to Credit Card Outages

To mitigate the effects of credit card outages, several solutions can be implemented. These include: * Regular maintenance: Regular maintenance and updates can help prevent technical glitches and cyberattacks. * Redundancy: Having redundant systems in place can help ensure that the credit card system remains operational, even in the event of an outage. * Communication: Clear communication with users and businesses can help minimize the impact of a credit card outage. * Alternative payment methods: Offering alternative payment methods, such as cash or other forms of payment, can help businesses continue to operate during a credit card outage.Preventing Credit Card Outages

Preventing credit card outages requires a proactive approach, involving regular maintenance, monitoring, and testing. Some of the ways to prevent credit card outages include:

- Regular software updates: Keeping software up to date can help prevent technical glitches and cyberattacks.

- Security measures: Implementing robust security measures, such as firewalls and encryption, can help protect the credit card system from cyberattacks.

- Redundancy: Having redundant systems in place can help ensure that the credit card system remains operational, even in the event of an outage.

- Employee training: Training employees on the credit card system and procedures can help minimize the risk of human error.

Best Practices for Credit Card Outages

In the event of a credit card outage, several best practices can be followed to minimize the impact. These include: * Clear communication: Clear communication with users and businesses can help minimize the impact of a credit card outage. * Alternative payment methods: Offering alternative payment methods, such as cash or other forms of payment, can help businesses continue to operate during a credit card outage. * Regular updates: Providing regular updates on the status of the credit card outage can help keep users informed and minimize frustration. * Compensation: Offering compensation or refunds to affected users can help mitigate the impact of a credit card outage.Gallery of Credit Card Outage Images

Credit Card Outage Image Gallery

Frequently Asked Questions

What is a credit card outage?

+A credit card outage is a disruption to the credit card system, preventing users from making purchases or accessing funds.

What causes credit card outages?

+Credit card outages can be caused by technical glitches, cyberattacks, maintenance issues, network issues, and human error.

How can credit card outages be prevented?

+Credit card outages can be prevented by regular maintenance, monitoring, and testing, as well as implementing robust security measures and having redundant systems in place.

What are the effects of credit card outages?

+The effects of credit card outages can include inconvenience, financial losses, economic disruption, and security risks.

How can I protect myself from credit card outages?

+You can protect yourself from credit card outages by having alternative payment methods, monitoring your account activity, and reporting any suspicious transactions to your bank.

In conclusion, credit card outages can have significant impacts on individuals, businesses, and the economy. Understanding the causes and effects of credit card outages is crucial in preventing and mitigating these impacts. By implementing robust security measures, having redundant systems in place, and providing clear communication, credit card outages can be minimized, and the flow of money and commerce can be maintained. We invite you to share your thoughts and experiences with credit card outages in the comments section below. Have you ever been affected by a credit card outage? What measures do you take to protect yourself from credit card outages? Share your story and let's work together to create a more secure and reliable credit card system.