Intro

The 2016 printable 1099 form is a crucial document for individuals and businesses to report various types of income to the Internal Revenue Service (IRS). The 1099 form is used to report income that is not subject to withholding, such as freelance work, independent contracting, and self-employment income. In this article, we will delve into the details of the 2016 printable 1099 form, its importance, and how to fill it out correctly.

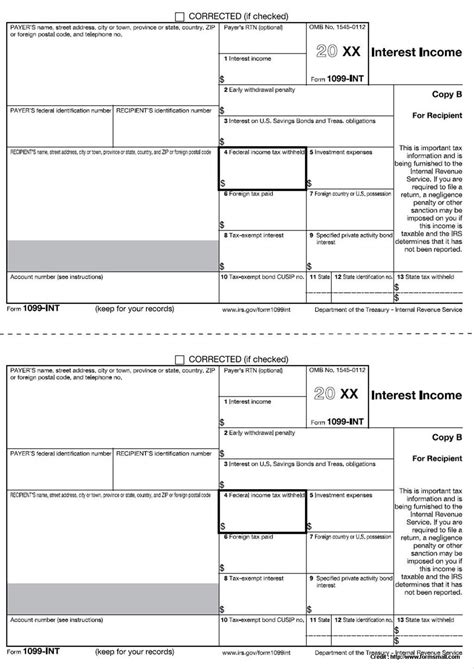

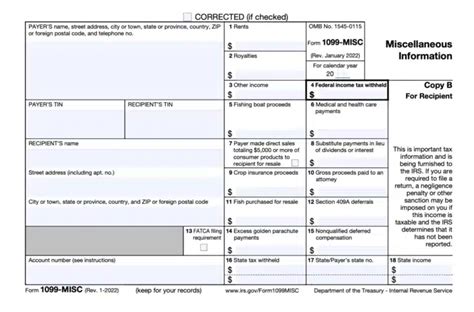

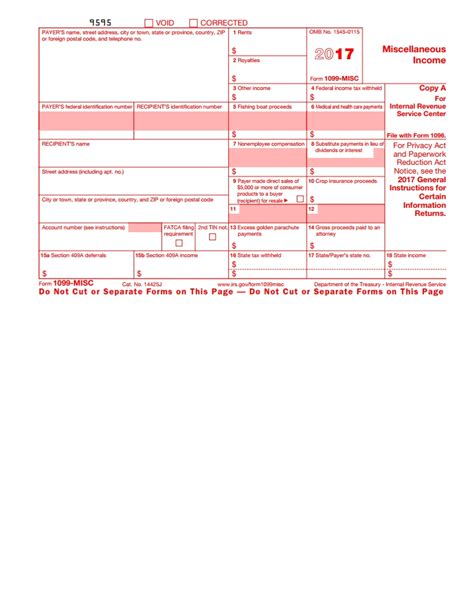

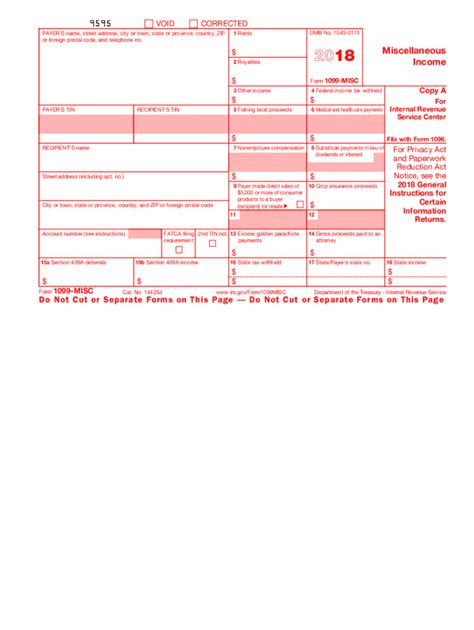

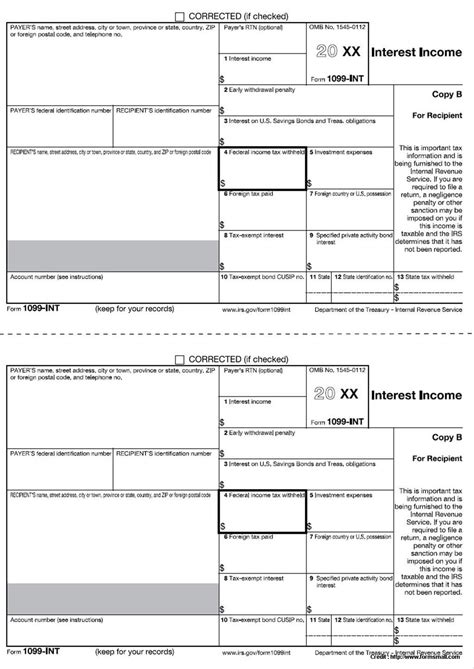

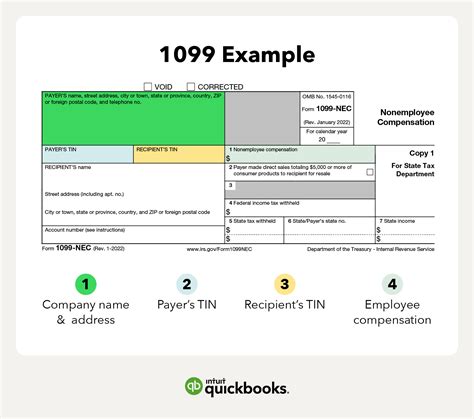

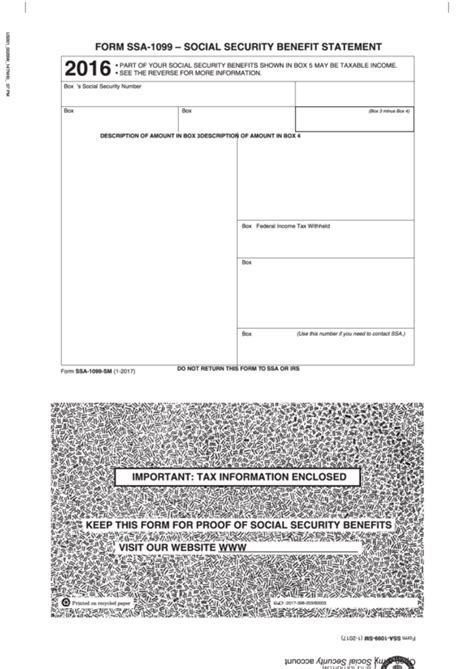

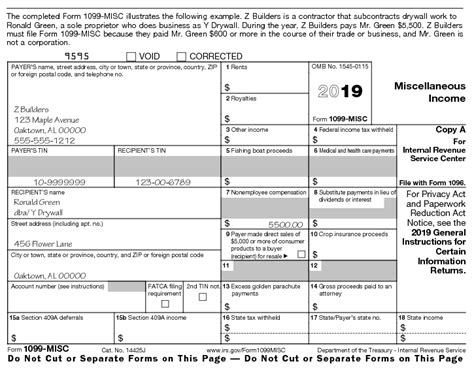

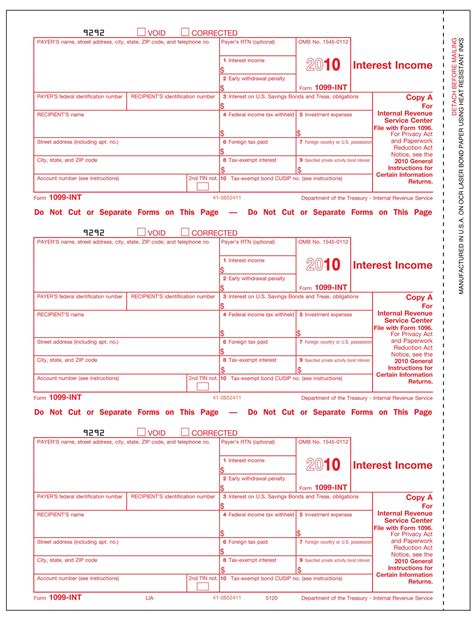

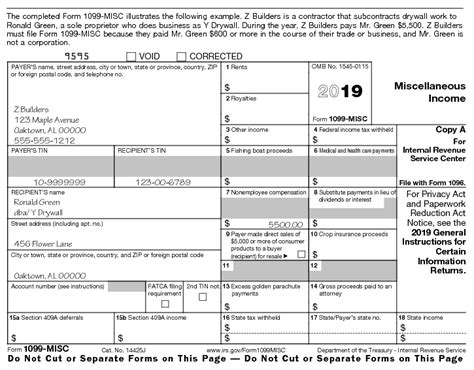

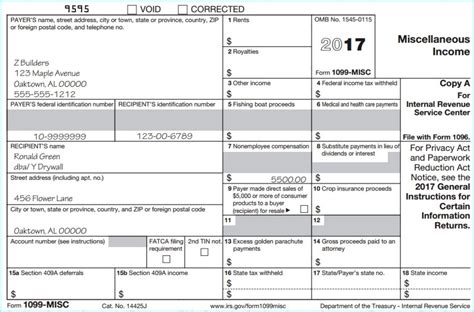

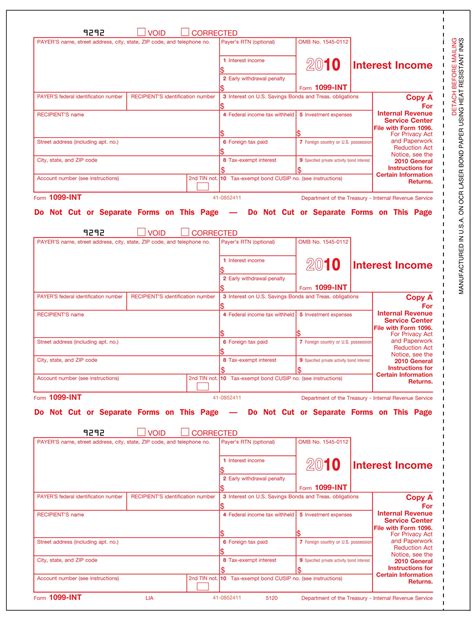

The 1099 form is a series of documents that the IRS uses to track income that is not subject to withholding. There are several types of 1099 forms, including the 1099-MISC, 1099-INT, and 1099-DIV. The 1099-MISC form is the most common type of 1099 form and is used to report miscellaneous income, such as freelance work, independent contracting, and self-employment income. The 1099-INT form is used to report interest income, while the 1099-DIV form is used to report dividend income.

Importance of the 2016 Printable 1099 Form

The 2016 printable 1099 form is also important for the IRS to track income and ensure that individuals and businesses are paying their fair share of taxes. The IRS uses the information reported on the 1099 form to verify the income reported on tax returns and to identify any discrepancies.

Types of 1099 Forms

- 1099-MISC: Used to report miscellaneous income, such as freelance work, independent contracting, and self-employment income.

- 1099-INT: Used to report interest income, such as interest earned on savings accounts and investments.

- 1099-DIV: Used to report dividend income, such as dividends earned on stock investments.

- 1099-B: Used to report proceeds from broker and barter exchange transactions.

- 1099-C: Used to report cancellation of debt income.

How to Fill Out the 2016 Printable 1099 Form

To fill out the 2016 printable 1099 form, you will need to provide the following information: * The payer's name, address, and tax identification number. * The recipient's name, address, and tax identification number. * The type of income being reported. * The amount of income being reported. * Any state or local tax withholding.It is essential to fill out the 2016 printable 1099 form accurately and completely to avoid any errors or discrepancies. The form should be filled out in black ink, and any corrections should be made in a way that is clear and legible.

Benefits of Using the 2016 Printable 1099 Form

- Accuracy: The 2016 printable 1099 form helps to ensure that income is reported accurately to the IRS.

- Convenience: The form can be easily downloaded and printed, making it a convenient option for individuals and businesses.

- Compliance: The 2016 printable 1099 form helps to ensure that individuals and businesses are in compliance with IRS regulations.

- Record-keeping: The form provides a record of income that can be used for tax purposes and other financial records.

Common Mistakes to Avoid When Filling Out the 2016 Printable 1099 Form

- Inaccurate or incomplete information.

- Failure to report all income.

- Incorrect tax identification numbers.

- Failure to provide the form to the recipient by the deadline.

It is essential to avoid these mistakes to ensure that the 2016 printable 1099 form is filled out accurately and completely.

Tips for Filling Out the 2016 Printable 1099 Form

- Use black ink to fill out the form.

- Make sure to fill out the form completely and accurately.

- Use a pen or pencil to make corrections, and make sure they are clear and legible.

- Keep a copy of the form for your records.

- Make sure to provide the form to the recipient by the deadline.

By following these tips, you can ensure that the 2016 printable 1099 form is filled out accurately and completely.

Conclusion and Next Steps

Next steps:

- Download and print the 2016 printable 1099 form.

- Fill out the form accurately and completely.

- Provide the form to the recipient by the deadline.

- Keep a copy of the form for your records.

By taking these next steps, you can ensure that you are in compliance with IRS regulations and that your income is reported accurately.

2016 Printable 1099 Form Image Gallery

What is the purpose of the 2016 printable 1099 form?

+The purpose of the 2016 printable 1099 form is to report various types of income to the IRS, such as freelance work, independent contracting, and self-employment income.

Who is required to fill out the 2016 printable 1099 form?

+The payer is required to fill out the 2016 printable 1099 form and provide it to the recipient by January 31st of each year.

What are the consequences of not filling out the 2016 printable 1099 form correctly?

+The consequences of not filling out the 2016 printable 1099 form correctly can include penalties, fines, and interest on unpaid taxes.

Can I fill out the 2016 printable 1099 form electronically?

+Yes, you can fill out the 2016 printable 1099 form electronically using tax software or by downloading the form from the IRS website.

What is the deadline for providing the 2016 printable 1099 form to the recipient?

+The deadline for providing the 2016 printable 1099 form to the recipient is January 31st of each year.

We hope this article has provided you with a comprehensive understanding of the 2016 printable 1099 form and its importance. If you have any further questions or need assistance with filling out the form, please don't hesitate to reach out. Share this article with others who may find it helpful, and let us know in the comments if you have any other topics you would like us to cover.