Intro

Discover PCI compliance meaning, ensuring secure payment processing with PCI DSS standards, data protection, and fraud prevention for businesses, merchants, and online transactions.

Payment Card Industry (PCI) compliance is a set of security standards designed to ensure that companies that handle credit card information maintain a secure environment for the protection of cardholder data. The PCI Security Standards Council, a coalition of major payment card brands including Visa, Mastercard, and American Express, established these standards to prevent data breaches and fraud. PCI compliance is crucial for any business that accepts, processes, stores, or transmits credit card information, as it helps to safeguard sensitive customer data and protect against financial losses.

The importance of PCI compliance cannot be overstated, as the consequences of non-compliance can be severe. Businesses that fail to meet PCI standards may face significant fines, penalties, and even the loss of their ability to accept credit card payments. Moreover, data breaches can damage a company's reputation and erode customer trust, leading to long-term financial and reputational harm. By achieving and maintaining PCI compliance, businesses can demonstrate their commitment to protecting customer data and maintaining the trust of their clients.

In today's digital age, the risk of data breaches and cyber attacks is higher than ever, making PCI compliance a critical aspect of any business that handles credit card information. As technology continues to evolve and new threats emerge, the PCI Security Standards Council regularly updates its standards to ensure that businesses have the necessary tools and guidelines to protect against these threats. By staying informed about the latest PCI compliance requirements and implementing robust security measures, businesses can minimize the risk of data breaches and maintain a secure environment for their customers' sensitive information.

What is PCI Compliance?

PCI compliance refers to the adherence to a set of security standards and guidelines established by the PCI Security Standards Council. These standards are designed to ensure that businesses that handle credit card information maintain a secure environment for the protection of cardholder data. The PCI Data Security Standard (DSS) is the core standard that outlines the requirements for PCI compliance. The DSS consists of 12 requirements that cover various aspects of data security, including network security, password management, and data encryption.

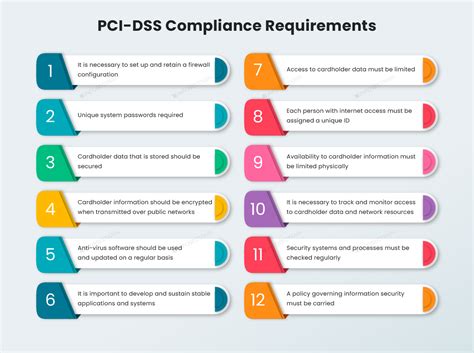

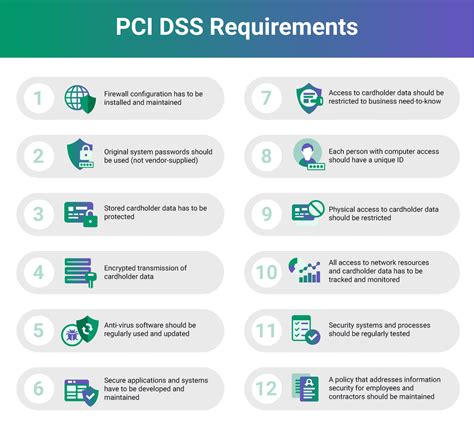

The 12 requirements of the PCI DSS are:

- Install and maintain a firewall configuration to protect cardholder data

- Do not use vendor-supplied defaults for system passwords and other security parameters

- Protect stored cardholder data

- Encrypt transmission of cardholder data across open, public networks

- Use and regularly update antivirus software

- Develop and maintain secure systems and applications

- Restrict access to cardholder data by business need-to-know

- Assign a unique ID to each person with computer access

- Restrict physical access to cardholder data

- Monitor and analyze security logs

- Conduct regular security audits and penetration testing

- Maintain a policy that addresses information security for all personnel

Benefits of PCI Compliance

The benefits of PCI compliance are numerous and significant. By achieving and maintaining PCI compliance, businesses can: * Protect customer data and prevent data breaches * Avoid significant fines and penalties for non-compliance * Maintain the trust of their customers and protect their reputation * Stay ahead of emerging threats and vulnerabilities * Improve their overall security posture and reduce the risk of cyber attacksIn addition to these benefits, PCI compliance can also help businesses to improve their operational efficiency and reduce costs. By implementing robust security measures and maintaining a secure environment, businesses can minimize the risk of data breaches and reduce the need for costly remediation efforts.

How to Achieve PCI Compliance

Achieving PCI compliance requires a comprehensive approach that involves several steps and ongoing efforts. Here are some steps that businesses can take to achieve PCI compliance:

- Conduct a thorough risk assessment to identify vulnerabilities and weaknesses in their systems and processes

- Implement robust security measures, such as firewalls, encryption, and access controls

- Develop and maintain a comprehensive security policy that addresses all aspects of PCI compliance

- Provide regular training and awareness programs for employees and personnel

- Conduct regular security audits and penetration testing to identify and address vulnerabilities

- Maintain accurate and detailed records of security logs and incident response efforts

By following these steps and maintaining a commitment to PCI compliance, businesses can ensure that they are protecting customer data and maintaining a secure environment for credit card transactions.

PCI Compliance Levels

The PCI Security Standards Council has established four levels of compliance, each with its own set of requirements and validation procedures. The levels are based on the volume of credit card transactions that a business processes annually. The levels are: * Level 1: Businesses that process over 6 million credit card transactions annually * Level 2: Businesses that process between 1 million and 6 million credit card transactions annually * Level 3: Businesses that process between 20,000 and 1 million credit card transactions annually * Level 4: Businesses that process fewer than 20,000 credit card transactions annuallyEach level has its own set of requirements and validation procedures, including self-assessment questionnaires, security audits, and penetration testing. Businesses must validate their compliance annually, and the validation procedures may vary depending on the level of compliance.

PCI Compliance Requirements

The PCI DSS outlines 12 requirements that businesses must follow to achieve PCI compliance. These requirements cover various aspects of data security, including network security, password management, and data encryption. Some of the key requirements include:

- Installing and maintaining a firewall configuration to protect cardholder data

- Protecting stored cardholder data through encryption and access controls

- Encrypting transmission of cardholder data across open, public networks

- Using and regularly updating antivirus software

- Developing and maintaining secure systems and applications

- Restricting access to cardholder data by business need-to-know

- Assigning a unique ID to each person with computer access

- Restricting physical access to cardholder data

- Monitoring and analyzing security logs

- Conducting regular security audits and penetration testing

By following these requirements and maintaining a commitment to PCI compliance, businesses can ensure that they are protecting customer data and maintaining a secure environment for credit card transactions.

PCI Compliance and Data Breaches

Data breaches can have devastating consequences for businesses, including significant fines, penalties, and reputational damage. PCI compliance is critical in preventing data breaches and protecting customer data. By achieving and maintaining PCI compliance, businesses can minimize the risk of data breaches and reduce the likelihood of financial and reputational harm.In the event of a data breach, businesses must respond quickly and effectively to contain the breach and prevent further damage. This includes notifying affected customers, conducting a thorough investigation, and implementing additional security measures to prevent future breaches.

PCI Compliance and Cybersecurity

PCI compliance is an essential aspect of cybersecurity, as it helps to protect customer data and prevent data breaches. By achieving and maintaining PCI compliance, businesses can demonstrate their commitment to cybersecurity and protect against financial and reputational harm.

Cybersecurity is a critical concern for businesses, as the risk of cyber attacks and data breaches is higher than ever. By implementing robust security measures and maintaining a secure environment, businesses can minimize the risk of cyber attacks and protect customer data.

PCI Compliance and Cloud Computing

Cloud computing is becoming increasingly popular, as it offers businesses greater flexibility, scalability, and cost savings. However, cloud computing also introduces new security risks and challenges, including the risk of data breaches and cyber attacks.PCI compliance is critical in cloud computing, as it helps to protect customer data and prevent data breaches. By achieving and maintaining PCI compliance, businesses can ensure that their cloud computing environment is secure and protected against cyber threats.

PCI Compliance and Mobile Payments

Mobile payments are becoming increasingly popular, as they offer businesses and consumers greater convenience and flexibility. However, mobile payments also introduce new security risks and challenges, including the risk of data breaches and cyber attacks.

PCI compliance is critical in mobile payments, as it helps to protect customer data and prevent data breaches. By achieving and maintaining PCI compliance, businesses can ensure that their mobile payment environment is secure and protected against cyber threats.

PCI Compliance and E-Commerce

E-commerce is a rapidly growing industry, as it offers businesses and consumers greater convenience and flexibility. However, e-commerce also introduces new security risks and challenges, including the risk of data breaches and cyber attacks.PCI compliance is critical in e-commerce, as it helps to protect customer data and prevent data breaches. By achieving and maintaining PCI compliance, businesses can ensure that their e-commerce environment is secure and protected against cyber threats.

Gallery of PCI Compliance

PCI Compliance Image Gallery

Frequently Asked Questions

What is PCI compliance?

+PCI compliance refers to the adherence to a set of security standards and guidelines established by the PCI Security Standards Council to protect customer data and prevent data breaches.

Why is PCI compliance important?

+PCI compliance is important because it helps to protect customer data and prevent data breaches, which can have devastating consequences for businesses, including significant fines, penalties, and reputational damage.

How do I achieve PCI compliance?

+To achieve PCI compliance, businesses must follow the 12 requirements of the PCI DSS, which include installing and maintaining a firewall configuration, protecting stored cardholder data, and encrypting transmission of cardholder data across open, public networks.

What are the benefits of PCI compliance?

+The benefits of PCI compliance include protecting customer data, preventing data breaches, avoiding significant fines and penalties, and maintaining the trust of customers and protecting reputation.

How often do I need to validate my PCI compliance?

+Businesses must validate their PCI compliance annually, and the validation procedures may vary depending on the level of compliance.

In conclusion, PCI compliance is a critical aspect of any business that handles credit card information. By achieving and maintaining PCI compliance, businesses can protect customer data, prevent data breaches, and avoid significant fines and penalties. We encourage readers to share their thoughts and experiences with PCI compliance in the comments below. Additionally, we invite readers to share this article with others who may benefit from learning about the importance of PCI compliance. By working together, we can promote a culture of security and protect against the growing threat of cyber attacks and data breaches.