Intro

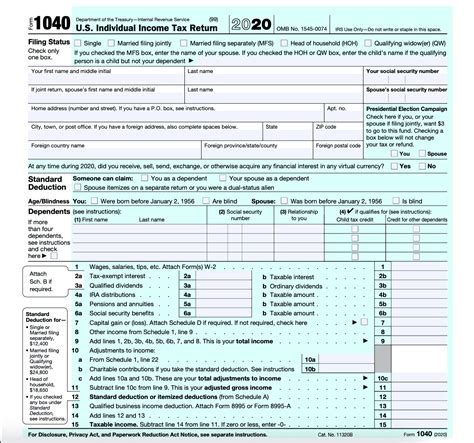

The year 2016 was a significant one for tax filing, with various forms and regulations in place to ensure compliance with the Internal Revenue Service (IRS) guidelines. One of the essential forms for that year was the 1099 series, which is used to report different types of income that are not subject to withholding, such as freelance work, interest, dividends, and more. In this article, we will delve into the world of 2016 1099 printable forms, exploring their importance, the various types available, and how to access and use them.

For individuals and businesses alike, understanding the 1099 forms is crucial for accurate tax reporting. These forms are designed to provide a clear picture of income earned from sources other than employment, helping the IRS to track and verify the income reported on tax returns. The 1099 series includes several forms, each tailored to a specific type of income, making it essential to identify and use the correct form for the relevant income type.

The process of obtaining and filling out 1099 forms has been simplified over the years, with the option to download and print these forms directly from the IRS website or through other authorized sources. This convenience allows taxpayers to easily access the necessary forms, reducing the hassle and time spent on tax preparation. Moreover, the availability of 2016 1099 printable forms online enables individuals and businesses to manage their tax obligations more efficiently, ensuring compliance with IRS regulations and avoiding potential penalties for late or inaccurate filings.

Introduction to 1099 Forms

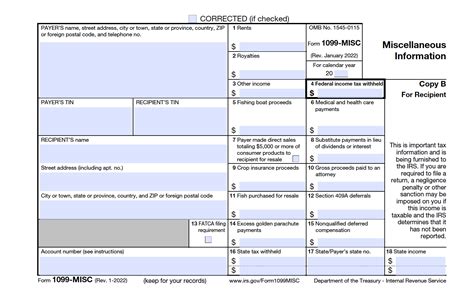

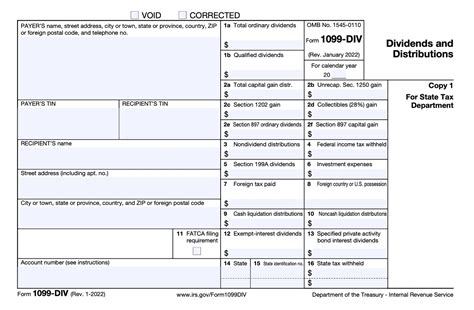

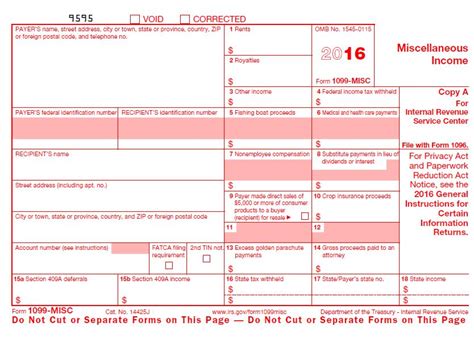

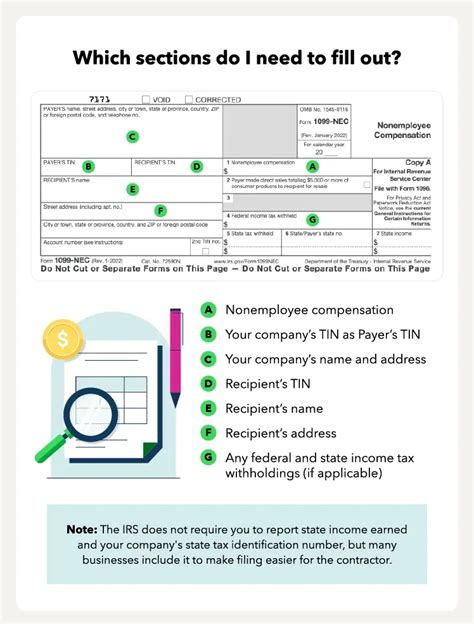

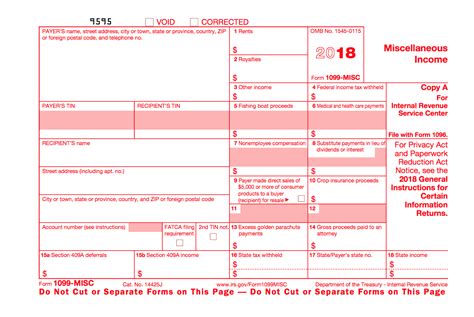

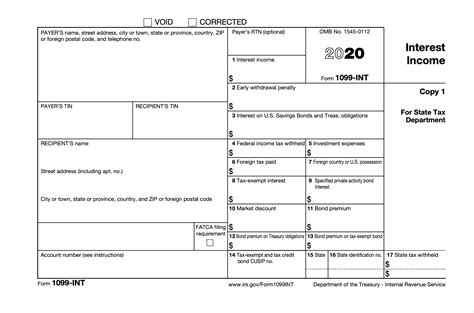

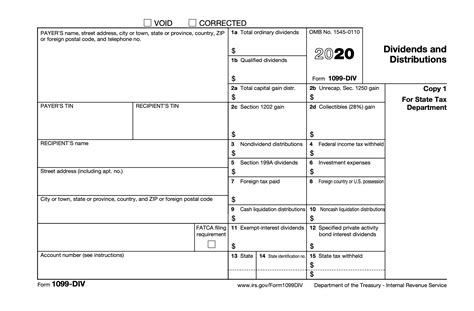

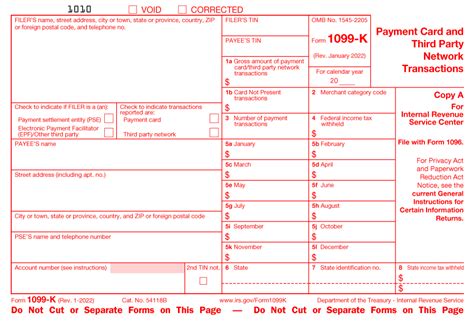

The 1099 series of forms is a collection of documents used by the IRS to track and report various types of income that are not subject to withholding. These forms are crucial for both the payer and the recipient, as they provide a record of income earned and paid, which is then used to file tax returns accurately. The most common types of 1099 forms include the 1099-MISC for miscellaneous income, 1099-INT for interest income, 1099-DIV for dividend income, and 1099-K for payment card and third-party network transactions.

Understanding which 1099 form to use is vital, as each form is designed for a specific purpose. For example, the 1099-MISC form is used to report miscellaneous income such as freelance work, rents, and royalties, while the 1099-INT form is used for interest income earned from bank accounts, bonds, and other investments. By using the correct form, individuals and businesses can ensure that their income is reported accurately, reducing the risk of errors or audits.

Types of 1099 Forms

The IRS offers several types of 1099 forms, each catering to different income categories. The most commonly used forms include:

- 1099-MISC: Used for reporting miscellaneous income such as freelance work, rents, and royalties.

- 1099-INT: Used for reporting interest income from bank accounts, bonds, and other investments.

- 1099-DIV: Used for reporting dividend income from stock holdings.

- 1099-K: Used for reporting payment card and third-party network transactions.

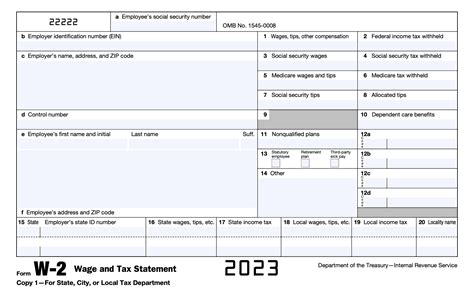

Each of these forms requires specific information, including the payer's and recipient's names, addresses, and taxpayer identification numbers, as well as the amount and type of income being reported. It's essential to carefully review the instructions for each form to ensure that all required information is accurately provided.

Accessing 2016 1099 Printable Forms

Accessing 2016 1099 printable forms is straightforward, thanks to the digital age. The IRS website is a primary source for downloading these forms, along with the instructions for completing them. Additionally, tax preparation software and professional tax services often provide access to these forms as part of their packages. It's crucial to ensure that the forms are downloaded from authorized sources to avoid any potential issues with authenticity or compliance.

When downloading 2016 1099 printable forms, it's essential to have the necessary software to view and print them, typically Adobe Acrobat Reader. The forms are designed to be filled out electronically and then printed, or they can be printed blank and filled out by hand. Either way, it's vital to ensure that the information provided is accurate and complete to avoid any delays or issues with the IRS.

Filling Out 1099 Forms

Filling out 1099 forms requires careful attention to detail to ensure accuracy. Here are the general steps to follow:

- Identify the Correct Form: Determine which 1099 form is appropriate for the type of income being reported.

- Gather Necessary Information: Collect the payer's and recipient's names, addresses, and taxpayer identification numbers, along with the details of the income being reported.

- Fill Out the Form: Enter the required information in the designated boxes. For electronic forms, this can be done using a computer. For printed forms, use black ink and print clearly.

- Review for Accuracy: Double-check all information for accuracy and completeness.

- Submit to the Recipient and IRS: Provide a copy of the form to the recipient by the specified deadline (usually January 31st) and file a copy with the IRS by the end of February.

Importance of 1099 Forms for Tax Compliance

The 1099 forms play a critical role in tax compliance, serving as a mechanism for reporting income that is not subject to withholding. By accurately completing and submitting these forms, individuals and businesses can ensure that their tax obligations are met, reducing the risk of penalties, fines, and potential audits. Furthermore, the information reported on 1099 forms helps the IRS to verify the income reported on tax returns, promoting fairness and compliance within the tax system.

Common Mistakes to Avoid

When dealing with 1099 forms, there are several common mistakes to avoid:

- Inaccurate or Missing Information: Ensure all required fields are completed accurately, including names, addresses, and taxpayer identification numbers.

- Late Filing: Submit forms to recipients and the IRS by the specified deadlines to avoid penalties.

- Using the Wrong Form: Choose the correct 1099 form for the type of income being reported.

By being aware of these potential pitfalls, individuals and businesses can navigate the process of completing and filing 1099 forms more smoothly, ensuring compliance with IRS regulations.

Gallery of 1099 Forms

1099 Forms Image Gallery

Frequently Asked Questions

What is a 1099 form used for?

+A 1099 form is used to report income that is not subject to withholding, such as freelance work, interest, dividends, and more.

How do I get a 1099 form?

+You can download 1099 forms from the IRS website or obtain them through tax preparation software and professional tax services.

What is the deadline for filing 1099 forms?

+The deadline for providing 1099 forms to recipients is usually January 31st, and for filing with the IRS, it's by the end of February.

Can I file 1099 forms electronically?

+Yes, the IRS allows for electronic filing of 1099 forms, which can simplify the process and reduce errors.

What happens if I miss the deadline for filing 1099 forms?

+Missing the deadline can result in penalties and fines. It's essential to file as soon as possible and contact the IRS if you have any issues.

In conclusion, understanding and correctly using 2016 1099 printable forms is a critical aspect of tax compliance for individuals and businesses. By recognizing the importance of these forms, accessing them from authorized sources, filling them out accurately, and submitting them on time, taxpayers can ensure they meet their tax obligations and avoid potential penalties. Whether you're a freelancer, investor, or business owner, navigating the world of 1099 forms with confidence can make a significant difference in your tax filing experience. We invite you to share your thoughts and questions about 1099 forms in the comments below and look forward to helping you navigate the complexities of tax reporting.