Intro

Discover 5 ways to define cash advance, including payday loans, merchant cash advances, and more, to understand short-term financing options and manage financial emergencies effectively.

The concept of cash advance has become increasingly popular in recent years, especially among individuals and businesses looking for quick access to funds. A cash advance is a type of short-term loan that provides immediate access to cash, often with a higher interest rate and fees compared to traditional loans. In this article, we will delve into the world of cash advances, exploring the different ways to define this financial concept.

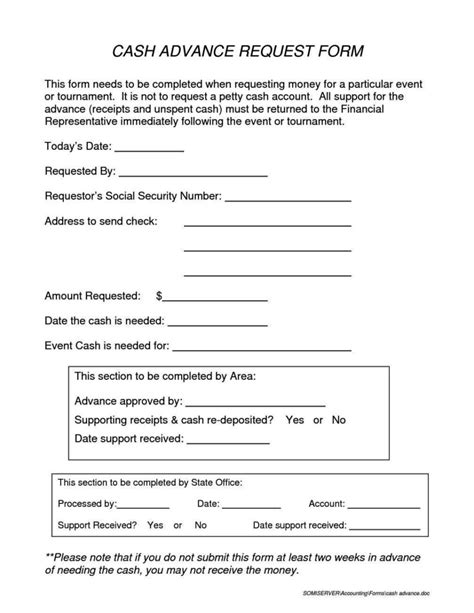

A cash advance can be a lifesaver for individuals facing financial emergencies or businesses needing to cover unexpected expenses. However, it's essential to understand the terms and conditions of a cash advance before applying for one. With the rise of online lenders and financial institutions offering cash advance services, it's crucial to be aware of the benefits and drawbacks of this type of loan. Whether you're looking to cover a medical bill, pay for car repairs, or finance a business venture, a cash advance can provide the necessary funds to get you back on track.

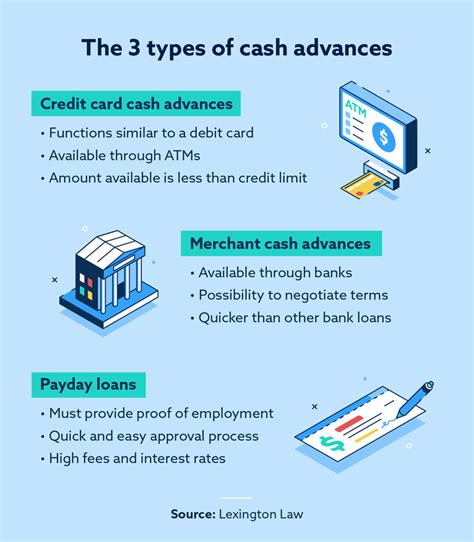

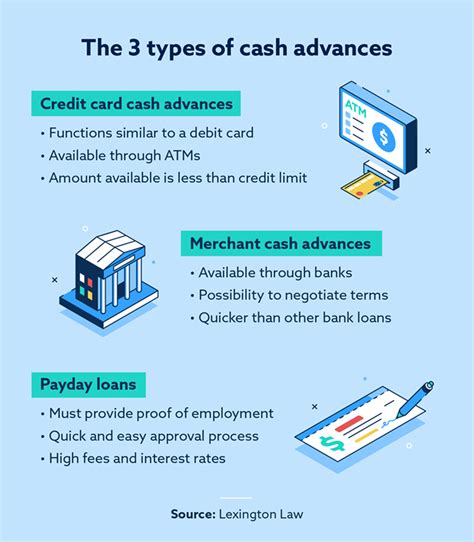

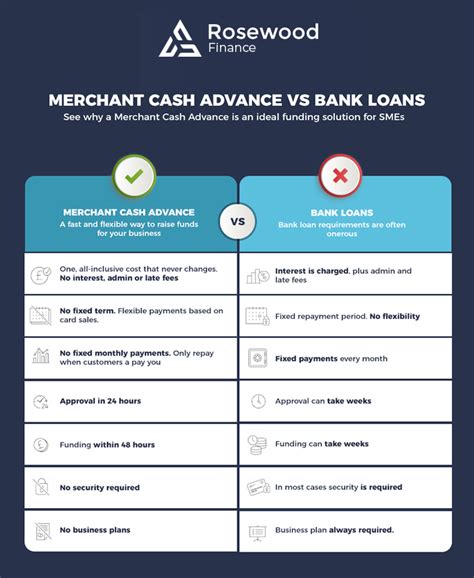

The importance of understanding cash advances cannot be overstated. With the increasing demand for quick access to funds, it's essential to be aware of the different types of cash advances available, including credit card cash advances, merchant cash advances, and payday loans. Each type of cash advance has its unique features, benefits, and drawbacks, and it's crucial to choose the right one that suits your financial needs. In this article, we will explore the different ways to define a cash advance, providing you with a comprehensive understanding of this financial concept.

Introduction to Cash Advance

Types of Cash Advances

Benefits of Cash Advances

Risks and Drawbacks of Cash Advances

Alternatives to Cash Advances

Gallery of Cash Advance Images

Cash Advance Image Gallery

What is a cash advance?

+A cash advance is a type of loan that provides immediate access to cash, often with a higher interest rate and fees compared to traditional loans.

What are the benefits of a cash advance?

+Cash advances offer several benefits, including quick access to cash, easy application process, no collateral required, and flexibility.

What are the risks and drawbacks of a cash advance?

+Cash advances come with risks and drawbacks, including higher interest rates, fees, debt cycle, and limited regulation.

What are the alternatives to a cash advance?

+Alternatives to cash advances include personal loans, credit cards, lines of credit, and savings.

How do I choose a reputable cash advance lender?

+To choose a reputable cash advance lender, research the lender's reputation, read reviews, and compare rates and fees.

In conclusion, a cash advance can be a useful financial tool for individuals and businesses needing quick access to cash. However, it's essential to understand the terms and conditions of a cash advance, including the benefits, risks, and drawbacks. By choosing a reputable lender and being aware of the alternatives to cash advances, you can make an informed decision that suits your financial needs. We hope this article has provided you with a comprehensive understanding of cash advances, helping you to navigate the complex world of finance with confidence. If you have any further questions or comments, please don't hesitate to share them below.