Intro

Discover the difference between Lifo and Fifo accounting methods, including inventory valuation, cost flow, and tax implications, to optimize your financial reporting and management with these key accounting techniques.

The accounting world is filled with various methods and techniques that help businesses and organizations manage their finances effectively. Two of the most commonly used accounting methods are LIFO (Last-In, First-Out) and FIFO (First-In, First-Out). These methods are used to value inventory and determine the cost of goods sold. In this article, we will delve into the world of LIFO and FIFO accounting methods, exploring their differences, benefits, and drawbacks.

The importance of choosing the right accounting method cannot be overstated. It can have a significant impact on a company's financial statements, tax liabilities, and overall profitability. LIFO and FIFO accounting methods are used in various industries, including retail, manufacturing, and wholesale. Understanding the differences between these methods is crucial for businesses to make informed decisions about their inventory management and financial reporting.

The LIFO and FIFO accounting methods have been widely used for decades, and each has its own set of advantages and disadvantages. The choice between LIFO and FIFO depends on various factors, including the type of business, industry, and economic conditions. In the following sections, we will explore the LIFO and FIFO accounting methods in detail, including their definitions, examples, and implications for businesses.

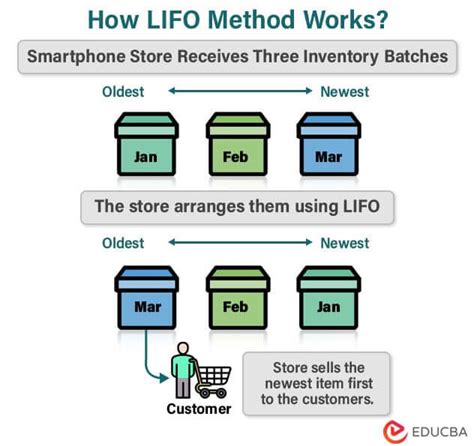

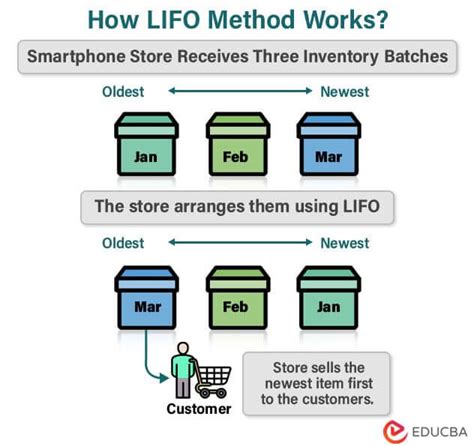

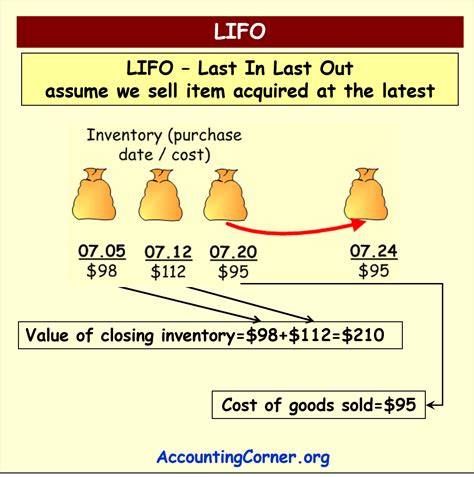

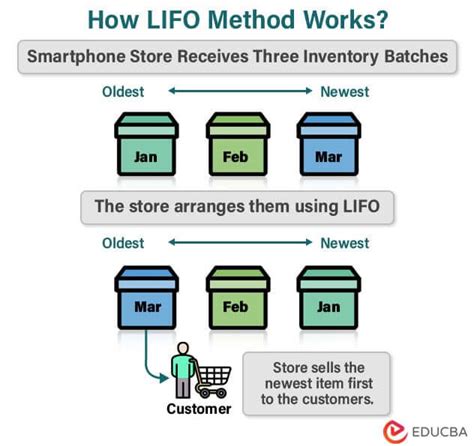

Introduction to LIFO Accounting Method

The LIFO accounting method assumes that the most recent inventory items are sold first. This means that the last items purchased or produced are the first ones to be sold. The LIFO method is commonly used in industries where inventory is constantly being updated, such as retail and technology. The main advantage of the LIFO method is that it matches the current cost of inventory with the current revenue, providing a more accurate picture of a company's profitability.

For example, suppose a company purchases 100 units of inventory at $10 each in January and another 100 units at $12 each in February. If the company sells 100 units in March, the LIFO method would assume that the units sold were the ones purchased in February at $12 each. This means that the cost of goods sold would be $1,200 (100 units x $12 each).

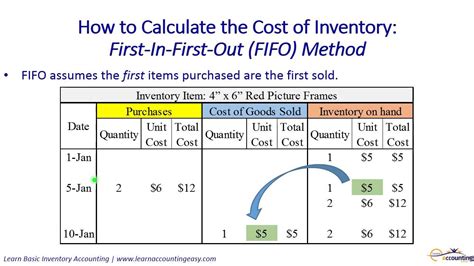

Introduction to FIFO Accounting Method

The FIFO accounting method, on the other hand, assumes that the oldest inventory items are sold first. This means that the first items purchased or produced are the first ones to be sold. The FIFO method is commonly used in industries where inventory is not constantly being updated, such as manufacturing and wholesale. The main advantage of the FIFO method is that it provides a more accurate picture of a company's inventory levels and costs.

Using the same example as above, if the company sells 100 units in March, the FIFO method would assume that the units sold were the ones purchased in January at $10 each. This means that the cost of goods sold would be $1,000 (100 units x $10 each).

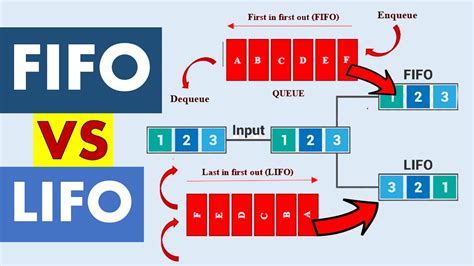

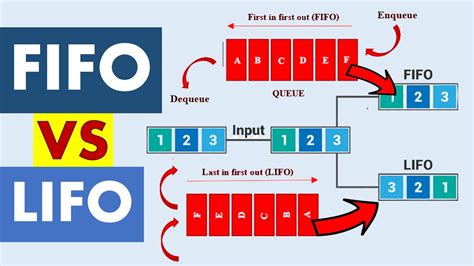

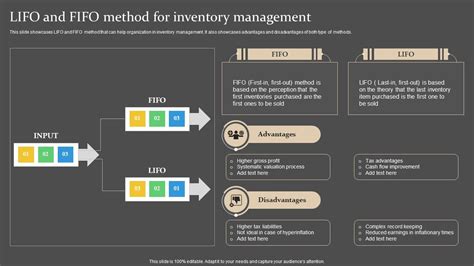

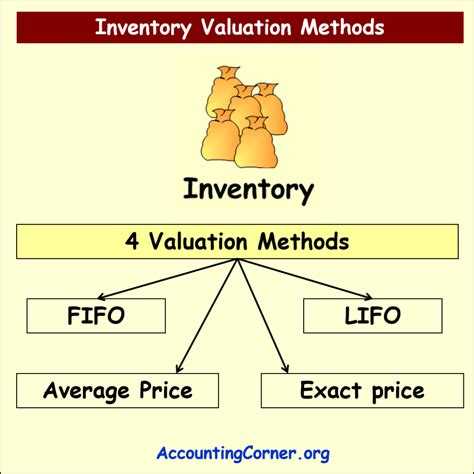

Comparison of LIFO and FIFO Accounting Methods

The LIFO and FIFO accounting methods have different implications for businesses. The LIFO method can result in higher cost of goods sold and lower profitability during periods of rising prices, while the FIFO method can result in lower cost of goods sold and higher profitability during periods of rising prices. The choice between LIFO and FIFO depends on various factors, including the type of business, industry, and economic conditions.

Here are some key differences between LIFO and FIFO accounting methods:

- Cost of Goods Sold: LIFO results in higher cost of goods sold, while FIFO results in lower cost of goods sold.

- Profitability: LIFO results in lower profitability, while FIFO results in higher profitability.

- Inventory Valuation: LIFO values inventory at the most recent cost, while FIFO values inventory at the oldest cost.

- Tax Implications: LIFO can result in higher tax liabilities, while FIFO can result in lower tax liabilities.

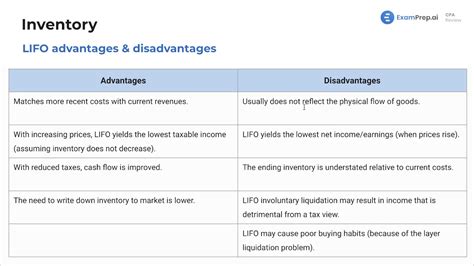

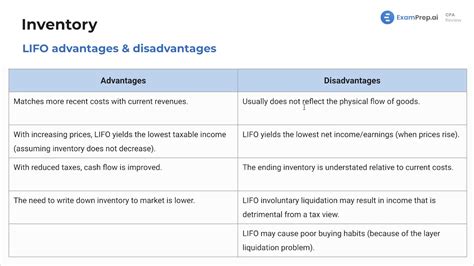

Benefits and Drawbacks of LIFO Accounting Method

The LIFO accounting method has several benefits, including:

- Matching Current Costs with Current Revenue: LIFO matches the current cost of inventory with the current revenue, providing a more accurate picture of a company's profitability.

- Reducing Tax Liabilities: LIFO can result in lower tax liabilities during periods of rising prices.

- Simplifying Inventory Management: LIFO can simplify inventory management by assuming that the most recent inventory items are sold first.

However, the LIFO accounting method also has some drawbacks, including:

- Inaccurate Inventory Valuation: LIFO can result in inaccurate inventory valuation, as the most recent cost of inventory may not reflect the actual cost of the inventory sold.

- Higher Cost of Goods Sold: LIFO can result in higher cost of goods sold, which can reduce a company's profitability.

- Complexity: LIFO can be complex to implement and maintain, especially for companies with large and diverse inventory.

Benefits and Drawbacks of FIFO Accounting Method

The FIFO accounting method has several benefits, including:

- Accurate Inventory Valuation: FIFO provides an accurate picture of a company's inventory levels and costs.

- Lower Cost of Goods Sold: FIFO can result in lower cost of goods sold, which can increase a company's profitability.

- Simplifying Financial Reporting: FIFO can simplify financial reporting by assuming that the oldest inventory items are sold first.

However, the FIFO accounting method also has some drawbacks, including:

- Not Matching Current Costs with Current Revenue: FIFO does not match the current cost of inventory with the current revenue, which can provide an inaccurate picture of a company's profitability.

- Higher Tax Liabilities: FIFO can result in higher tax liabilities during periods of rising prices.

- Complexity: FIFO can be complex to implement and maintain, especially for companies with large and diverse inventory.

Real-World Examples of LIFO and FIFO Accounting Methods

The LIFO and FIFO accounting methods are used in various industries, including retail, manufacturing, and wholesale. Here are some real-world examples of companies that use LIFO and FIFO accounting methods:

- Retail Industry: Companies like Walmart and Target use the LIFO accounting method to value their inventory.

- Manufacturing Industry: Companies like Ford and General Motors use the FIFO accounting method to value their inventory.

- Wholesale Industry: Companies like Costco and Sam's Club use the FIFO accounting method to value their inventory.

Gallery of LIFO and FIFO Images

LIFO and FIFO Image Gallery

Frequently Asked Questions

What is the main difference between LIFO and FIFO accounting methods?

+The main difference between LIFO and FIFO accounting methods is the assumption about the order in which inventory items are sold. LIFO assumes that the most recent inventory items are sold first, while FIFO assumes that the oldest inventory items are sold first.

Which accounting method is more commonly used in the retail industry?

+The LIFO accounting method is more commonly used in the retail industry, as it matches the current cost of inventory with the current revenue.

What are the benefits of using the FIFO accounting method?

+The benefits of using the FIFO accounting method include accurate inventory valuation, lower cost of goods sold, and simplified financial reporting.

Can companies use both LIFO and FIFO accounting methods?

+Yes, companies can use both LIFO and FIFO accounting methods, depending on the type of inventory and the industry. However, it is recommended to use one method consistently to avoid confusion and ensure accuracy.

How do LIFO and FIFO accounting methods affect tax liabilities?

+LIFO can result in lower tax liabilities during periods of rising prices, while FIFO can result in higher tax liabilities during periods of rising prices.

In conclusion, the LIFO and FIFO accounting methods are two commonly used methods for valuing inventory and determining the cost of goods sold. While both methods have their benefits and drawbacks, the choice between LIFO and FIFO depends on various factors, including the type of business, industry, and economic conditions. By understanding the differences between LIFO and FIFO accounting methods, businesses can make informed decisions about their inventory management and financial reporting. We encourage readers to share their thoughts and experiences with LIFO and FIFO accounting methods in the comments section below. Additionally, we invite readers to share this article with others who may benefit from understanding the differences between LIFO and FIFO accounting methods.