Intro

Discover strategies for investing in small companies, including venture capital, angel investing, and equity financing, to drive growth and maximize returns in emerging markets and startups.

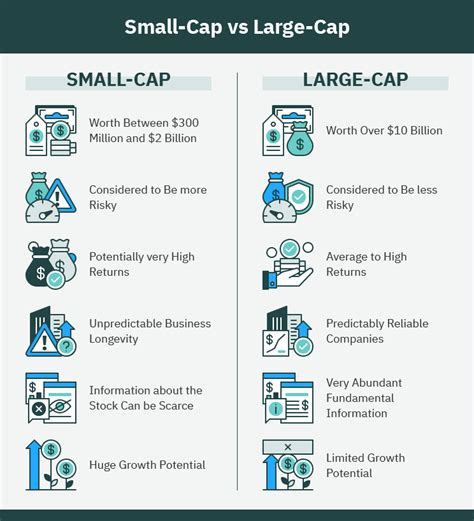

Investing in small companies can be a lucrative venture, offering the potential for significant returns on investment. Small companies, often referred to as small-cap stocks, are typically defined as those with a market capitalization of less than $2 billion. These companies are often in the early stages of development and may not have the same level of brand recognition as larger, more established corporations. However, this does not mean they lack potential. Many small companies have gone on to become industry leaders, providing substantial returns for investors who got in on the ground floor.

The appeal of investing in small companies lies in their ability to grow and expand rapidly. Unlike larger corporations, which may be hindered by bureaucracy and red tape, small companies are often more agile and able to respond quickly to changes in the market. This flexibility allows them to innovate and adapt, potentially leading to significant increases in revenue and profitability. Additionally, small companies may be more likely to be acquired by larger corporations, providing investors with a potential exit strategy and a significant return on their investment.

Investing in small companies can also provide a level of diversification, reducing an investor's reliance on larger, more established corporations. By spreading investments across a range of companies, including small-cap stocks, investors can reduce their risk and increase their potential for returns. This is because small companies are often less correlated with larger corporations, meaning their performance is not as closely tied to the overall market. As a result, even if the broader market experiences a downturn, small companies may continue to perform well, providing a potential hedge against losses.

Benefits Of Investing In Small Companies

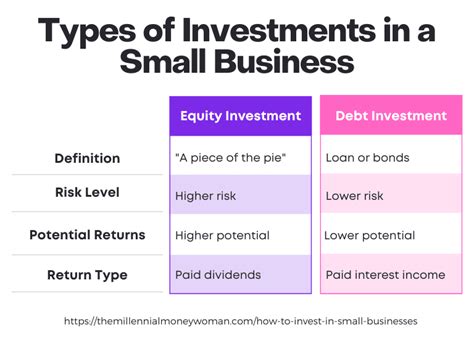

There are several benefits to investing in small companies. One of the primary advantages is the potential for significant returns on investment. Small companies are often undervalued, meaning their stock prices may not reflect their true potential. By investing in these companies, investors may be able to purchase stocks at a low price and then sell them at a higher price, generating a significant return. Additionally, small companies may be more likely to pay dividends, providing investors with a regular stream of income.

Another benefit of investing in small companies is the level of control and influence investors may have. Unlike larger corporations, which may have thousands of shareholders, small companies often have a more limited number of investors. As a result, investors may have a greater level of control and influence over the company's direction and strategy. This can be particularly appealing for investors who want to be actively involved in the companies they invest in.

Key Considerations For Investing In Small Companies

When investing in small companies, there are several key considerations to keep in mind. One of the most important is the level of risk involved. Small companies are often more volatile than larger corporations, meaning their stock prices may fluctuate rapidly. This can be intimidating for investors, particularly those who are new to the market. However, it is essential to remember that risk and reward are closely correlated. By taking on more risk, investors may be able to generate higher returns.Another consideration is the level of research and due diligence required. Unlike larger corporations, which are often widely covered by analysts and the media, small companies may not receive the same level of attention. As a result, investors may need to conduct their own research and analysis to determine the company's potential and value. This can be time-consuming and may require a significant amount of expertise and knowledge.

Risk Management Strategies For Investing In Small Companies

There are several risk management strategies that investors can use when investing in small companies. One of the most effective is diversification. By spreading investments across a range of companies, including small-cap stocks, investors can reduce their risk and increase their potential for returns. This is because small companies are often less correlated with larger corporations, meaning their performance is not as closely tied to the overall market.

Another strategy is to focus on companies with strong fundamentals. This includes factors such as revenue growth, profitability, and management team experience. By investing in companies with solid fundamentals, investors can reduce their risk and increase their potential for returns. Additionally, investors may want to consider companies with a strong competitive advantage, such as a unique product or service, or a dominant market position.

Steps To Take Before Investing In Small Companies

Before investing in small companies, there are several steps that investors should take. One of the most important is to conduct thorough research and analysis. This includes reviewing the company's financial statements, management team, and competitive position. Investors should also consider the company's industry and market trends, as well as any potential risks or challenges.Another step is to set clear investment goals and objectives. This includes determining the level of risk that is acceptable, as well as the potential returns that are expected. Investors should also consider their time horizon, as well as any other factors that may impact their investment decisions.

Common Mistakes To Avoid When Investing In Small Companies

There are several common mistakes that investors should avoid when investing in small companies. One of the most significant is failing to conduct thorough research and analysis. This can lead to investments in companies that are not well-positioned for success, resulting in significant losses.

Another mistake is to invest too much in a single company. This can lead to a lack of diversification, increasing the risk of significant losses. Investors should also avoid investing in companies with weak fundamentals, such as poor revenue growth or a lack of profitability.

Best Practices For Investing In Small Companies

There are several best practices that investors can follow when investing in small companies. One of the most important is to maintain a long-term perspective. This means avoiding the temptation to buy and sell stocks quickly, based on short-term market fluctuations. Instead, investors should focus on the company's long-term potential, as well as its ability to generate sustainable returns.Another best practice is to stay informed and up-to-date. This includes monitoring the company's financial performance, as well as any changes in the market or industry. Investors should also consider seeking the advice of a financial advisor or investment professional, particularly if they are new to the market.

Gallery of Investing In Small Companies

Investing In Small Companies Image Gallery

Frequently Asked Questions

What are the benefits of investing in small companies?

+The benefits of investing in small companies include the potential for significant returns on investment, diversification, and the ability to invest in companies with strong growth potential.

What are the risks of investing in small companies?

+The risks of investing in small companies include the potential for significant losses, volatility, and the lack of liquidity.

How can I get started with investing in small companies?

+To get started with investing in small companies, you can begin by conducting research and analysis on potential investment opportunities, setting clear investment goals and objectives, and considering the advice of a financial advisor or investment professional.

What are the best practices for investing in small companies?

+The best practices for investing in small companies include maintaining a long-term perspective, staying informed and up-to-date, and considering the advice of a financial advisor or investment professional.

How can I avoid common mistakes when investing in small companies?

+To avoid common mistakes when investing in small companies, you can conduct thorough research and analysis, set clear investment goals and objectives, and consider the advice of a financial advisor or investment professional.

In conclusion, investing in small companies can be a lucrative venture, offering the potential for significant returns on investment. However, it is essential to approach this type of investing with caution, conducting thorough research and analysis, and considering the advice of a financial advisor or investment professional. By following best practices, such as maintaining a long-term perspective and staying informed and up-to-date, investors can increase their potential for success and reduce their risk of significant losses. We encourage readers to share their thoughts and experiences with investing in small companies, and to consider the potential benefits and risks of this type of investing. Whether you are a seasoned investor or just starting out, investing in small companies can be a rewarding and profitable venture, providing you with the potential to achieve your financial goals and objectives.