Intro

The concept of debt snowballing has been a popular strategy for paying off debt, particularly for individuals with multiple debts and limited financial resources. The idea is to prioritize debts based on their balances, focusing on the smallest balance first while making minimum payments on the rest. As each debt is paid off, the payment amount is applied to the next debt, creating a snowball effect that gains momentum over time. A debt snowball spreadsheet printable can be a valuable tool in implementing this strategy, providing a clear and organized approach to managing and eliminating debt.

The importance of having a well-structured plan when tackling debt cannot be overstated. Without a clear strategy, individuals may find themselves overwhelmed by the sheer number of debts they owe, leading to missed payments, late fees, and a cycle of debt that seems impossible to escape. The debt snowball method, popularized by financial experts like Dave Ramsey, offers a straightforward and achievable approach to becoming debt-free. By using a debt snowball spreadsheet printable, individuals can visualize their progress, stay motivated, and make informed decisions about their financial priorities.

One of the key benefits of the debt snowball method is its psychological impact. By focusing on the smallest debt first, individuals can quickly experience the satisfaction of paying off a debt in full, which can be a powerful motivator. This approach also helps to build momentum, as the payment amount applied to each subsequent debt increases, allowing for faster payoff. Additionally, the debt snowball method can be less overwhelming than other strategies, such as the debt avalanche method, which prioritizes debts based on their interest rates. While the debt avalanche method may be more efficient in terms of saving money on interest, the debt snowball method can be more effective in terms of providing a sense of accomplishment and progress.

How to Use a Debt Snowball Spreadsheet Printable

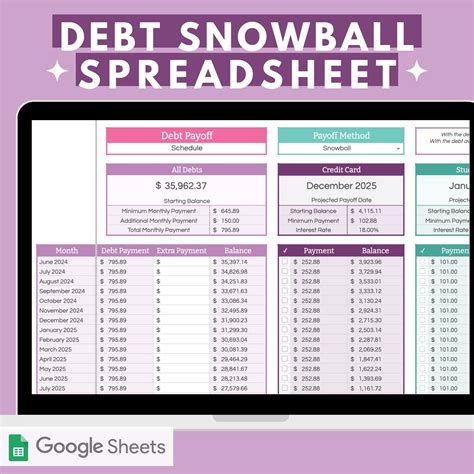

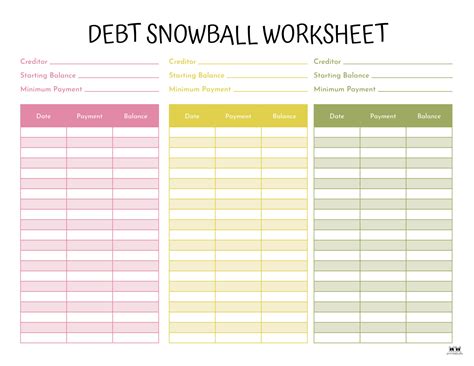

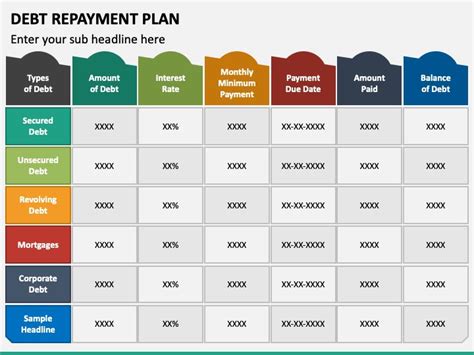

Using a debt snowball spreadsheet printable is a straightforward process that involves several key steps. First, individuals must gather all relevant information about their debts, including the balance, interest rate, and minimum payment for each debt. This information should be entered into the spreadsheet, which will typically include columns for the debt name, balance, interest rate, minimum payment, and payoff order. The spreadsheet will then calculate the total amount owed, the total interest paid, and the payoff period, providing a comprehensive overview of the individual's debt situation.

Next, the debts should be prioritized based on their balances, with the smallest balance first. The minimum payment should be made on all debts except the first one, which should be paid off as aggressively as possible. As each debt is paid off, the payment amount should be applied to the next debt, creating the snowball effect. The spreadsheet can be updated regularly to reflect progress, providing a visual representation of the debt payoff journey.

Benefits of Using a Debt Snowball Spreadsheet Printable

The benefits of using a debt snowball spreadsheet printable are numerous. One of the primary advantages is the ability to visualize progress, which can be a powerful motivator. By seeing the debts being paid off one by one, individuals can stay focused and committed to their financial goals. Additionally, the spreadsheet provides a clear and organized approach to managing debt, making it easier to stay on track and avoid missed payments.Another benefit of using a debt snowball spreadsheet printable is the ability to make informed decisions about financial priorities. By having a comprehensive overview of the debt situation, individuals can identify areas where they can cut back on expenses and allocate more funds towards debt repayment. This can involve creating a budget, reducing unnecessary expenses, and increasing income through side hustles or other means.

Creating a Debt Snowball Spreadsheet Printable

Creating a debt snowball spreadsheet printable can be a straightforward process, especially for individuals with basic computer skills. One approach is to use a spreadsheet software like Microsoft Excel or Google Sheets, which offer a range of templates and tools for creating custom spreadsheets. Alternatively, individuals can search for debt snowball spreadsheet printables online, which can be downloaded and customized to suit their needs.

When creating a debt snowball spreadsheet printable, there are several key elements to include. First, the spreadsheet should have columns for the debt name, balance, interest rate, minimum payment, and payoff order. Additionally, the spreadsheet should calculate the total amount owed, the total interest paid, and the payoff period, providing a comprehensive overview of the debt situation.

Customizing a Debt Snowball Spreadsheet Printable

Customizing a debt snowball spreadsheet printable can be an important step in making it an effective tool for managing debt. One approach is to add additional columns or rows to track progress, such as a column for the payment date or a row for the total amount paid. Individuals can also customize the spreadsheet to fit their personal financial goals, such as adding a column for savings or investments.Another way to customize a debt snowball spreadsheet printable is to use conditional formatting to highlight important information, such as debts that are nearing payoff or payments that are overdue. This can help individuals stay focused on their financial priorities and avoid missed payments.

Using a Debt Snowball Spreadsheet Printable with Other Debt Repayment Strategies

While the debt snowball method can be an effective approach to paying off debt, it may not be the best strategy for everyone. In some cases, individuals may benefit from using a combination of debt repayment strategies, such as the debt avalanche method or debt consolidation. A debt snowball spreadsheet printable can be a useful tool in these situations, providing a comprehensive overview of the debt situation and helping individuals to make informed decisions about their financial priorities.

One approach is to use the debt snowball method for debts with smaller balances, while using the debt avalanche method for debts with higher interest rates. This can help individuals to save money on interest while still experiencing the psychological benefits of paying off smaller debts first.

Common Mistakes to Avoid When Using a Debt Snowball Spreadsheet Printable

While a debt snowball spreadsheet printable can be a powerful tool for managing debt, there are several common mistakes to avoid. One of the most significant mistakes is failing to update the spreadsheet regularly, which can lead to inaccurate information and a lack of progress. Individuals should also avoid using the spreadsheet as a one-time tool, instead making it a regular part of their financial routine.Another mistake to avoid is failing to prioritize needs over wants, which can lead to a lack of funds for debt repayment. Individuals should prioritize essential expenses, such as housing and food, while cutting back on non-essential expenses, such as dining out or entertainment.

Conclusion and Next Steps

In conclusion, a debt snowball spreadsheet printable can be a valuable tool for individuals seeking to pay off debt and achieve financial freedom. By providing a clear and organized approach to managing debt, the spreadsheet can help individuals to stay motivated, make informed decisions about their financial priorities, and avoid common mistakes. Whether used alone or in combination with other debt repayment strategies, a debt snowball spreadsheet printable can be an effective way to take control of debt and achieve long-term financial stability.

To get started with a debt snowball spreadsheet printable, individuals can search for templates online or create their own using spreadsheet software. It's also important to regularly review and update the spreadsheet, making adjustments as needed to stay on track with financial goals.

Debt Snowball Image Gallery

What is the debt snowball method?

+The debt snowball method is a debt repayment strategy that involves prioritizing debts based on their balances, focusing on the smallest balance first while making minimum payments on the rest.

How do I create a debt snowball spreadsheet printable?

+To create a debt snowball spreadsheet printable, you can use spreadsheet software like Microsoft Excel or Google Sheets, or search for templates online. The spreadsheet should include columns for the debt name, balance, interest rate, minimum payment, and payoff order.

What are the benefits of using a debt snowball spreadsheet printable?

+The benefits of using a debt snowball spreadsheet printable include the ability to visualize progress, make informed decisions about financial priorities, and avoid common mistakes. The spreadsheet can also help individuals to stay motivated and focused on their financial goals.

Can I use a debt snowball spreadsheet printable with other debt repayment strategies?

+Yes, a debt snowball spreadsheet printable can be used with other debt repayment strategies, such as the debt avalanche method or debt consolidation. The spreadsheet can provide a comprehensive overview of the debt situation, helping individuals to make informed decisions about their financial priorities.

How often should I update my debt snowball spreadsheet printable?

+It's recommended to update your debt snowball spreadsheet printable regularly, ideally once a month, to reflect changes in your debt situation and stay on track with your financial goals.

We hope this article has provided you with a comprehensive understanding of the debt snowball spreadsheet printable and its benefits. If you have any further questions or would like to share your experiences with using a debt snowball spreadsheet printable, please don't hesitate to comment below. Additionally, if you found this article helpful, please consider sharing it with others who may benefit from this information. By working together, we can achieve financial freedom and create a brighter future for ourselves and our loved ones.