Intro

Explore Ach financial transactions, including direct deposit, e-checks, and online payments, to streamline secure and efficient fund transfers with automated clearing house services.

The world of financial transactions has undergone significant transformations in recent years, with the advent of digital payment systems, online banking, and mobile wallets. At the heart of these innovations lies the Automated Clearing House (ACH) network, a fundamental component of the US financial system. ACH financial transactions have become an essential part of modern banking, enabling individuals and businesses to transfer funds electronically.

The importance of ACH financial transactions cannot be overstated, as they provide a secure, efficient, and cost-effective way to move money between bank accounts. With the rise of online commerce, bill payments, and direct deposit, ACH transactions have become increasingly popular. In fact, according to the National Automated Clearing House Association (NACHA), the number of ACH transactions has grown significantly over the years, with over 23 billion transactions processed in 2020 alone. This growth is a testament to the convenience, reliability, and widespread adoption of ACH financial transactions.

As the financial landscape continues to evolve, it is essential to understand the intricacies of ACH financial transactions, including their benefits, working mechanisms, and potential applications. In this article, we will delve into the world of ACH financial transactions, exploring their history, advantages, and future prospects. Whether you are an individual, business owner, or financial professional, this comprehensive guide will provide you with a deeper understanding of the ACH network and its role in modern banking.

Introduction to ACH Financial Transactions

The ACH network was established in the 1970s as a way to facilitate electronic transactions between banks. The network allows financial institutions to exchange funds electronically, eliminating the need for physical checks and other paper-based transactions. ACH financial transactions are typically used for direct deposit, bill payments, and online transactions. They are also used for business-to-business (B2B) transactions, such as payroll processing and accounts payable.

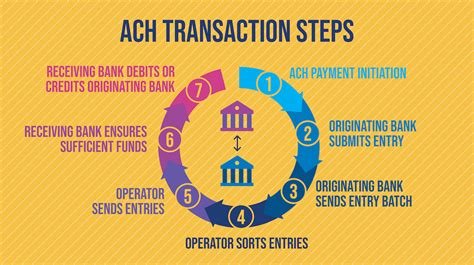

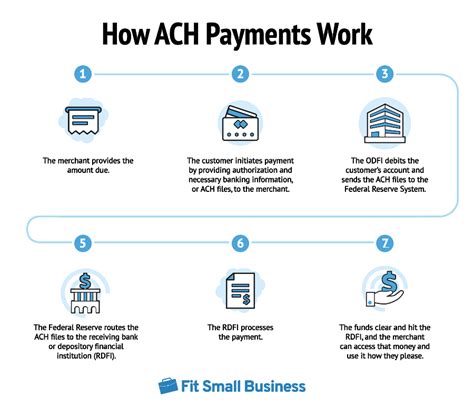

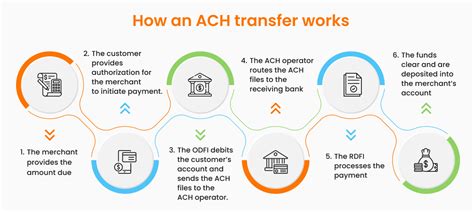

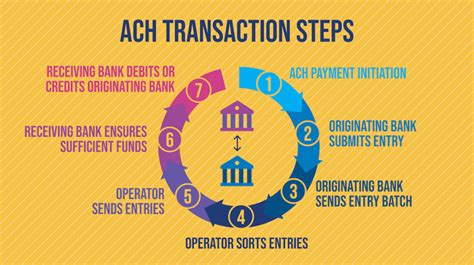

How ACH Financial Transactions Work

The ACH network operates on a batch processing system, where transactions are collected and processed in batches throughout the day. When an individual or business initiates an ACH transaction, the originating bank sends the transaction to the ACH operator, which then forwards it to the receiving bank. The receiving bank verifies the transaction and credits the recipient's account. The entire process typically takes one to two business days, although same-day ACH transactions are becoming increasingly common.

Benefits of ACH Financial Transactions

ACH financial transactions offer numerous benefits, including:

- Convenience: ACH transactions can be initiated online or through mobile banking, making it easy to transfer funds from anywhere.

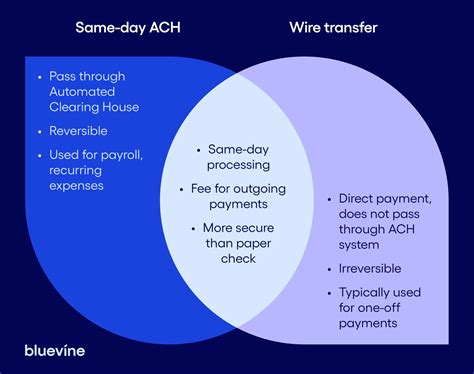

- Cost-effectiveness: ACH transactions are generally less expensive than wire transfers or other payment methods.

- Security: ACH transactions are heavily regulated and subject to strict security protocols, reducing the risk of fraud and errors.

- Efficiency: ACH transactions are processed electronically, eliminating the need for physical checks and reducing processing times.

Types of ACH Financial Transactions

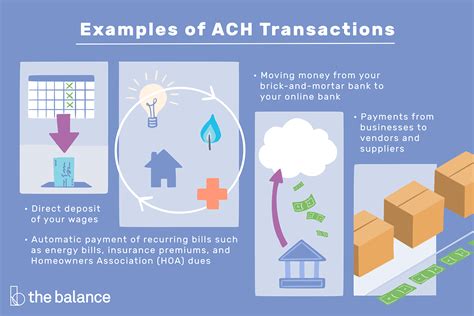

There are two main types of ACH financial transactions: direct deposit and direct payment. Direct deposit involves the electronic transfer of funds from a payer's account to a payee's account, while direct payment involves the electronic transfer of funds from a consumer's account to a business's account.

Applications of ACH Financial Transactions

ACH financial transactions have a wide range of applications, including:

- Payroll processing: ACH transactions are commonly used for direct deposit of employee salaries.

- Bill payments: ACH transactions can be used to pay bills, such as utility bills, credit card bills, and loan payments.

- Online transactions: ACH transactions are used for online purchases, such as buying goods and services from e-commerce websites.

- Business-to-business transactions: ACH transactions are used for B2B transactions, such as payroll processing, accounts payable, and accounts receivable.

Future of ACH Financial Transactions

The future of ACH financial transactions looks promising, with advancements in technology and the increasing adoption of digital payment systems. Same-day ACH transactions, for example, are becoming increasingly common, allowing for faster processing times and greater convenience. Additionally, the use of artificial intelligence and machine learning is expected to improve the security and efficiency of ACH transactions.

Security and Regulation of ACH Financial Transactions

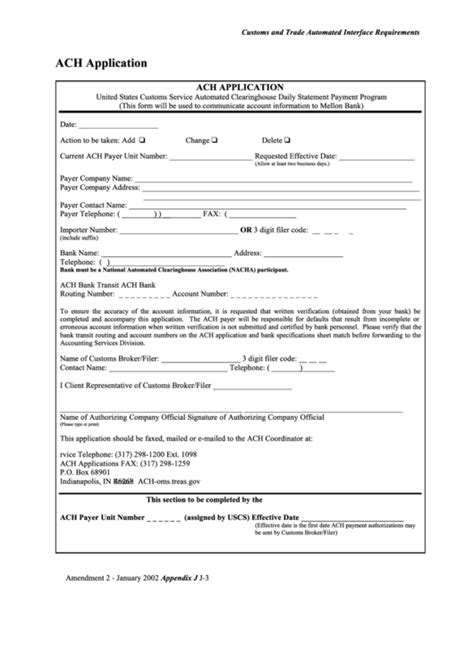

ACH financial transactions are heavily regulated and subject to strict security protocols. The ACH network is governed by NACHA, which sets rules and guidelines for ACH transactions. Additionally, the Federal Reserve and other regulatory agencies oversee the ACH network to ensure its security and integrity.

Risks and Challenges Associated with ACH Financial Transactions

While ACH financial transactions are generally secure, there are risks and challenges associated with them. These include:

- Fraud: ACH transactions can be vulnerable to fraud, such as phishing scams and identity theft.

- Errors: ACH transactions can be subject to errors, such as incorrect account numbers or insufficient funds.

- Regulatory compliance: ACH transactions must comply with regulatory requirements, such as anti-money laundering and know-your-customer laws.

Best Practices for ACH Financial Transactions

To ensure the security and efficiency of ACH financial transactions, it is essential to follow best practices, such as:

- Verifying account information: Verify account numbers and routing numbers to ensure accuracy.

- Monitoring transactions: Monitor transactions regularly to detect any suspicious activity.

- Implementing security protocols: Implement security protocols, such as encryption and two-factor authentication, to protect transactions.

Conclusion and Future Outlook

In conclusion, ACH financial transactions are a vital component of modern banking, offering a secure, efficient, and cost-effective way to transfer funds electronically. As the financial landscape continues to evolve, it is essential to stay informed about the latest developments and advancements in ACH financial transactions. By following best practices and staying vigilant, individuals and businesses can ensure the security and integrity of their ACH transactions.

ACH Financial Transactions Image Gallery

What is an ACH financial transaction?

+An ACH financial transaction is an electronic transfer of funds between bank accounts using the Automated Clearing House (ACH) network.

How do ACH financial transactions work?

+ACH financial transactions work by sending transactions through the ACH network, which then forwards them to the receiving bank for processing.

What are the benefits of ACH financial transactions?

+The benefits of ACH financial transactions include convenience, cost-effectiveness, security, and efficiency.

What are the risks associated with ACH financial transactions?

+The risks associated with ACH financial transactions include fraud, errors, and regulatory non-compliance.

How can I ensure the security of my ACH financial transactions?

+You can ensure the security of your ACH financial transactions by verifying account information, monitoring transactions, and implementing security protocols.

We hope this comprehensive guide to ACH financial transactions has provided you with a deeper understanding of this vital component of modern banking. Whether you are an individual, business owner, or financial professional, we encourage you to share your thoughts and experiences with ACH financial transactions in the comments below. Additionally, if you have any further questions or topics you would like to discuss, please do not hesitate to reach out. By working together, we can ensure the security, efficiency, and integrity of ACH financial transactions for years to come.