Intro

Discover 5 ways merchant payment processing enhances transactions with secure payment gateways, online payment systems, and credit card processing, boosting sales and customer experience through efficient payment solutions and merchant services.

The world of commerce has undergone a significant transformation with the advent of digital payment systems. As technology continues to evolve, businesses are presented with a multitude of options for processing payments. For merchants, understanding the various payment processing methods is crucial for providing a seamless and secure transaction experience for their customers. In this article, we will delve into the importance of merchant payment processing and explore five key ways it can be facilitated.

Merchant payment processing is the backbone of any business that accepts payments from customers. It involves a complex network of financial institutions, payment gateways, and processing systems that work together to authorize and settle transactions. The efficiency and security of payment processing can make or break a business, as customers expect fast, reliable, and secure transactions. With the rise of e-commerce and digital payments, merchants must adapt to the changing landscape and offer a variety of payment options to stay competitive.

The benefits of efficient payment processing are numerous. It can lead to increased customer satisfaction, reduced cart abandonment rates, and improved sales. Moreover, a well-implemented payment processing system can help merchants to reduce the risk of fraud, minimize chargebacks, and optimize their revenue streams. As the payment landscape continues to evolve, merchants must stay informed about the latest trends and technologies to remain ahead of the curve.

Introduction to Merchant Payment Processing

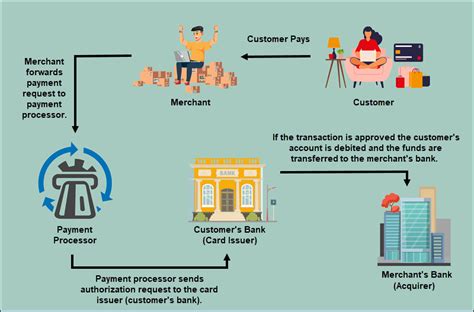

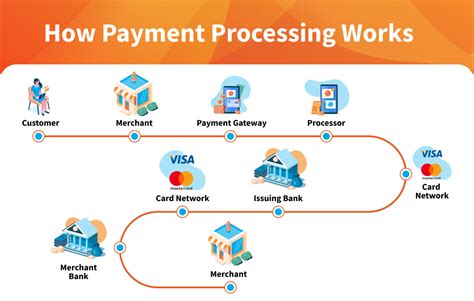

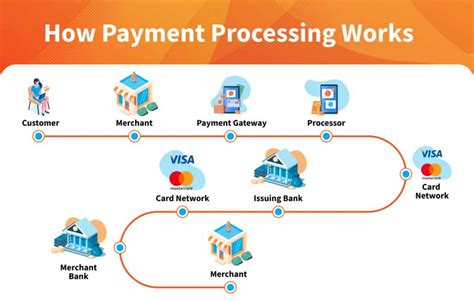

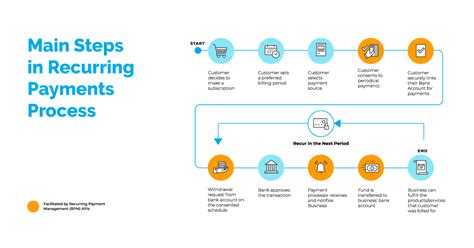

Merchant payment processing involves several key stakeholders, including the merchant, the customer, the payment gateway, and the acquiring bank. The process begins when a customer initiates a transaction, either online or in-store. The payment information is then transmitted to the payment gateway, which forwards it to the acquiring bank for authorization. If the transaction is approved, the funds are settled into the merchant's account, and the customer receives a confirmation of the payment.

Key Players in Merchant Payment Processing

The key players in merchant payment processing include: * Merchants: The businesses that accept payments from customers. * Customers: The individuals or organizations that make payments to merchants. * Payment Gateways: The platforms that facilitate the transmission of payment information between the merchant and the acquiring bank. * Acquiring Banks: The financial institutions that hold the merchant's account and facilitate the settlement of transactions. * Issuing Banks: The financial institutions that issue credit or debit cards to customers.5 Ways Merchant Payment Processing Can Be Facilitated

There are several ways that merchant payment processing can be facilitated. These include:

- Online Payment Gateways: Online payment gateways, such as PayPal or Stripe, provide merchants with a secure and efficient way to process transactions. These gateways can be integrated into e-commerce websites or mobile apps, allowing customers to make payments quickly and easily.

- Point-of-Sale (POS) Systems: POS systems, such as those provided by Square or Clover, enable merchants to process transactions in-store. These systems typically include a card reader, a receipt printer, and a cash drawer, and can be integrated with inventory management and accounting software.

- Mobile Payment Processing: Mobile payment processing, such as Apple Pay or Google Pay, allows customers to make payments using their mobile devices. These payments are typically facilitated through a digital wallet, which stores the customer's payment information and provides a secure and convenient way to make transactions.

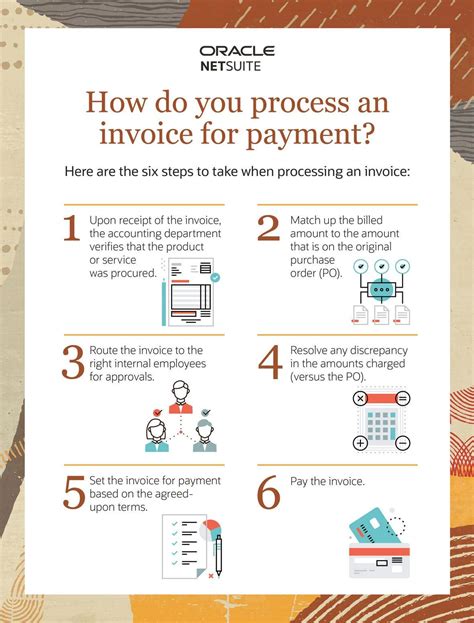

- Invoice Payment Processing: Invoice payment processing, such as that provided by Bill.com or FreshBooks, enables merchants to send invoices to customers and accept payments online. These systems can be integrated with accounting software, allowing merchants to track payments and manage their cash flow.

- Recurring Payment Processing: Recurring payment processing, such as that provided by Recurly or Chargify, enables merchants to accept recurring payments from customers. These payments can be facilitated through a subscription-based model, where customers are charged a fixed amount on a regular basis.

Benefits of Efficient Payment Processing

The benefits of efficient payment processing are numerous. These include: * Increased customer satisfaction: Efficient payment processing can lead to increased customer satisfaction, as customers expect fast and reliable transactions. * Reduced cart abandonment rates: Efficient payment processing can reduce cart abandonment rates, as customers are less likely to abandon their purchases due to slow or unreliable payment processing. * Improved sales: Efficient payment processing can improve sales, as customers are more likely to make purchases when the payment process is fast and reliable. * Reduced risk of fraud: Efficient payment processing can reduce the risk of fraud, as payment gateways and processing systems can detect and prevent suspicious transactions. * Minimized chargebacks: Efficient payment processing can minimize chargebacks, as payment gateways and processing systems can provide merchants with the tools and resources they need to manage disputes and resolve issues.Security Measures for Merchant Payment Processing

Security is a critical component of merchant payment processing. Merchants must ensure that their payment processing systems are secure and compliant with industry standards, such as the Payment Card Industry Data Security Standard (PCI DSS). This can be achieved through the implementation of various security measures, including:

- Encryption: Encryption is the process of converting sensitive data into a secure code that can only be deciphered by authorized parties.

- Tokenization: Tokenization is the process of replacing sensitive data with a unique token or symbol that can be used to reference the original data.

- Secure Sockets Layer (SSL) certificates: SSL certificates are used to establish a secure connection between the merchant's website and the customer's browser.

- Regular security updates and patches: Regular security updates and patches can help to prevent vulnerabilities and protect against cyber threats.

Best Practices for Merchant Payment Processing

There are several best practices that merchants can follow to ensure efficient and secure payment processing. These include: * Providing clear and transparent payment information to customers * Offering a variety of payment options to customers * Ensuring that payment processing systems are secure and compliant with industry standards * Providing excellent customer service and support * Regularly reviewing and updating payment processing systems to ensure they are efficient and secureFuture of Merchant Payment Processing

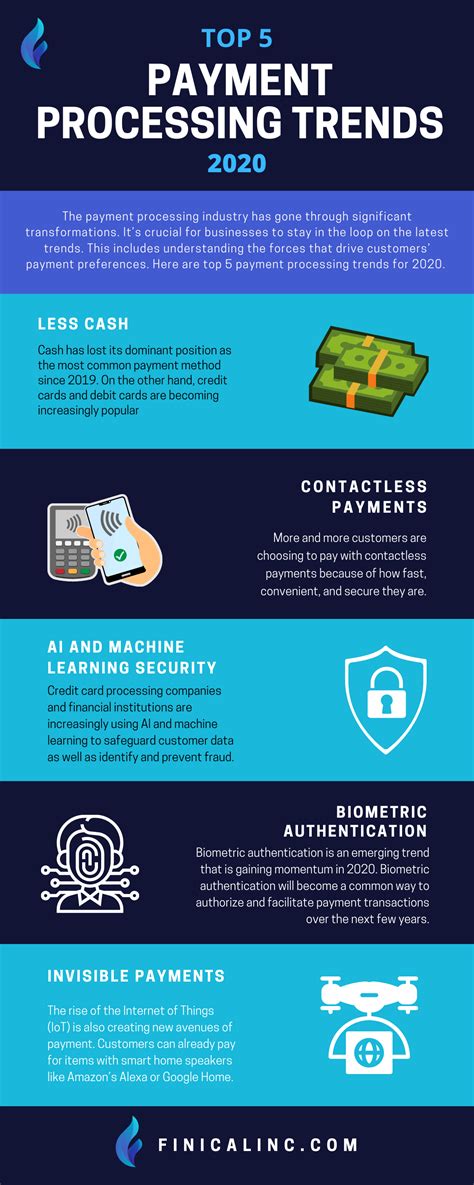

The future of merchant payment processing is exciting and rapidly evolving. Emerging technologies, such as blockchain and artificial intelligence, are expected to play a significant role in shaping the payment landscape. Additionally, the rise of mobile payments and contactless transactions is expected to continue, providing customers with even more convenient and secure ways to make payments.

Trends in Merchant Payment Processing

There are several trends that are expected to shape the future of merchant payment processing. These include: * Increased use of mobile payments and contactless transactions * Greater adoption of emerging technologies, such as blockchain and artificial intelligence * Increased focus on security and compliance * Greater emphasis on providing excellent customer service and support * Increased use of data analytics and machine learning to optimize payment processing and reduce riskGallery of Merchant Payment Processing

Merchant Payment Processing Image Gallery

Frequently Asked Questions

What is merchant payment processing?

+Merchant payment processing refers to the process of facilitating transactions between a merchant and a customer. It involves a complex network of financial institutions, payment gateways, and processing systems that work together to authorize and settle transactions.

What are the benefits of efficient payment processing?

+The benefits of efficient payment processing include increased customer satisfaction, reduced cart abandonment rates, improved sales, reduced risk of fraud, and minimized chargebacks.

What are the key players in merchant payment processing?

+The key players in merchant payment processing include merchants, customers, payment gateways, acquiring banks, and issuing banks.

What are the security measures for merchant payment processing?

+The security measures for merchant payment processing include encryption, tokenization, secure sockets layer (SSL) certificates, and regular security updates and patches.

What is the future of merchant payment processing?

+The future of merchant payment processing is expected to be shaped by emerging technologies, such as blockchain and artificial intelligence, and trends, such as increased use of mobile payments and contactless transactions.

In conclusion, merchant payment processing is a critical component of any business that accepts payments from customers. By understanding the various payment processing methods and implementing efficient and secure payment processing systems, merchants can provide a seamless and secure transaction experience for their customers. As the payment landscape continues to evolve, it is essential for merchants to stay informed about the latest trends and technologies to remain ahead of the curve. We invite you to share your thoughts and experiences with merchant payment processing in the comments section below. Additionally, if you found this article informative, please share it with your network to help others understand the importance of efficient payment processing.