Intro

Discover 5 NYC restaurant tax tips, including sales tax, income tax, and payroll tax strategies to minimize liability and maximize savings for New York City eateries and food establishments.

Eating out in New York City can be a thrilling experience, with its diverse range of cuisines and dining options. However, navigating the tax implications of running a restaurant in the city can be complex and overwhelming. As a restaurant owner or manager, it's essential to understand the tax laws and regulations that apply to your business to avoid penalties and ensure compliance. In this article, we'll explore five NYC restaurant tax tips to help you optimize your tax strategy and minimize your tax liability.

The restaurant industry is a significant contributor to New York City's economy, with thousands of establishments employing millions of people. However, the city's tax environment can be challenging, with multiple layers of taxation and complex regulations. To succeed in this environment, restaurant owners and managers need to stay up-to-date on the latest tax developments and plan carefully to minimize their tax burden. By following these five NYC restaurant tax tips, you can ensure that your restaurant is in compliance with all tax laws and regulations, and that you're taking advantage of all the tax savings available to you.

New York City's tax laws and regulations are constantly evolving, with new rules and amendments being introduced regularly. To stay ahead of the curve, restaurant owners and managers need to be proactive and seek out professional advice from experienced tax consultants. By working with a tax expert, you can ensure that your restaurant is in compliance with all tax laws and regulations, and that you're taking advantage of all the tax savings available to you. Whether you're a seasoned restaurant owner or just starting out, these five NYC restaurant tax tips will provide you with the knowledge and insights you need to succeed in the city's competitive dining scene.

Understanding NYC Restaurant Taxes

One of the most important things to understand about NYC restaurant taxes is the concept of nexus. Nexus refers to the connection between a business and a taxing jurisdiction, such as a state or city. In New York City, a restaurant is considered to have nexus if it has a physical presence in the city, such as a storefront or a kitchen. If your restaurant has nexus in New York City, you'll be required to collect and remit sales tax on your sales, as well as file income tax returns and pay property tax on your premises.

Tip 1: Take Advantage of Sales Tax Exemptions

Another way to reduce your sales tax liability is to use a sales tax exemption certificate for purchases of food and beverages for resale. If you're a restaurant owner or manager, you can use a sales tax exemption certificate to purchase food and beverages without paying sales tax. This can help reduce your costs and increase your profit margins. However, it's essential to ensure that you're using the exemption certificate correctly and that you're keeping accurate records of your purchases.

Tip 2: Claim the NYC Restaurant Tax Credit

The NYC restaurant tax credit can provide significant tax savings for eligible restaurants. The credit is calculated as a percentage of the restaurant's tax liability, and it can be claimed for up to five years. To maximize your tax savings, it's essential to ensure that you're claiming the credit correctly and that you're keeping accurate records of your tax liability.

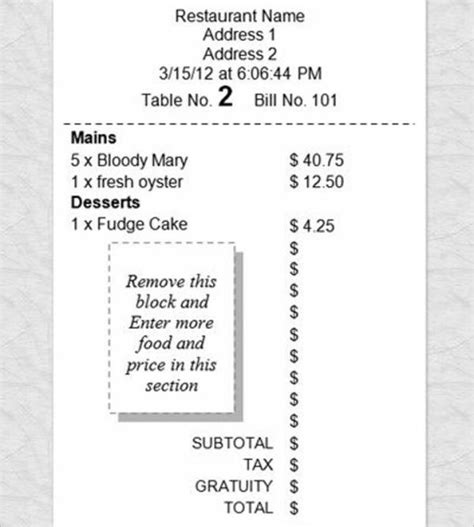

Tip 3: Keep Accurate Records of Tips and Gratuities

To keep accurate records of tips and gratuities, you can use a tip tracking system or a point-of-sale system that includes a tip tracking feature. These systems can help you track tips and gratuities in real-time, and they can also provide detailed reports and analytics to help you manage your tip income.

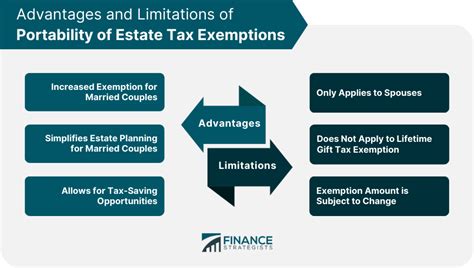

Tip 4: Take Advantage of Property Tax Exemptions

To take advantage of property tax exemptions, you'll need to apply for an exemption with the New York City Department of Finance. You'll need to provide documentation to support your application, including proof of ownership and proof of eligibility. If your application is approved, you'll be exempt from paying property tax on your premises, which can help reduce your costs and increase your profit margins.

Tip 5: Consult with a Tax Professional

A tax professional can provide you with expert advice and guidance on all aspects of tax planning and compliance, including sales tax, income tax, and property tax. They can help you identify areas where you can reduce your tax liability, and they can provide you with strategies and solutions to help you achieve your tax goals. Whether you're a seasoned restaurant owner or just starting out, consulting with a tax professional can help you succeed in the competitive NYC dining scene.

Gallery of NYC Restaurant Tax Tips

NYC Restaurant Tax Tips Image Gallery

What are the most common tax mistakes made by restaurant owners in NYC?

+The most common tax mistakes made by restaurant owners in NYC include failing to collect and remit sales tax, failing to keep accurate records of tips and gratuities, and failing to take advantage of available tax credits and exemptions.

How can I reduce my restaurant's tax liability in NYC?

+To reduce your restaurant's tax liability in NYC, you can take advantage of available tax credits and exemptions, keep accurate records of tips and gratuities, and consult with a tax professional to ensure that you're in compliance with all tax laws and regulations.

What are the penalties for failing to comply with NYC tax laws and regulations?

+The penalties for failing to comply with NYC tax laws and regulations can be significant, including fines, penalties, and even criminal prosecution. To avoid these penalties, it's essential to consult with a tax professional and ensure that you're in compliance with all tax laws and regulations.

How can I stay up-to-date on changes to NYC tax laws and regulations?

+To stay up-to-date on changes to NYC tax laws and regulations, you can consult with a tax professional, attend seminars and workshops, and subscribe to tax newsletters and publications.

What are the benefits of consulting with a tax professional for my NYC restaurant?

+The benefits of consulting with a tax professional for your NYC restaurant include ensuring compliance with all tax laws and regulations, reducing your tax liability, and taking advantage of available tax credits and exemptions.

In conclusion, navigating the complex tax laws and regulations in New York City can be challenging, even for experienced restaurant owners and managers. By following these five NYC restaurant tax tips, you can ensure that you're in compliance with all tax laws and regulations, and that you're taking advantage of all the tax savings available to you. Whether you're a seasoned restaurant owner or just starting out, consulting with a tax professional can help you succeed in the competitive NYC dining scene. We encourage you to share your thoughts and experiences with tax planning for restaurants in the comments below, and to share this article with anyone who may benefit from these valuable tax tips.