Intro

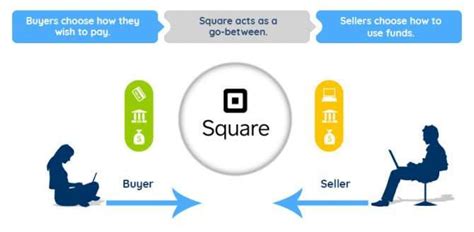

Discover how Square works, a payment processing platform using mobile payments, point-of-sale systems, and online invoicing, facilitating seamless transactions and financial services for businesses and individuals.

The world of payment processing has undergone a significant transformation in recent years, and one company that has been at the forefront of this change is Square. Founded in 2009 by Jack Dorsey and Jim McKelvey, Square has revolutionized the way businesses process payments, making it easier, faster, and more secure. In this article, we will delve into the inner workings of Square, exploring its features, benefits, and how it has become an essential tool for businesses of all sizes.

Square's innovative approach to payment processing has disrupted the traditional model, which often required businesses to invest in expensive hardware and software. With Square, businesses can accept payments using a simple, compact card reader that plugs into a mobile device or tablet. This reader, known as the Square Reader, is available for a one-time fee and can be easily set up and integrated with a business's existing point-of-sale system. The Square Reader is also compatible with a range of devices, including iPhones, iPads, and Android devices.

How Square Works

The Square payment processing system is designed to be user-friendly and efficient. When a customer makes a purchase, the business simply swipes the card through the Square Reader, and the payment is processed in real-time. The system uses advanced encryption and tokenization to ensure that sensitive card information is protected, reducing the risk of fraud and data breaches. Square also offers a range of payment options, including contactless payments, chip card payments, and mobile payments.

Key Features of Square

Some of the key features of Square include: * Fast and secure payment processing * Compact and portable card reader * Compatibility with a range of devices * Advanced encryption and tokenization * Contactless, chip card, and mobile payment options * Real-time payment processing and reporting * Integrated point-of-sale systemBenefits of Using Square

The benefits of using Square are numerous. For businesses, Square offers a fast and secure way to process payments, reducing the risk of fraud and data breaches. The system is also easy to use, with a simple and intuitive interface that makes it easy to manage payments and track sales. Additionally, Square offers a range of reporting and analytics tools, providing businesses with valuable insights into their sales and customer behavior.

Advantages for Businesses

Some of the advantages of using Square for businesses include: * Fast and secure payment processing * Reduced risk of fraud and data breaches * Easy to use and manage * Integrated point-of-sale system * Real-time reporting and analytics * Compatibility with a range of devices * Affordable pricing and no hidden feesHow Square Makes Money

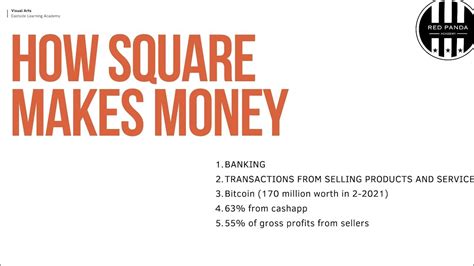

So, how does Square make money? The company generates revenue through a combination of transaction fees and hardware sales. For each transaction processed through the Square system, the company charges a small fee, typically ranging from 2.5% to 3.5% of the transaction amount. Square also sells its hardware, including the Square Reader and other point-of-sale devices, to businesses.

Revenue Streams

Some of the revenue streams for Square include: * Transaction fees * Hardware sales * Software subscriptions * Payment processing fees * Interest on stored fundsSecurity and Compliance

Security and compliance are top priorities for Square. The company uses advanced encryption and tokenization to protect sensitive card information, reducing the risk of fraud and data breaches. Square is also compliant with industry standards, including PCI-DSS and EMV, ensuring that businesses can trust the system to process payments securely.

Security Measures

Some of the security measures used by Square include: * Advanced encryption and tokenization * Secure socket layer (SSL) technology * Regular security audits and testing * Compliance with industry standards * Secure storage of sensitive card informationConclusion and Future Developments

In conclusion, Square has revolutionized the payment processing industry, providing businesses with a fast, secure, and efficient way to process payments. With its compact and portable card reader, advanced encryption and tokenization, and integrated point-of-sale system, Square has become an essential tool for businesses of all sizes. As the company continues to innovate and expand its services, it is likely that we will see even more exciting developments in the world of payment processing.

Future Developments

Some of the potential future developments for Square include: * Expanded payment options, such as cryptocurrency and mobile payments * Integration with emerging technologies, such as artificial intelligence and blockchain * Enhanced security measures, such as biometric authentication and machine learning-based fraud detection * Increased focus on international expansion and global paymentsSquare Image Gallery

What is Square and how does it work?

+Square is a payment processing company that provides businesses with a fast and secure way to process payments. The system uses a compact and portable card reader that plugs into a mobile device or tablet, and payments are processed in real-time using advanced encryption and tokenization.

What are the benefits of using Square for businesses?

+The benefits of using Square for businesses include fast and secure payment processing, reduced risk of fraud and data breaches, easy to use and manage, integrated point-of-sale system, real-time reporting and analytics, and compatibility with a range of devices.

How does Square make money?

+Square generates revenue through a combination of transaction fees and hardware sales. The company charges a small fee for each transaction processed through the system, and also sells its hardware, including the Square Reader and other point-of-sale devices, to businesses.

Is Square secure and compliant with industry standards?

+Yes, Square is secure and compliant with industry standards. The company uses advanced encryption and tokenization to protect sensitive card information, and is compliant with industry standards, including PCI-DSS and EMV.

What are the future developments for Square?

+Square is continuously innovating and expanding its services. Some potential future developments include expanded payment options, integration with emerging technologies, enhanced security measures, and increased focus on international expansion and global payments.

We hope this article has provided you with a comprehensive understanding of how Square works and the benefits it offers to businesses. Whether you are a small business owner or a large enterprise, Square is an essential tool for processing payments securely and efficiently. If you have any further questions or comments, please do not hesitate to reach out to us. Share this article with your friends and colleagues, and let us know what you think about Square and its impact on the payment processing industry.