Intro

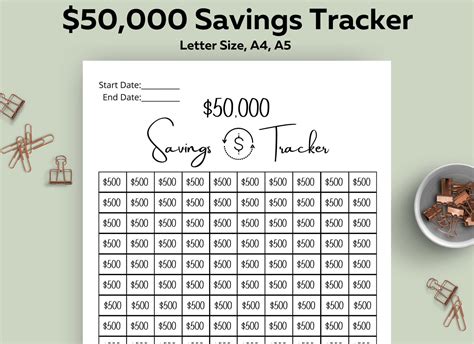

Get a free money saving chart printable to track expenses, create a budget, and reach financial goals with customizable templates and budgeting tools for effective money management.

Saving money is an essential aspect of personal finance, and having a clear plan can make all the difference. With the rise of digital tools and apps, it's easy to get caught up in complex budgeting systems. However, sometimes, going back to basics with a simple, visual aid like a money saving chart can be incredibly effective. In this article, we'll explore the benefits of using a free money saving chart printable, how it works, and provide tips on how to get the most out of it.

Creating a budget and tracking expenses can be a daunting task, especially for those who are new to managing their finances. A money saving chart provides a straightforward and easy-to-understand way to visualize your progress, making it an excellent tool for anyone looking to save money. Whether you're trying to pay off debt, build an emergency fund, or work towards a long-term goal, a money saving chart can help you stay focused and motivated.

The concept of a money saving chart is simple: it's a physical or digital chart that allows you to track your progress towards a specific financial goal. By breaking down your goal into smaller, manageable increments, you can see how far you've come and how much farther you need to go. This visual representation of your progress can be a powerful motivator, helping you stay on track and avoid dipping into your savings.

Benefits of Using a Money Saving Chart

Using a money saving chart offers several benefits, including increased motivation, improved tracking, and enhanced visualization. By seeing your progress, you'll be more likely to stick to your budget and make adjustments as needed. A money saving chart also helps you identify areas where you can cut back on unnecessary expenses, allowing you to allocate that money towards your savings goals.

Some of the key benefits of using a money saving chart include:

- Increased motivation: Seeing your progress can be a powerful motivator, helping you stay on track and avoid dipping into your savings.

- Improved tracking: A money saving chart provides a clear and concise way to track your progress, making it easier to identify areas where you need to make adjustments.

- Enhanced visualization: By breaking down your goal into smaller increments, you can see how far you've come and how much farther you need to go.

- Simplified budgeting: A money saving chart can be a simple and effective way to manage your finances, without the need for complex budgeting software or apps.

How to Use a Money Saving Chart

Using a money saving chart is straightforward. Here are the steps to get started:

- Set a specific financial goal: Determine what you want to save for, whether it's a short-term goal like a vacation or a long-term goal like a down payment on a house.

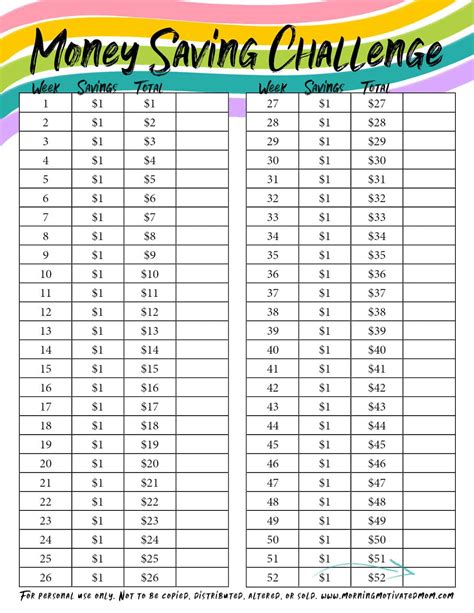

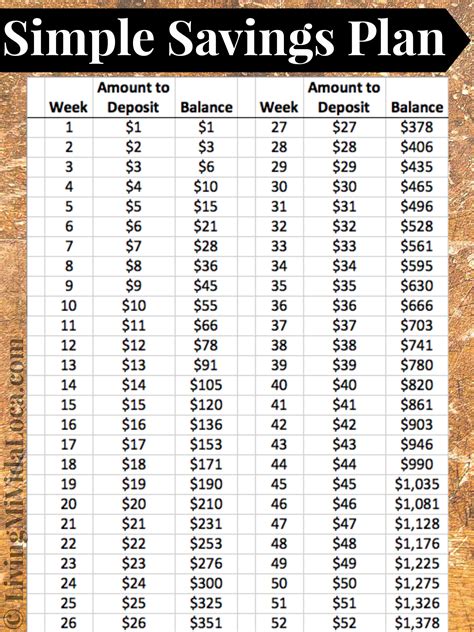

- Break down your goal into smaller increments: Divide your goal into smaller, manageable chunks, such as weekly or monthly savings targets.

- Create a chart: You can use a physical chart or a digital tool to create your money saving chart. Be sure to include the following elements:

- A title or header that indicates what you're saving for

- A series of boxes or increments that represent your progress

- A way to track your progress, such as a checkbox or a fill-in-the-blank space

- Track your progress: Each time you make a deposit into your savings account, fill in the corresponding box or increment on your chart.

- Review and adjust: Regularly review your progress and make adjustments as needed. If you find that you're consistently missing your targets, you may need to reassess your budget and make changes.

Types of Money Saving Charts

There are several types of money saving charts available, each with its own unique features and benefits. Some popular options include:

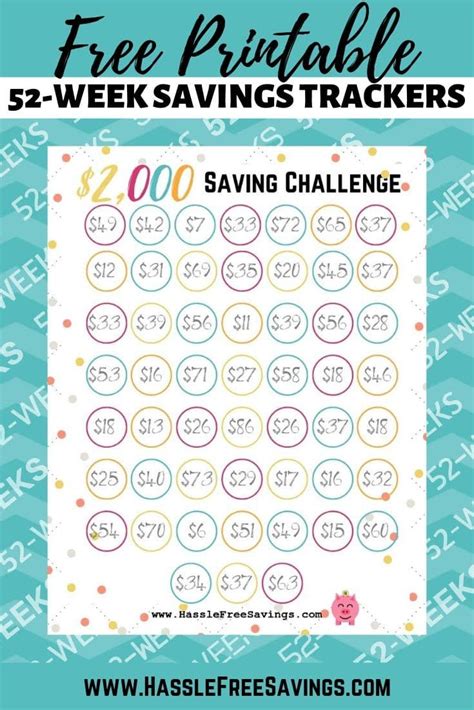

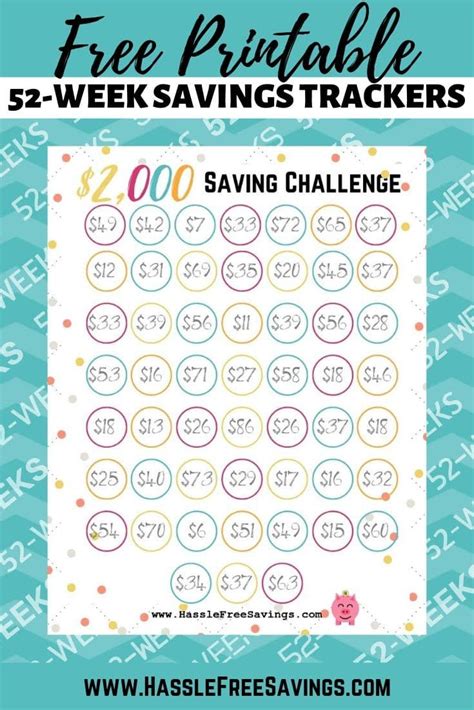

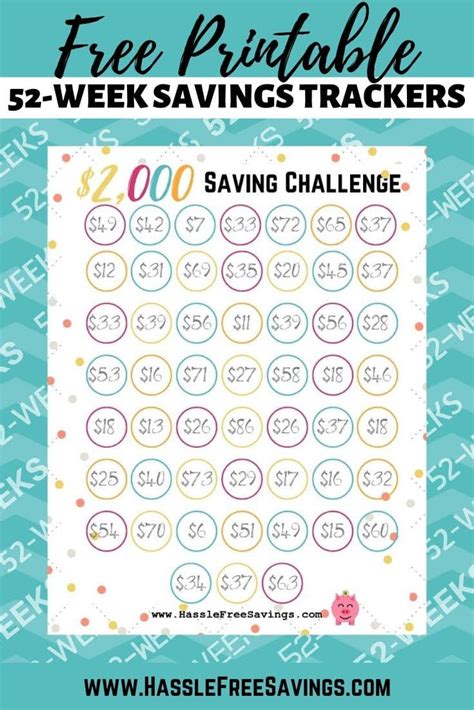

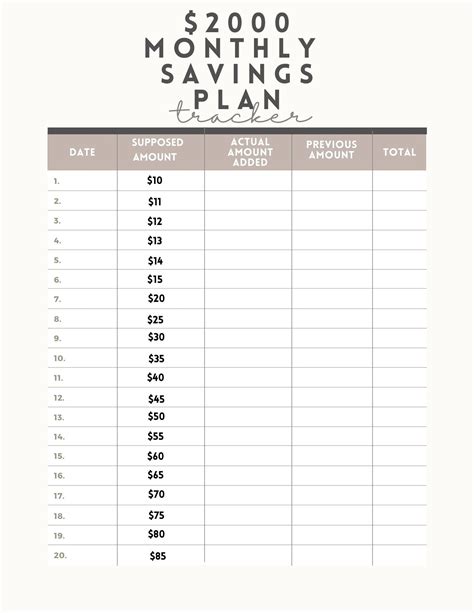

- Weekly savings charts: These charts are designed to help you track your progress on a weekly basis, with a focus on short-term goals.

- Monthly savings charts: These charts provide a longer-term view, helping you track your progress over the course of a month.

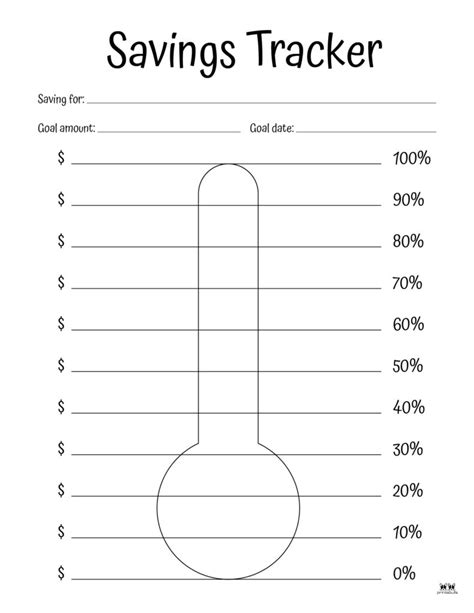

- Thermometer charts: These charts use a thermometer-like design to track your progress, with the goal of "filling up" the thermometer as you reach your target.

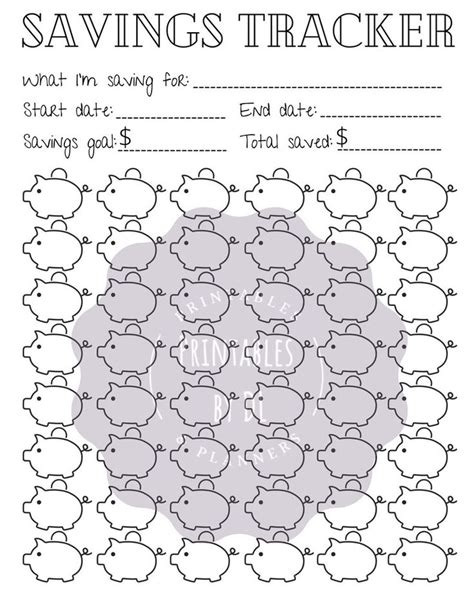

- Piggy bank charts: These charts use a piggy bank design to track your progress, with each deposit represented by a coin or bill being added to the piggy bank.

Tips for Using a Money Saving Chart

Here are some tips to help you get the most out of your money saving chart:

- Make it visible: Place your chart in a prominent location, such as on your fridge or near your computer, to help you stay motivated and focused.

- Make it fun: Consider adding colorful markers or stickers to your chart to make it more engaging and fun to use.

- Make it a habit: Try to make tracking your progress a regular habit, such as weekly or monthly, to help you stay on track.

- Be consistent: Consistency is key when it comes to using a money saving chart. Try to make deposits at the same time each week or month to help you stay on track.

Common Mistakes to Avoid

While using a money saving chart can be an effective way to manage your finances, there are some common mistakes to avoid:

- Not setting a specific goal: Without a clear goal in mind, it can be difficult to stay motivated and focused.

- Not tracking progress regularly: Failing to track your progress regularly can make it difficult to stay on track and make adjustments as needed.

- Not being consistent: Consistency is key when it comes to using a money saving chart. Try to make deposits at the same time each week or month to help you stay on track.

- Not reviewing and adjusting: Regularly reviewing your progress and making adjustments as needed can help you stay on track and avoid plateaus.

Gallery of Money Saving Charts

Money Saving Chart Image Gallery

Frequently Asked Questions

What is a money saving chart?

+A money saving chart is a visual tool used to track progress towards a specific financial goal. It helps individuals stay motivated and focused on their savings targets.

How do I create a money saving chart?

+To create a money saving chart, determine your financial goal, break it down into smaller increments, and create a chart with boxes or increments to track your progress.

What are the benefits of using a money saving chart?

+The benefits of using a money saving chart include increased motivation, improved tracking, and enhanced visualization of progress towards your financial goals.

Can I use a digital money saving chart?

+Yes, you can use a digital money saving chart. There are many online tools and apps available that offer digital money saving charts and trackers.

How often should I review my money saving chart?

+It's recommended to review your money saving chart regularly, such as weekly or monthly, to track your progress and make adjustments as needed.

In