Intro

Discover 5 ways invoicing works, streamlining billing processes with efficient payment systems, online invoicing tools, and automated invoicing software for seamless transactions and improved cash flow management.

Invoicing is a crucial aspect of any business, as it enables companies to request payments from clients for goods or services provided. The invoicing process has undergone significant changes over the years, with the introduction of digital technologies and automated systems. Understanding how invoicing works is essential for businesses to manage their finances effectively and maintain healthy relationships with clients. In this article, we will delve into the world of invoicing and explore its various aspects, including the benefits, working mechanisms, and best practices.

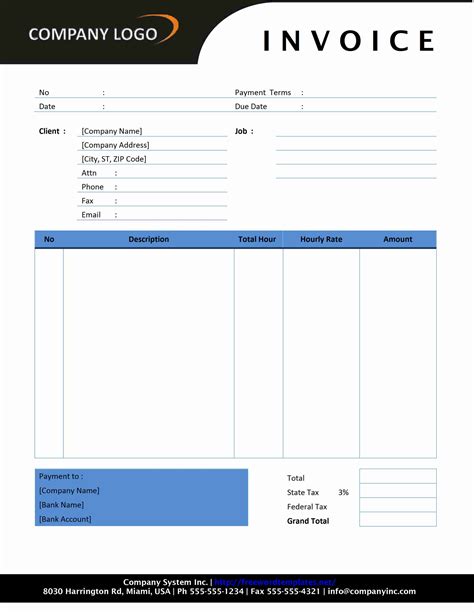

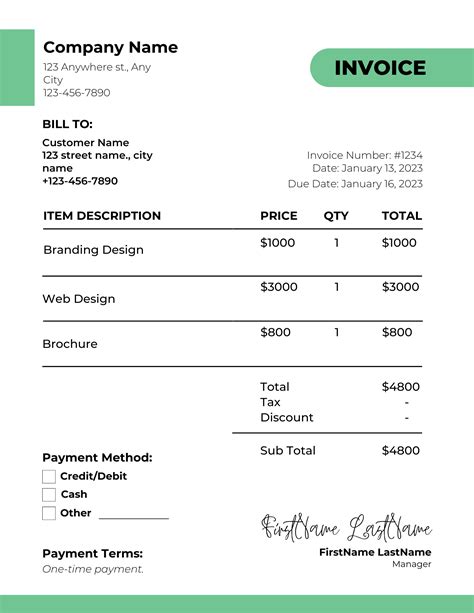

The importance of invoicing cannot be overstated, as it serves as a formal request for payment and helps businesses to track their income and expenses. A well-structured invoice provides clients with a clear breakdown of the services or products provided, along with the corresponding costs and payment terms. This transparency helps to build trust and ensures that clients are aware of their financial obligations. Moreover, invoicing helps businesses to stay organized and focused on their financial goals, enabling them to make informed decisions about investments, expansions, and other strategic initiatives.

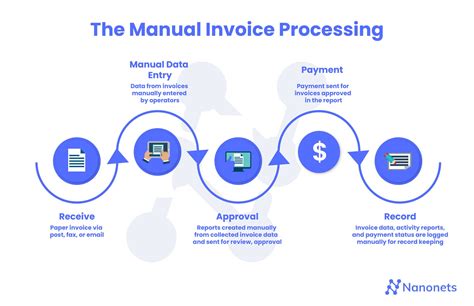

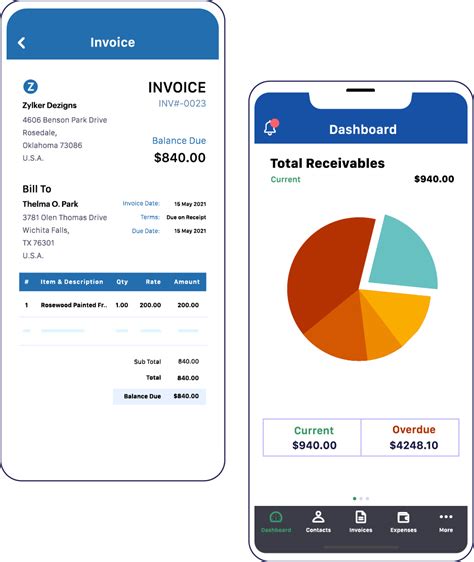

Invoicing is a complex process that involves several steps, from creating and sending invoices to tracking payments and following up with clients. The traditional method of invoicing involved manual preparation of invoices, which were then sent to clients via mail or fax. However, with the advent of digital technologies, businesses can now create and send invoices electronically, using specialized software or online platforms. This has streamlined the invoicing process, reducing the time and effort required to manage invoices and payments.

Benefits of Invoicing

Types of Invoicing

There are several types of invoicing, each with its own unique characteristics and benefits. These include recurring invoicing, which involves sending regular invoices to clients for ongoing services or subscriptions. Another type is project-based invoicing, which involves creating invoices for specific projects or tasks. Businesses can also use time-and-materials invoicing, which involves billing clients for the actual time and materials used to complete a project. Understanding the different types of invoicing is essential for businesses to choose the approach that best suits their needs and goals.How Invoicing Works

Best Practices for Invoicing

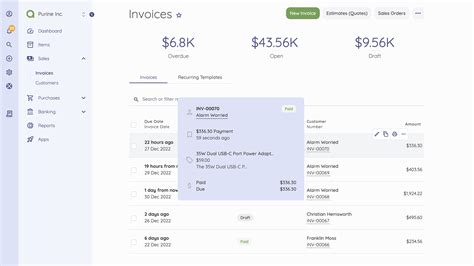

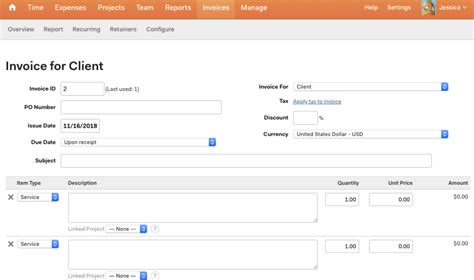

To get the most out of invoicing, businesses should follow best practices that promote efficiency, transparency, and client satisfaction. These include creating clear and concise invoices, using automated software to manage invoices and payments, and establishing a consistent invoicing schedule. Businesses should also ensure that their invoices are professional and well-designed, with a clear breakdown of services or products provided and the corresponding costs. Additionally, businesses should be proactive in following up with clients who have overdue payments, using polite and respectful communication to resolve any issues.Invoicing Software and Tools

Common Invoicing Mistakes

Despite the importance of invoicing, many businesses make common mistakes that can have negative consequences. These include failing to send invoices promptly, using incorrect or incomplete information, and not following up with clients who have overdue payments. Businesses should also avoid using overly complex language or jargon, which can confuse clients and lead to disputes. Additionally, businesses should ensure that their invoices are compliant with relevant laws and regulations, such as tax laws and consumer protection laws.Invoicing for Small Businesses

Invoicing for Freelancers

Freelancers also need to manage invoices and payments, which can be challenging due to the irregular nature of their work. Freelancers should use invoicing software and tools to create and manage invoices, which can help to streamline the process and reduce administrative costs. Freelancers should also establish clear payment terms and communicate regularly with clients to ensure that they are aware of their financial obligations. Additionally, freelancers should be proactive in following up with clients who have overdue payments, using polite and respectful communication to resolve any issues.Invoicing Trends and Future Directions

Conclusion and Next Steps

In conclusion, invoicing is a critical aspect of any business, and understanding how it works is essential for managing finances effectively and maintaining healthy relationships with clients. By following best practices, using invoicing software and tools, and staying up-to-date with the latest trends and technologies, businesses can streamline their invoicing processes and improve their financial health. Whether you are a small business, freelancer, or large corporation, invoicing is an essential part of your operations, and it requires careful attention and management.Invoicing Image Gallery

What is invoicing and why is it important?

+Invoicing is the process of creating and sending bills to clients for goods or services provided. It is essential for businesses to manage their finances effectively and maintain healthy relationships with clients.

What are the benefits of using invoicing software?

+The benefits of using invoicing software include improved cash flow, reduced administrative costs, and enhanced transparency. It can also help to automate many tasks, such as data entry and payment tracking.

How can I create an effective invoice?

+To create an effective invoice, you should include relevant details such as the client's name, address, and payment terms. You should also use clear and concise language and ensure that the invoice is professional and well-designed.

What are some common invoicing mistakes to avoid?

+Some common invoicing mistakes to avoid include failing to send invoices promptly, using incorrect or incomplete information, and not following up with clients who have overdue payments.

How can I stay up-to-date with the latest invoicing trends and technologies?

+You can stay up-to-date with the latest invoicing trends and technologies by attending industry events, reading industry publications, and following invoicing software and tool providers on social media.

We hope this article has provided you with a comprehensive understanding of invoicing and its importance for businesses. Whether you are a small business, freelancer, or large corporation, invoicing is an essential part of your operations, and it requires careful attention and management. By following best practices, using invoicing software and tools, and staying up-to-date with the latest trends and technologies, you can streamline your invoicing processes and improve your financial health. If you have any questions or comments, please do not hesitate to reach out to us. We would be happy to hear from you and provide any additional guidance or support you may need.